When Are Payroll Taxes Due?

When are payroll taxes due? This is a question that many employers and employees ask themselves, especially as tax season approaches. Payroll taxes are a vital part of our economic system, funding essential programs like Social Security and Medicare.

Understanding the intricacies of payroll tax deadlines is crucial for ensuring compliance and avoiding potential penalties.

This article will delve into the world of payroll taxes, providing a comprehensive guide to payment schedules, deadlines, and filing procedures. Whether you’re a seasoned business owner or a new employee, understanding these key concepts is essential for navigating the complexities of payroll tax obligations.

Payroll Tax Basics: When Are Payroll Taxes Due

Payroll taxes are mandatory contributions deducted from an employee’s paycheck and paid to the government. They fund essential social programs like Social Security and Medicare. Understanding the different types of payroll taxes and who is responsible for paying them is crucial for both employers and employees.

Types of Payroll Taxes

Payroll taxes are categorized into two primary groups: federal income tax and payroll taxes. Federal income tax is a progressive tax system where higher earners pay a larger percentage of their income in taxes. Payroll taxes, on the other hand, are levied at a flat rate.

Here’s a breakdown of the most common payroll taxes:

- Social Security Tax:This tax funds retirement, disability, and survivor benefits. Both employers and employees contribute 6.2% of an employee’s wages, up to a maximum taxable wage base. For 2023, the maximum taxable wage base is $160,200.

- Medicare Tax:This tax helps fund healthcare for seniors and people with disabilities. Both employers and employees contribute 1.45% of an employee’s wages. There is no limit on the amount of wages subject to Medicare tax.

- Federal Income Tax:This tax funds various federal programs, including national defense, education, and infrastructure. The amount of federal income tax withheld from an employee’s paycheck depends on their earnings, filing status, and deductions. The Internal Revenue Service (IRS) provides withholding tables and calculators to help determine the appropriate amount of tax to withhold.

Figuring out when payroll taxes are due can be a real head-scratcher, especially when you’re trying to stay on top of everything else. But hey, a little caffeine boost can help! If you’re looking for a way to perk up your day, check out this amazing Nespresso complimentary coffee maker offer.

Once you’ve got your coffee fix, you can tackle those payroll taxes with a fresh perspective.

- State Income Tax:Most states also impose an income tax on wages. The rates and deductions vary by state. Some states, such as Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming, do not have a state income tax.

Purpose of Payroll Taxes

Payroll taxes play a vital role in funding essential social programs and services. These programs provide a safety net for individuals and families facing various life challenges.

- Social Security:Provides retirement, disability, and survivor benefits to eligible individuals and their families.

- Medicare:Provides health insurance coverage for individuals aged 65 and older, as well as people with disabilities.

- Unemployment Insurance:Provides temporary financial assistance to workers who have lost their jobs through no fault of their own.

- Workers’ Compensation:Provides medical benefits and wage replacement for workers who are injured or become ill on the job.

Entities Responsible for Payroll Tax Payments, When are payroll taxes due

Both employers and employees are responsible for paying payroll taxes.

- Employers:Employers are responsible for withholding payroll taxes from their employees’ wages and paying their share of Social Security and Medicare taxes. They also need to file quarterly tax returns with the IRS and state tax agencies, reporting the taxes withheld and paid.

Figuring out when payroll taxes are due can be a real head-scratcher, especially if you’re juggling a busy schedule like I am with my new project, elsies kitchen progress report. It’s a good thing I’ve got my trusty calendar handy to keep track of everything, including those crucial tax deadlines!

- Employees:Employees are responsible for paying their share of Social Security, Medicare, and federal income tax. The amount withheld from their paychecks is based on their earnings, filing status, and deductions. They are also responsible for filing an annual tax return with the IRS to report their income and taxes paid.

Figuring out when payroll taxes are due can be a bit of a head-scratcher, especially if you’re juggling multiple deadlines. It’s kind of like trying to understand the intricacies of OpenAI’s ProcGen benchmark, where the models can sometimes overfit to the training data, leading to poor performance on unseen environments.

openais procgen benchmark overfitting But once you get a handle on the basics, it all starts to make sense, and you’ll be able to keep your payroll taxes in check without any stress.

Payroll Tax Payment Schedules

The Internal Revenue Service (IRS) provides different payment schedules for businesses to remit their payroll taxes, offering flexibility based on the company’s size and payroll frequency. These schedules ensure timely payment of payroll taxes while accommodating various business needs.

Payroll Tax Payment Schedule Options

The IRS offers several payroll tax payment schedules, each with its own set of deadlines and requirements:

- Monthly:Businesses with a total tax liability exceeding $50,000 in the previous year are generally required to pay their payroll taxes monthly. This schedule involves filing Form 941, Employer’s Quarterly Federal Tax Return, every month and making the corresponding payments.

- Quarterly:Most businesses pay their payroll taxes on a quarterly basis. This schedule involves filing Form 941 every three months and making the corresponding payments.

- Semi-weekly:Larger businesses with significant payroll obligations may be required to pay their payroll taxes semi-weekly. This schedule involves filing Form 941 every other week and making the corresponding payments.

Factors Determining Payroll Tax Payment Schedule

Several factors influence a business’s payroll tax payment schedule, including:

- Tax Liability:Businesses with higher tax liabilities are more likely to be required to pay their taxes more frequently. This ensures the government receives timely revenue and avoids potential tax burdens on the company.

- Payroll Frequency:Businesses with more frequent payrolls may need to pay their taxes more often to keep up with their tax obligations.

- Industry:Some industries, like construction, have specific tax payment requirements. These industries often have higher payroll taxes due to the nature of their work and may be subject to different payment schedules.

Payroll Tax Payment Deadlines

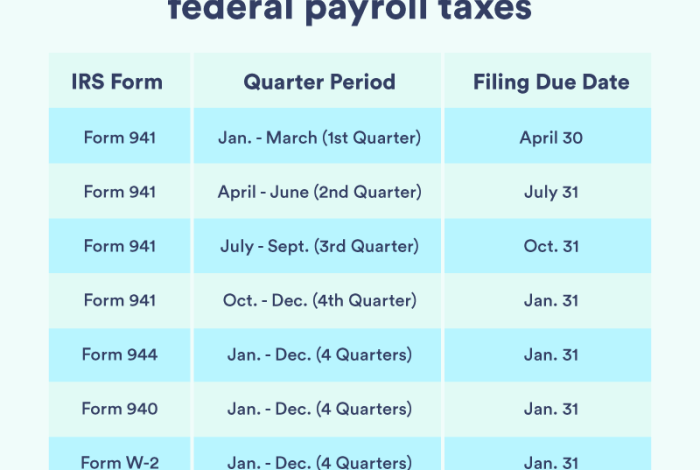

The following table summarizes the payroll tax payment deadlines for each schedule:

| Payment Schedule | Deadlines |

|---|---|

| Monthly | The 15th of the month following the tax period. |

| Quarterly | April 15, July 15, October 15, and January 15 (with an extension until April 15 for the fourth quarter). |

| Semi-weekly | The 7th and 15th of the month for payrolls paid on or before the 15th, and the 7th and 22nd of the month for payrolls paid on or after the 16th. |

Payroll Tax Deadlines

Meeting payroll tax deadlines is crucial for businesses to avoid penalties and maintain a good standing with the IRS. These deadlines vary depending on the payment frequency and the type of tax being paid.

Payroll Tax Payment Frequencies

The IRS offers different payment frequencies to accommodate various business needs. These frequencies, along with their corresponding deadlines, are Artikeld below.

- Monthly:Businesses that owe $50,000 or more in payroll taxes during the previous calendar year must file and pay their taxes monthly. The deadline for monthly payments is the 15th of the month following the month for which the taxes are due.

For example, taxes for January are due on February 15th.

- Quarterly:Businesses that owe less than $50,000 in payroll taxes during the previous calendar year can choose to file and pay their taxes quarterly. The deadlines for quarterly payments are as follows:

- First Quarter:April 15th (for taxes due for January, February, and March)

- Second Quarter:June 15th (for taxes due for April, May, and June)

- Third Quarter:September 15th (for taxes due for July, August, and September)

- Fourth Quarter:January 15th of the following year (for taxes due for October, November, and December)

- Semi-weekly:Businesses that owe $50,000 or more in payroll taxes during the previous calendar year and are required to make semi-weekly deposits, must deposit their taxes on Wednesdays and Fridays. The specific deposit schedule depends on the pay dates.

Penalties for Late Payroll Tax Payments

The IRS imposes penalties for late payroll tax payments. These penalties can be significant and include:

- Failure to Pay Penalty:A penalty of 0.5% of the unpaid taxes is charged for each month or part of a month that taxes are unpaid. The penalty is capped at 25% of the unpaid taxes.

- Failure to File Penalty:A penalty of 5% of the unpaid taxes is charged for each month or part of a month that taxes are not filed, up to a maximum of 25% of the unpaid taxes.

- Interest:The IRS charges interest on unpaid taxes. The interest rate is set by the IRS and changes periodically.

Payroll Tax Deadlines Calendar

The following calendar highlights the key payroll tax deadlines throughout the year:

| Month | Deadline | Taxes Due |

|---|---|---|

| January | January 15th | Fourth Quarter Taxes (October, November, December) |

| February | February 15th | January Taxes |

| March | March 15th | February Taxes |

| April | April 15th | First Quarter Taxes (January, February, March) |

| May | May 15th | April Taxes |

| June | June 15th | Second Quarter Taxes (April, May, June) |

| July | July 15th | July Taxes |

| August | August 15th | August Taxes |

| September | September 15th | Third Quarter Taxes (July, August, September) |

| October | October 15th | October Taxes |

| November | November 15th | November Taxes |

| December | December 15th | December Taxes |

It is important to note that these deadlines may be subject to change. Businesses should consult with the IRS or a tax professional for the most up-to-date information.

Payroll Tax Filing

Once you’ve calculated your payroll taxes and determined your payment schedule, the next step is filing those taxes. Filing payroll taxes involves completing specific forms and submitting them to the relevant government agency. This process ensures that your business is in compliance with tax regulations and that your employees receive the benefits they’re entitled to.

Methods for Filing Payroll Taxes

There are several methods for filing payroll taxes, each with its own advantages and disadvantages. The most common methods include:

- Online Filing:This method is generally the most convenient and efficient. It allows you to file and pay your taxes electronically, eliminating the need for paper forms and physical mail. Many online services are available, including those provided by the IRS, state tax agencies, and third-party payroll providers.

- Mail Filing:You can also file your payroll taxes by mail. This method typically involves completing paper forms and sending them to the appropriate government agency. While it’s less convenient than online filing, it can be a viable option for businesses that prefer traditional methods or don’t have access to reliable internet connections.

- Third-Party Payroll Providers:Many businesses choose to outsource their payroll processing to third-party providers. These providers handle all aspects of payroll, including tax calculations, filing, and payments. Using a third-party provider can save you time and effort, but it comes with additional costs.

Step-by-Step Guide for Filing Payroll Taxes

Here’s a step-by-step guide for filing payroll taxes using the online method, which is the most common and convenient option:

- Gather the Necessary Information:Before you begin filing, you’ll need to gather all the required information, including your employer identification number (EIN), employee Social Security numbers, wages paid, and any withholdings.

- Choose an Online Filing Service:Select an online filing service that meets your needs. You can use the IRS’s e-File system, a state tax agency’s website, or a third-party payroll provider.

- Create an Account:If you haven’t already, create an account with the chosen online filing service. This will allow you to access the necessary forms and submit your tax information.

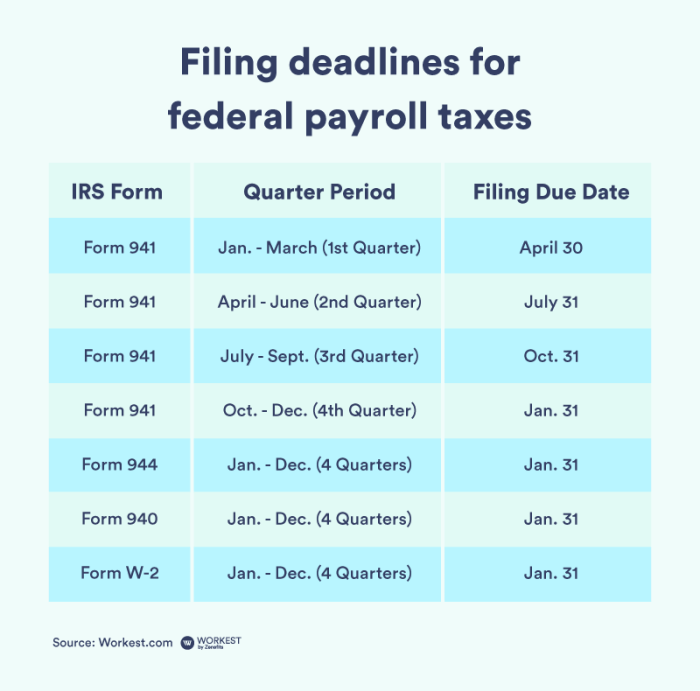

- Complete the Required Forms:Use the online platform to complete the required payroll tax forms. This may include forms like Form 941 (Employer’s Quarterly Federal Tax Return), Form 940 (Employer’s Annual Federal Unemployment (FUTA) Tax Return), and state-specific forms.

- Review and Submit:Carefully review all the information you’ve entered to ensure accuracy. Once you’re satisfied, submit your tax forms and payments electronically.

- Keep Records:Maintain accurate records of all your payroll tax filings, including payment receipts and confirmation emails. These records will be crucial for future tax audits and compliance purposes.

Payroll Tax Resources

Navigating the complex world of payroll taxes can be daunting, but there are valuable resources available to help you understand your obligations and ensure compliance. From government websites to software solutions, a variety of tools can simplify the process and provide essential information.

Government Websites

Government websites are the primary source for accurate and up-to-date information on payroll tax laws and regulations.

- Internal Revenue Service (IRS):The IRS website is a comprehensive resource for all things related to federal taxes, including payroll taxes. You can find information on tax rates, deadlines, forms, and publications. The IRS also offers a variety of tools and resources, such as the Tax Withholding Estimator, to help you calculate your payroll tax obligations.

- State Tax Agencies:Each state has its own tax agency that administers state income tax and unemployment insurance. These agencies also provide information on state payroll tax requirements, including rates, forms, and deadlines. You can typically find these agencies’ websites by searching for “[State Name] Department of Revenue” or “[State Name] Tax Agency.”

Payroll Tax Software

Payroll tax software can streamline the process of calculating, withholding, and filing payroll taxes. These software programs typically automate many of the tasks involved in payroll, such as calculating employee wages, withholding taxes, and generating tax reports.

- Features:Payroll tax software often includes features such as:

- Tax rate updates: These programs automatically update to reflect changes in tax laws and rates.

- Tax form generation: They generate the necessary tax forms, such as W-2s and 1099s.

- Electronic filing: They allow you to file tax forms electronically with the IRS and state tax agencies.

- Payroll reporting: They provide reports on payroll taxes, including summaries of withholdings and payments.

Payroll Tax Assistance

For businesses that need additional support with payroll taxes, there are organizations that offer assistance and guidance.

- Accountants and CPA Firms:Accountants and CPA firms specialize in tax preparation and can provide expert advice on payroll tax compliance. They can help you understand your obligations, calculate your tax liability, and file your tax returns.

- Payroll Service Providers:Payroll service providers offer a range of services, including payroll processing, tax filing, and compliance support. They can handle all aspects of your payroll, freeing you to focus on other aspects of your business.

- Small Business Administration (SBA):The SBA offers a variety of resources for small businesses, including information on payroll taxes. They can provide guidance on compliance, tax credits, and other relevant topics.