Apple Card Interest Rate Climbs Again: 4.5% APR After Second Hike in a Month

Apple card savings rate increased again interest now 45 after second increase in just one month – Apple Card Interest Rate Climbs Again: 4.5% APR After Second Hike in a Month sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

The Apple Card, once known for its sleek design and enticing rewards, has recently made headlines for a different reason: a rapid increase in interest rates. Just a month after its initial hike, the Apple Card’s APR has climbed again, now sitting at 4.5%.

This unexpected move has left many users questioning the future of their financial relationship with Apple.

This sudden increase begs the question: why is Apple raising its interest rates so drastically? The answer, like most financial matters, is complex and intertwined with larger economic forces. The current inflationary environment and rising borrowing costs are playing a significant role, pushing credit card providers like Apple to adjust their rates.

However, the impact on Apple Card users is undeniable. As interest rates climb, the cost of carrying a balance on the card increases, potentially leading to higher debt accumulation and a strain on personal finances.

Reasons for the Increase

The recent Apple Card interest rate increase to 4.5% is a significant development, reflecting broader trends in the financial landscape. This move, coming on the heels of another increase just a month prior, has understandably raised questions among cardholders about the rationale behind it.

The Economic Climate and Credit Card Interest Rates

The current economic climate is a major factor influencing credit card interest rates. Inflation, a persistent issue in recent times, has forced the Federal Reserve to raise interest rates to curb rising prices. These increases in the federal funds rate, the rate at which banks lend to each other, directly impact the cost of borrowing for financial institutions.

This ripple effect flows down to credit card interest rates, as lenders adjust their rates to reflect the higher cost of funds.

The Role of Inflation and Rising Borrowing Costs

Inflation, a key driver of the recent interest rate increases, erodes the purchasing power of money. To combat this, the Federal Reserve has implemented a series of interest rate hikes, making borrowing more expensive. This directly affects credit card issuers, as they face higher borrowing costs themselves.

To offset these costs and maintain profitability, they often pass on the increased borrowing costs to cardholders through higher interest rates.

Comparison with Other Credit Cards

The Apple Card’s recent interest rate increase raises questions about its competitiveness in the credit card market. To understand its position, let’s compare it to other popular credit cards and analyze their features.

The Apple Card savings rate just jumped again, now at 4.5% after its second increase in a single month! It’s a good time to be an Apple Card user, but maybe not so much for Xbox or PlayStation. In fact, the Nintendo Switch outsells Xbox and PS4 , showing a clear preference for portable gaming.

It seems like everyone’s looking for ways to save money these days, even if it means ditching the big console for a more affordable option. Maybe Apple’s rate hike is a reflection of that, too.

Interest Rate Comparison

To assess the Apple Card’s current interest rate, we can compare it to other well-known credit cards. The table below provides a snapshot of interest rates from various providers:

| Credit Card Provider | APR (Variable) |

|---|---|

| Apple Card | 19.99%

|

| Chase Freedom Unlimited | 15.99%

|

| Citi Double Cash | 13.99%

|

| Discover it Cash Back | 13.99%

The Apple Card savings rate just went up again, now sitting at 4.5% after its second increase in a single month! It seems like everything is on the rise lately, even the interest rates on things like credit cards. It makes you wonder about the overall state of things, and maybe even take a look at the state of Java Azul for some perspective. I’m not sure if I’ll be able to keep up with these rising rates, but at least I can still use my Apple Card to earn some extra cash back.

|

| Capital One Venture X Rewards Credit Card | 16.99%

|

It’s important to note that APRs can vary based on individual creditworthiness.

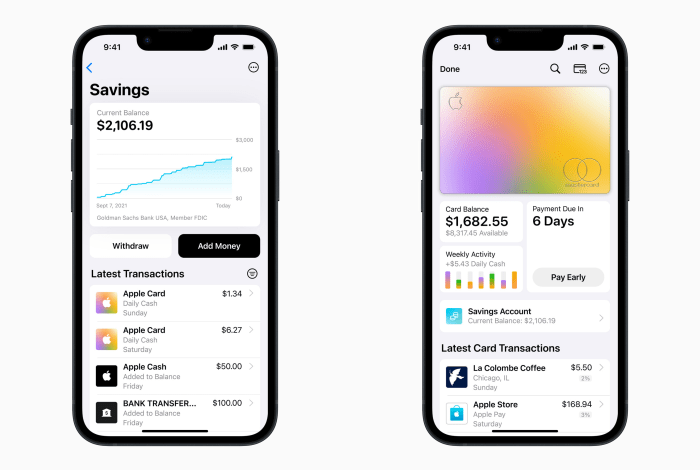

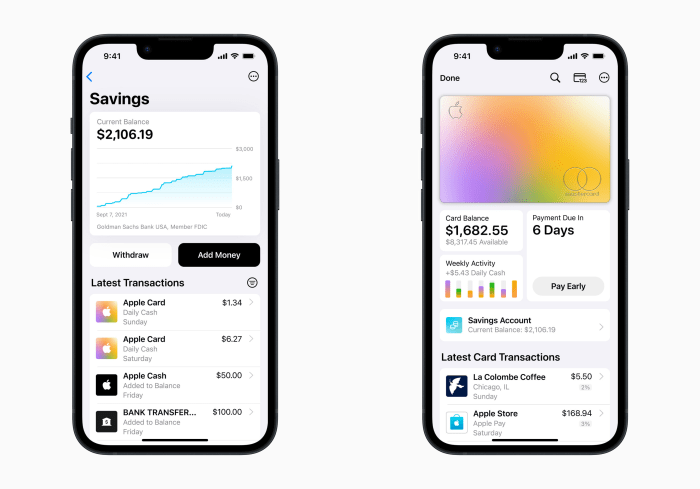

Reward Programs and Fees

Reward programs and fees are key differentiators among credit cards. The Apple Card offers 2% Daily Cash back on all purchases, 3% back at Apple stores, and 1% back on Apple Pay purchases. It has no annual fee. Other cards may offer different rewards structures, such as travel miles, cash back on specific categories, or points that can be redeemed for various items.

Some cards also charge annual fees, which can range from a few dollars to hundreds of dollars.

It’s crucial to compare reward programs and fees carefully to determine which card best suits your spending habits and financial goals.

With the Apple Card savings rate increasing again, now at 4.5% after its second bump in just one month, I’m finding myself looking for ways to stretch my budget even further. Just like learning how to get the most out of your makeup, like finding out tips to get the most uses out of your foundation and what to do when it breaks , there’s always a way to make things last longer.

It’s a good thing that the Apple Card savings rate is rising because with these interest rates, it’s more important than ever to be mindful of our spending.

Other Features

Other features to consider include:

- Credit Limit:The maximum amount you can borrow on the card.

- Balance Transfer Offers:Options to transfer balances from other credit cards, potentially with a lower interest rate.

- Customer Service:Responsiveness and accessibility of customer support.

- Fraud Protection:Measures to safeguard your account from unauthorized transactions.

- Mobile App Features:Functionality for managing your account, tracking spending, and making payments.

It’s essential to assess these features based on your individual needs and preferences.

Impact on Consumers: Apple Card Savings Rate Increased Again Interest Now 45 After Second Increase In Just One Month

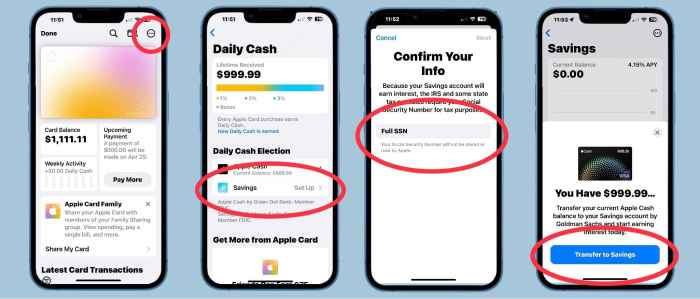

The recent surge in Apple Card’s savings rate, now at a remarkable 4.5%, while seemingly beneficial, might have a complex impact on consumers. While the increased interest earned on savings could be enticing, it’s crucial to understand how this change might influence spending habits and debt accumulation.

Potential Impact on Spending Habits, Apple card savings rate increased again interest now 45 after second increase in just one month

The increased savings rate could potentially influence consumers’ spending habits in several ways. The allure of earning higher interest on their savings might encourage some users to prioritize saving over spending. This shift in financial priorities could lead to reduced discretionary spending and an increase in overall savings.

However, it’s equally plausible that the increased savings rate might have a negligible impact on spending habits, especially for consumers who are already disciplined savers.

Potential Impact on Debt Accumulation

The impact of the increased savings rate on debt accumulation is a more complex issue. While the increased interest earned on savings could potentially offset some of the interest accrued on outstanding debt, this effect is likely to be marginal.

The interest rate on Apple Card debt remains significantly higher than the savings rate, meaning that consumers will still accrue substantial interest charges on their outstanding balances. Therefore, the increased savings rate is unlikely to have a substantial impact on debt accumulation for most users.

Managing Finances

In light of the increased savings rate, it’s essential for Apple Card users to manage their finances strategically. Here are some key considerations:

- Prioritize Debt Repayment:Despite the increased savings rate, it’s crucial to prioritize paying off high-interest debt. The interest accrued on outstanding debt is likely to outweigh the interest earned on savings.

- Maximize Savings Potential:Utilize the increased savings rate to your advantage by consistently contributing to your Apple Card savings account. Consider setting up automatic transfers to ensure regular contributions.

- Budgeting and Financial Planning:Develop a comprehensive budget that accounts for your income, expenses, and debt obligations. This will help you make informed financial decisions and ensure that you’re allocating your resources effectively.

Future Outlook

The recent surge in Apple Card savings interest rates raises questions about the future trajectory of these rates. While a 4.5% APY is currently attractive, there’s a chance it could be surpassed, leading to even higher returns for cardholders.

Factors Influencing Future Interest Rate Decisions

Several factors could influence future interest rate decisions for the Apple Card, shaping the potential returns for consumers.

- Competition in the Credit Card Market:The credit card market is highly competitive, with numerous players offering attractive rewards and interest rates. Apple Card’s interest rate increases may be a response to competitive pressure, pushing it to remain competitive and attract new customers. As other credit card providers adjust their offerings, Apple Card might follow suit to maintain its market position.

- Economic Conditions:Interest rates are influenced by economic conditions, including inflation and the Federal Reserve’s monetary policy. If inflation continues to rise, the Federal Reserve may increase interest rates to curb inflation. This could lead to higher borrowing costs for credit card companies, potentially influencing Apple Card’s interest rates.

- Apple’s Financial Strategy:Apple’s financial strategy plays a role in setting interest rates. The company may choose to offer higher interest rates to attract more customers and increase the usage of Apple Card, potentially leading to higher revenue. However, they must also consider the cost of offering these rates and their impact on profitability.