Cyber Insurance Premiums Declining: Howden Brokers Report

Cyber insurance premiums declining howden insurance brokers report – Cyber insurance premiums are declining, according to a new report from Howden Insurance Brokers. This trend, while seemingly positive for businesses, presents a complex landscape with both potential benefits and risks. The report highlights a confluence of factors driving this shift, including increased competition among insurers, improved cybersecurity practices by businesses, and regulatory changes.

The decline in premiums is particularly noticeable in specific regions and industries, with the report identifying key areas where this trend is most pronounced. While the report provides a valuable snapshot of the current market, it’s crucial to understand the nuances and implications of this shift for businesses.

Cyber Insurance Market Trends

The cyber insurance market is currently experiencing a period of significant growth and evolution. As cyberattacks become increasingly sophisticated and frequent, the demand for cyber insurance is rising rapidly. This trend is driven by several factors, including the growing reliance on digital technology, the increasing severity of cyberattacks, and the growing awareness of cyber risks among businesses.

Impact of Recent Cyberattacks on Insurance Premiums

Recent cyberattacks have had a significant impact on insurance premiums. The increasing frequency and severity of attacks have led insurers to reassess their risk profiles and adjust their pricing accordingly. This has resulted in higher premiums for many businesses, particularly those with high-risk profiles.For example, the 2021 Colonial Pipeline ransomware attack, which disrupted fuel supplies across the eastern United States, led to a significant increase in cyber insurance premiums for energy companies.

Similarly, the 2021 SolarWinds hack, which compromised the software supply chain of thousands of organizations, led to higher premiums for companies using SolarWinds products.

“The cyber insurance market is undergoing a period of rapid change. Insurers are becoming more risk-averse, and premiums are rising as a result. Businesses need to be aware of these trends and take steps to mitigate their cyber risk.”

[Source

Insurance Journal]

Factors Driving Demand for Cyber Insurance

Several factors are driving the demand for cyber insurance:

- Growing reliance on digital technology:Businesses are increasingly reliant on digital technology for their operations, making them more vulnerable to cyberattacks. This reliance on technology is driving the demand for cyber insurance, as businesses seek to protect themselves from the financial consequences of a cyberattack.

It’s good news for businesses facing the rising costs of cyber insurance, with Howden Insurance Brokers reporting a decline in premiums. While that’s great news, it’s also a good time to consider investing in your own well-being, and what better place to start than with exciting new offers now live at Allies of Skin UK ?

With a focus on cyber security, businesses can save money on premiums by implementing strong security measures, just as a healthy lifestyle can help you save on healthcare costs.

- Increasing severity of cyberattacks:Cyberattacks are becoming more sophisticated and severe, with attackers targeting larger and more valuable data. This increase in severity is driving the demand for cyber insurance, as businesses need to protect themselves from the potentially devastating financial consequences of a major cyberattack.

- Growing awareness of cyber risks:Businesses are becoming more aware of the risks of cyberattacks, thanks to high-profile incidents and increased media coverage. This growing awareness is driving the demand for cyber insurance, as businesses seek to protect themselves from these risks.

- Regulatory requirements:Some industries are subject to regulatory requirements that mandate cyber insurance. For example, the healthcare industry is subject to HIPAA regulations, which require organizations to implement security measures and obtain cyber insurance. These regulatory requirements are driving the demand for cyber insurance in these industries.

Current State of the Cyber Insurance Market

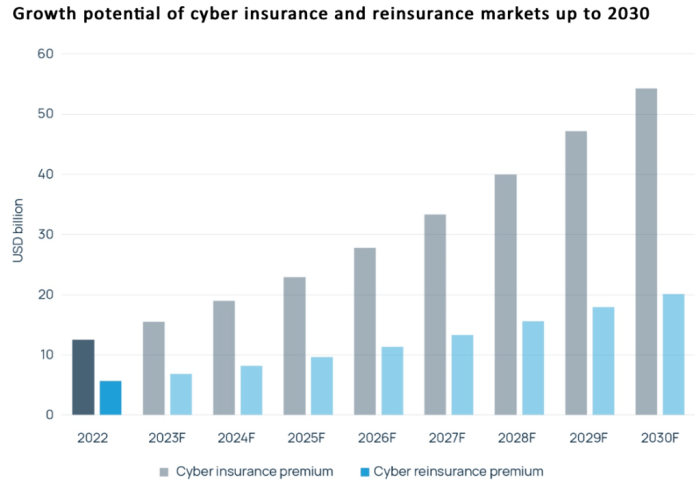

The cyber insurance market is currently in a state of flux. Insurers are becoming more risk-averse and are increasingly scrutinizing potential policyholders. This is leading to higher premiums, stricter underwriting requirements, and a decline in the availability of coverage for certain risks.Despite these challenges, the cyber insurance market is expected to continue to grow in the coming years.

As cyberattacks become more prevalent and businesses become more aware of the risks, the demand for cyber insurance is likely to increase.

Howden Insurance Brokers Report: Cyber Insurance Premiums Declining Howden Insurance Brokers Report

Howden, a leading global insurance broker, has released a report that examines the current state of the cyber insurance market. The report highlights a significant trend: a decline in cyber insurance premiums. This trend is driven by several factors, including increased competition among insurers and a growing understanding of cyber risk among businesses.

The latest report from Howden Insurance Brokers indicates a decline in cyber insurance premiums, which is good news for businesses. While we’re all focused on keeping our digital lives secure, sometimes a bit of hands-on creativity is a welcome change of pace.

Why not try making some leather pouches for kids DIY this weekend? It’s a fun project, and the finished product will be a unique and personalized gift. Back to the cyber insurance news, the decline in premiums is likely due to increased competition in the market and a growing understanding of cyber risk management strategies.

Regions and Industries with Most Pronounced Premium Declines

The report identifies specific regions and industries where premium declines are most pronounced. The most notable decreases in premiums are observed in the United States and Europe, particularly in the technology, financial services, and healthcare sectors. These industries have historically been the most targeted by cyberattacks, leading to higher premiums in the past.

Reasons for the Decline in Cyber Insurance Premiums

Howden’s report attributes the decline in cyber insurance premiums to several factors:

- Increased Competition:The cyber insurance market has become increasingly competitive, with more insurers entering the market and offering more attractive pricing. This competition has driven down premiums as insurers seek to attract new clients.

- Growing Understanding of Cyber Risk:Businesses are becoming more sophisticated in their understanding of cyber risk and how to mitigate it. This has led to a decrease in the number of cyber claims, which has, in turn, lowered premiums.

- Improved Security Measures:Businesses are investing in more robust cybersecurity measures, which are reducing the frequency and severity of cyberattacks. This improved security posture has made cyber insurance more affordable.

- Innovation in Cyber Risk Management:New technologies and approaches to cyber risk management are emerging, providing businesses with more effective ways to protect themselves from cyberattacks. This innovation has contributed to the decline in premiums.

Factors Influencing Premium Declines

The decline in cyber insurance premiums can be attributed to a confluence of factors, including increased competition within the insurance market, enhanced cybersecurity practices adopted by businesses, and the evolving regulatory landscape.

Competition Among Insurers, Cyber insurance premiums declining howden insurance brokers report

The growing number of cyber insurance providers has intensified competition, driving down premiums. Insurers are vying for market share, leading to more competitive pricing strategies. As more companies enter the market, the pressure to attract clients and maintain profitability compels insurers to offer more affordable policies.

This competitive environment creates a dynamic where insurers constantly adjust their premiums to stay ahead of the curve, resulting in a downward trend in pricing.

Improved Cybersecurity Practices

Businesses are increasingly investing in robust cybersecurity measures to mitigate risks and improve their resilience against cyberattacks. These investments include implementing advanced security technologies, training employees on cybersecurity best practices, and establishing robust incident response plans. As businesses demonstrate their commitment to strong cybersecurity practices, insurers recognize the reduced risk they pose and respond by offering lower premiums.

The recent Howden Insurance Brokers report on declining cyber insurance premiums is a welcome sign, but it’s important to remember that cyber threats are still a major concern. To help mitigate risk, businesses should consider implementing chatbots for customer service and support.

By following the 4 steps to chatbot retention outlined in this helpful article, companies can ensure their chatbots are effective and provide a valuable service to their customers. This can help reduce the likelihood of cyber attacks and contribute to the overall decline in cyber insurance premiums.

Regulatory Changes

Regulatory changes, particularly those focused on data privacy and security, are influencing cyber insurance pricing. Governments worldwide are enacting regulations to protect sensitive information and enhance cybersecurity standards. These regulations often impose specific requirements on businesses, such as data breach notification and incident reporting.

By promoting a more standardized approach to cybersecurity, these regulations can contribute to a reduction in cyber risk and, consequently, lower insurance premiums.

Implications for Businesses

The decline in cyber insurance premiums presents a complex landscape for businesses, offering potential benefits alongside inherent risks. Understanding these implications is crucial for navigating the evolving cyber insurance market effectively.

Businesses should carefully weigh the advantages and disadvantages of lower premiums, considering their unique risk profiles and cyber security posture. A proactive approach to risk management is essential to mitigate potential downsides and leverage the opportunities presented by this shifting market.

Advantages and Disadvantages of Lower Premiums

Lower cyber insurance premiums can offer significant financial benefits for businesses, but it’s essential to consider the potential drawbacks. The following table Artikels the advantages and disadvantages of this trend:

| Advantages | Disadvantages |

|---|---|

| Reduced insurance costs, freeing up budget for other business priorities. | Potential for reduced coverage limits or stricter underwriting criteria, leading to gaps in protection. |

| Increased affordability, making cyber insurance accessible to smaller businesses with limited resources. | Lower premiums may incentivize businesses to relax their cyber security practices, increasing vulnerability to attacks. |

| Greater competition among insurers, potentially leading to more innovative and customized policy options. | Insurers may become more selective in accepting clients, potentially excluding businesses with higher risk profiles. |

Navigating the Changing Cyber Insurance Landscape

Businesses need to adapt their approach to cyber insurance in light of these evolving market dynamics. Here are some key strategies:

- Strengthen cyber security posture:Invest in robust security measures to reduce risk and improve insurability. This includes implementing strong passwords, multi-factor authentication, regular security audits, and employee training programs.

- Negotiate favorable terms:Carefully review policy terms and conditions, ensuring adequate coverage for potential risks and negotiating favorable premiums. Engage with multiple insurers to compare offerings and find the best fit.

- Maintain open communication:Establish clear communication channels with insurers, keeping them informed of any significant changes to the business’s cyber security posture. This transparency can help maintain favorable premiums and ensure adequate coverage.

- Stay informed about industry trends:Monitor developments in the cyber insurance market, including changes in pricing, coverage, and underwriting criteria. This proactive approach helps businesses adapt their strategies and secure the best possible coverage.

Future Outlook for Cyber Insurance

The recent decline in cyber insurance premiums might seem like a positive development for businesses, but it’s crucial to understand the long-term implications and potential future trajectory of this market. While premiums have come down in the short term, several factors suggest that this trend may not be sustainable in the long run.

Impact of Emerging Cyber Threats

The cyber threat landscape is constantly evolving, with new and sophisticated threats emerging regularly. These threats are becoming more difficult to detect and defend against, leading to higher insurance claims and potentially impacting the future cost of cyber insurance.

For example, the rise of ransomware attacks, which often target critical infrastructure and businesses, has significantly increased the cost of cyber insurance claims.

Future Trends in Cyber Insurance

The future of cyber insurance will likely be shaped by a complex interplay of factors, including the evolving threat landscape, regulatory changes, and technological advancements. Here’s a timeline outlining key milestones and predictions for the cyber insurance industry:

- Short Term (Next 1-2 Years):

- Premium stabilization: While premiums may continue to decline slightly in the short term, they are expected to stabilize as insurers adjust to the changing risk landscape and the increasing frequency of cyberattacks.

- Focus on risk mitigation: Insurers will likely place greater emphasis on risk mitigation strategies, requiring businesses to implement robust cybersecurity measures to qualify for coverage.

- Increased use of technology: Insurers will continue to leverage technology to assess risk, automate underwriting processes, and improve fraud detection.

- Medium Term (Next 3-5 Years):

- Premium increases: As the severity and frequency of cyberattacks continue to rise, insurers are likely to increase premiums to offset the increased risk.

- New coverage options: Insurers will likely introduce new coverage options to address emerging threats, such as those related to artificial intelligence (AI) and quantum computing.

- Greater focus on data privacy: With increasing regulatory scrutiny of data privacy, insurers will likely offer coverage for data breaches and other privacy-related incidents.

- Long Term (Beyond 5 Years):

- Cyber insurance as a necessity: Cyber insurance will become a necessity for most businesses, as the risks of cyberattacks become increasingly significant.

- Integration with other insurance products: Cyber insurance will likely be integrated with other insurance products, such as property and casualty insurance, to offer comprehensive coverage.

- Increased government involvement: Governments are likely to play a more active role in regulating the cyber insurance market and promoting cybersecurity best practices.