Find the Best B2B Payment Processors for Your Business

Best B2B payment processors are the backbone of modern business transactions, enabling seamless and secure exchange of funds between companies. These platforms streamline payment processes, reduce administrative burdens, and enhance efficiency for both buyers and sellers.

From manufacturing and retail to healthcare and technology, B2B payment processors play a crucial role in facilitating transactions across diverse industries. They offer a range of features and benefits, including secure payment gateways, automated reconciliation, and real-time transaction tracking. Understanding the nuances of B2B payment processing is essential for businesses looking to optimize their financial operations and achieve sustainable growth.

Introduction to B2B Payment Processors: Best B2b Payment Processors

In the modern business landscape, seamless and efficient payment processing is paramount for companies of all sizes. B2B payment processors play a crucial role in facilitating these transactions, streamlining the exchange of funds between businesses. These processors offer a range of features and benefits that enhance the payment experience, making it easier for businesses to manage their finances and focus on their core operations.

Key Features and Benefits of B2B Payment Processors

B2B payment processors offer a comprehensive suite of features designed to meet the unique needs of businesses. These features contribute to increased efficiency, security, and convenience in payment processing. Here are some key features and benefits:

- Automated Payment Processing:B2B payment processors automate payment processes, eliminating manual tasks and reducing the risk of errors. This automation streamlines workflows, saves time, and improves overall efficiency.

- Secure Payment Gateway:B2B payment processors provide secure payment gateways that protect sensitive financial data from unauthorized access. This ensures the safety of transactions and builds trust between businesses.

- Multiple Payment Methods:B2B payment processors support a variety of payment methods, including credit cards, debit cards, bank transfers, and digital wallets. This flexibility allows businesses to choose the most convenient and cost-effective options for their specific needs.

- Real-Time Transaction Tracking:B2B payment processors provide real-time transaction tracking, allowing businesses to monitor the status of their payments and identify any potential issues. This transparency ensures accountability and facilitates timely resolution of any discrepancies.

- Reconciliation and Reporting:B2B payment processors offer comprehensive reconciliation and reporting features. These tools help businesses track their payment history, analyze spending patterns, and identify areas for improvement. This data-driven approach enables businesses to optimize their financial management.

- Integration with Business Systems:B2B payment processors seamlessly integrate with various business systems, including accounting software, enterprise resource planning (ERP) systems, and customer relationship management (CRM) systems. This integration eliminates data silos and creates a unified view of financial transactions.

Industries That Rely on B2B Payment Processors

B2B payment processors are widely used across a diverse range of industries, playing a vital role in facilitating transactions and driving business growth. Here are some industries that heavily rely on B2B payment processors:

- Manufacturing:Manufacturers rely on B2B payment processors to manage payments for raw materials, components, and finished goods. The efficiency and security provided by these processors streamline supply chain operations and ensure timely payments.

- Retail:Retailers use B2B payment processors to handle payments from suppliers, distributors, and other businesses. These processors simplify inventory management, ensure timely payments, and improve overall efficiency in the retail supply chain.

- Healthcare:The healthcare industry heavily relies on B2B payment processors to manage payments for medical supplies, equipment, and services. These processors facilitate secure and efficient transactions, ensuring timely payments to healthcare providers and suppliers.

- Technology:Technology companies utilize B2B payment processors to manage payments for software licenses, hardware purchases, and cloud services. These processors streamline transactions, improve security, and ensure timely payments within the technology sector.

- E-commerce:E-commerce businesses heavily rely on B2B payment processors to handle payments from online marketplaces, suppliers, and other businesses. These processors enable secure and efficient transactions, facilitating seamless online commerce.

Key Considerations for Choosing a B2B Payment Processor

Choosing the right B2B payment processor is crucial for businesses that want to streamline their operations and optimize their financial processes. A robust payment processor can enhance efficiency, reduce costs, and provide greater control over transactions.

Security and Compliance

Security and compliance are paramount in B2B payments, as sensitive financial data is constantly being exchanged. It’s essential to choose a processor that prioritizes these aspects.

Finding the best B2B payment processor can feel overwhelming with all the features and options out there. But sometimes, focusing on the fundamentals can be the key to success. My philosophy is that basics are my secret favorites , and this definitely applies to B2B payments.

Look for a processor with strong security, user-friendly interfaces, and transparent pricing. These essentials will provide a solid foundation for your business transactions.

- Data Encryption:The processor should use industry-standard encryption protocols like Transport Layer Security (TLS) and Secure Sockets Layer (SSL) to protect data during transmission.

- PCI DSS Compliance:Payment Card Industry Data Security Standard (PCI DSS) is a set of security requirements designed to protect cardholder data.

Choosing the right B2B payment processor can be a game-changer for your business, streamlining transactions and improving cash flow. But sometimes, you need a little nostalgia to get your creative juices flowing, and that’s where the recent collaboration between Weir Sons and Banjoman comes in.

Their nostalgic advert is a reminder that even in the world of business, a touch of whimsy can go a long way. Ultimately, finding the best B2B payment processor is about finding the right balance of efficiency and effectiveness, just like finding the right creative team for your marketing needs.

Ensure the processor is PCI DSS compliant and has undergone regular audits to maintain compliance.

- Tokenization:Tokenization replaces sensitive data like credit card numbers with unique tokens, reducing the risk of data breaches.

- Two-Factor Authentication:Implementing two-factor authentication adds an extra layer of security by requiring users to provide two forms of identification, such as a password and a one-time code.

- Fraud Prevention:Look for processors that offer robust fraud detection and prevention mechanisms, such as real-time monitoring, anomaly detection, and machine learning algorithms.

Payment Processing Models

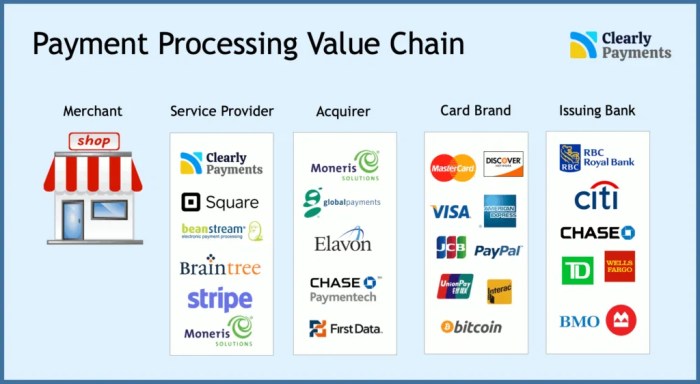

Different payment processing models cater to specific business needs. Understanding the differences between these models can help you choose the best fit for your organization.

- Payment Gateway:A payment gateway acts as a bridge between a merchant’s website or application and the payment processor. It facilitates secure transactions by securely transmitting payment information to the processor.

- Payment Aggregator:A payment aggregator combines multiple payment methods and channels into a single platform.

This simplifies payment management for businesses dealing with various payment options.

- Direct Integration:In a direct integration model, businesses directly connect their systems with the payment processor, eliminating the need for a third-party gateway. This approach offers greater control and customization but may require more technical expertise.

Finding the best B2B payment processors can be a game-changer for your business. Streamlining payments not only saves time and resources but also contributes to a smoother, more efficient operation. And when it comes to accelerating transformation, it’s crucial to optimize every aspect of your business, including payment processes.

Learn more about how companies can accelerate transformation to discover new avenues for growth. By integrating a reliable B2B payment processor, you can unlock greater agility and adaptability, ultimately leading to a more successful and future-proof business.

Popular B2B Payment Processors

Choosing the right B2B payment processor is crucial for streamlining your business operations and maximizing efficiency. With numerous options available, it’s important to carefully evaluate their features, pricing, and overall suitability for your specific needs. This section will delve into some of the most popular B2B payment processors, highlighting their strengths and weaknesses to help you make an informed decision.

Popular B2B Payment Processors

The B2B payment processing landscape is diverse, offering a range of solutions to meet different business requirements. Here’s a comparison of some top contenders:

| Processor Name | Features | Pricing | Pros | Cons |

|---|---|---|---|---|

| Stripe |

|

|

|

|

| PayPal |

|

|

|

|

| Square |

|

|

|

|

| Adyen |

|

|

|

|

| Worldpay from FIS |

|

|

|

|

B2B Payment Processing Trends

The B2B payment landscape is constantly evolving, driven by technological advancements and changing business needs. Traditional methods are being replaced by innovative solutions that offer greater efficiency, security, and flexibility.

Mobile Payments

Mobile payments are becoming increasingly popular in B2B transactions. Businesses are embracing mobile wallets and payment apps to streamline their payment processes.

- Convenience:Mobile payments allow businesses to make and receive payments anytime, anywhere, using their smartphones or tablets. This eliminates the need for physical checks or wire transfers, which can be time-consuming and cumbersome.

- Security:Mobile payment platforms often employ advanced security measures, such as encryption and multi-factor authentication, to protect sensitive financial data.

- Cost-effectiveness:Mobile payments can reduce processing fees associated with traditional methods, leading to significant cost savings for businesses.

Blockchain Technology, Best b2b payment processors

Blockchain technology is transforming the B2B payment industry by providing a secure and transparent platform for transactions.

- Decentralized ledger:Blockchain records transactions on a distributed network, making it difficult for any single entity to tamper with the data.

- Transparency:All transactions are recorded on the blockchain, providing a clear audit trail and enhancing accountability.

- Faster settlements:Blockchain-based payments can be processed much faster than traditional methods, reducing delays and improving cash flow.

Best Practices for B2B Payment Processing

Streamlining B2B payments requires more than just choosing the right payment processor. Implementing best practices ensures secure, efficient, and cost-effective transactions. This guide Artikels essential steps to optimize your B2B payment processing system.

Security Measures for B2B Payments

Security is paramount in B2B transactions, where sensitive financial data is exchanged. Implementing robust security measures is essential to prevent fraud and protect your business.

- Data Encryption:All sensitive information, including payment details, should be encrypted during transmission and storage. This prevents unauthorized access and ensures data confidentiality. Use strong encryption protocols like Transport Layer Security (TLS) and Advanced Encryption Standard (AES) for data protection.

- Two-Factor Authentication (2FA):Require 2FA for accessing payment portals and making transactions. This adds an extra layer of security by requiring users to provide two distinct forms of identification, such as a password and a one-time code sent to their mobile device.

- Regular Security Audits:Conduct regular security audits to identify vulnerabilities and ensure your payment system remains secure. These audits should assess your network infrastructure, access controls, and data encryption practices.

- Employee Training:Educate employees on best practices for handling sensitive data, recognizing phishing attempts, and implementing strong passwords. This helps prevent human error and accidental data breaches.

Streamlining B2B Payment Workflows

Efficient payment workflows streamline operations, reduce errors, and enhance customer satisfaction.

- Automated Invoice Processing:Automate invoice generation and delivery to eliminate manual errors and speed up the payment process. Integrate your accounting software with your payment processor for seamless invoice management.

- Online Payment Portals:Provide secure online payment portals for customers to make payments conveniently and securely. This eliminates the need for manual checks or wire transfers, reducing processing time and administrative overhead.

- Payment Reconciliation:Automate payment reconciliation to match invoices with payments, ensuring accuracy and timely resolution of discrepancies. This reduces manual effort and improves cash flow management.

- Real-time Payment Tracking:Implement real-time payment tracking to monitor transactions and ensure timely payments. This allows you to identify and address potential issues promptly.

Optimizing B2B Payment Costs

Minimizing payment processing costs is crucial for maximizing profitability.

- Negotiate Transaction Fees:Negotiate competitive transaction fees with your payment processor based on your transaction volume and payment methods. Consider factors like processing fees, monthly fees, and interchange fees.

- Optimize Payment Methods:Choose payment methods that align with your business needs and minimize processing costs. Electronic payments, such as ACH transfers and online payments, often have lower fees compared to credit card transactions.

- Batch Processing:Consider batch processing for recurring payments to reduce transaction fees. This allows you to process multiple payments simultaneously, resulting in lower processing costs.

- Discount Programs:Explore discount programs offered by your payment processor based on your transaction volume or loyalty. These programs can significantly reduce your overall payment processing costs.