QuickBooks Payroll vs Square Payroll: Which is Right for You?

QuickBooks Payroll vs Square Payroll sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Choosing the right payroll software can be a daunting task, especially when faced with a plethora of options like QuickBooks Payroll and Square Payroll.

Both platforms cater to different business needs and offer a range of features, making it essential to understand their nuances and weigh their pros and cons before making a decision.

This comprehensive comparison delves into the key features, pricing, and functionalities of both QuickBooks Payroll and Square Payroll, providing insights into their strengths and limitations. We’ll explore their payroll processing capabilities, employee management tools, compliance features, and integration options to help you make an informed choice that aligns with your business goals.

Introduction

QuickBooks Payroll and Square Payroll are popular payroll services designed to simplify the process of paying employees and managing payroll taxes. While both offer core payroll features, they cater to different target audiences and have unique strengths.This article will provide a comprehensive overview of QuickBooks Payroll and Square Payroll, highlighting their key features, target audience, and functionalities.

Choosing between QuickBooks Payroll and Square Payroll can be a real head-scratcher, especially when you consider all the features and pricing plans. But you know what’s not a head-scratcher? The new features in iOS 18’s Control Center, as described in this great article control center on iphone has always been useful has ios 18 just made it exciting , are a game-changer! Anyway, back to QuickBooks and Square, I’m leaning towards QuickBooks for its robust reporting options, but Square’s ease of use is pretty tempting too.

Target Audience

QuickBooks Payroll is primarily targeted towards small and medium-sized businesses (SMBs) with a focus on accounting and financial management. The platform integrates seamlessly with QuickBooks accounting software, making it ideal for businesses already using QuickBooks for their accounting needs. Square Payroll, on the other hand, is designed for small businesses, freelancers, and contractors.

It is particularly well-suited for businesses that use Square’s point-of-sale (POS) system for processing transactions.

Key Features and Functionalities

Both QuickBooks Payroll and Square Payroll offer a range of features designed to streamline payroll processes and ensure compliance with tax regulations.

QuickBooks Payroll

- Payroll Processing:QuickBooks Payroll allows businesses to calculate and process payroll, including deductions, taxes, and direct deposits. It also provides tools for managing employee time and attendance.

- Tax Filing and Payment:The platform automatically calculates and files federal, state, and local payroll taxes, ensuring compliance with tax regulations.

- Employee Self-Service:Employees can access their pay stubs, W-2 forms, and other payroll information online through a secure portal.

- Integration with QuickBooks:QuickBooks Payroll seamlessly integrates with QuickBooks accounting software, simplifying the process of reconciling payroll expenses with other financial records.

- Reporting and Analytics:The platform provides various reports and analytics tools to track payroll costs, employee productivity, and other key metrics.

Square Payroll

- Payroll Processing:Square Payroll allows businesses to calculate and process payroll, including deductions, taxes, and direct deposits. It also offers tools for managing employee time and attendance.

- Tax Filing and Payment:The platform automatically calculates and files federal, state, and local payroll taxes, ensuring compliance with tax regulations.

- Employee Self-Service:Employees can access their pay stubs, W-2 forms, and other payroll information online through a secure portal.

- Integration with Square POS:Square Payroll seamlessly integrates with Square’s point-of-sale (POS) system, simplifying the process of managing employee wages and tips.

- Contractor Management:Square Payroll provides tools for managing independent contractors, including issuing 1099 forms and tracking payments.

Pricing and Plans

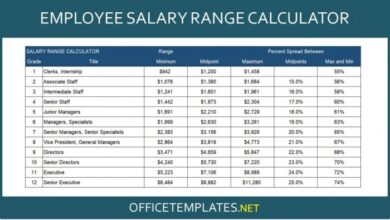

Choosing the right payroll solution for your business depends on various factors, including your budget, the number of employees, and the features you need. This section compares the pricing structures of QuickBooks Payroll and Square Payroll, outlining their different plans and associated features.

QuickBooks Payroll Pricing

QuickBooks Payroll offers a range of plans designed to suit businesses of different sizes and needs. The plans differ in terms of features and pricing.

- Self-Employed: This plan is ideal for freelancers and independent contractors. It costs $15 per month and includes features like filing 1099-NEC forms, tracking income and expenses, and paying estimated taxes.

- Simple Start: This plan is for businesses with one to two employees and costs $45 per month. It includes basic payroll features like calculating and paying wages, filing taxes, and direct deposit.

- Essentials: This plan is for businesses with one to 50 employees and costs $65 per month. It includes all the features of Simple Start, plus additional features like employee onboarding and time tracking.

- Premium: This plan is for businesses with one to 100 employees and costs $85 per month. It includes all the features of Essentials, plus additional features like HR support and 401(k) administration.

- Elite: This plan is for businesses with one to 100 employees and costs $115 per month. It includes all the features of Premium, plus additional features like payroll tax liability management and dedicated payroll support.

Square Payroll Pricing

Square Payroll offers two main plans:

- Team: This plan is for businesses with one to 50 employees and costs $45 per month. It includes basic payroll features like calculating and paying wages, filing taxes, and direct deposit.

- Full Service: This plan is for businesses with one to 50 employees and costs $65 per month. It includes all the features of Team, plus additional features like HR support, workers’ compensation, and payroll tax liability management.

Square Payroll also offers a Self-Employedplan for freelancers and independent contractors. It costs $20 per month and includes features like tracking income and expenses, filing 1099-NEC forms, and paying estimated taxes.

Add-ons and Integrations

Both QuickBooks Payroll and Square Payroll offer additional features and integrations for a fee. These include features like time tracking, benefits administration, and payroll tax filing.

For example, QuickBooks Payroll offers a time tracking add-on that integrates with its software, allowing businesses to track employee hours and pay them accurately. Square Payroll also offers a similar time tracking feature through its integration with Square Timecards.

Another example is QuickBooks Payroll’s integration with various HR software platforms, allowing businesses to manage employee information, benefits, and onboarding processes. Similarly, Square Payroll integrates with other third-party applications, providing businesses with additional functionalities.

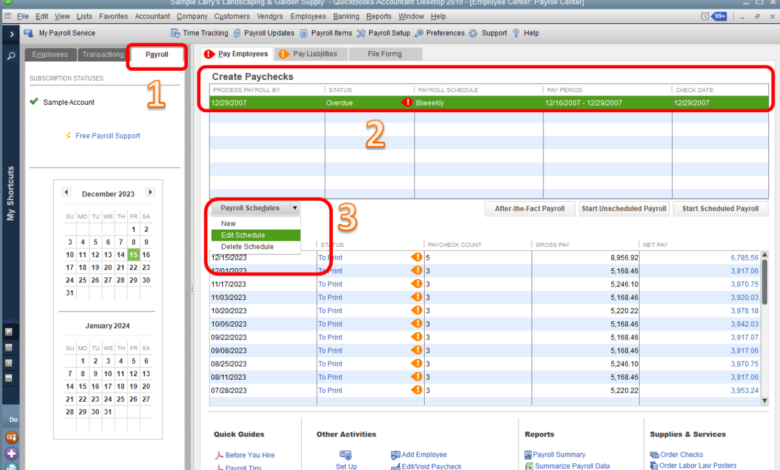

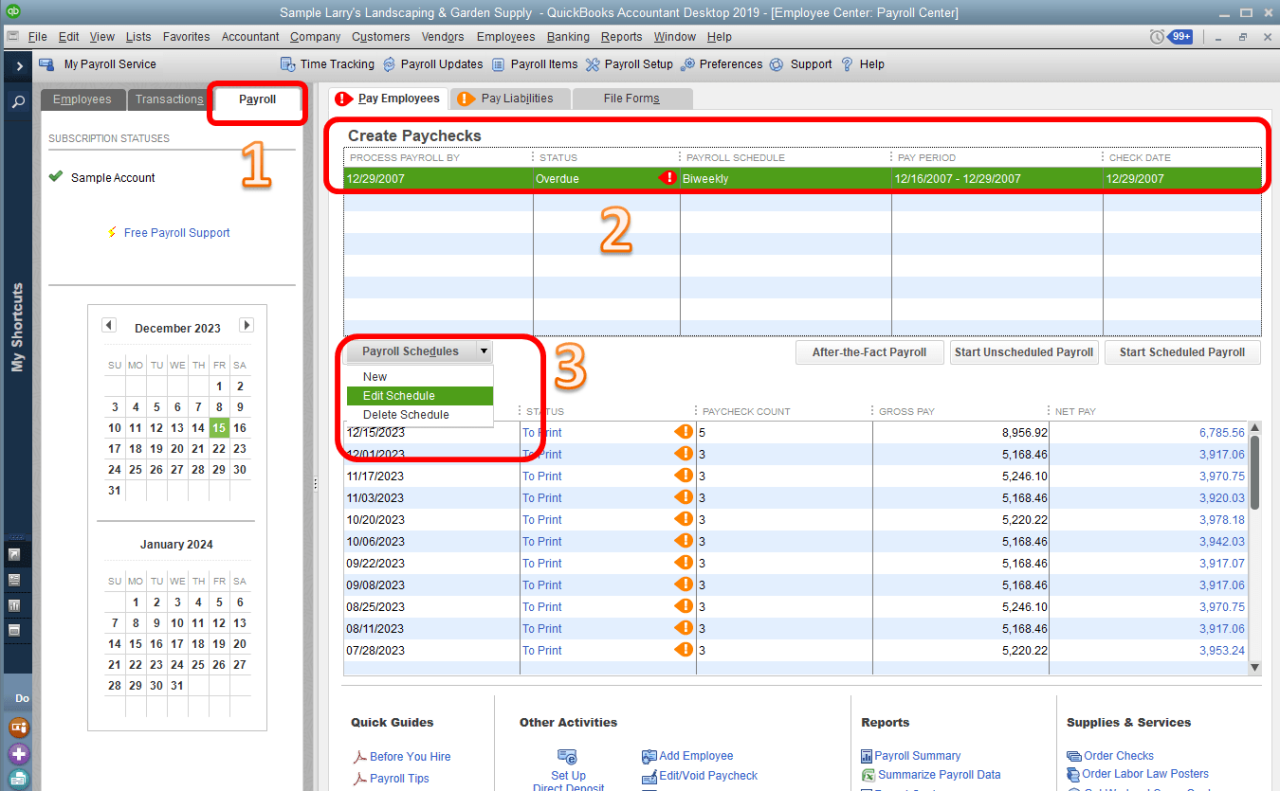

Payroll Processing Features

Both QuickBooks Payroll and Square Payroll offer a range of features designed to streamline payroll processing, making it easier for businesses to pay their employees accurately and on time. Let’s delve into the specific capabilities of each platform, focusing on how they handle calculating and paying wages, taxes, and deductions.

Payroll Calculation and Payment

Both QuickBooks Payroll and Square Payroll excel at calculating and paying wages, taxes, and deductions. Both platforms automatically calculate payroll taxes based on your location and employee information. This includes federal, state, and local taxes, as well as any applicable deductions for health insurance, retirement plans, and other benefits.The key differences lie in the user interface and the specific features offered.

QuickBooks Payroll provides a more comprehensive and customizable approach, allowing for greater control over payroll calculations. Square Payroll, on the other hand, focuses on simplicity and ease of use, making it ideal for smaller businesses.Here’s a breakdown of the key features:

QuickBooks Payroll

- Multiple Pay Periods:Supports various pay frequencies, including weekly, bi-weekly, semi-monthly, and monthly.

- Customizable Deductions:Offers a wide range of customizable deductions, including pre-tax and after-tax deductions, allowing businesses to tailor payroll to their specific needs.

- Direct Deposit and Check Options:Provides both direct deposit and check payment options, offering flexibility in how employees receive their pay.

- Advanced Reporting:Generates detailed payroll reports, including pay stubs, tax summaries, and employee earnings statements, providing valuable insights into payroll data.

Square Payroll

- Simplified Payroll:Offers a streamlined payroll process, making it easy for businesses to calculate and pay wages, taxes, and deductions.

- Automated Tax Filing:Automatically files federal and state taxes, reducing the administrative burden on businesses.

- Direct Deposit Only:Supports only direct deposit payments, streamlining the payment process.

- Mobile-Friendly Interface:Provides a user-friendly mobile app, allowing businesses to manage payroll on the go.

Ease of Use and User Interface

Both QuickBooks Payroll and Square Payroll prioritize user-friendliness, aiming to simplify the payroll process for businesses of all sizes. However, they differ in their approach to user experience.

QuickBooks Payroll

- Intuitive Interface:QuickBooks Payroll features a familiar interface for users already accustomed to the QuickBooks ecosystem. It offers a comprehensive set of tools and options, but it may require some time to learn and master.

- Advanced Features:Its extensive features, while powerful, can be overwhelming for new users. The platform offers a learning curve, requiring users to familiarize themselves with its various functionalities.

Square Payroll

- Simple and Straightforward:Square Payroll boasts a user-friendly interface designed for simplicity and ease of use. It’s ideal for businesses seeking a straightforward and intuitive payroll solution.

- Mobile-First Approach:Its mobile app provides a seamless experience for managing payroll on the go, making it convenient for businesses with mobile-centric workflows.

Employee Management

Both QuickBooks Payroll and Square Payroll offer features that help businesses manage their employees efficiently. However, the specific features and their depth vary between the two platforms. Let’s delve into the differences.

Employee Onboarding, Quickbooks payroll vs square payroll

The process of bringing new employees on board is critical for any business. Both QuickBooks Payroll and Square Payroll offer features to simplify this process. * QuickBooks Payroll:QuickBooks Payroll allows you to create custom onboarding checklists, send new hire paperwork electronically, and track employee progress through the onboarding process.

The platform also integrates with other QuickBooks products, such as QuickBooks Online, for a seamless experience.

Square Payroll

Square Payroll offers a simpler onboarding experience, allowing you to collect employee information, generate tax forms, and send them electronically. The platform also offers a mobile app for employees to access their onboarding documents.

Time Tracking

Accurate time tracking is essential for payroll accuracy and employee productivity. * QuickBooks Payroll:QuickBooks Payroll offers a range of time tracking options, including manual time entry, online time clocks, and integrations with third-party time tracking software. The platform also allows for flexible scheduling, overtime tracking, and break management.

Square Payroll

Square Payroll provides a basic time tracking feature through its mobile app. Employees can clock in and out, and the platform automatically calculates their hours worked. However, Square Payroll lacks the advanced features found in QuickBooks Payroll, such as integrations with third-party time tracking software and flexible scheduling.

Leave Management

Managing employee leave requests can be a complex task. Both QuickBooks Payroll and Square Payroll offer features to help businesses manage leave.* QuickBooks Payroll:QuickBooks Payroll allows businesses to set up different leave types, such as vacation, sick leave, and unpaid leave.

The platform also allows for automated leave approvals and tracking of leave balances. QuickBooks Payroll integrates with other HR tools, such as PTO tracking software, to streamline leave management.

Square Payroll

Square Payroll provides a basic leave management feature that allows employees to submit leave requests and for employers to approve them. The platform also tracks leave balances. However, Square Payroll lacks the advanced features found in QuickBooks Payroll, such as automated leave approvals and integrations with other HR tools.

Employee Communication

Effective communication with employees is crucial for building a positive work environment. Both QuickBooks Payroll and Square Payroll offer features for employee communication.* QuickBooks Payroll:QuickBooks Payroll offers features for sending employee announcements, pay stubs, and tax forms. The platform also integrates with other communication tools, such as email and text messaging, to streamline communication.

Square Payroll

Square Payroll provides a basic communication feature that allows employers to send messages to employees through the platform. The platform also allows employees to access their pay stubs and tax forms. However, Square Payroll lacks the advanced communication features found in QuickBooks Payroll, such as integrations with other communication tools.

Integration with Other HR Tools

Both QuickBooks Payroll and Square Payroll offer integrations with other HR tools. However, the specific integrations vary between the two platforms.* QuickBooks Payroll:QuickBooks Payroll integrates with a wide range of HR tools, including applicant tracking systems, performance management software, and benefits administration platforms.

This integration allows businesses to manage all aspects of their HR operations from a single platform.

Square Payroll

Square Payroll offers a limited number of integrations with other HR tools. The platform integrates with some popular apps, such as Gusto and Zenefits. However, Square Payroll’s integration capabilities are not as extensive as QuickBooks Payroll.

Compliance and Reporting: Quickbooks Payroll Vs Square Payroll

Both QuickBooks Payroll and Square Payroll are designed to help businesses comply with tax regulations and provide accurate payroll reports. However, they differ in their specific features and capabilities.

Compliance with Federal, State, and Local Tax Regulations

Both platforms offer robust features to ensure compliance with federal, state, and local tax regulations. They automatically calculate and withhold taxes based on your business’s location and the employee’s tax information. They also provide features for filing payroll taxes and generating tax forms, including W-2s, 1099s, and other required documents.

- QuickBooks Payroll: QuickBooks Payroll excels in its ability to manage complex tax situations, including multi-state payroll, federal and state tax compliance, and tax-related reports. It automatically calculates and files payroll taxes, and its features include tax-related forms, tax tables, and tax filing guides.

Choosing between QuickBooks Payroll and Square Payroll can be tough, especially when considering features and pricing. But, I just read this super interesting article on Apple Insider revealing the full iPad slate for after the Let Loose event on Tuesday, and there’s a big surprise! It’s making me wonder if Apple will release a new iPad specifically designed for business owners, maybe with integrated payroll software.

That would definitely change the game for QuickBooks and Square, wouldn’t it? Anyway, back to payroll, I’m still trying to decide which platform is right for my small business.

It also provides a robust system for managing employee tax information and withholding.

- Square Payroll: Square Payroll offers a more streamlined approach to tax compliance. It focuses on providing a user-friendly interface for managing payroll taxes and filing tax forms. While it handles basic tax calculations and withholding, it may not be as comprehensive as QuickBooks Payroll for businesses with complex tax needs.

Square Payroll is known for its ease of use, particularly for small businesses with simpler tax situations.

Availability and Accessibility of Payroll Reports and Data

Both platforms offer a variety of payroll reports that can be accessed and downloaded. These reports provide valuable insights into your payroll expenses, employee earnings, and tax withholdings. They can be used for financial planning, budgeting, and regulatory compliance.

- QuickBooks Payroll: QuickBooks Payroll offers a comprehensive suite of payroll reports, including detailed earnings statements, tax summaries, and year-to-date reports. These reports can be customized to meet specific needs and can be exported in various formats, such as PDF, CSV, and Excel.

The reports can be accessed through the online platform and the mobile app, providing convenient access from any location.

- Square Payroll: Square Payroll provides a more limited selection of payroll reports compared to QuickBooks Payroll. However, it still offers essential reports, such as pay stubs, pay summaries, and tax forms. These reports are easily accessible through the online platform and can be downloaded in PDF format.

Square Payroll’s focus on simplicity makes it easy to find and access the information you need.

Customer Support and Resources

When selecting a payroll service, reliable customer support and accessible resources are crucial. Both QuickBooks Payroll and Square Payroll offer various support options to assist businesses with their payroll needs.

Choosing between QuickBooks Payroll and Square Payroll depends on your specific needs, but if you’re managing properties, you might also want to consider investing in a robust best property management CRM to streamline your operations. These systems can help you manage tenant communications, track rent payments, and even automate tasks like lease renewals, which can free up your time to focus on other aspects of your business, like comparing payroll services!

Customer Support Options

Both QuickBooks Payroll and Square Payroll provide multiple avenues for businesses to access customer support. These options include:

- Phone Support:Both services offer phone support, allowing businesses to speak directly with a representative. This option is particularly useful for urgent issues or complex inquiries.

- Email Support:Both QuickBooks Payroll and Square Payroll provide email support, enabling businesses to submit inquiries and receive responses via email. This option is suitable for less urgent issues or for providing detailed information.

- Live Chat Support:QuickBooks Payroll offers live chat support, allowing businesses to engage in real-time conversations with a support representative. This option provides immediate assistance and can be convenient for quick questions or troubleshooting.

- Online Help Center:Both services offer comprehensive online help centers, providing access to a vast library of articles, FAQs, and tutorials. This resource can be helpful for self-service troubleshooting and finding answers to common questions.

Availability of Online Resources

Both QuickBooks Payroll and Square Payroll offer extensive online resources to support businesses. These resources include:

- Knowledge Base Articles:Both services maintain a comprehensive knowledge base containing articles covering a wide range of payroll topics, including setup, processing, compliance, and troubleshooting. This resource is a valuable starting point for businesses seeking information on specific issues.

- FAQs:Both services provide a section dedicated to frequently asked questions, offering quick answers to common inquiries. This resource can be a convenient way to find solutions to general questions.

- Tutorials and Videos:Both QuickBooks Payroll and Square Payroll offer a selection of tutorials and videos demonstrating various payroll tasks, such as setting up payroll, processing paychecks, and filing taxes. These resources can be helpful for businesses learning how to use the software or for refreshing their knowledge.

- Community Forums:QuickBooks Payroll offers a community forum where businesses can connect with other users, share experiences, and ask questions. This platform can be a valuable resource for obtaining insights and support from peers.

Responsiveness and Quality of Customer Support

The responsiveness and quality of customer support can vary depending on the service provider and the specific issue. Generally, both QuickBooks Payroll and Square Payroll strive to provide timely and helpful support. However, it’s important to consider factors such as the time of day, day of the week, and the complexity of the issue.

- QuickBooks Payroll:QuickBooks Payroll is known for its extensive support resources and generally positive customer reviews. The company has a reputation for providing responsive and helpful support, particularly for phone and email inquiries. However, some users have reported longer wait times during peak hours.

- Square Payroll:Square Payroll is relatively new to the payroll market but has gained a reputation for providing excellent customer support. The company emphasizes a friendly and helpful approach, with a focus on providing clear and concise solutions. However, the availability of live chat support may be limited compared to QuickBooks Payroll.

Integration with Other Tools

In today’s business environment, seamless integration is essential for streamlining operations and maximizing efficiency. Both QuickBooks Payroll and Square Payroll offer integration capabilities with other business tools, but their strengths and limitations differ. Let’s delve into the details of their integration features.

Compatibility with Accounting Software

The ability to integrate with accounting software is crucial for businesses to maintain accurate financial records and streamline workflows. Both QuickBooks Payroll and Square Payroll excel in this area, but their strengths lie in different areas.

- QuickBooks Payroll:Seamlessly integrates with QuickBooks Online and QuickBooks Desktop, providing a unified platform for managing payroll, accounting, and other financial tasks. This integration allows for automatic syncing of payroll data with accounting records, eliminating manual data entry and minimizing errors.

- Square Payroll:Offers integration with Xero, a popular cloud-based accounting software. This integration allows businesses using Xero to synchronize payroll data, ensuring consistency and efficiency. However, Square Payroll’s integration with QuickBooks is limited, primarily focused on basic data sharing.

Compatibility with POS Systems

Integrating with point-of-sale (POS) systems is essential for businesses that process transactions directly through their physical locations. Both QuickBooks Payroll and Square Payroll offer different levels of integration with POS systems.

- QuickBooks Payroll:Integrates with a wide range of POS systems, including Square, Shopify, and Clover. This integration allows businesses to automatically sync sales data with payroll, simplifying employee compensation calculations based on sales performance.

- Square Payroll:Provides seamless integration with Square POS, its own POS system. This integration simplifies payroll processing for businesses using Square POS, allowing for automatic syncing of employee hours and sales data. However, integration with other POS systems is limited.

Compatibility with Business Applications

Beyond accounting and POS systems, integration with other business applications can enhance efficiency and streamline various processes. Both QuickBooks Payroll and Square Payroll offer integration with various applications, but their capabilities vary.

- QuickBooks Payroll:Offers integration with popular business applications such as Salesforce, Microsoft Dynamics, and Zoho CRM. This integration enables businesses to access and manage employee data from various platforms, improving data visibility and communication.

- Square Payroll:Provides limited integration with business applications, focusing primarily on integration with Square’s own suite of tools, including Square Appointments and Square Marketing. This integration allows for managing employee schedules and marketing campaigns within the Square ecosystem.

Benefits of Integration

Integrating payroll with other business tools offers several benefits, including:

- Streamlined Workflows:Integration automates data transfer, reducing manual data entry and minimizing errors.

- Improved Efficiency:Centralized data access and automated processes enhance efficiency and save time.

- Enhanced Accuracy:Data synchronization ensures consistent information across different platforms, reducing errors and improving data integrity.

- Better Insights:Integration allows for consolidated data analysis, providing valuable insights into business performance and employee productivity.

Limitations of Integration

While integration offers significant benefits, it also has some limitations:

- Compatibility Issues:Not all platforms and applications are compatible, limiting integration options.

- Data Security Concerns:Sharing data across platforms raises concerns about data security and privacy.

- Technical Complexity:Setting up and managing integrations can be technically complex, requiring technical expertise or support.

Security and Data Protection

Protecting your sensitive financial data and employee information is paramount, and both QuickBooks Payroll and Square Payroll understand this. They employ robust security measures and data protection policies to safeguard your information.

Encryption Protocols

Both platforms utilize industry-standard encryption protocols to protect data transmitted between your devices and their servers. QuickBooks Payroll uses 256-bit Advanced Encryption Standard (AES) encryption for data in transit, while Square Payroll uses Transport Layer Security (TLS) with 256-bit encryption.

This ensures that your sensitive information, such as payroll data, employee details, and financial transactions, is encrypted and protected from unauthorized access during transmission.

Access Controls

Both platforms implement strict access controls to limit access to your data. This includes:

- Multi-factor authentication (MFA) to verify user identity

- Role-based access control (RBAC) to grant different levels of access to different users

- Password complexity requirements to prevent unauthorized access

Data Backup Procedures

Data backup is crucial to ensure data recovery in case of a system failure or security breach. QuickBooks Payroll automatically backs up your data regularly, storing it in secure off-site locations. Square Payroll also offers automatic data backups, ensuring your data is protected against data loss.

Compliance with Industry Standards and Regulations

Both platforms are compliant with industry standards and regulations related to data security and privacy. This includes:

- QuickBooks Payroll:SOC 2 Type II, PCI DSS Level 1, HIPAA

- Square Payroll:SOC 2 Type II, PCI DSS Level 1, GDPR

These certifications demonstrate their commitment to meeting industry best practices and ensuring the security and privacy of your data.

Pros and Cons

Choosing the right payroll software can be a significant decision for any business. It’s important to weigh the pros and cons of each option to find the best fit for your specific needs. This section will Artikel the key advantages and disadvantages of QuickBooks Payroll and Square Payroll, helping you make an informed choice.

QuickBooks Payroll

QuickBooks Payroll is a well-established and popular payroll solution, offering a wide range of features and integrations. It’s particularly suitable for businesses that already use QuickBooks for accounting and financial management.

Advantages

- Seamless integration with QuickBooks:This integration streamlines accounting processes, eliminating the need for manual data entry and reducing the risk of errors.

- Comprehensive features:QuickBooks Payroll offers a wide range of features, including direct deposit, tax filing, and payroll reporting, catering to the needs of various businesses.

- Strong customer support:QuickBooks provides extensive customer support resources, including phone, email, and online chat.

- Industry-specific solutions:QuickBooks offers specialized payroll solutions tailored to specific industries, such as construction, retail, and healthcare.

Disadvantages

- Higher pricing:QuickBooks Payroll can be more expensive than some other payroll solutions, particularly for smaller businesses.

- Limited mobile functionality:While QuickBooks offers a mobile app, its functionality is limited compared to some competitors.

- Steep learning curve:The interface and features of QuickBooks Payroll can be complex, requiring some time and effort to master.

Square Payroll

Square Payroll is a user-friendly and affordable payroll solution designed for small businesses. It’s known for its simplicity and ease of use, making it a good option for businesses with limited payroll experience.

Advantages

Disadvantages

Conclusion

Choosing the right payroll solution is crucial for any business, and QuickBooks Payroll and Square Payroll offer distinct advantages. Ultimately, the best choice depends on your specific needs and priorities.

Factors to Consider When Choosing Between QuickBooks Payroll and Square Payroll

The following factors should be considered when choosing between QuickBooks Payroll and Square Payroll:

- Business Size:QuickBooks Payroll is well-suited for businesses of all sizes, while Square Payroll is particularly advantageous for smaller businesses and startups.

- Industry:QuickBooks Payroll caters to a broader range of industries, while Square Payroll excels in retail, restaurants, and service-based businesses.

- Budget:QuickBooks Payroll offers a wider range of pricing options, including a basic plan that may be more affordable for smaller businesses. Square Payroll provides a more streamlined pricing structure, but it may be more expensive for larger businesses.

- Features:QuickBooks Payroll offers a comprehensive suite of features, including time tracking, benefits administration, and direct deposit. Square Payroll provides a more focused set of features, primarily focused on payroll processing and employee management.

- Integration:QuickBooks Payroll seamlessly integrates with other QuickBooks products, such as QuickBooks Online and QuickBooks Self-Employed. Square Payroll integrates with Square’s POS system and other Square products.