Apple Stock Plunges Weeks Before Vision Pro Launch

Apples share price just tanked weeks before the expected vision pro launch aapl down more than 4 after major bank issues price warning – Apple’s share price just tanked weeks before the expected Vision Pro launch, with AAPL down more than 4% after a major bank issued a price warning. This unexpected dip has sent shockwaves through the tech world, raising questions about the future of Apple’s flagship product and the company’s overall performance.

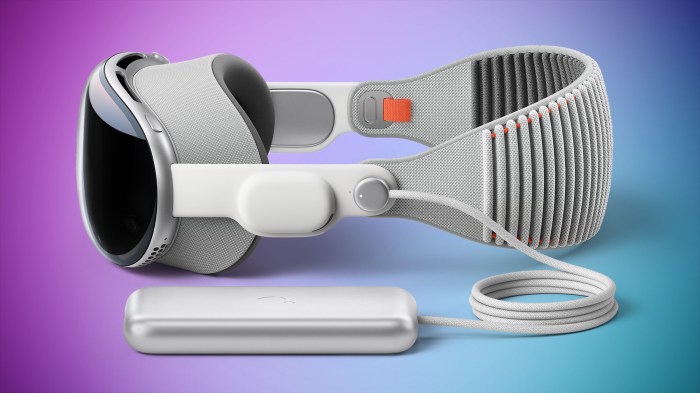

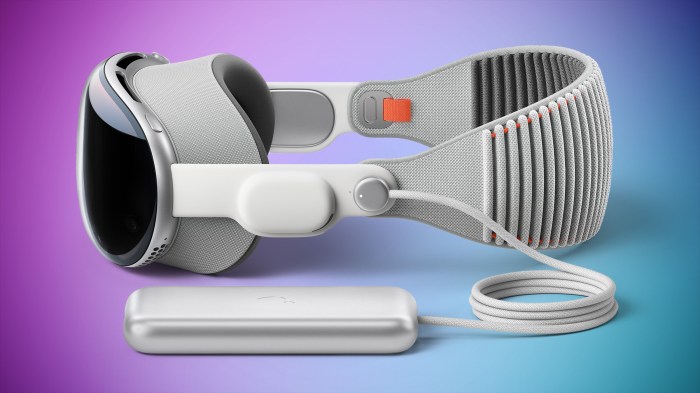

The timing of this drop is particularly concerning, as Apple typically enjoys a surge in stock price leading up to major product releases. The Vision Pro, a revolutionary mixed-reality headset, has been touted as a potential game-changer for Apple, but the recent share price decline suggests investors may be wary of its success.

Timing of the Share Price Drop

The recent drop in Apple’s share price, occurring weeks before the anticipated launch of the Vision Pro, has sparked considerable discussion among investors and analysts. This event is particularly intriguing, considering Apple’s historical track record of stock performance around new product releases.

The timing of this drop raises questions about its potential impact on the Vision Pro’s launch and the broader market’s perception of Apple’s future growth.

It’s a wild week for Apple investors, with the share price plummeting just weeks before the highly anticipated Vision Pro launch. Major banks are issuing price warnings, citing concerns about the product’s market appeal. To escape the financial roller coaster, I’m finding solace in a DIY project – building some stunning DIY diamond-shaped book shelves to add a touch of geometric flair to my home office.

Perhaps some creative woodworking will help me forget about the market’s volatility for a while!

Apple’s Historical Stock Performance Around New Product Releases

Historically, Apple’s stock price has generally trended upward in the lead-up to major product launches. The release of new iPhones, for example, has often been accompanied by a surge in Apple’s stock price. This pattern is driven by investor optimism about the potential for new products to drive increased revenue and profitability.

The current share price decline, therefore, deviates from this historical pattern and suggests a shift in investor sentiment.

Major Bank Price Warning: Apples Share Price Just Tanked Weeks Before The Expected Vision Pro Launch Aapl Down More Than 4 After Major Bank Issues Price Warning

The recent decline in Apple’s share price, occurring just weeks before the anticipated Vision Pro launch, has raised eyebrows among investors. One key factor contributing to this drop was a price warning issued by a major bank, raising concerns about the potential impact of the new device on Apple’s overall financial performance.

Bank of America’s Warning

Bank of America, a prominent financial institution, issued a price target reduction for Apple shares, citing concerns about the potential impact of the Vision Pro on Apple’s overall financial performance. The bank’s analysts believe that the Vision Pro, despite its innovative technology, may face challenges in achieving widespread adoption due to its high price point of $3,499.

Apple’s share price taking a tumble just weeks before the Vision Pro launch is definitely raising eyebrows. Aapl is down over 4% after a major bank issued a price warning, leaving investors wondering if the excitement surrounding the new headset is enough to offset the market’s concerns.

Meanwhile, in a different corner of the market, Dundee Corporation is taking a different approach, dundee corporation strengthens commitment to core strategy and announces the sale of its investment management business. It’s interesting to see these contrasting moves in the market, with some companies focusing on innovation and others on streamlining their operations.

Will Apple’s Vision Pro be the game-changer it needs to be, or will the market’s current volatility overshadow its potential?

This could potentially limit the device’s contribution to Apple’s revenue and earnings, especially in the near term.

“While the Vision Pro is an impressive technological feat, we believe its high price point and limited initial market appeal could result in modest near-term revenue contributions,”

stated the Bank of America analysts in their research note.

Impact of the Warning on Share Price

Bank of America’s price warning, coupled with other factors such as the broader market volatility and concerns about the economic outlook, contributed to the decline in Apple’s share price. Investors, taking note of the potential challenges facing the Vision Pro, became cautious about Apple’s future prospects, leading to a sell-off in the company’s stock.

This sell-off, in turn, amplified the downward pressure on the share price, resulting in a significant drop.

The stock market can be a wild ride, and Apple’s recent share price drop just weeks before the highly anticipated Vision Pro launch is a prime example. With major banks issuing price warnings, it seems investors are feeling a bit uneasy.

But hey, at least we can all take comfort in the fact that we can still find joy in baking and decorating delicious sugar cookies. If you’re looking for inspiration and tips on how to create beautiful cookie masterpieces, check out this helpful guide on what you need to decorate sugar cookies.

Who knows, maybe a little sugar rush is just what we need to get through the rollercoaster of the stock market!

Potential Factors Influencing the Share Price Drop

The recent decline in Apple’s share price, occurring just weeks before the highly anticipated launch of the Vision Pro, has sparked widespread speculation and analysis. Several factors, including macroeconomic conditions, industry trends, and company-specific news, could be contributing to this downturn.

Understanding these factors is crucial for investors and market observers to assess the long-term implications for Apple’s stock.

Macroeconomic Factors

The current macroeconomic environment is characterized by rising interest rates, persistent inflation, and concerns about a potential recession. These factors can negatively impact consumer spending and business investment, leading to decreased demand for discretionary products like Apple’s devices.

The Federal Reserve’s aggressive rate hikes aim to curb inflation, but they also increase borrowing costs for businesses and consumers, potentially dampening economic growth.

Industry Trends

The technology sector, particularly the smartphone market, is facing growing competition from emerging players and mature markets.

- The rise of affordable Android devices is putting pressure on Apple’s iPhone sales, particularly in price-sensitive markets.

- The slowdown in global smartphone sales, fueled by factors like economic uncertainty and increased device lifecycles, further contributes to industry headwinds.

Company-Specific News

Several company-specific factors could be influencing Apple’s share price.

- Recent reports suggest a lower-than-expected demand for the iPhone 15 series, potentially indicating a slowdown in Apple’s flagship product sales.

- The upcoming Vision Pro launch, while generating significant hype, faces uncertainty regarding consumer adoption and pricing. The market is closely watching how this new product performs.

Interconnected Factors

The factors discussed above are interconnected. For instance, macroeconomic uncertainty can impact consumer spending on discretionary products like iPhones, leading to a slowdown in Apple’s sales. This, in turn, could affect the company’s overall revenue and profitability, influencing investor sentiment and share price.

Impact on Apple’s Future

While the recent share price drop is concerning, it’s crucial to analyze its potential long-term impact on Apple. The drop reflects market sentiment, but Apple’s fundamentals remain strong, and its future prospects remain bright.

Investor Confidence and Future Product Launches, Apples share price just tanked weeks before the expected vision pro launch aapl down more than 4 after major bank issues price warning

The share price drop could impact investor confidence, particularly in the short term. However, Apple has a history of weathering market fluctuations and delivering strong results. The company’s loyal customer base, robust ecosystem, and consistent innovation are key strengths that will likely mitigate the impact of this decline.

Investors may adopt a wait-and-see approach, but Apple’s track record suggests that they will likely return to the stock once the market stabilizes.

Apple’s Strategies to Mitigate the Impact

Apple has several strategies to mitigate the impact of the share price drop. The company can focus on enhancing its product offerings, expanding its services, and optimizing its supply chain. Apple’s commitment to innovation is likely to continue, with upcoming products like the Vision Pro expected to drive growth.

The company can also focus on cost management and shareholder value creation to reassure investors. Apple’s strong financial position and brand equity will be crucial in navigating this period.