Documents Needed for Payroll: A Guide for Businesses

Navigating the world of payroll can feel like a complex maze, especially when you’re trying to figure out the right documents to ensure smooth sailing. Documents Needed for Payroll: A Guide for Businesses is your roadmap to success, demystifying the essential paperwork and helping you avoid costly mistakes.

From basic employee information to timekeeping records, this guide will equip you with the knowledge to confidently manage your payroll obligations.

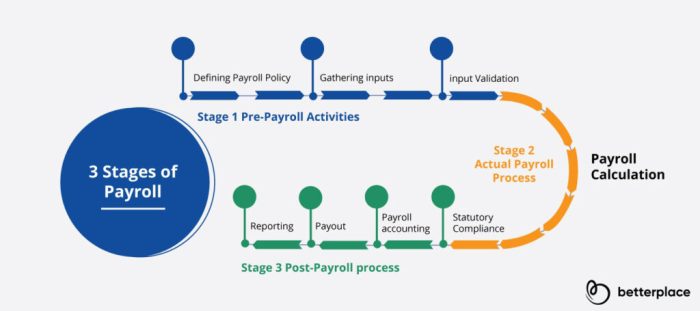

Payroll isn’t just about cutting checks; it’s a crucial aspect of running a successful business. Understanding the legal requirements, gathering accurate data, and adhering to strict compliance standards are all vital components of a smooth and efficient payroll process. This guide will walk you through each step, providing practical advice and actionable insights to help you navigate this essential aspect of your business.

Understanding Payroll Requirements: Documents Needed For Payroll

Payroll is a critical function for any business, ensuring employees are paid accurately and on time. However, navigating the complex world of payroll regulations can be challenging, especially considering the differences in laws and requirements across various countries and regions.

Getting payroll right means having all the necessary documents, like W-2s and pay stubs. But sometimes, I just want to dream of simpler things, like finding the perfect gift for everyone on my Christmas list! This year, I’m hoping to find something special for everyone, and I’ve already started brainstorming ideas.

You can check out my Christmas wishlist for the whole family here , and maybe get some inspiration for your own list. Once the holidays are over, it’s back to the reality of payroll documents, but for now, I’m enjoying the magic of the season.

This guide will delve into the essential aspects of payroll compliance, helping you understand the legal framework and its implications.

Payroll Requirements in Different Countries/Regions

Payroll laws vary significantly from country to country. Understanding these differences is crucial for businesses operating in multiple locations or employing international workers. Here are some examples of key payroll requirements in different regions:

- United States:The United States has a complex system of federal, state, and local payroll taxes. Employers are responsible for withholding income tax, Social Security tax, and Medicare tax from employee paychecks. They also need to pay matching contributions for Social Security and Medicare.

State and local taxes, such as unemployment insurance and workers’ compensation, may also apply.

- European Union:The EU has a framework of employment and labor laws, including payroll regulations. Member states have some flexibility in implementing these laws, but common elements include minimum wage, paid leave, and social security contributions.

- Canada:Similar to the US, Canada has federal and provincial payroll taxes. Employers must withhold income tax, Canada Pension Plan (CPP) contributions, and Employment Insurance (EI) premiums. Provincial taxes may also apply.

Common Payroll Deductions and Taxes

Payroll deductions are amounts withheld from employee paychecks to cover various expenses, including taxes, benefits, and contributions. Understanding these deductions is crucial for both employers and employees.

Payroll is a vital part of any business, and it’s essential to have the right documents in place to ensure everything runs smoothly. Just like putting together the perfect abstract painting, it requires careful planning and the right tools. If you’re looking for inspiration on how to create an abstract painting that anyone can make, check out this great guide an abstract painting that anyone can make.

Once you’ve got your artistic vision, you can return to the world of payroll and ensure you have all the necessary documents, like employee time sheets and tax forms, to complete the process successfully.

- Income Tax:This is the largest deduction for most employees. It is based on the employee’s income level and tax bracket, determined by federal and state/local tax laws.

- Social Security and Medicare:These are federal taxes that fund retirement, disability, and healthcare benefits. Employers and employees contribute equally to these programs.

- Health Insurance:Employers may offer health insurance plans to employees, with premiums deducted from paychecks.

- Retirement Savings:Employees may contribute to retirement savings plans, such as 401(k)s, with pre-tax deductions from their paychecks.

- Other Deductions:Depending on the country and employer, other deductions may apply, including union dues, charitable contributions, and garnishments.

Staying Updated on Payroll Regulations and Changes

Payroll laws and regulations are constantly evolving. It is crucial for businesses to stay informed about any changes that could impact their payroll processes.

- Government Websites:Regularly check official government websites for updates on payroll laws and regulations.

- Professional Organizations:Join professional organizations focused on payroll and human resources. These organizations often provide updates and resources on payroll compliance.

- Payroll Software Providers:Reputable payroll software providers typically offer resources and support to keep users informed about regulatory changes.

Time and Attendance Records

Accurate time and attendance records are crucial for payroll accuracy and compliance. They ensure employees are paid correctly for the hours worked, track overtime, and provide data for various labor-related reports.

Methods for Tracking Time and Attendance

Various methods are available for tracking employee time and attendance, each with its advantages and disadvantages.

- Time Clocks:Traditional time clocks, both manual and digital, are a simple and cost-effective method. Employees punch in and out, recording their arrival and departure times.

- Time Sheets:Employees manually fill out time sheets, recording their hours worked for each day or week. This method is flexible but requires careful monitoring to prevent inaccuracies.

- Biometric Systems:These systems use unique biological characteristics like fingerprints or facial recognition to verify employee identity and record time. They offer high accuracy and security but can be expensive to implement.

- Mobile Apps:Mobile apps allow employees to clock in and out using their smartphones, providing flexibility and real-time tracking. However, they require internet access and may pose security risks.

- GPS Tracking:For employees working remotely or in the field, GPS tracking can verify their location and work hours. This method ensures accurate timekeeping but raises privacy concerns.

Managing Time Off Requests and Approvals, Documents needed for payroll

Effective time off management is vital for smooth operations and accurate payroll. A well-designed system ensures timely processing of requests, reduces administrative burden, and minimizes errors.

- Time Off Request Form:A standardized form should be used for all time off requests, capturing essential details like request date, start and end dates, reason for leave, and contact information.

- Approval Workflow:Establish a clear approval workflow based on the employee’s role and level of authority. This ensures appropriate approvals before granting time off.

- Automated System:Consider using automated time off management software. It streamlines the process, tracks employee leave balances, and sends reminders for pending approvals.

- Communication and Transparency:Clear communication with employees about the time off policy and procedures is crucial. Provide access to their leave balances and ensure timely updates on their requests.

Preventing Time Theft and Ensuring Accurate Record-Keeping

Time theft, which includes inflating hours worked or falsifying records, can significantly impact payroll costs. Implement strong measures to prevent this and maintain accurate records.

Getting your payroll organized can be a bit of a chore, but it’s essential to keep your finances in check. Remember to gather all the necessary documents, like timesheets and tax forms. And while you’re at it, why not take a break and whip up some delicious appetizers?

Check out this fantastic article for 5 easy crostini appetizers perfect for the holidays that are sure to impress your guests. Once you’ve enjoyed a tasty snack, you’ll be ready to tackle the rest of your payroll tasks with renewed energy.

- Regular Monitoring:Regularly review time and attendance records for any discrepancies or unusual patterns. This helps identify potential time theft and address it promptly.

- Clear Policies and Procedures:Establish clear policies on time and attendance, including acceptable reasons for time off, overtime rules, and procedures for handling time discrepancies. Communicate these policies effectively to all employees.

- Employee Training:Train employees on the importance of accurate timekeeping and the consequences of time theft. This emphasizes the need for honesty and accountability in recording their work hours.

- Supervisory Oversight:Encourage supervisors to actively monitor employee time and attendance, identify any inconsistencies, and address them directly with employees.

- Auditing:Conduct periodic audits of time and attendance records to ensure accuracy and compliance with company policies. This helps identify any systemic issues and implement corrective measures.

Compensation and Benefits

Compensation and benefits are crucial aspects of employee relations. They encompass the total package an employer provides in exchange for an employee’s services. Understanding the various types of compensation and benefits is essential for accurately calculating and processing payroll.

Types of Compensation

Compensation refers to the financial rewards employees receive for their work. It can be structured in various ways, each with its own implications for payroll processing.

- Salaries: Salaries are fixed payments made to employees on a regular basis, typically monthly or bi-weekly. They are often used for salaried positions, where employees are expected to work a set number of hours per week, regardless of the actual time spent working.

- Wages: Wages are payments made to employees based on the number of hours they work. They are typically paid hourly, and overtime rates may apply for hours worked beyond a standard workweek.

- Bonuses: Bonuses are additional payments made to employees based on performance, company profitability, or other criteria. They can be paid as a lump sum or spread out over time.

Employee Benefits

Employee benefits are non-wage compensation that employers provide to employees. They can include health insurance, retirement plans, and paid time off. Benefits can be a significant part of an employee’s total compensation package.

- Health Insurance: Health insurance provides coverage for medical expenses, such as doctor’s visits, hospital stays, and prescription drugs. Employers may offer different types of health insurance plans, including HMOs, PPOs, and POS plans.

- Retirement Plans: Retirement plans allow employees to save for retirement. Employers may offer traditional 401(k) plans, Roth 401(k) plans, or other types of retirement savings plans. Employers may also contribute to these plans, matching employee contributions.

- Paid Time Off: Paid time off (PTO) includes vacation time, sick leave, and personal days. Employers may offer a set amount of PTO per year, or they may allow employees to accrue PTO over time.

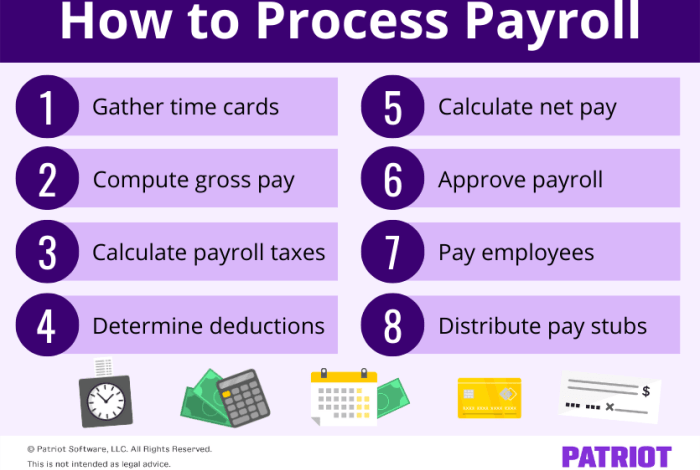

Calculating and Processing Payroll

The process of calculating and processing payroll involves determining the amount of compensation and benefits owed to each employee. This process varies depending on the type of compensation and benefits offered.

- Salaries: To calculate salary payroll, multiply the employee’s annual salary by the number of pay periods in a year. For example, if an employee’s annual salary is $50,000 and they are paid bi-weekly, their gross pay per pay period would be $50,000 / 26 = $1,923.08.

- Wages: To calculate wage payroll, multiply the employee’s hourly rate by the number of hours worked. For example, if an employee’s hourly rate is $15 and they work 40 hours in a week, their gross pay for the week would be $15 x 40 = $600.

Overtime rates may apply for hours worked beyond a standard workweek.

- Bonuses: Bonuses are typically added to an employee’s regular pay. For example, if an employee’s regular pay is $1,000 and they receive a $500 bonus, their total pay for the pay period would be $1,500.

- Benefits: Benefits are typically deducted from an employee’s gross pay. For example, if an employee’s gross pay is $2,000 and they have $100 in health insurance premiums deducted, their net pay would be $1,900.

Payroll Reporting and Compliance

Payroll reporting is a crucial aspect of any organization, as it provides insights into financial performance, employee compensation, and tax obligations. Generating accurate and timely reports is essential for both internal and external stakeholders.

Types of Payroll Reports

Payroll reports provide valuable information for various purposes. Here are some common types of payroll reports and their uses:

- Payroll Register:A detailed summary of employee earnings, deductions, and net pay for a specific pay period. It’s used for internal accounting and record-keeping.

- Tax Reports:These reports summarize withholdings for federal, state, and local taxes. They are used to file tax returns and ensure compliance with tax regulations.

- Employee Earnings Statements:These statements provide individual employees with a breakdown of their earnings, deductions, and net pay for each pay period. They are essential for employees to track their income and taxes.

- Payroll Summary Report:This report provides an overview of total payroll expenses, including gross pay, taxes, and other deductions. It’s used for financial reporting and budgeting purposes.

- Time and Attendance Reports:These reports track employee hours worked and provide information on overtime, sick leave, and vacation time. They are used for payroll calculations and performance monitoring.

Payroll Compliance Checklist

Ensuring payroll compliance is critical to avoid penalties and legal issues. Here’s a checklist to help you maintain compliance:

- Review and update payroll policies regularly:This ensures your policies are aligned with current laws and regulations.

- Verify employee tax information:Ensure you have the correct W-4 forms and other tax documents for all employees.

- Track and pay state and federal taxes:Timely payment of taxes is essential for compliance. Consider using a payroll software or service to help with tax calculations and payments.

- Keep accurate records:Maintain detailed payroll records, including employee time sheets, pay stubs, and tax forms. This documentation is crucial for audits and legal disputes.

- Stay informed about changes in laws and regulations:The laws and regulations surrounding payroll are constantly evolving. Stay updated through professional development, industry publications, or consulting with a payroll expert.