What Are Payroll Taxes: Understanding Your Paycheck Deductions

What are payroll taxes? It’s a question that pops up when you first get a paycheck, leaving you wondering where a chunk of your hard-earned money goes. Payroll taxes are essentially contributions you and your employer make to fund various government programs that benefit us all.

They’re not just a necessary evil; they’re the lifeblood of essential services like Social Security, Medicare, and unemployment insurance. Think of them as your investment in a safety net for times when you might need it most.

These taxes are taken directly from your paycheck, often before you even see it. But knowing how they work can empower you to understand your financial picture better. We’ll break down the different types of payroll taxes, who pays them, how they’re calculated, and how they impact your overall financial wellbeing.

What are Payroll Taxes?

Payroll taxes are mandatory contributions deducted from an employee’s paycheck and paid to the government. They are a significant source of revenue for funding various government programs.

Purpose of Payroll Taxes

Payroll taxes play a crucial role in funding essential government programs that benefit both current and future generations. They are designed to ensure the financial sustainability of these programs by providing a steady stream of revenue.

Payroll taxes are deductions from your paycheck that fund government programs like Social Security and Medicare. It’s kind of like a “tax on your tax,” but with a much bigger impact on your wallet. Speaking of wallet-friendly updates, did you hear that Apple patched a major Vision Pro issue in VisionOS 11 beta that allows users to reset their passwords without a trip to the Apple Store?

Anyway, back to payroll taxes, it’s important to understand these deductions, as they directly affect your take-home pay.

Types of Payroll Taxes

Payroll taxes are generally categorized into three main types: federal, state, and local.

Federal Payroll Taxes

The federal government levies payroll taxes on both employers and employees to fund programs like Social Security and Medicare. These taxes are commonly referred to as FICA (Federal Insurance Contributions Act) taxes.

State Payroll Taxes

Many states also impose payroll taxes on their residents. These taxes can vary significantly from state to state and are typically used to fund state-level programs, such as unemployment insurance and state-funded retirement plans.

Payroll taxes are a crucial part of any business, covering things like Social Security and Medicare. But beyond those core elements, there’s a growing need to understand the evolving landscape of customer identity, especially with trends like those highlighted in this recent article on Okta customer identity trends.

As businesses navigate the complexities of data privacy and security, ensuring secure and reliable access for employees and customers becomes increasingly important, making payroll taxes and customer identity management two sides of the same coin for successful operations.

Local Payroll Taxes

Some local governments may also levy payroll taxes on their residents. These taxes are typically used to fund local services, such as public education, law enforcement, and fire protection.

Government Programs Funded by Payroll Taxes

Payroll taxes are the primary source of funding for a wide range of government programs, including:

Social Security

Social Security is a federal program that provides retirement, disability, and survivor benefits to eligible individuals. It is funded primarily through payroll taxes.

Medicare

Medicare is a federal health insurance program for individuals aged 65 and older, as well as certain younger individuals with disabilities. It is also funded primarily through payroll taxes.

Unemployment Insurance

Unemployment insurance is a state-run program that provides temporary financial assistance to individuals who have lost their jobs through no fault of their own. It is funded through payroll taxes paid by employers.

Who Pays Payroll Taxes?

Payroll taxes are a significant part of the U.S. tax system, and understanding who pays them is crucial. Both employers and employees contribute to payroll taxes, with each party having distinct responsibilities.

Payroll Tax Responsibilities of Employers and Employees

Employers and employees share the responsibility for paying payroll taxes. The employer is responsible for withholding the employee’s portion of the payroll taxes from their paycheck and then matching that amount. The employer then sends both portions of the payroll taxes to the government.

- Employer’s Responsibilities:Employers are responsible for withholding and paying the following taxes:

- Social Security Taxes (6.2% of the first $160,200 of wages in 2023)

- Medicare Taxes (1.45% of all wages)

- Federal Unemployment Tax (FUTA) (0.6% of the first $7,000 of wages)

- State Unemployment Tax (varies by state)

- Employee’s Responsibilities:Employees are responsible for paying the following taxes:

- Social Security Taxes (6.2% of the first $160,200 of wages in 2023)

- Medicare Taxes (1.45% of all wages)

Types of Income Subject to Payroll Taxes

Payroll taxes apply to various forms of income, including:

- Wages and Salaries:These are the most common types of income subject to payroll taxes. They represent regular payments for work performed.

- Tips:Tips received by employees are considered taxable income and are subject to payroll taxes.

- Bonuses:Bonuses, whether paid in cash or other forms, are generally subject to payroll taxes.

Payroll Taxes for Independent Contractors and Self-Employed Individuals

Independent contractors and self-employed individuals are responsible for paying both the employer and employee portions of payroll taxes. This is because they are considered both the employer and employee for tax purposes.

- Self-Employment Taxes:Self-employed individuals pay self-employment taxes, which combine the Social Security and Medicare taxes that employees and employers would normally pay. The self-employment tax rate for 2023 is 15.3% (12.4% for Social Security and 2.9% for Medicare).

- Estimated Taxes:Self-employed individuals are also required to make estimated tax payments throughout the year to avoid penalties.

Calculating Payroll Taxes

Calculating payroll taxes involves a process of determining the amount of taxes to be withheld from an employee’s paycheck. This process takes into account various factors, including the employee’s earnings, tax rates, and deductions.

Payroll Tax Rates and Deductions

Payroll taxes are typically divided into two main categories: Social Security and Medicare taxes. These taxes are calculated as a percentage of an employee’s wages. The rates for these taxes are set by the federal government and can change over time.

Social Security tax rate: 6.2% of the first $160,200 in wages (as of 2023)Medicare tax rate: 1.45% of all wages

Payroll taxes are a crucial part of our financial system, contributing to social security, Medicare, and unemployment benefits. But sometimes, even the most essential things can feel a little clunky, just like the way we manage our finances. After two weeks with iOS 18, I’m convinced the new update’s improved budgeting tools, as detailed in this article after two weeks with iOS 18 this one change could be the biggest quality of life improvement of the iphones next software update , could make a real difference in how we handle our payroll taxes and overall financial well-being.

It’s exciting to think about the potential for technology to make such a fundamental aspect of our lives more efficient and user-friendly.

In addition to federal payroll taxes, many states also impose their own state income tax and unemployment tax. These taxes are calculated based on the state’s specific tax laws and rates.

Payroll Tax Calculation Breakdown

To illustrate the process of calculating payroll taxes, consider a hypothetical employee named John, who earns $5,000 per month.

| Tax Type | Tax Rate | Taxable Income | Tax Amount |

|---|---|---|---|

| Social Security | 6.2% | $5,000 | $310 |

| Medicare | 1.45% | $5,000 | $72.50 |

| Federal Income Tax | 12% (assuming John falls in the 12% tax bracket) | $5,000 | $600 |

| State Income Tax | 5% (assuming John’s state has a 5% income tax rate) | $5,000 | $250 |

| Total Payroll Taxes | – | – | $1,232.50 |

In this example, John’s total payroll taxes for the month amount to $1,232.50. This amount is deducted from his gross pay, leaving him with his net pay or take-home pay.

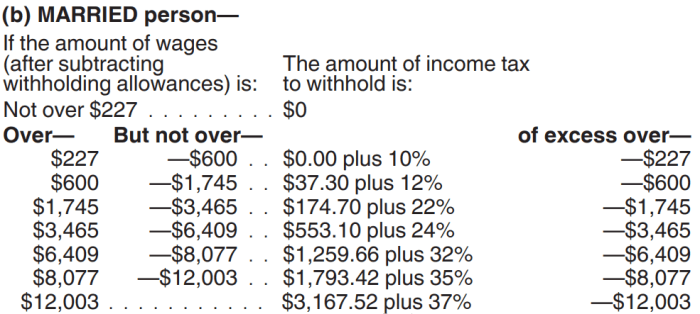

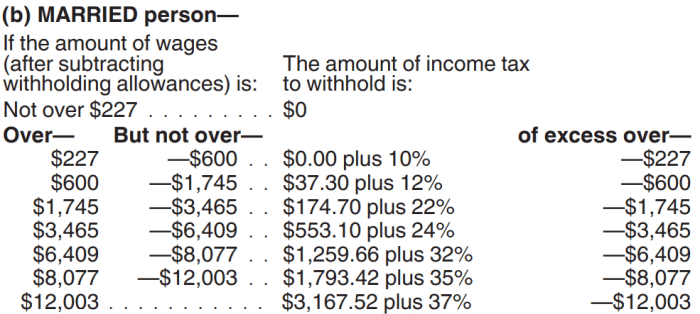

Tax Brackets

The concept of “tax brackets” refers to the different income levels that are subject to varying tax rates. Each tax bracket has a specific range of income and a corresponding tax rate. For example, in the United States, there are several federal income tax brackets, each with a different tax rate.

As an individual’s income increases, they may move into a higher tax bracket, resulting in a higher tax rate on their additional income.

For example, in 2023, the first $10,275 of income is taxed at 10%, the income between $10,275 and $41,775 is taxed at 12%, and so on.

Tax brackets ensure that individuals pay a fair share of taxes based on their income level.

Payroll Tax Forms and Filing

As an employer, you are responsible for withholding payroll taxes from your employees’ wages and paying these taxes to the government. This involves filing specific forms and meeting deadlines.

Key Forms for Reporting and Paying Payroll Taxes, What are payroll taxes

The forms you use for reporting and paying payroll taxes depend on the type of business you operate. Here are some of the most common forms:

- Form W-2, Wage and Tax Statement: This form summarizes the employee’s wages, salaries, and tips, along with the taxes withheld throughout the year. Employers must provide this form to each employee by January 31st of the following year.

- Form 941, Employer’s Quarterly Federal Tax Return: This form is used to report and pay federal income tax withholding, Social Security and Medicare taxes, and unemployment taxes for employees. Businesses typically file this form quarterly, with deadlines falling on April 15th, July 15th, October 15th, and January 15th.

- Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return: This form is used to report and pay the federal unemployment tax. The deadline for filing this form is January 31st of the following year.

Deadlines for Filing Payroll Tax Returns

Meeting the deadlines for filing payroll tax returns is crucial to avoid penalties.

- Form W-2: The deadline for filing Form W-2 is January 31st of the following year.

- Form 941: The deadlines for filing Form 941 are:

- April 15th for the first quarter (January 1st to March 31st)

- July 15th for the second quarter (April 1st to June 30th)

- October 15th for the third quarter (July 1st to September 30th)

- January 15th for the fourth quarter (October 1st to December 31st)

- Form 940: The deadline for filing Form 940 is January 31st of the following year.

Consequences of Late Filing

Late filing of payroll tax returns can result in significant penalties. These penalties can include:

- Failure to pay penalty: This penalty is applied to the amount of tax not paid on time. The penalty is typically calculated at a percentage of the unpaid tax, with the rate varying depending on the length of the delay.

- Failure to file penalty: This penalty is assessed for failing to file a return by the due date, even if the tax has been paid. The penalty is usually a fixed amount, but it can increase based on the length of the delay.

- Interest: Interest is charged on any unpaid tax or penalties. The interest rate is set by the Internal Revenue Service (IRS).

Obtaining an Employer Identification Number (EIN)

An Employer Identification Number (EIN) is a nine-digit number assigned by the IRS to businesses operating in the United States. It is essential for businesses to obtain an EIN to file payroll tax returns and other tax-related documents.

- How to Obtain an EIN: You can apply for an EIN online, by phone, or by mail.

- Online Application: You can apply for an EIN online through the IRS website. This is the fastest and most convenient method.

- Phone Application: You can call the IRS Business & Specialty Tax Line at 1-800-829-1040 to apply for an EIN.

- Mail Application: You can download Form SS-4, Application for Employer Identification Number, from the IRS website and mail it to the address provided on the form.

- Information Required for Application: To apply for an EIN, you will need to provide the following information:

- Your name and Social Security Number (SSN)

- Your business name and address

- The type of business you are operating

- The reason you need an EIN

Payroll Tax Regulations and Changes

Staying informed about payroll tax regulations and changes is crucial for businesses and individuals alike. These changes can impact tax obligations, deductions, and overall financial planning. Understanding these changes ensures compliance and minimizes potential penalties.

Recent Changes to Payroll Tax Laws

Recent changes to payroll tax laws have impacted businesses and individuals in various ways. For example, the Tax Cuts and Jobs Act of 2017 (TCJA) introduced changes to the standard deduction, individual tax brackets, and the corporate tax rate.

These changes have affected the amount of taxes withheld from paychecks and the overall tax burden for both employers and employees.

Role of the Internal Revenue Service (IRS) in Enforcing Payroll Tax Regulations

The IRS plays a crucial role in enforcing payroll tax regulations. The agency is responsible for:

- Providing guidance and resources to taxpayers regarding payroll tax requirements.

- Auditing businesses and individuals to ensure compliance with payroll tax regulations.

- Enforcing penalties for non-compliance with payroll tax laws.

The IRS offers various resources to help taxpayers understand their obligations, including publications, online tools, and guidance documents.

Payroll Tax Implications for Businesses: What Are Payroll Taxes

Payroll taxes are a significant expense for businesses, impacting profitability and financial planning. Understanding the intricacies of payroll taxes is crucial for business owners to ensure compliance, optimize financial strategies, and maintain a healthy bottom line.

Impact of Payroll Taxes on Business Profitability and Financial Planning

Payroll taxes directly affect a business’s profitability by reducing the amount of money available for other business expenses and investment. The taxes are calculated based on employee wages and salaries, impacting net income and ultimately, the company’s overall financial performance.

Payroll taxes also influence financial planning by requiring businesses to allocate funds for tax obligations. This allocation is essential to avoid penalties and ensure smooth operations. Accurate budgeting and forecasting are crucial for managing these tax liabilities effectively.