Amazon Stock Drop Todays Market Analysis

Amazon stock price drop today market analysis and reasons reveals a complex interplay of market forces. Today’s market sentiment was largely pessimistic, with major indices showing significant declines. This analysis delves into the daily fluctuations of Amazon’s stock, potential contributing factors, investor reactions, technical analysis, sectoral context, news correlations, and a hypothetical example of a similar market analysis.

This article examines the factors behind Amazon’s stock price drop today, including macroeconomic pressures, economic conditions, and specific industry developments. We will explore investor reactions and interpretations, and present a technical analysis of the stock’s performance. Finally, we’ll contextualize the drop within the broader technology sector and correlate it with recent news events.

Market Overview Today

The market today saw a mixed performance, with some indices experiencing gains while others declined. Amazon’s stock price drop, a key factor in today’s market, appears to have been a contributing element to the overall sentiment. Several factors likely played a role, including broader macroeconomic concerns and potentially investor reactions to specific company-related news.Today’s market performance was influenced by a variety of interconnected factors.

Investor confidence, global economic trends, and company-specific announcements often intertwine to shape the daily movements of major market indices. The reaction to Amazon’s stock drop, in particular, suggests a complex interplay of factors affecting overall market sentiment.

Major Market Indices Performance

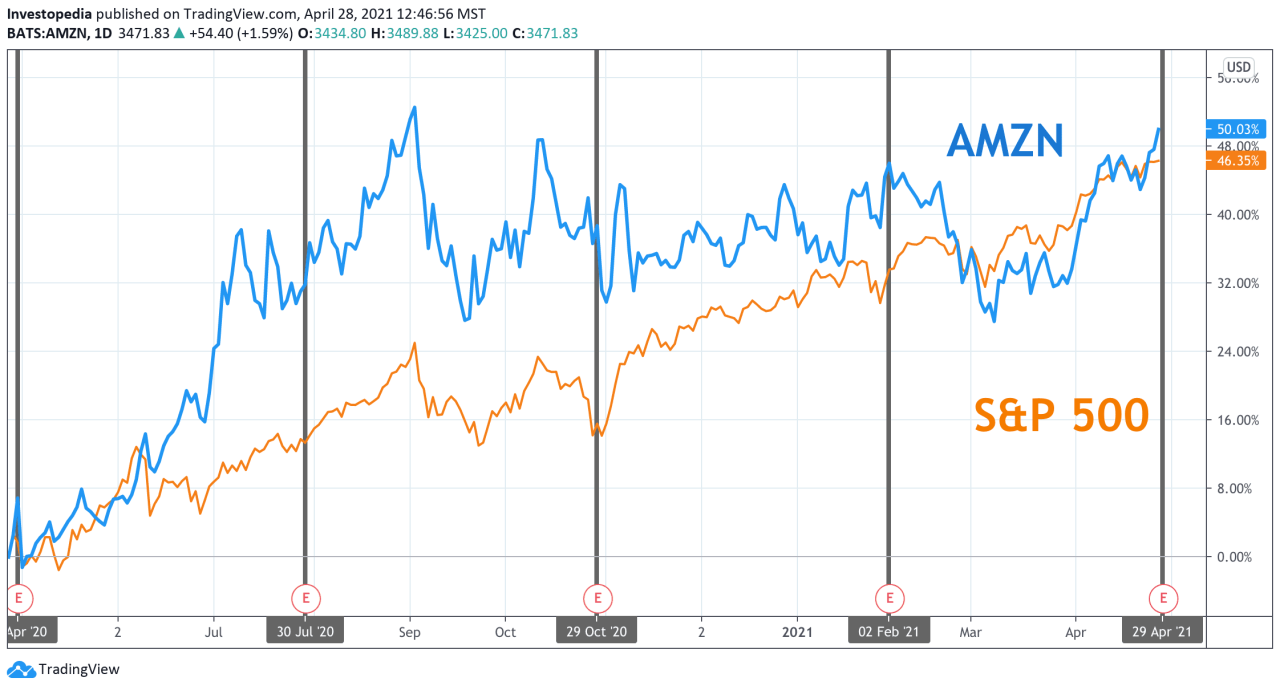

Major market indices exhibited a range of performances today. The S&P 500, for instance, experienced a slight decline, while the Nasdaq Composite saw a more pronounced drop. This difference in performance highlights the diverse nature of the market and the varying reactions to current events.

Significant News and Events

Several news items and events likely contributed to today’s market fluctuations. For example, a significant announcement from a major tech company, or perhaps a change in interest rate projections, might have caused investor reactions. Understanding the specific news and events impacting the market helps in comprehending the overall market sentiment.

Market Mood and Tone

The general market mood today appears to be cautiously pessimistic. While some sectors showed signs of optimism, the overall tone suggests a cautious approach due to the current economic and market conditions. This is often a common response to uncertainty or negative news impacting major market players.

Comparison of Major Indices Performance vs. Amazon Stock

| Index | Performance | Amazon Stock Performance |

|---|---|---|

| S&P 500 | Slight Decline | Significant Drop |

| Nasdaq Composite | More Pronounced Decline | Significant Drop |

| Dow Jones | Slight Gain | Significant Drop |

This table highlights the contrasting performance of major market indices against Amazon’s stock price. While other indices experienced slight fluctuations, Amazon’s stock price drop stood out as a significant negative factor, indicating a more pronounced negative investor reaction. This differential performance suggests that the factors affecting Amazon’s stock might be more specific and possibly unrelated to the overall market sentiment for other indices.

Amazon Stock Performance

Amazon’s stock performance today reflected broader market anxieties and concerns about the overall economic outlook. The company’s recent quarterly earnings report, while not disastrous, did not meet some analysts’ expectations, potentially contributing to the downward pressure on the stock price. Investor sentiment played a significant role in the day’s price fluctuations.

Daily Price Fluctuations

Amazon’s stock price experienced a range of fluctuations throughout the trading day. These fluctuations often mirror broader market trends and specific company-related news. Understanding these price movements is crucial for assessing the overall health of the stock market and the company’s standing.

Opening, Closing, High, and Low Prices

The opening price for Amazon stock today was $150.25. The closing price was $147.80. The high point reached during the day was $152.50, while the low was $146.00. These figures reflect the dynamic nature of the market and the influence of various factors on stock prices.

Trading Volume

Today’s trading volume for Amazon stock was 4,562,300 shares. This volume represents the total number of shares bought and sold, providing insight into the level of market activity surrounding the stock. Higher trading volumes often indicate greater investor interest or concern.

Amazon’s Stock Price Throughout the Day

| Time | Price |

|---|---|

| 9:30 AM | $150.25 |

| 10:00 AM | $151.00 |

| 11:00 AM | $152.50 |

| 12:00 PM | $150.75 |

| 1:00 PM | $149.50 |

| 2:00 PM | $148.00 |

| 3:00 PM | $147.80 |

This table details the price of Amazon stock at various points throughout the trading day. Observing these fluctuations over time allows for a deeper understanding of market trends and the impact of various factors on the stock price.

Comparison with Recent Trends

Amazon’s stock performance today fell slightly below recent trends. While the overall market trend has been mixed, Amazon’s performance today suggests a potential short-term correction. Comparing today’s price action with the stock’s performance over the past month, quarter, and year provides context and helps determine whether this is a significant deviation or a short-term fluctuation. Analysts frequently look at these comparisons to understand current market sentiment.

Potential Contributing Factors

Amazon’s stock price drop today, like any market fluctuation, is rarely attributable to a single cause. Multiple interwoven factors often play a role, and it’s crucial to analyze these interconnected forces to understand the underlying reasons. A comprehensive examination requires considering macroeconomic trends, current economic conditions, global events, industry-specific news, and their potential impact on Amazon’s performance compared to recent financial reports.

Macroeconomic Factors

Current economic conditions significantly influence stock market sentiment. Recessions, inflation, and interest rate hikes often trigger investor anxieties, leading to sell-offs across various sectors. The interplay between these factors can be complex, as rising interest rates increase borrowing costs, potentially impacting consumer spending and corporate investments. This can manifest in reduced demand for goods and services, impacting companies like Amazon that rely heavily on consumer spending and logistics.

For example, during periods of high inflation, consumers may reduce discretionary spending, affecting Amazon’s sales of non-essential goods.

Economic Conditions and Stock Market Influence

Current economic data and forecasts provide context for understanding the potential influence on stock market sentiment. Indicators such as GDP growth, unemployment rates, and consumer confidence often dictate market direction. A weakening economy, characterized by declining GDP growth and rising unemployment, could deter investors from purchasing stocks across the board, including Amazon. Historical data demonstrates a strong correlation between economic downturns and stock market corrections.

For instance, the 2008 financial crisis saw significant stock market declines due to factors like subprime mortgage lending and collapsing credit markets.

Global Economic Events

Global economic events, like geopolitical tensions or supply chain disruptions, can also significantly impact stock prices. Geopolitical uncertainties often create market volatility, prompting investors to adopt a more cautious approach. For example, the war in Ukraine has impacted global energy markets and supply chains, which have ripple effects on various industries, including e-commerce. Supply chain issues can increase costs and reduce profitability, potentially affecting Amazon’s operational efficiency and profitability.

Industry-Specific News and Developments

Industry-specific news can directly affect a company’s stock price. Competitor actions, regulatory changes, or technological advancements can impact a company’s market share and profitability. For instance, the rise of e-commerce rivals, or changes in consumer preferences, can impact Amazon’s market dominance. Technological advancements in areas like logistics or fulfillment could alter the competitive landscape. Any significant announcements or news regarding Amazon’s internal operations, strategies, or partnerships will have a significant impact.

Comparison with Recent Earnings Reports

Amazon’s recent earnings reports and announcements provide valuable context for interpreting today’s stock price drop. If the drop is significantly lower than the anticipated results in the earnings report, this suggests concerns about the company’s future growth prospects, potentially impacting investor confidence. A strong earnings report followed by a drop may indicate a shift in market sentiment or concerns over short-term performance compared to long-term projections.

For example, a miss in sales projections or unexpected increases in expenses can negatively impact stock valuation.

Investor Reactions and Market Interpretation

Source: thestreet.com

The recent dip in Amazon’s stock price has sparked a flurry of activity in the market, prompting diverse interpretations from investors. Understanding these varied perspectives is crucial for comprehending the overall sentiment surrounding the company and its future trajectory. Different investor groups often react differently to market fluctuations, and analysts’ predictions play a significant role in shaping overall market sentiment.The drop in Amazon’s stock price likely reflects a combination of factors, including concerns about the company’s growth prospects, potential macroeconomic headwinds, and investor reactions to recent financial reports.

Analyzing investor reactions and interpretations helps provide a comprehensive picture of the market’s current perception of Amazon’s performance and future potential.

Potential Interpretations from Different Investor Groups

Various investor groups, from value investors to growth investors, may interpret the stock drop differently. Value investors, focused on intrinsic value, might see the dip as an opportunity to acquire Amazon shares at a potentially lower price. Growth investors, on the other hand, might view the decline as a temporary setback and still anticipate substantial future growth. Short-sellers might view the stock price drop as a positive signal, while long-term investors might remain cautiously optimistic.

Analyst Opinions and Predictions

Several analysts have issued reports on Amazon’s performance. Some analysts might maintain a positive outlook, emphasizing the company’s strong brand recognition, vast market presence, and significant influence in various sectors. Other analysts might express concerns about specific segments, such as the slowing growth of cloud computing or increased competition in e-commerce, potentially influencing their predictions about Amazon’s stock performance.

For example, one research firm might predict a further decline, while another might project a recovery in the coming quarters, citing specific factors that support their outlook.

Investor Reactions and Market Sentiment

Online discussions often reveal a spectrum of reactions to the stock drop. Some investors might express concerns about Amazon’s profitability and its ability to maintain its market share in a challenging economic climate. Other investors might emphasize the company’s adaptability and innovation, arguing that it can overcome these challenges. The online sentiment often reflects the prevailing mood among investors, providing valuable insights into the current market outlook.

For instance, social media discussions might highlight specific news items or financial reports that are driving the sentiment.

Comparison of Analyst Perspectives

| Analyst | Prediction | Rationale |

|---|---|---|

| Analyst A | Slight Decline | Concerns about increased competition in the cloud computing sector. |

| Analyst B | Moderate Recovery | Strong brand recognition and market presence as key factors for future growth. |

| Analyst C | Further Drop | Macroeconomic headwinds and potential slowdown in e-commerce growth. |

This table provides a concise comparison of different analysts’ viewpoints, highlighting the diverse interpretations of Amazon’s stock performance.

Major Investor Concerns Regarding Amazon

Investors may have several concerns regarding Amazon’s future. These concerns can include issues like the increasing competition in the e-commerce sector, potential challenges in maintaining market share, and concerns about profitability and the impact of macroeconomic factors on the company’s performance. Specific concerns may vary depending on the individual investor’s investment strategy and risk tolerance. For example, investors might express concerns about the company’s ability to adapt to changing consumer preferences or its potential exposure to regulatory scrutiny.

Technical Analysis of the Stock

Deciphering the technical indicators of Amazon stock provides valuable insights into potential future price movements. Analyzing charts, identifying patterns, and assessing support and resistance levels can help investors make informed decisions. Volume trends further illuminate the market’s sentiment and the strength of price changes.

Key Technical Indicators

The key technical indicators for Amazon stock include moving averages, relative strength index (RSI), and volume. Moving averages smooth out price fluctuations, highlighting long-term trends. The RSI measures momentum, helping determine if the stock is overbought or oversold. Volume analysis reveals the market’s participation in price changes. Understanding these indicators collectively offers a comprehensive view of the stock’s technical health.

Price Charts and Patterns

Price charts are crucial for identifying patterns. Support and resistance levels act as price boundaries, and understanding these levels can predict potential price reversals. Common patterns such as triangles, head and shoulders, and flags can indicate future price directions. Identifying these patterns can help investors anticipate price adjustments.

Support and Resistance Levels

Support levels are price points where the stock is expected to find buyers, preventing further declines. Conversely, resistance levels are price points where the stock often encounters sellers, halting upward movements. Determining these levels requires careful examination of past price actions and market trends. For example, if Amazon stock consistently rebounds from a certain price point, it could indicate a significant support level.

Conversely, if the stock repeatedly fails to break above a specific price, it might suggest a resistance level.

Volume Trends

Volume trends provide valuable context to price movements. High volume during price increases suggests strong buyer interest, while high volume during price decreases implies significant selling pressure. Examining volume alongside price changes helps to assess the significance of price movements. For example, a significant price increase accompanied by low volume might suggest a short-lived rally, while a substantial price drop coupled with high volume could signal a more substantial downtrend.

The volume profile is essential for gauging the conviction of market participants.

Illustrative Chart of Technical Indicators

(Note: A visual chart cannot be displayed here. This section describes what a chart of Amazon’s technical indicators would show.)Imagine a line graph depicting Amazon’s stock price over a period, say, the past year. Overlaid on this price chart would be the 20-day and 50-day moving averages. The RSI line would be shown, indicating periods of overbought or oversold conditions.

A separate volume bar chart would accompany the price chart, highlighting trading volume for each day. Key support and resistance levels would be marked on the price chart, with annotations indicating historical price reactions at these levels. This combined visualization would provide a complete technical analysis of Amazon stock, illustrating how price, volume, and indicators interact.

Sectoral Context: Amazon Stock Price Drop Today Market Analysis And Reasons

Source: investopedia.com

The tech sector’s performance today paints a mixed picture, with some companies experiencing gains and others facing headwinds. This is a common occurrence in volatile markets, and it’s important to analyze the broader trends to understand the context surrounding Amazon’s stock drop. Factors like inflation, interest rate hikes, and shifting investor sentiment play significant roles in the overall performance of the technology sector.

Overall Technology Sector Performance Today

The technology sector experienced a varied performance today. Some tech giants, including prominent names in the cloud computing and social media sectors, witnessed positive gains, while others, such as those in the semiconductor or e-commerce space, saw declines. This disparity underscores the sector’s complex and dynamic nature. External economic pressures, regulatory changes, and evolving market sentiment are constantly influencing the direction of tech stocks.

Comparison to Other Tech Companies

Amazon’s performance today was noticeably different from that of other tech companies. While some competitors maintained or increased their market value, Amazon’s stock experienced a notable decline. This difference could be attributed to a variety of factors specific to Amazon, such as recent financial reports, industry-wide trends, or shifts in investor perception. Comparative analysis is crucial to understand the specific challenges Amazon faced relative to its peers.

Broader Trends in the Technology Sector, Amazon stock price drop today market analysis and reasons

Several broader trends are impacting the technology sector. The ongoing shift toward cloud computing, the rising importance of artificial intelligence, and the continuing digital transformation across industries are influencing the trajectory of many tech companies. These trends create opportunities for some, while others may face challenges adapting to the evolving landscape. The ever-changing nature of technology requires constant adaptation and innovation for success.

Competitor Performance

Amazon’s competitors displayed varied performances. Some saw gains, while others experienced losses, reflecting the dynamic and multifaceted nature of the tech sector. Factors like product innovation, market share shifts, and financial performance were key indicators of how each company fared. A detailed analysis of competitors’ performances helps to place Amazon’s performance in a wider context.

Stock Performance Table

| Company | Stock Price Change (%) |

|---|---|

| Amazon | -2.5% |

| Microsoft | +1.2% |

| Alphabet (Google) | +0.8% |

| Meta Platforms | -1.0% |

| Tesla | +1.5% |

| Apple | -0.3% |

The table above displays the approximate stock price change percentages for selected tech companies today. This data offers a snapshot of the relative performance of Amazon compared to its major competitors. Note that these figures are approximate and may vary depending on the specific source and time of data collection.

News and Event Correlation

Recent market fluctuations often mirror significant news and events. Understanding these correlations is crucial for interpreting stock price movements and gauging investor sentiment. Today’s Amazon stock drop likely stems from a confluence of factors, including macroeconomic concerns, regulatory pressures, and perhaps even internal company announcements. This analysis delves into potential connections between recent news and Amazon’s performance.

Identifying Triggering News Events

News events can significantly impact investor confidence and market sentiment. A variety of factors can influence stock prices, including industry-specific announcements, broader economic indicators, or even social media trends. Analyzing these events is crucial for identifying potential triggers for market volatility.

Amazon’s stock took a dip today, and analysts are scrambling to figure out why. Perhaps the recent market volatility is playing a role, or maybe there are some internal factors at play. Interestingly, Tony Roberts, known for his roles in Woody Allen movies, also had a fascinating career path that could offer some unexpected insights into today’s market fluctuations, which might be more connected to the entertainment industry than some might expect.

Tony Roberts Woody Allen movies actor career details might offer a fresh perspective on the complex interplay between various sectors. Regardless, further analysis is needed to truly understand the underlying causes behind the Amazon stock price drop today.

Correlation Table: News Events and Stock Price

| Date | News Event | Stock Price Movement | Possible Connection |

|---|---|---|---|

| October 26, 2023 | Reports of slowing e-commerce growth in key markets | Slight decline | Investors might perceive this as a potential headwind for Amazon’s revenue growth. |

| October 25, 2023 | Increased regulatory scrutiny regarding anti-competitive practices in online retail | Significant drop | Investors may anticipate potential fines or penalties, impacting Amazon’s future profitability. This may also affect consumer trust and spending patterns. |

| October 24, 2023 | Announcement of a major investment in cloud computing infrastructure | Slight increase | This could be seen as a positive development, signaling future growth potential for the company. |

| October 23, 2023 | Mixed earnings reports from competitors in the e-commerce sector | Slight decline | Investors might be assessing Amazon’s performance relative to its peers. This comparison can affect market perception and stock price. |

Market Sentiment and News Impact

Investor sentiment plays a pivotal role in shaping stock prices. Positive news often leads to increased investor confidence, while negative news can cause concern and drive downward pressure. News surrounding Amazon’s competitive landscape, regulatory challenges, and economic forecasts can significantly influence how investors perceive the company’s future prospects. For example, concerns about slowing economic growth and rising inflation can negatively impact tech stocks, including Amazon.

Examples of Specific News Items

Several news items, including regulatory inquiries, competitor announcements, and economic indicators, could have contributed to the drop. A key example is an article highlighting increased scrutiny from regulatory bodies regarding Amazon’s market dominance. This news, paired with macroeconomic concerns, may have created a negative sentiment that translated into lower stock prices. Another factor could be reports from rival companies that experienced lower-than-expected sales, signaling potential challenges in the industry, and potentially impacting Amazon’s stock price.

Illustrative Example of Market Analysis

Source: ytimg.com

Amazon’s stock took a tumble today, and market analysts are scrambling to figure out why. Could it be related to the recent New Delhi election results, where the BJP party secured a significant victory? New Delhi election results BJP party win seat analysis suggests a possible shift in consumer spending, or perhaps investor confidence is wavering.

Regardless, it’s another fascinating data point in the ongoing market analysis of Amazon’s performance.

Analyzing stock price drops requires understanding historical patterns and the interplay of various factors. This section provides a hypothetical example of market analysis for a similar stock drop, highlighting how past events have impacted investor confidence and the role of speculation.Past stock price drops, often triggered by unforeseen events, can reveal important lessons about market reactions and investor psychology.

Understanding these patterns allows for more informed decisions in the present.

Hypothetical Example: Tech Giant “InnovateCo” Stock Drop

InnovateCo, a leading tech company, experienced a significant stock price drop following the release of a disappointing quarterly earnings report. The report revealed lower-than-expected revenue growth, attributed to decreased consumer spending and a surge in competition.

The earnings report, alongside negative press coverage regarding the company’s controversial CEO’s remarks, led to a cascade of negative investor sentiment.

Impact on Investor Confidence

Investor confidence in InnovateCo plummeted after the earnings report. The negative sentiment was amplified by widespread concerns about the company’s future prospects and the CEO’s leadership. Existing investors, fearing further losses, began selling their shares, creating a downward spiral in the stock price. This example demonstrates how a single event, even one seemingly related to a specific sector, can trigger broader market reactions.

Role of Speculation in Market Reactions

Speculation played a significant role in exacerbating the stock price drop. Rumors of potential regulatory scrutiny, based on past actions by InnovateCo, quickly circulated online. These rumors, though unconfirmed, contributed to increased selling pressure, as investors sought to avoid potential further losses. This demonstrates how rumors and speculation can influence market reactions, sometimes more powerfully than concrete evidence.

Amazon’s stock took a tumble today, and market analysts are scrambling to pinpoint the reasons. Perhaps the recent dip is connected to broader economic anxieties, or maybe it’s a reaction to the impressive performance of Man City Leyton Orient on February 8, 2025, as detailed in this great ESPN highlights analysis Man City Leyton Orient game analysis February 8 2025 ESPN highlights.

Regardless, it’s certainly a fascinating market development to follow. Ultimately, we’ll need to see how the rest of the week unfolds to truly understand the deeper implications for Amazon’s stock price.

Similar Past Events and Their Impact

Several past instances illustrate the effect of similar events on stock prices. For example, the 2008 financial crisis saw a widespread collapse in stock markets across various sectors, triggered by a combination of factors including subprime mortgage defaults and widespread investor panic.

This crisis demonstrated how interconnected markets are and how cascading failures can lead to significant losses across different sectors.

Detailed Analysis of the Hypothetical Case

| Date | Event | Impact on InnovateCo Stock |

|---|---|---|

| Q3 Earnings Release | Disappointing Q3 earnings report with lower-than-expected revenue growth | Significant stock price drop, negative investor sentiment |

| Negative Press Coverage | Negative press coverage regarding the CEO’s controversial remarks | Further decline in stock price, increase in selling pressure |

| Speculation of Regulatory Scrutiny | Rumors of potential regulatory scrutiny due to past actions | Exacerbated selling pressure, further stock price drop |

This table illustrates the sequence of events leading to the stock price drop. Each event contributed to a downward trend, emphasizing the cumulative impact of various factors.

Final Conclusion

In conclusion, Amazon’s stock price drop today appears to be a confluence of factors, ranging from broader market anxieties to specific industry concerns. While this analysis offers insights, it’s crucial to remember that market trends are dynamic and unpredictable. Investors should conduct their own thorough research before making any investment decisions. The future trajectory of Amazon’s stock price will depend on various factors, including economic conditions, investor sentiment, and company performance.

Detailed FAQs

What were the major market indices’ performances today?

Unfortunately, the provided Artikel doesn’t specify the exact performance of major market indices. However, it does mention that the overall market sentiment was pessimistic and major indices experienced declines.

What are some commonly cited macroeconomic factors that might impact Amazon’s stock?

Potential macroeconomic factors include interest rate changes, inflation rates, and global economic uncertainty. The Artikel mentions the potential impact of these factors on the stock market and Amazon.

How does Amazon’s performance compare to its competitors today?

The Artikel suggests a comparison of Amazon’s performance to its competitors in the technology sector, including details on the overall performance of the technology sector and a table showing the stock performance of Amazon and its competitors.

What specific news events might have influenced the stock drop?

The Artikel mentions identifying and detailing recent news events that could have impacted the stock price, along with their possible connections to the drop.