Best Accounting Software UK: Find the Perfect Fit for Your Business

Best accounting software UK is crucial for any business, regardless of size or industry. Choosing the right software can streamline your finances, boost efficiency, and give you valuable insights into your operations. But with so many options available, how do you know which one is best for you?

This guide will walk you through the essential features, factors to consider, and top software options in the UK market. We’ll explore everything from invoicing and expense tracking to payroll and tax compliance, ensuring you have the information you need to make an informed decision.

Accounting Software in the UK

Accounting software is a vital tool for businesses of all sizes in the UK. It automates and streamlines financial processes, saving time and resources while providing valuable insights into financial performance. From managing invoices and expenses to generating reports and tax returns, accounting software simplifies complex tasks and empowers businesses to make informed decisions.

Choosing the right accounting software is crucial for a business’s success. It needs to align with specific requirements, such as industry, size, and budget, and be able to adapt as the business grows. Selecting the wrong software can lead to inefficiencies, errors, and ultimately, financial losses.

Key Features and Functionalities to Consider

When choosing accounting software, it is essential to consider several key features and functionalities that can significantly impact a business’s operations and financial management.

- Invoice Management:Efficiently create, send, and track invoices, automating the invoicing process and reducing the risk of errors.

- Expense Tracking:Categorize and track expenses, providing detailed insights into spending patterns and identifying potential cost-saving opportunities.

- Bank Reconciliation:Automatically reconcile bank statements with accounting records, ensuring accurate financial reporting and minimizing discrepancies.

- Reporting and Analysis:Generate customizable reports and dashboards to gain valuable insights into financial performance, including profit margins, cash flow, and key performance indicators (KPIs).

- Tax Compliance:Streamline tax compliance by automating the calculation and filing of taxes, reducing the risk of penalties and errors.

- Inventory Management:For businesses with inventory, track stock levels, manage purchase orders, and monitor inventory turnover rates to optimize supply chain efficiency.

- Payroll Management:Automate payroll processing, calculate taxes and deductions, and generate pay slips, simplifying payroll administration and reducing errors.

- Integration with Other Applications:Integrate with other business applications, such as CRM, e-commerce platforms, and online payment gateways, for a seamless workflow and improved data synchronization.

Top Accounting Software Options

Choosing the right accounting software is crucial for any UK business, regardless of its size or industry. It can streamline financial processes, improve efficiency, and provide valuable insights into your business performance. But with so many options available, it can be overwhelming to know where to start.

Popular Accounting Software Options, Best accounting software uk

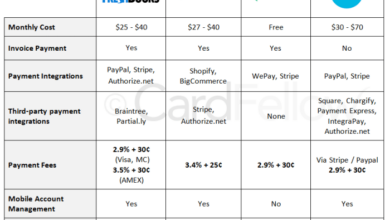

Here’s a breakdown of some of the most popular accounting software options in the UK, outlining their key features, pricing, and target audience:

| Software Name | Key Features | Pricing | Target Audience |

|---|---|---|---|

| Xero |

|

|

|

| QuickBooks Online |

|

|

|

| Sage Business Cloud Accounting |

|

|

|

| FreeAgent |

|

|

|

This table provides a general overview of some popular accounting software options. It’s important to note that the specific features and pricing can vary depending on the chosen plan.

Key Features to Consider

Choosing the right accounting software for your business is crucial, as it can significantly impact your efficiency, accuracy, and financial management. To make an informed decision, it’s essential to consider the key features offered by different accounting software solutions.

Invoicing

Invoicing is a fundamental aspect of any business, regardless of its size. It allows you to track sales, manage customer accounts, and ensure timely payments. Accounting software with robust invoicing features can streamline this process, saving you time and effort.

- Automated invoice creation:This feature enables you to create invoices quickly and easily, eliminating manual data entry and reducing errors. You can customize invoice templates with your company’s branding and include all necessary details, such as invoice number, date, customer information, and items sold.

- Online invoice delivery:Instead of sending invoices via mail or email attachments, you can use online invoicing to send invoices directly to your customers through a secure link. This makes it easier for customers to access and pay their invoices.

- Payment reminders:Late payments can be a major headache for businesses.

Automated payment reminders ensure that your customers are aware of outstanding invoices and can make timely payments. You can set up reminders to be sent automatically at specific intervals, for example, a week before the due date or when the invoice is overdue.

- Tracking invoice status:A good accounting software solution allows you to track the status of your invoices, providing insights into which invoices have been paid, which are overdue, and which are still pending. This visibility allows you to manage cash flow more effectively.

For example, a small business owner can use automated invoice creation to send professional-looking invoices to their clients, track payment status, and send automated reminders for overdue invoices. This helps the owner manage their finances efficiently and improve cash flow.

Expense Tracking

Effective expense tracking is essential for businesses of all sizes, as it helps to control spending, identify areas for cost savings, and ensure financial accuracy. Accounting software with robust expense tracking features can simplify this process, making it easier for businesses to manage their expenses.

Choosing the best accounting software for your UK business is crucial for efficient financial management. But with the ever-increasing threat of cyberattacks, it’s also important to prioritize security. Implementing robust authentication methods like microsoft phishing passwordless authentication can significantly reduce the risk of unauthorized access to your sensitive financial data.

By investing in strong security measures, you can ensure the integrity of your accounting records and safeguard your business from potential breaches.

- Categorization and tagging:Categorize expenses based on their nature, such as office supplies, travel, marketing, or salaries. This allows you to analyze your spending patterns and identify areas where you might be able to cut costs.

- Receipt scanning and storage:You can scan receipts using your smartphone or tablet and store them digitally within the accounting software.

This eliminates the need for paper receipts and simplifies expense tracking.

- Expense reports:Accounting software can automatically generate expense reports that summarize your spending for a specific period, providing insights into your spending habits and helping you identify areas for improvement.

- Integration with bank accounts:This feature automatically imports your bank transactions into the software, allowing you to reconcile your bank statements and track your expenses more efficiently.

For example, a freelancer can use expense tracking features to categorize their expenses, track mileage, and create expense reports for their clients. This allows the freelancer to manage their finances effectively and ensure accurate reporting for their clients.

Bank Reconciliation

Bank reconciliation is the process of comparing your bank statement with your internal records to ensure that they match. Accounting software can automate this process, saving you time and reducing the risk of errors.

- Automatic reconciliation:This feature automatically compares your bank transactions with your internal records, highlighting any discrepancies.

- Reconciliation reports:These reports provide a detailed overview of your bank reconciliation process, identifying any outstanding items or errors.

- Reconciliation tools:Many accounting software solutions offer tools to help you resolve any discrepancies between your bank statement and your internal records.

For example, a small business owner can use automatic bank reconciliation to identify any discrepancies between their bank statement and their accounting records, ensuring that their financial records are accurate.

Payroll

Payroll is a complex and time-consuming process, especially for businesses with a large number of employees. Accounting software with integrated payroll features can simplify this process, reducing errors and improving efficiency.

- Automated payroll calculations:The software automatically calculates employee wages, deductions, and taxes, eliminating manual calculations and reducing the risk of errors.

- Direct deposit:This feature allows you to deposit employee wages directly into their bank accounts, saving you time and reducing the risk of lost or stolen checks.

- Tax filing:The software can generate payroll tax forms, such as W-2s and 1099s, and file them electronically with the relevant tax authorities.

- Employee self-service:This feature allows employees to access their pay stubs, update their personal information, and submit time-off requests online, reducing the administrative burden on your payroll department.

For example, a mid-sized company can use integrated payroll features to calculate employee wages, generate pay stubs, and file payroll taxes electronically. This streamlines the payroll process, reduces errors, and saves the company time and money.

Choosing the best accounting software for your UK business can feel like a daunting task, but it’s essential for efficient financial management. After a long day of sorting through spreadsheets and invoices, a healthy and delicious meal like this kale cobb salad with facon vinaigrette can be the perfect reward.

Just like a well-organized spreadsheet, a good accounting software can help you keep track of your finances and make informed decisions about your business’s future.

Reporting

Reporting is an essential aspect of financial management, as it allows you to analyze your financial performance, identify trends, and make informed business decisions. Accounting software with robust reporting features can provide you with the insights you need to make informed decisions.

- Customizable reports:You can create customized reports to track specific metrics that are important to your business, such as revenue, expenses, profit, and cash flow.

- Real-time reporting:This feature allows you to access up-to-date financial information, enabling you to make informed decisions based on the latest data.

- Data visualization:Accounting software can present financial data in visually appealing charts and graphs, making it easier to understand and analyze trends.

- Reporting dashboards:These dashboards provide a centralized view of your key financial metrics, allowing you to quickly assess your business’s performance.

For example, a large corporation can use customized reports to analyze their revenue streams, track expenses, and identify areas for cost savings. This helps the corporation to make informed decisions about their business operations and maximize profitability.

Tax Compliance

Tax compliance is a crucial aspect of running a business. Accounting software with tax compliance features can help you stay on top of your tax obligations, ensuring that you file your taxes accurately and on time.

Choosing the right accounting software is a big decision, especially when you’re running a business in the UK. It’s important to find a system that fits your needs and budget. And while you’re weighing your options, why not take a break and try a fun DIY project like making a pom pom bracelet ?

It’s a great way to unwind and add a little personality to your look. Once you’re back to business, you’ll be ready to tackle your accounting with renewed energy!

- Tax calculation and filing:The software can calculate your taxes based on your financial data and file your tax returns electronically with the relevant tax authorities.

- Tax reporting:The software can generate tax reports, such as profit and loss statements and balance sheets, which you can use to prepare your tax returns.

- Tax reminders:The software can send you reminders about upcoming tax deadlines, ensuring that you don’t miss any important tax obligations.

For example, a small business owner can use tax compliance features to calculate their taxes, file their tax returns electronically, and receive reminders about upcoming tax deadlines. This helps the owner to stay compliant with tax regulations and avoid penalties.

Choosing the Right Software

Selecting the best accounting software for your UK business is a crucial decision that can impact your financial management, efficiency, and overall success. With numerous options available, it’s essential to carefully consider your specific needs and requirements to make an informed choice.

Factors to Consider

Choosing the right accounting software involves considering various factors that are specific to your business. These factors can help you narrow down your choices and identify the most suitable software for your needs.

- Business Size:Smaller businesses might benefit from simpler, more affordable software with basic features, while larger enterprises might require more complex solutions with advanced functionalities.

- Industry:Different industries have unique accounting needs. For instance, a retail business might require inventory management features, while a service-based business might need time tracking and billing capabilities.

- Budget:Accounting software comes with varying price tags, from free or low-cost options to more expensive enterprise solutions. Determine your budget and choose a software that fits your financial constraints.

- Integration Needs:Consider whether you need to integrate your accounting software with other business applications, such as CRM, e-commerce platforms, or payroll systems. Ensure the software you choose offers seamless integration with your existing tools.

Evaluating Software Demos and Free Trials

Software demos and free trials provide valuable opportunities to test and evaluate different accounting solutions before making a commitment. This allows you to experience the software’s features, user interface, and functionalities firsthand.

- Focus on Your Key Needs:During the demo or trial, prioritize testing the features that are most crucial for your business. For example, if you manage inventory, focus on the inventory management module. If you need to generate detailed reports, explore the reporting capabilities.

- Consider User-Friendliness:Evaluate the software’s user interface and ease of use. Ensure it is intuitive and easy to navigate, even for users with limited accounting experience.

- Assess Data Security and Privacy:Inquire about the software provider’s data security measures and privacy policies. Ensure your sensitive financial data is protected.

- Explore Support Options:Evaluate the level of customer support offered by the software provider. Consider factors like response time, availability, and the availability of online resources, such as tutorials and FAQs.

Compatibility with Existing Systems and Workflows

Before choosing an accounting software, it’s crucial to ensure compatibility with your existing systems and workflows. This can prevent disruptions and ensure a smooth transition.

- Data Migration:Inquire about the software’s data migration capabilities. Ensure it can import data from your current accounting system without any loss or corruption.

- Integration with Existing Systems:If you use other business applications, such as CRM or e-commerce platforms, verify that the accounting software integrates seamlessly with these systems.

- Workflow Compatibility:Assess whether the software’s features and functionalities align with your existing accounting processes and workflows. Ensure it can support your current practices and adapt to any future changes.

Integration and Compatibility

In today’s interconnected business environment, accounting software that seamlessly integrates with other essential tools is crucial for streamlined operations and data flow. This integration enables businesses to centralize their data, automate processes, and gain valuable insights from a unified platform.

Seamless integration allows businesses to automate data exchange between their accounting software and other applications, eliminating the need for manual data entry and reducing the risk of errors. This integration not only saves time and effort but also provides a more accurate and comprehensive view of the business’s financial performance.

Common Integrations and Benefits

Accounting software integrates with various business tools, offering a wide range of benefits. Some common integrations include:

- CRM (Customer Relationship Management):Integrating CRM software with accounting software enables businesses to track customer interactions, manage sales pipelines, and generate invoices directly from customer records. This integration streamlines the sales process and improves customer service by providing a unified view of customer data.

- E-commerce Platforms:Integrating e-commerce platforms with accounting software automates order processing, inventory management, and financial reporting. Businesses can track sales, manage inventory levels, and generate invoices directly from their online store, simplifying operations and reducing manual work.

- Payment Gateways:Integrating payment gateways with accounting software enables businesses to receive online payments, reconcile transactions, and track payment history within the accounting system. This integration simplifies payment processing and provides real-time visibility into cash flow.

- Payroll Software:Integrating payroll software with accounting software automates payroll processing, tax calculations, and employee deductions. This integration streamlines payroll operations and reduces the risk of errors.

- Project Management Tools:Integrating project management tools with accounting software enables businesses to track project expenses, allocate resources, and generate reports on project profitability. This integration improves project management efficiency and provides valuable insights into project performance.

Data Security and Compliance

Data security and compliance are critical considerations when selecting integrated software. Businesses must ensure that their accounting software and integrated applications meet industry standards for data protection and adhere to relevant regulations, such as GDPR (General Data Protection Regulation) and PCI DSS (Payment Card Industry Data Security Standard).

When evaluating integrated software, businesses should look for solutions that:

- Offer robust security features, such as encryption, access controls, and multi-factor authentication.

- Comply with relevant data protection regulations and industry standards.

- Provide regular security updates and patches to address vulnerabilities.

- Offer clear data retention policies and procedures for data deletion.

Choosing integrated software that prioritizes data security and compliance is essential for protecting sensitive business information and maintaining customer trust.

Support and Training

Choosing the right accounting software is only half the battle. The other half is ensuring you can effectively use it. This is where reliable customer support and comprehensive training resources come into play. You need to be confident that you can get help when you need it, and that you have the knowledge and skills to use the software to its full potential.

Types of Support Options

Different accounting software providers offer a variety of support options to cater to different needs. Here are some common types:

- Phone support:This is the most traditional form of support and can be very helpful for urgent issues or when you need immediate assistance. However, it can sometimes be difficult to get through to a representative, and wait times can be long.

- Email support:Email support is a good option for non-urgent issues or when you need a detailed explanation. However, it can take some time to receive a response, and it may not be suitable for complex problems.

- Live chat:Live chat is a more immediate form of support than email, but it may not be available 24/7. It’s a good option for quick questions or troubleshooting basic issues.

- Online resources:Many accounting software providers offer a comprehensive library of online resources, such as FAQs, user guides, and video tutorials. These can be a great way to learn about the software and troubleshoot common problems.

Importance of User-Friendly Interfaces

The best accounting software is easy to use and navigate. Look for software with an intuitive interface, clear menus, and helpful tooltips. This will make it easier to learn the software and find the features you need. A user-friendly interface can save you time and frustration in the long run.

Cost and Value

Choosing the right accounting software involves a careful consideration of cost and value. While initial cost is an important factor, it’s crucial to understand the long-term benefits and return on investment (ROI) that a software solution can offer.

Pricing Models

Different accounting software providers offer various pricing models to cater to the needs of businesses of all sizes.

- Subscription-based:This is the most common pricing model, where you pay a recurring monthly or annual fee for access to the software. This model often includes regular updates and support.

- One-time purchase:In this model, you pay a lump sum to purchase the software outright. You may need to pay for additional features or support separately.

- Tiered pricing:This model offers different pricing tiers based on the features and functionality included. Businesses can choose the tier that best suits their needs and budget.

Cost-Effectiveness Comparison

Comparing the cost-effectiveness of different software options requires considering factors beyond just the initial price tag.

- Features and Functionality:Evaluate whether the software offers the features you need, such as invoicing, expense tracking, bank reconciliation, and reporting.

- Scalability:Consider the software’s ability to grow with your business as it expands.

- Integration:Assess whether the software integrates with other essential business tools, such as CRM or e-commerce platforms.

- Support and Training:Factor in the cost of support and training, as these can significantly impact the overall cost of ownership.

Determining True Value

The true value of accounting software goes beyond its initial cost. Consider the following factors:

- Time Savings:Automated tasks and streamlined workflows can save you valuable time.

- Improved Accuracy:Software can help reduce errors and improve the accuracy of your financial data.

- Enhanced Insights:Robust reporting and analytics features provide valuable insights into your business performance.

- Increased Efficiency:Software can automate tasks and improve overall business efficiency.

- Reduced Costs:Streamlined processes and accurate data can lead to cost savings in the long run.

“The true value of accounting software lies in its ability to improve your business processes, enhance decision-making, and ultimately, increase your profitability.”

Future Trends: Best Accounting Software Uk

The accounting software landscape is constantly evolving, driven by technological advancements and changing business needs. Emerging trends are shaping the future of accounting, offering businesses greater efficiency, insights, and automation.

Cloud-Based Solutions

Cloud-based accounting software has gained immense popularity in recent years, offering several advantages over traditional on-premise solutions. This trend is likely to continue, with more businesses migrating to the cloud for its flexibility, accessibility, and cost-effectiveness.

- Scalability:Cloud-based software allows businesses to scale their accounting resources easily, adding users or features as their needs evolve. This is particularly beneficial for growing businesses that require flexible solutions.

- Accessibility:Users can access their accounting data anytime, anywhere, with an internet connection. This remote accessibility enhances collaboration and productivity, especially for businesses with geographically dispersed teams.

- Cost-effectiveness:Cloud-based solutions often come with subscription-based pricing models, eliminating the need for upfront investments in hardware and software licenses. This cost-effective approach makes accounting software more accessible to businesses of all sizes.

Artificial Intelligence

Artificial intelligence (AI) is transforming various industries, and accounting is no exception. AI-powered accounting software can automate repetitive tasks, provide real-time insights, and improve decision-making.

- Automated Data Entry:AI algorithms can analyze invoices, receipts, and other financial documents, automatically extracting and entering data into accounting systems. This eliminates manual data entry, reducing errors and freeing up time for more strategic tasks.

- Fraud Detection:AI can analyze financial data for anomalies and suspicious patterns, flagging potential fraudulent activities. This proactive approach helps businesses mitigate financial risks and protect their assets.

- Predictive Analytics:AI-powered software can analyze historical data to identify trends and predict future financial performance. This predictive capability enables businesses to make informed decisions about investments, pricing, and resource allocation.

Automation

Automation is another key trend driving the future of accounting software. By automating repetitive tasks, businesses can streamline their accounting processes, improve accuracy, and free up time for value-added activities.

- Invoice Processing:Automated invoice processing systems can receive, track, and process invoices, reducing manual intervention and improving efficiency.

- Bank Reconciliation:Automated bank reconciliation tools can match bank statements with accounting records, minimizing manual effort and reducing the risk of errors.

- Financial Reporting:Automated financial reporting systems can generate reports, dashboards, and key performance indicators (KPIs) with minimal manual input, providing businesses with real-time insights into their financial performance.