What is a Payroll Register and Why It Matters?

What is payroll register – What is a payroll register? It’s more than just a document that lists your employees’ paychecks. It’s a vital tool for managing payroll, ensuring accuracy, and maintaining compliance. Think of it as the backbone of your payroll system, keeping everything organized and in line with regulations.

Essentially, a payroll register is a detailed record of all payroll-related transactions for a specific pay period. It encompasses everything from employee names and hours worked to deductions, taxes, and net pay. This information is crucial for various purposes, from generating paychecks and filing taxes to tracking employee earnings and ensuring compliance with labor laws.

Definition of a Payroll Register

A payroll register is a crucial document in payroll management, serving as a comprehensive record of all employee earnings and deductions for a specific pay period. It acts as a detailed summary of the payroll process, providing a clear and organized overview of all payroll transactions.

Key Information Included in a Payroll Register

The payroll register typically includes essential information about each employee, their earnings, deductions, and net pay. The following are key components typically found in a payroll register:

- Employee Information:Employee name, employee ID, social security number, address, and contact information.

- Earnings:Regular pay, overtime pay, bonuses, commissions, and other forms of compensation.

- Deductions:Federal, state, and local taxes, health insurance premiums, retirement contributions, and other pre-tax and post-tax deductions.

- Net Pay:The amount of money an employee receives after all deductions are subtracted from their gross earnings.

- Pay Period Dates:The specific start and end dates of the pay period covered by the register.

- Payroll Date:The date on which the payroll was processed and the paychecks were issued.

Examples of Different Types of Payroll Registers

Payroll registers can vary depending on the industry, size of the company, and specific payroll system used. Here are examples of different types of payroll registers:

- Manual Payroll Register:This is a traditional paper-based register where payroll information is manually entered and calculated. It is often used by small businesses with a limited number of employees.

- Electronic Payroll Register:With the advent of technology, many businesses have transitioned to electronic payroll registers. These registers are typically part of payroll software systems that automate the payroll process and generate electronic reports.

- Cloud-Based Payroll Register:Cloud-based payroll registers offer flexibility and accessibility. They can be accessed from any device with an internet connection, allowing for real-time updates and collaboration.

Payroll Register Creation and Maintenance

The payroll register is the cornerstone of accurate and timely payroll processing. It serves as a comprehensive record of all payroll transactions, providing a detailed overview of employee earnings, deductions, and net pay. Creating and maintaining a payroll register is a crucial process that demands careful attention to detail and adherence to established procedures.

A payroll register is a crucial document that tracks employee wages, deductions, and net pay. It’s essential for maintaining accurate financial records and ensuring compliance with labor laws. But just as important is safeguarding employee data, a challenge that’s highlighted by the evolving landscape of Okta customer identity trends.

As identity management becomes increasingly complex, companies need robust security measures to protect sensitive payroll information, just like they need a well-maintained payroll register to ensure accurate and timely compensation for their employees.

Creating a Payroll Register

Creating a payroll register involves a structured process that ensures all relevant information is captured and processed accurately.

A payroll register is a document that records all the details of an employee’s earnings and deductions for a specific pay period. It’s a vital tool for businesses to manage their payroll and ensure accuracy. Speaking of accuracy, have you heard about Apple’s next design trick – building a modern-day pyramid in Malaysia?

This ambitious project might seem unrelated to payroll, but it highlights the importance of meticulous planning and execution, just like a payroll register requires.

- Gather Employee Data: The foundation of a payroll register is accurate employee information. This includes personal details such as name, address, and Social Security number, as well as employment information such as job title, pay rate, and tax withholding status.

- Collect Time and Attendance Data: To calculate earnings, accurate time and attendance data is essential. This involves recording hours worked, overtime hours, and any other time-related factors that affect pay.

- Calculate Gross Earnings: Gross earnings represent the total amount earned by employees before deductions. This calculation involves multiplying the employee’s hourly rate by the number of hours worked, adding any overtime pay, bonuses, or commissions.

- Calculate Deductions: Deductions are amounts withheld from an employee’s gross earnings. These include mandatory deductions such as federal, state, and local taxes, as well as voluntary deductions like health insurance premiums, retirement contributions, and charitable donations.

- Calculate Net Pay: Net pay represents the amount of money an employee receives after all deductions are taken from their gross earnings. This calculation involves subtracting all deductions from the gross earnings.

Maintaining a Payroll Register

Maintaining a payroll register is an ongoing process that ensures its accuracy and timeliness.

A payroll register is a crucial document for any business, outlining employee wages, deductions, and net pay. It’s essential for accurate record-keeping and tax compliance. Speaking of compliance, I recently learned about Google Chronicle Security Operations Preview Duet AI , which seems like a game-changer for cybersecurity.

Anyway, back to payroll registers, these documents can be a lifesaver when it comes to reconciling payroll data and ensuring everyone is paid correctly.

- Regular Updates: The payroll register should be updated regularly to reflect changes in employee information, pay rates, deductions, and time and attendance records.

- Accuracy Verification: Ensuring accuracy is paramount. This includes verifying that all data entered into the payroll register is correct and that calculations are accurate.

- Timely Filing: Payroll registers are often used for tax reporting purposes. It is crucial to maintain accurate and up-to-date records for timely filing of tax returns.

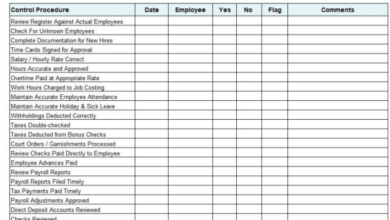

Tips and Best Practices for Payroll Register Integrity

- Use Reliable Software: Payroll software can automate many tasks, reducing the risk of errors. Select a reputable software provider that offers features that meet your specific needs.

- Implement Strong Internal Controls: Establish clear procedures for data entry, review, and approval to minimize the risk of fraud or errors.

- Regular Audits: Conduct periodic audits of the payroll register to ensure accuracy and compliance with regulations.

- Employee Training: Train employees on proper data entry and payroll procedures to minimize errors.

- Data Backup and Security: Implement measures to protect the payroll register from data loss or unauthorized access.

Uses and Benefits of a Payroll Register

A payroll register serves as a vital tool for businesses of all sizes, streamlining payroll processing, ensuring compliance, and providing valuable insights for effective payroll management. This document serves as a comprehensive record of all payroll transactions, encompassing employee details, earnings, deductions, and net pay.

Payroll Processing Efficiency

The payroll register simplifies the process of calculating and distributing employee pay. It acts as a central repository for all relevant payroll data, eliminating the need for manual calculations and reducing the risk of errors. By organizing employee information and pay details in a structured format, the register streamlines payroll processing, saving time and resources for businesses.

Accurate and Transparent Reporting

The payroll register provides a detailed and accurate record of all payroll transactions, enabling businesses to generate comprehensive reports for various purposes. These reports can be used to track employee earnings, deductions, and net pay over time, providing valuable insights for financial planning and analysis.

The transparency offered by the register fosters trust and confidence among employees by providing them with a clear understanding of their earnings and deductions.

Compliance with Labor Laws

Maintaining accurate payroll records is crucial for compliance with labor laws and regulations. The payroll register serves as a primary document for demonstrating adherence to legal requirements, such as minimum wage laws, overtime regulations, and tax withholdings. By providing a detailed record of payroll transactions, the register helps businesses avoid legal issues and penalties associated with non-compliance.

Effective Payroll Management, What is payroll register

The payroll register enables businesses to identify and address potential payroll issues proactively. By analyzing the data within the register, businesses can identify trends in employee earnings, deductions, and overtime hours. This information can be used to optimize payroll processes, identify areas for cost savings, and ensure employee satisfaction.

Employee Satisfaction

A well-maintained payroll register contributes to employee satisfaction by ensuring accurate and timely payment of wages. Employees appreciate transparency and clarity regarding their earnings and deductions, which the register provides. By demonstrating a commitment to accurate payroll practices, businesses can foster a positive and productive work environment.

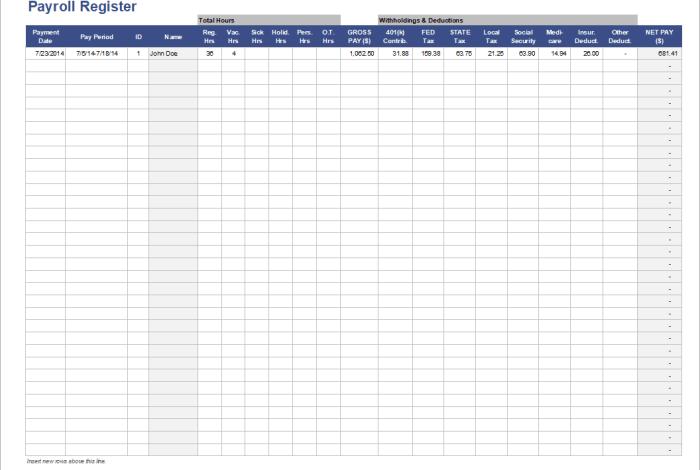

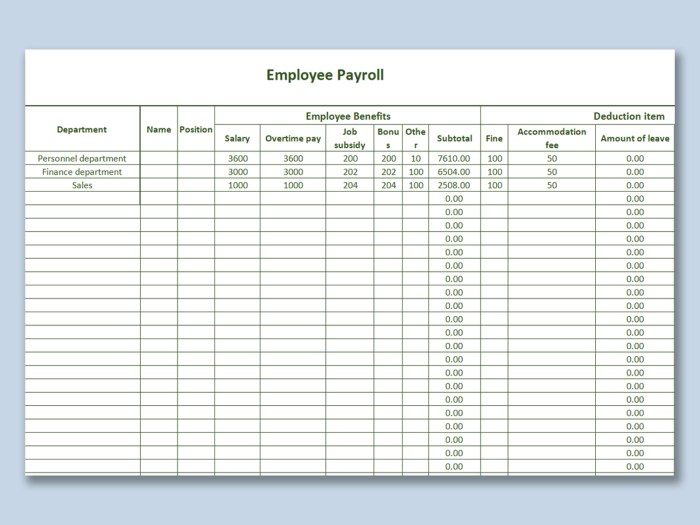

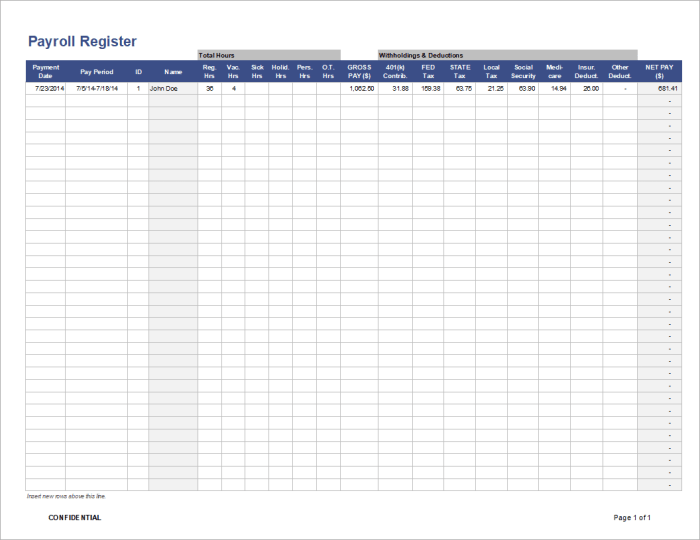

Examples of Payroll Registers: What Is Payroll Register

Payroll registers are essential tools for businesses of all sizes, helping them manage employee compensation and track payroll expenses. They provide a comprehensive record of each employee’s earnings, deductions, and net pay for a specific pay period. To illustrate the diverse applications of payroll registers, we will explore real-world examples and compare the features of various payroll register software solutions.

Real-World Examples of Payroll Registers

Organizations across various industries utilize payroll registers to streamline their payroll processes and ensure accurate compensation for their employees. Here are some examples:

- Small Businesses:A local bakery might use a simple spreadsheet-based payroll register to track employee hours, wages, and deductions. This register can be easily maintained and provides a clear overview of payroll expenses.

- Large Corporations:A multinational corporation might utilize a sophisticated payroll software solution with advanced features like automated time tracking, tax calculations, and direct deposit. This solution ensures accurate and efficient payroll processing for thousands of employees across multiple locations.

- Non-Profit Organizations:A non-profit organization might use a payroll register to manage the compensation of its staff and volunteers. The register helps track hours worked, stipends, and any applicable deductions.

- Government Agencies:Government agencies often employ complex payroll systems with integrated tax and benefits management. These systems ensure compliance with regulations and provide comprehensive reporting capabilities.

Comparison of Payroll Register Software Solutions

The market offers a wide array of payroll register software solutions, each catering to different needs and budgets. Here’s a comparison of features and functionalities:

- Cloud-Based Payroll Software:Cloud-based solutions like QuickBooks Payroll and Gusto offer accessibility from any device with an internet connection. They automate payroll processing, tax calculations, and direct deposit, making them ideal for businesses of all sizes.

- On-Premise Payroll Software:On-premise solutions like ADP Workforce Now are installed on a company’s server and require dedicated IT support. They offer comprehensive features, including time and attendance tracking, benefits administration, and reporting.

- Spreadsheet-Based Payroll Registers:Spreadsheets like Microsoft Excel can be used to create simple payroll registers, especially for small businesses with a limited number of employees. They offer flexibility and cost-effectiveness but require manual calculations and data entry.

Design of a Simple Payroll Register Template

For a small business, a simple payroll register template can be easily created using a spreadsheet application like Microsoft Excel. This template can be customized to meet specific needs and should include the following columns:

| Employee Name | Employee ID | Pay Period | Regular Hours | Overtime Hours | Hourly Rate | Gross Pay | Federal Income Tax | Social Security | Medicare | State Income Tax | Other Deductions | Net Pay |

|---|

This template can be used to calculate gross pay, deductions, and net pay for each employee. The formulas used for calculating these values can be easily replicated for other employees, ensuring consistency and accuracy.

For example, the Gross Pay can be calculated by multiplying the Regular Hours by the Hourly Rate and adding the product of Overtime Hours and Overtime Rate.

- Employee Name:This column lists the names of all employees for whom payroll is being processed.

- Employee ID:This column contains a unique identification number assigned to each employee.

- Pay Period:This column indicates the specific pay period for which the payroll register is being prepared.

- Regular Hours:This column lists the number of regular hours worked by each employee during the pay period.

- Overtime Hours:This column lists the number of overtime hours worked by each employee during the pay period.

- Hourly Rate:This column specifies the hourly rate of pay for each employee.

- Gross Pay:This column represents the total amount earned by each employee before any deductions.

- Federal Income Tax:This column shows the amount of federal income tax withheld from each employee’s pay.

- Social Security:This column displays the amount of Social Security tax withheld from each employee’s pay.

- Medicare:This column shows the amount of Medicare tax withheld from each employee’s pay.

- State Income Tax:This column displays the amount of state income tax withheld from each employee’s pay.

- Other Deductions:This column includes any other deductions, such as health insurance premiums or retirement contributions.

- Net Pay:This column represents the amount of money each employee receives after all deductions are withheld.