What Is a Certified Public Accountant?

What is certified public accountant – What is a certified public accountant sets the stage for this enthralling narrative, offering readers a glimpse into a world of financial expertise, meticulous auditing, and unwavering ethical standards. A Certified Public Accountant (CPA) is a highly respected professional who plays a crucial role in the financial health of individuals, businesses, and even entire economies.

CPAs are more than just number crunchers; they are trusted advisors, strategists, and guardians of financial integrity. Their expertise spans a wide range of areas, from tax preparation and financial reporting to auditing and consulting. CPAs are found in diverse industries, including accounting firms, corporations, government agencies, and non-profit organizations.

Definition of a Certified Public Accountant (CPA): What Is Certified Public Accountant

A Certified Public Accountant (CPA) is a highly skilled and licensed professional who plays a crucial role in the financial world. They are entrusted with maintaining the integrity and accuracy of financial records, providing expert financial advice, and ensuring compliance with accounting regulations.

Role of a CPA in the Financial World

CPAs are essential for the smooth functioning of businesses, organizations, and individuals. They provide a wide range of services, including:

- Financial Reporting and Auditing:CPAs ensure that financial statements accurately reflect the financial health of a company. They perform audits to verify the accuracy and reliability of financial records, safeguarding investors and stakeholders.

- Tax Preparation and Planning:CPAs assist individuals and businesses in preparing tax returns and developing tax strategies to minimize tax liabilities. They stay abreast of complex tax laws and regulations to provide effective tax planning advice.

- Financial Advisory Services:CPAs offer financial guidance to businesses and individuals on various matters, including budgeting, investment planning, risk management, and mergers and acquisitions.

- Forensic Accounting:CPAs specializing in forensic accounting investigate financial fraud and misconduct. They use their expertise to uncover financial irregularities and provide evidence for legal proceedings.

Key Responsibilities and Duties of a CPA

CPAs are responsible for a wide range of tasks, including:

- Maintaining Financial Records:CPAs meticulously maintain financial records, ensuring accuracy and compliance with accounting standards.

- Preparing Financial Statements:CPAs prepare financial statements, including balance sheets, income statements, and cash flow statements, providing a clear picture of a company’s financial performance.

- Conducting Audits:CPAs perform audits to assess the accuracy and reliability of financial records, identifying any inconsistencies or potential risks.

- Providing Tax Advice:CPAs advise clients on tax planning, compliance, and strategies to minimize tax liabilities.

- Analyzing Financial Data:CPAs analyze financial data to identify trends, assess financial performance, and provide insights for decision-making.

- Ensuring Compliance:CPAs ensure compliance with accounting standards, tax regulations, and other relevant laws and regulations.

Industries Where CPAs are Employed

CPAs are employed in a diverse range of industries, including:

- Accounting and Finance:CPAs are employed in accounting firms, corporations, and financial institutions, providing essential financial expertise.

- Government:CPAs work in government agencies, auditing government programs and ensuring financial accountability.

- Education:CPAs teach accounting and finance courses at universities and colleges, sharing their knowledge and skills with future generations.

- Non-Profit Organizations:CPAs work for non-profit organizations, managing finances and ensuring transparency and accountability.

- Consulting:CPAs work as consultants, providing financial advisory services to businesses and individuals.

Education and Licensing Requirements

Becoming a CPA requires a significant commitment to education and professional development. It’s a rigorous process that ensures individuals possess the necessary knowledge, skills, and ethical standards to practice public accounting.

Educational Requirements

The first step towards becoming a CPA is obtaining a bachelor’s degree. While a specific major is not mandated, most aspiring CPAs pursue degrees in accounting, finance, or related business fields. This foundation provides the necessary knowledge and skills in accounting principles, financial reporting, auditing, and taxation.

Obtaining CPA Licensure

After completing a bachelor’s degree, aspiring CPAs must meet specific requirements to obtain licensure. These requirements vary by state, but generally include:

Passing the Uniform CPA Examination

The Uniform CPA Examination is a challenging, comprehensive assessment that tests an individual’s knowledge and skills in four core areas:

- Auditing and Attestation (AUD)

- Financial Accounting and Reporting (FAR)

- Regulation (REG)

- Business Environment and Concepts (BEC)

Each section of the exam consists of multiple-choice questions and task-based simulations. The exam is graded on a pass/fail basis, and candidates must pass all four sections to obtain licensure.

Meeting Experience Requirements

Most states require candidates to complete a specified number of hours of work experience under the supervision of a licensed CPA. This experience typically involves working in a public accounting firm or other related field.

Continuing Professional Education (CPE)

Once licensed, CPAs are required to complete a certain number of hours of continuing professional education (CPE) each year. This ensures they stay current with changes in accounting standards, regulations, and industry practices.

Passing the Uniform CPA Examination

The Uniform CPA Examination is a challenging, comprehensive assessment that tests an individual’s knowledge and skills in four core areas:

- Auditing and Attestation (AUD)

- Financial Accounting and Reporting (FAR)

- Regulation (REG)

- Business Environment and Concepts (BEC)

Each section of the exam consists of multiple-choice questions and task-based simulations. The exam is graded on a pass/fail basis, and candidates must pass all four sections to obtain licensure.

Key Areas of Expertise

CPAs are highly skilled professionals with a broad range of expertise in accounting, finance, taxation, and auditing. Their knowledge and abilities extend beyond just crunching numbers; they are adept at analyzing financial information, identifying trends, and providing valuable insights to help businesses make informed decisions.

A Certified Public Accountant (CPA) is a highly trained professional who provides accounting and financial expertise to individuals and businesses. CPAs can help with a wide range of tasks, including tax preparation, financial planning, and auditing. When managing multiple businesses, it can be especially helpful to utilize accounting software for multiple businesses to streamline financial processes.

By leveraging technology, CPAs can offer even more efficient and effective services, ensuring their clients’ financial health is in good hands.

Financial Accounting and Reporting

Financial accounting focuses on the preparation and presentation of financial statements, providing a clear picture of a company’s financial health. CPAs play a crucial role in ensuring these statements are accurate, reliable, and comply with relevant accounting standards.

So, you’re wondering what a Certified Public Accountant (CPA) is? They’re financial experts who provide auditing, tax, and consulting services. It’s a demanding field, but rewarding. Speaking of rewarding, have you seen the leaked images of the new HomePod 3?

It looks like Apple might be adding a display, which could make it even more versatile. Check out the leak here to see for yourself! Anyway, back to CPAs, they’re crucial for businesses of all sizes.

- Generally Accepted Accounting Principles (GAAP):CPAs are well-versed in GAAP, a set of rules and guidelines that govern financial reporting in the United States. This ensures consistency and comparability across different companies.

- International Financial Reporting Standards (IFRS):Many CPAs are also familiar with IFRS, the international accounting standards used by companies in over 140 countries.

- Financial Statement Analysis:CPAs can analyze financial statements to identify trends, assess financial performance, and evaluate risk. They use various tools and techniques like ratio analysis, trend analysis, and cash flow analysis.

Taxation

Taxation is a complex area where CPAs provide expert guidance to individuals and businesses. They help navigate the intricacies of tax laws, minimize tax liabilities, and ensure compliance with tax regulations.

- Tax Planning:CPAs help individuals and businesses develop strategies to minimize their tax obligations by taking advantage of deductions, credits, and other tax benefits.

- Tax Compliance:CPAs prepare and file tax returns accurately and on time, ensuring compliance with federal, state, and local tax laws. They also represent clients in tax audits and disputes.

- Tax Advisory:CPAs provide expert advice on tax matters, including estate planning, business acquisitions, and international taxation.

Auditing

Auditing is the process of examining and evaluating financial records and internal controls to ensure their accuracy and reliability. CPAs play a vital role in providing independent assurance to stakeholders, including investors, creditors, and regulators.

- Financial Statement Audits:CPAs conduct audits of financial statements to express an opinion on their fairness and accuracy. This provides assurance to stakeholders that the financial information is reliable.

- Internal Control Audits:CPAs assess the effectiveness of a company’s internal controls to prevent fraud and ensure financial accuracy. This helps companies mitigate risks and improve operational efficiency.

- Compliance Audits:CPAs perform audits to ensure compliance with specific laws, regulations, and industry standards. This helps organizations avoid penalties and maintain their reputation.

Management Advisory Services

CPAs go beyond traditional accounting and auditing services to provide management advisory services. This involves providing strategic advice, improving business processes, and helping organizations achieve their goals.

- Financial Planning and Analysis:CPAs help businesses develop financial plans, analyze financial performance, and make informed decisions about resource allocation.

- Business Process Improvement:CPAs can identify inefficiencies and recommend improvements to business processes, increasing productivity and profitability.

- Information Technology (IT) Consulting:CPAs with expertise in IT can help businesses select, implement, and manage IT systems, ensuring data integrity and security.

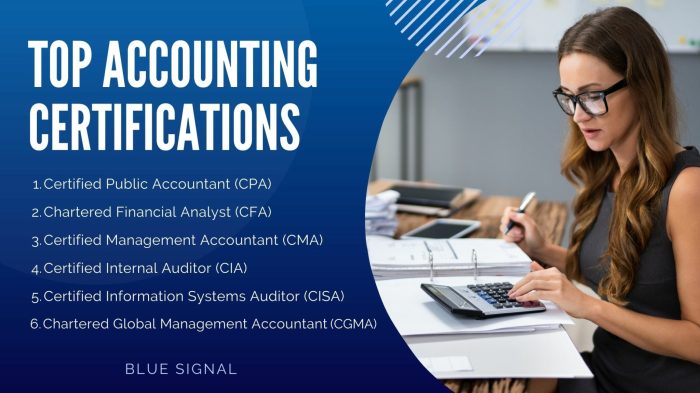

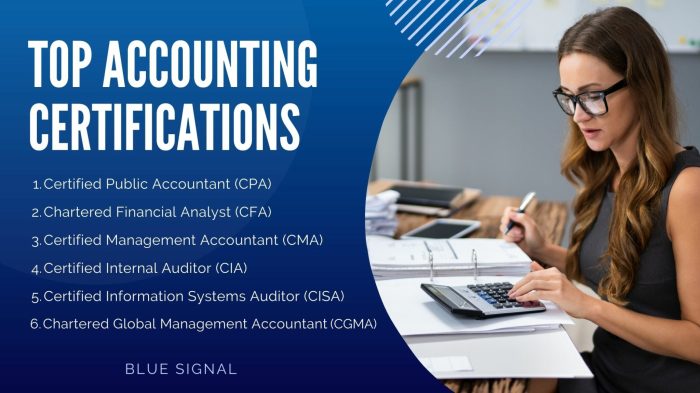

Specializations

The CPA profession offers various specializations, allowing individuals to focus on specific areas of expertise. Some common specializations include:

- Forensic Accounting:Forensic accountants investigate financial crimes, such as fraud, embezzlement, and money laundering. They use their expertise to gather evidence, analyze financial data, and provide expert testimony in legal proceedings.

- Tax Consulting:Tax consultants specialize in tax planning, compliance, and advisory services. They help individuals and businesses navigate complex tax laws and minimize their tax liabilities.

- Auditing:Auditors specialize in examining and evaluating financial records and internal controls. They provide assurance to stakeholders that the financial information is reliable and accurate.

- Management Consulting:Management consultants provide strategic advice and guidance to organizations, helping them improve their operations, performance, and profitability.

- Financial Planning:Financial planners help individuals and families manage their finances, including investments, retirement planning, and estate planning.

Ethical Standards and Professional Conduct

CPAs are entrusted with handling sensitive financial information and providing impartial advice, making adherence to ethical standards crucial. Their professional conduct is guided by a set of principles that ensure public trust and maintain the integrity of the accounting profession.

Ethical Principles

The ethical principles that guide CPAs are Artikeld in the AICPA Code of Professional Conduct and other relevant regulatory bodies. These principles form the foundation for ethical decision-making and ensure that CPAs act with integrity and professionalism.

| Ethical Principle | Description |

|---|---|

| Integrity | CPAs must be honest and straightforward in all professional and business relationships. |

| Objectivity | CPAs must be impartial and free from conflicts of interest. |

| Professional Competence and Due Care | CPAs must maintain the necessary professional skills and knowledge to perform their duties competently. |

| Confidentiality | CPAs must protect confidential information obtained during their work. |

| Professionalism | CPAs must conduct themselves in a manner that upholds the reputation of the profession. |

Maintaining Confidentiality and Objectivity

Confidentiality is a cornerstone of the CPA profession. CPAs are obligated to protect sensitive financial information, such as client data, trade secrets, and personal details. This principle prevents misuse of information and fosters trust between CPAs and their clients. Maintaining objectivity is equally important.

CPAs must be impartial in their judgments and avoid situations that could compromise their independence. This ensures that their advice and recommendations are not influenced by personal biases or conflicts of interest.

A Certified Public Accountant (CPA) is a highly qualified professional who can provide a wide range of financial services, including auditing, tax preparation, and financial consulting. To effectively manage their clients’ finances, CPAs often rely on specialized accounting software, which can streamline processes and provide valuable insights.

If you’re interested in learning more about the different types of accounting software available and how they can benefit your business, check out this comprehensive accounting software complete guide. Understanding the tools CPAs use can help you make informed decisions about your own financial management.

Upholding Professional Integrity

CPAs uphold professional integrity by adhering to codes of conduct, which Artikel specific ethical standards and guidelines. These codes address various aspects of professional behavior, including:

- Avoiding conflicts of interest

- Maintaining independence

- Communicating effectively with clients

- Performing work with due care and professional competence

- Adhering to professional standards and regulations

By adhering to these codes, CPAs demonstrate their commitment to ethical practice and ensure that their work meets the highest standards of professionalism.

Career Paths and Opportunities

The Certified Public Accountant (CPA) designation opens doors to a wide range of career paths, offering diverse opportunities for professional growth and advancement. CPAs are highly sought-after professionals, possessing a unique blend of technical expertise, analytical skills, and ethical standards.

Their versatility and adaptability allow them to thrive in various industries and sectors.

Career Paths for CPAs

The CPA profession offers a multitude of career paths, catering to diverse interests and skillsets. Here are some examples:

- Public Accounting:This traditional path involves working for accounting firms, providing audit, tax, and advisory services to clients. CPAs in public accounting often specialize in specific industries, such as financial services, healthcare, or technology.

- Industry:CPAs are highly valued in various industries, including manufacturing, retail, and technology. They play crucial roles in financial reporting, budgeting, internal controls, and risk management.

- Government:CPAs work for federal, state, and local governments, performing audits, financial analysis, and tax compliance activities. They contribute to ensuring the integrity of public funds and financial transparency.

- Entrepreneurship:CPAs can leverage their expertise to start their own accounting firms, consulting businesses, or financial advisory practices.

- Education:CPAs with a passion for teaching can pursue careers as professors, lecturers, or instructors in accounting programs at universities and colleges.

Advancement and Leadership Roles, What is certified public accountant

The CPA profession offers ample opportunities for advancement and leadership roles. As CPAs gain experience and expertise, they can progress to senior positions, such as:

- Partner or Principal:In public accounting firms, CPAs can rise to become partners or principals, leading teams, managing clients, and contributing to firm strategy.

- Chief Financial Officer (CFO):In industry, CPAs can become CFOs, overseeing the financial operations of an organization, managing financial risk, and providing strategic financial guidance.

- Controller:CPAs can assume the role of controller, responsible for managing the accounting department, ensuring accurate financial reporting, and overseeing internal controls.

Job Market and Salary Expectations

The job market for CPAs remains strong, with consistent demand across various industries. According to the U.S. Bureau of Labor Statistics, the median annual salary for accountants and auditors was $77,250 in May 2022.

- Factors influencing salary:Salary expectations for CPAs are influenced by factors such as experience, industry, location, and specialization. CPAs with specialized skills, such as forensic accounting or tax consulting, may command higher salaries.

- Job outlook:The job outlook for accountants and auditors is projected to be positive, with a projected growth rate of 7% from 2020 to 2030, according to the U.S. Bureau of Labor Statistics. This growth is attributed to the increasing complexity of financial regulations and the need for qualified professionals to ensure financial transparency and accountability.

Impact of Technology on the CPA Profession

The accounting and auditing profession has been significantly impacted by technological advancements, leading to a transformation in the way CPAs perform their duties. From data analytics to automation, technology has revolutionized the field, creating new opportunities and challenges for CPAs.

Data Analytics and Automation

The rise of big data and advanced analytics has empowered CPAs to extract valuable insights from vast amounts of financial information. This allows them to identify trends, patterns, and anomalies that were previously difficult to detect. Data analytics tools can be used for tasks such as:

- Fraud detection: CPAs can analyze data to identify unusual patterns or transactions that may indicate fraudulent activities.

- Financial forecasting: By analyzing historical data, CPAs can develop more accurate financial forecasts and projections.

- Risk assessment: Data analytics can help CPAs identify and assess financial risks, enabling them to take proactive measures to mitigate potential losses.

- Audit planning and execution: CPAs can use data analytics to optimize audit procedures, identify high-risk areas, and improve the efficiency of audits.

Automation tools are also transforming the accounting and auditing profession, streamlining repetitive tasks and freeing up CPAs to focus on higher-value activities. Examples of automation tools include:

- Robotic Process Automation (RPA): RPA software can automate repetitive tasks such as data entry, reconciliation, and invoice processing.

- Artificial Intelligence (AI): AI algorithms can analyze large datasets, identify patterns, and make predictions, assisting CPAs in tasks like fraud detection and financial forecasting.

- Cloud-based accounting software: Cloud-based accounting software provides real-time access to financial data, enabling CPAs to collaborate with clients and perform tasks remotely.