Accrual Accounting vs Cash Accounting: Which is Right for You?

Accrual accounting vs cash accounting – these two methods are the bread and butter of financial reporting, but they’re not always easy to understand. At their core, they’re about how and when you record your income and expenses. Accrual accounting, the more common method, focuses on recognizing revenue and expenses when they occur, regardless of when the cash actually changes hands.

Cash accounting, on the other hand, only records transactions when cash is received or paid out. This fundamental difference has significant implications for your financial statements and ultimately, your business decisions.

The choice between accrual and cash accounting can be a game-changer for your business. Accrual accounting is often favored by larger companies and those with complex financial transactions, while cash accounting is a popular choice for smaller businesses, especially those with simpler operations.

Understanding the strengths and weaknesses of each method can help you choose the right approach for your specific needs and goals.

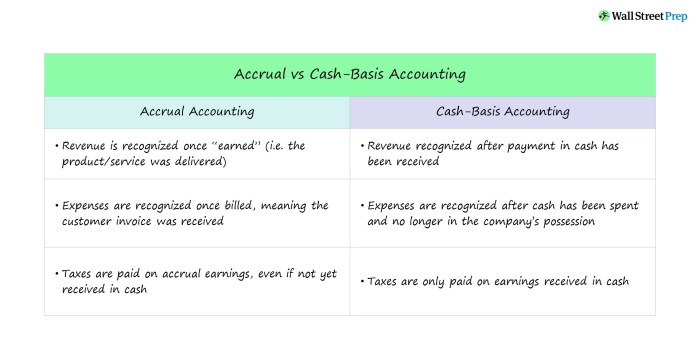

Comparison of Accrual and Cash Accounting

Accrual and cash accounting are two primary methods used to record financial transactions. While they both aim to provide a comprehensive picture of a company’s financial performance, they differ significantly in their approach to recognizing revenue and expenses. Understanding these differences is crucial for making informed financial decisions and interpreting financial statements.

Revenue and Expense Recognition

The timing of revenue and expense recognition is the fundamental difference between accrual and cash accounting.

- Accrual Accounting: Revenue is recognized when it is earned, regardless of whether cash is received. Expenses are recognized when they are incurred, regardless of whether cash is paid. For example, if a company provides services in January but receives payment in February, the revenue is recognized in January under accrual accounting.

Accrual accounting and cash accounting are two different methods for recording financial transactions. Accrual accounting recognizes revenue and expenses when they are earned or incurred, regardless of when cash is received or paid. Cash accounting, on the other hand, only records transactions when cash changes hands.

The Apple Vision Pro’s international launch is likely to be a major event for the company, and it will be interesting to see how the company accounts for the sales of this new product under its chosen accounting method.

Similarly, if a company purchases supplies in January but pays for them in February, the expense is recognized in January.

- Cash Accounting: Revenue is recognized when cash is received, and expenses are recognized when cash is paid. Using the same example, the company would recognize revenue in February when payment is received and the expense in February when payment is made.

Impact on Financial Statements

The choice of accounting method significantly impacts a company’s financial statements.

Income Statements

- Accrual Accounting: The income statement reflects the company’s revenue and expenses for a specific period, regardless of when cash is received or paid. This provides a more accurate picture of the company’s profitability over time. For example, a company that has a high volume of sales on credit may show higher profits under accrual accounting, as revenue is recognized when earned, not when cash is received.

Accrual accounting records income when it’s earned and expenses when they’re incurred, while cash accounting only records transactions when cash changes hands. It’s like the difference between knowing how much money you’ll have next month vs. how much you have right now.

You might have a bunch of orders for your handcrafted leather stud bracelets, but you won’t see the cash until they’re shipped! Learn how to make these bracelets and you can start building your business, whether you choose accrual or cash accounting.

- Cash Accounting: The income statement only reflects the cash inflows and outflows during the period. This can lead to a distorted view of the company’s profitability, especially if there are significant differences between cash receipts and revenue earned or cash payments and expenses incurred.

Balance Sheets

- Accrual Accounting: The balance sheet reflects the company’s assets, liabilities, and equity at a specific point in time. It includes accounts receivable (money owed to the company) and accounts payable (money owed by the company). These accounts are recognized under accrual accounting, even if cash has not been received or paid.

- Cash Accounting: The balance sheet only reflects the company’s cash and cash equivalents. It does not include accounts receivable or accounts payable, which can significantly impact the company’s financial position.

Advantages and Disadvantages

Accrual Accounting

Advantages

- Provides a more accurate picture of a company’s financial performance over time.

- Allows for better financial planning and decision-making.

- Is generally accepted for public companies and many private companies.

Disadvantages

- Can be more complex and time-consuming to implement.

- Requires more sophisticated accounting systems.

- May result in a mismatch between reported profits and cash flow.

Cash Accounting

Advantages

- Simpler to understand and implement.

- Provides a clear picture of the company’s cash flow.

- Suitable for small businesses with limited accounting resources.

Disadvantages

Choosing the Right Method

Choosing the right accounting method for your business is a critical decision that can significantly impact your financial reporting, tax obligations, and overall business strategy. While both accrual and cash accounting have their advantages and disadvantages, the best method for your business depends on several factors, including your business size, industry, and financial reporting requirements.

Accrual accounting, unlike cash accounting, recognizes revenue when earned and expenses when incurred, regardless of when cash is received or paid. This can be a complex system, but it paints a more accurate picture of a business’s financial health.

For example, if you’re planning to buy a new new Forzieri bag by Balmain , accrual accounting would reflect the purchase as an expense, even if you haven’t yet paid for it, while cash accounting wouldn’t show the expense until the payment is made.

Factors to Consider

Choosing the right accounting method for your business requires careful consideration of several factors, including:

- Business Size:Smaller businesses with simple operations and a limited number of transactions often find cash accounting easier to manage. However, larger businesses with complex transactions and multiple departments may benefit from the greater accuracy and transparency of accrual accounting.

- Industry:Certain industries, such as manufacturing, retail, and services, typically use accrual accounting because of the long-term nature of their transactions. On the other hand, businesses in industries with short transaction cycles, like consulting or freelance work, might prefer cash accounting.

- Financial Reporting Requirements:If your business is publicly traded or requires audited financial statements, accrual accounting is usually mandated by regulatory bodies like the Securities and Exchange Commission (SEC).

Comparison Table

Here’s a table summarizing the suitability of each accounting method for different types of businesses:

| Factor | Cash Accounting | Accrual Accounting |

|---|---|---|

| Business Size | Suitable for small businesses with simple operations and limited transactions. | More suitable for large businesses with complex transactions and multiple departments. |

| Industry | Suitable for industries with short transaction cycles, like consulting or freelance work. | Typically used in industries with long-term transactions, such as manufacturing, retail, and services. |

| Financial Reporting Requirements | Not required for public companies or businesses with audited financial statements. | Mandatory for public companies and businesses with audited financial statements. |

Legal and Regulatory Considerations

Legal and regulatory requirements can significantly influence your choice of accounting method. For example, businesses that are subject to the Generally Accepted Accounting Principles (GAAP) are typically required to use accrual accounting. However, small businesses that meet certain criteria may be eligible to use the cash method under the Internal Revenue Code (IRC).

Examples of Industries

Here are some examples of industries that typically utilize each accounting method:

- Cash Accounting:Consulting, freelance work, small retail stores, and sole proprietorships.

- Accrual Accounting:Manufacturing, retail, services, healthcare, and financial institutions.

Examples of Accrual vs. Cash Accounting: Accrual Accounting Vs Cash Accounting

Let’s dive into some real-world examples to see how accrual and cash accounting work in practice. Imagine a service-based business like a web design company. We’ll track their revenue and expenses using both methods.

Service-Based Business Example

This example will showcase the differences between accrual and cash accounting using a web design company. We’ll explore how revenue and expenses are recorded under each method, highlighting the key distinctions.

| Transaction | Accrual Accounting Entry | Cash Accounting Entry |

|---|---|---|

| Client signs a contract for website design, paying a $5,000 deposit. |

This entry reflects the receipt of cash but recognizes that the service hasn’t been performed yet, so it’s considered unearned revenue. |

Cash accounting recognizes revenue as soon as the cash is received, regardless of whether the service has been performed. |

| The web design company completes the website design. |

This entry recognizes the revenue earned as the service is completed, regardless of when the cash was received. |

Cash accounting doesn’t record this transaction because no cash has been received yet. |

| The web design company pays a $1,000 monthly rent. |

This entry reflects the expense incurred for rent, even though the cash payment may be made at a later date. |

Cash accounting records the expense when the cash is paid, regardless of the period the rent covers. |

| The web design company purchases a new computer for $2,000, paying $500 upfront and financing the remaining $1,500. |

This entry recognizes the full cost of the computer as an asset, even though the full payment is not made immediately. |

Cash accounting only records the expense for the portion of the computer paid for in cash. The financed amount is not recorded until it’s paid off. |

Transitioning Between Methods

Switching from cash accounting to accrual accounting can be a significant change for businesses, particularly those used to the simplicity of cash-based recording.

While accrual accounting provides a more accurate picture of financial performance, the transition requires careful planning and execution to ensure a smooth transition and avoid potential pitfalls.

Considerations and Challenges

Transitioning from cash accounting to accrual accounting involves several considerations and challenges.

Understanding the Differences

The most crucial aspect is understanding the fundamental differences between cash and accrual accounting. Cash accounting recognizes revenue and expenses when cash is received or paid, while accrual accounting recognizes them when they are earned or incurred, regardless of the cash flow.

This shift in perspective can be challenging for businesses accustomed to cash-based recording.

Accounting Adjustments

The transition necessitates adjustments to the company’s accounting records to reflect the accrual accounting method. This includes identifying and recording unrecorded revenues and expenses that have been earned or incurred but not yet paid or received.

Reconciling Accounts

The transition requires reconciling accounts to ensure consistency between the cash and accrual methods. This involves identifying and adjusting any discrepancies in account balances arising from the different accounting methods.

Potential Impact on Financial Reporting

Switching to accrual accounting can significantly impact financial reporting. Businesses need to understand the potential implications of these changes on their financial statements, particularly for tax purposes.

Accounting Adjustments During Transition

The transition process often requires adjustments to the company’s financial records to align with accrual accounting principles. These adjustments can be categorized into the following:

Revenue Recognition

- Unearned Revenue:Recognizing revenue earned but not yet received, such as advance payments for services or subscriptions.

- Accrued Revenue:Recognizing revenue earned but not yet billed, such as services provided but not yet invoiced.

Expense Recognition

- Accrued Expenses:Recognizing expenses incurred but not yet paid, such as salaries, utilities, or rent.

- Prepaid Expenses:Recognizing expenses paid in advance but not yet incurred, such as insurance premiums or rent paid for future periods.

Common Issues During Transition, Accrual accounting vs cash accounting

Several common issues can arise during the transition process, including:

Data Availability

Businesses may face challenges in gathering accurate historical data required for the transition. This can be particularly challenging for businesses that have not maintained detailed records or have poor data management practices.

Software and Systems

Switching to accrual accounting may require changes to the company’s accounting software or systems. This can involve significant costs and technical expertise to implement and maintain.

Internal Training

Employees need to be trained on the principles of accrual accounting and the new processes involved. This can be time-consuming and require resources to ensure everyone understands the changes.

Impact on Financial Statements

The transition can significantly impact the company’s financial statements, particularly in the first year. This can affect financial ratios, profitability, and other key performance indicators.