Best Crypto Payment Gateways: Your Guide to Secure & Easy Transactions

Best crypto payment gateways are revolutionizing the way we transact online. These gateways offer a secure and efficient alternative to traditional payment methods, allowing businesses and consumers to seamlessly exchange cryptocurrencies for goods and services. From Bitcoin to Ethereum and beyond, these gateways are paving the way for a more decentralized and accessible financial future.

This guide explores the key features, popular options, and factors to consider when choosing a crypto payment gateway. We’ll delve into the advantages and disadvantages, security protocols, and emerging trends shaping this dynamic industry. Whether you’re a merchant seeking to expand your payment options or a consumer looking for a convenient way to spend your crypto, this comprehensive overview will provide valuable insights.

What are Crypto Payment Gateways?: Best Crypto Payment Gateways

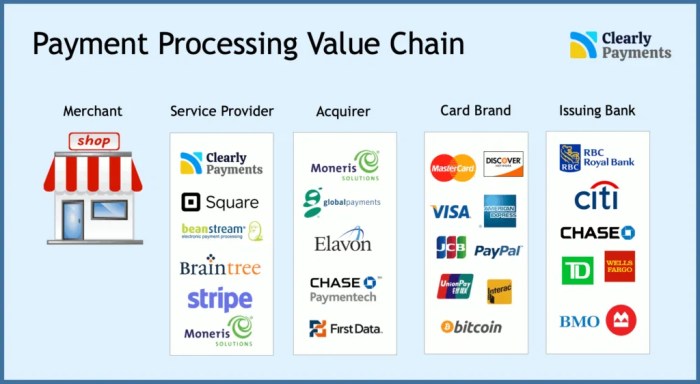

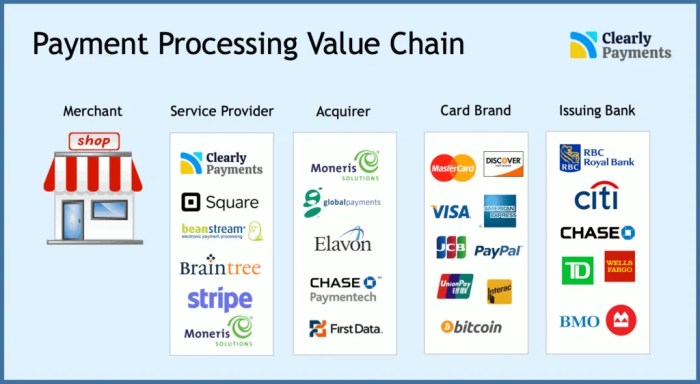

Crypto payment gateways are a crucial element in the world of cryptocurrency transactions. They act as intermediaries, facilitating the seamless exchange of digital currencies between buyers and sellers in online marketplaces. Essentially, they bridge the gap between the traditional financial system and the decentralized world of cryptocurrencies.

Role of Crypto Payment Gateways

Crypto payment gateways simplify the process of accepting and processing cryptocurrency payments. They handle the technical complexities of crypto transactions, enabling merchants to accept cryptocurrencies without needing to directly manage the intricacies of blockchain technology.

Advantages of Crypto Payment Gateways

Crypto payment gateways offer several advantages for both businesses and consumers:

For Businesses

- Reduced Transaction Fees:Crypto payment gateways generally have lower transaction fees compared to traditional payment processors, leading to increased profitability.

- Global Reach:They enable businesses to accept payments from customers worldwide, expanding their customer base and market reach.

- Faster Transactions:Crypto transactions are typically processed faster than traditional bank transfers, providing a more efficient and convenient experience for both businesses and customers.

- Enhanced Security:Crypto transactions are secured by robust cryptographic algorithms, offering a higher level of security compared to traditional payment methods.

- Transparency:Blockchain technology provides a transparent and immutable record of all transactions, fostering trust and accountability.

For Consumers

- Faster Payments:Crypto transactions are generally faster than traditional bank transfers, allowing consumers to receive their purchases quickly.

- Lower Fees:Consumers often benefit from lower transaction fees compared to traditional payment methods.

- Privacy:Crypto transactions offer a greater level of privacy compared to traditional payment methods, as they do not require sharing personal information.

- Global Accessibility:Cryptocurrencies are accessible worldwide, enabling consumers to make payments regardless of their location.

Comparison with Traditional Payment Methods

Crypto payment gateways offer distinct advantages over traditional payment methods:

- Speed:Crypto transactions are generally faster than traditional bank transfers, which can take several days to process.

- Cost:Crypto payment gateways typically have lower transaction fees compared to traditional payment processors, saving both businesses and consumers money.

- Security:Crypto transactions are secured by advanced cryptographic algorithms, offering a higher level of security compared to traditional payment methods.

- Accessibility:Cryptocurrencies are accessible worldwide, enabling businesses and consumers to transact regardless of their location.

Popular Crypto Payment Gateway Options

Navigating the world of crypto payment gateways can feel overwhelming, especially with so many options available. Choosing the right one for your business depends on factors like supported cryptocurrencies, transaction fees, and target audience. This section explores some of the most popular crypto payment gateways, outlining their strengths and key features.

Popular Crypto Payment Gateways

Here’s a table showcasing some popular crypto payment gateways, their supported cryptocurrencies, and transaction fees. These are just a few examples, and the market is constantly evolving with new players emerging.

Choosing the best crypto payment gateway for your business can be a real game-changer, especially when you’re looking to streamline transactions and reach a wider audience. Just like you can use quick parts in Microsoft Outlook to save time by reusing pre-written content, these gateways can help you simplify your payment process and make it easier for customers to pay with their preferred cryptocurrencies.

| Gateway | Supported Cryptocurrencies | Transaction Fees | Strengths |

|---|---|---|---|

| Coinbase Commerce | BTC, ETH, USDT, USDC, DAI, BCH, LTC, DOGE | Variable, typically around 1% | Easy to use, integrated with popular e-commerce platforms, wide range of supported cryptocurrencies. |

| BitPay | BTC, ETH, BCH, LTC, DOGE, XRP, GUSD | Variable, typically around 1% | Established player, strong security features, supports multiple cryptocurrencies and fiat currencies. |

| Mercuryo | BTC, ETH, USDT, USDC, BUSD, XRP, DOGE, LTC | Variable, typically around 1% | Focus on speed and efficiency, offers both fiat and crypto payment options, global reach. |

| Stripe | BTC, ETH, USDC, LTC, DOGE | Variable, typically around 1% | Widely used for online payments, seamless integration with other Stripe services, user-friendly interface. |

| CoinGate | BTC, ETH, LTC, BCH, DOGE, DASH, XRP, USDT, USDC | Variable, typically around 1% | Offers both merchant and user accounts, supports a wide range of cryptocurrencies, strong security measures. |

Factors to Consider When Choosing a Crypto Payment Gateway

Choosing the right crypto payment gateway is crucial for any business looking to accept cryptocurrency payments. It’s essential to carefully consider several factors to ensure the gateway aligns with your business needs and goals. This decision-making framework will help you navigate the various options and select the most suitable gateway for your business.

Supported Cryptocurrencies

The range of cryptocurrencies supported by a payment gateway is a primary consideration. This factor directly influences the types of payments your business can accept.

Finding the best crypto payment gateways for your business is essential, especially as you navigate the world of online transactions. One thing to consider is the security of your data, which is where VPNs come in. If you’re debating between NordVPN vs ExpressVPN , both offer robust security features.

Once you’ve chosen your VPN, you can focus on finding the best crypto payment gateway to match your business needs, ensuring smooth and secure transactions for your customers.

- If your target audience primarily uses Bitcoin and Ethereum, a gateway supporting these two cryptocurrencies will suffice.

- However, if you cater to a broader audience or expect to expand your cryptocurrency acceptance in the future, consider a gateway that supports a wider range of cryptocurrencies, including stablecoins like Tether (USDT) and USD Coin (USDC).

- For businesses operating in specific niches, such as gaming or decentralized finance (DeFi), a gateway supporting niche cryptocurrencies like Shiba Inu (SHIB) or Polygon (MATIC) might be beneficial.

Transaction Fees

Transaction fees are a significant expense associated with cryptocurrency payments. It’s crucial to understand the fee structure of each gateway to minimize costs and maximize profit margins.

- Transaction fees can vary based on the cryptocurrency used, the transaction amount, and the gateway’s pricing model.

- Some gateways charge a fixed fee per transaction, while others charge a percentage of the transaction amount.

- It’s important to compare the fees of different gateways and choose one that offers competitive rates, especially for high-volume transactions.

Security Features

Security is paramount when handling cryptocurrency payments. Choose a gateway that prioritizes security and employs robust measures to protect your business and your customers.

- Look for gateways that offer features like two-factor authentication (2FA), encryption, and cold storage for cryptocurrency holdings.

- Consider gateways that comply with industry standards like PCI DSS (Payment Card Industry Data Security Standard) and have a proven track record of security.

- It’s also essential to understand the gateway’s security policies and procedures for handling sensitive customer data.

Customer Support

Reliable customer support is essential for resolving issues and ensuring a smooth payment experience. Choose a gateway that provides responsive and comprehensive customer support.

- Look for gateways that offer multiple support channels, such as email, phone, and live chat.

- Evaluate the availability of support, including hours of operation and response times.

- Read reviews and testimonials from other businesses to gauge the quality of customer support provided by the gateway.

Integration and Compatibility

The ease of integration with your existing systems is crucial. Choose a gateway that seamlessly integrates with your website, point-of-sale (POS) system, or other relevant platforms.

Choosing the best crypto payment gateway for your business is crucial, especially with the growing adoption of digital currencies. But beyond just security, it’s also essential to consider how you’ll protect your business from potential threats. Leveraging resources like google cloud threat intelligence can provide valuable insights into emerging threats and vulnerabilities, helping you make informed decisions about your payment gateway selection and overall security strategy.

- Look for gateways that offer APIs (Application Programming Interfaces) or plugins for easy integration.

- Ensure compatibility with your chosen e-commerce platform, such as Shopify, WooCommerce, or Magento.

- Consider the gateway’s compatibility with other relevant tools and services you use, such as accounting software or payment processing platforms.

Compliance and Regulations

Cryptocurrency regulations are evolving rapidly, and it’s essential to choose a gateway that complies with all relevant laws and regulations.

- Ensure the gateway is licensed and registered in the jurisdictions where you operate.

- Check for compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

- Consider the gateway’s approach to handling regulatory changes and updates.

Additional Considerations

- Scalability:Choose a gateway that can handle your current transaction volume and can scale as your business grows.

- Reporting and Analytics:Look for a gateway that provides comprehensive reporting and analytics to track your cryptocurrency payments and performance.

- Pricing Transparency:Ensure the gateway’s pricing is transparent and clearly Artikeld, with no hidden fees or charges.

Examples

- For a small online store selling digital products, a gateway with low transaction fees and a user-friendly interface might be ideal.

- For a large e-commerce platform accepting payments from a global audience, a gateway supporting multiple cryptocurrencies and offering advanced security features would be more suitable.

- For a gaming company integrating cryptocurrency payments into its platform, a gateway with fast transaction speeds and a robust API for seamless integration would be crucial.

Emerging Trends in Crypto Payment Gateways

The world of crypto payment gateways is constantly evolving, with new trends emerging and shaping the future of how we transact. These trends are driven by the ever-growing adoption of cryptocurrencies, the advancements in blockchain technology, and the increasing demand for secure and efficient payment solutions.

Integration of Blockchain Technology

The integration of blockchain technology is a fundamental driver of innovation in crypto payment gateways. Blockchain’s inherent features like decentralization, transparency, and security are revolutionizing the way payments are processed.

- Decentralized Finance (DeFi):DeFi applications are enabling users to access financial services directly through blockchain networks, bypassing traditional intermediaries. This has led to the emergence of decentralized payment gateways that offer faster, more cost-effective, and transparent transactions.

- Smart Contracts:Smart contracts are self-executing agreements stored on the blockchain, automating payment processes and eliminating the need for intermediaries. This ensures faster and more secure transactions, reducing the risk of fraud and errors.

- Cross-Border Payments:Blockchain technology facilitates seamless cross-border payments by eliminating the need for complex international banking networks. This makes it easier for businesses to operate globally and reach new markets.

Increased Focus on User Experience

Crypto payment gateways are increasingly focusing on providing a user-friendly experience, similar to traditional payment methods. This includes:

- Simplified Onboarding:Gateways are making it easier for users to sign up and start using their services, often with streamlined KYC/AML processes and intuitive interfaces.

- Multiple Payment Options:Gateways are supporting a wider range of cryptocurrencies and fiat currencies, giving users more flexibility in their payment choices.

- Enhanced Security Features:Gateways are implementing advanced security measures, such as multi-factor authentication and fraud detection systems, to protect users’ funds and data.

Expansion of Use Cases

Crypto payment gateways are expanding their reach beyond traditional e-commerce and are being adopted in various industries, including:

- Gaming:Crypto payments are becoming increasingly popular in the gaming industry, allowing players to buy in-game items and make transactions using cryptocurrencies.

- Travel and Hospitality:Travel agencies and hotels are starting to accept crypto payments, providing travelers with more convenient and cost-effective payment options.

- Subscription Services:Subscription-based services, such as streaming platforms and online courses, are exploring the use of crypto payments to offer alternative payment options to their customers.

Best Practices for Secure Crypto Payments

Cryptocurrency payments offer a unique blend of convenience and security, but they require a proactive approach to safeguard both your assets and your personal information. Whether you’re a merchant accepting crypto payments or a consumer making purchases, implementing best practices is crucial for a seamless and secure experience.

Importance of Two-Factor Authentication, Best crypto payment gateways

Two-factor authentication (2FA) adds an extra layer of security to your crypto transactions, significantly reducing the risk of unauthorized access to your accounts. When enabled, 2FA requires you to provide two forms of authentication—typically a password and a unique code generated by a mobile app or sent to your phone—before granting access to your account.

This makes it significantly harder for hackers to gain access even if they manage to steal your password.

Robust Security Protocols

Merchants and consumers alike should prioritize choosing crypto payment gateways that employ robust security protocols. Look for gateways that implement industry-standard security measures like:

- SSL/TLS Encryption:This encrypts data transmitted between your device and the gateway, making it virtually impossible for unauthorized parties to intercept your information.

- Multi-Signature Wallets:These wallets require multiple signatures for transactions, reducing the risk of unauthorized spending.

- Regular Security Audits:Reputable gateways conduct regular security audits to identify and address potential vulnerabilities.

Safeguarding Personal and Financial Information

Protecting your personal and financial information during online payments is paramount. Here are some essential tips:

- Avoid Public Wi-Fi for Sensitive Transactions:Public Wi-Fi networks are often unsecured, making them susceptible to eavesdropping. Use a VPN or conduct sensitive transactions over a secure private network.

- Use Strong Passwords:Create complex passwords that combine uppercase and lowercase letters, numbers, and symbols. Avoid using easily guessable information like your birthdate or pet’s name.

- Be Cautious of Phishing Attempts:Phishing scams often try to trick you into revealing your personal information by mimicking legitimate websites or emails. Be wary of suspicious links and always verify the authenticity of a website before entering sensitive data.

- Keep Your Software Updated:Regularly update your operating system, web browser, and antivirus software to protect against known security vulnerabilities.