Find the Best International Merchant Account for Your Business

The best international merchant account is essential for businesses that operate globally or sell products and services to customers in multiple countries. These accounts allow you to accept payments in various currencies, manage foreign exchange rates, and comply with international payment regulations.

Whether you’re a small online store or a large multinational corporation, having a reliable and secure international merchant account can significantly impact your success. This guide will explore the key features, considerations, and best practices for choosing the right international merchant account provider for your specific needs.

Understanding International Merchant Accounts

An international merchant account is a specialized financial tool that allows businesses to accept payments from customers located in different countries. It’s essential for businesses that conduct transactions across borders, enabling them to expand their reach and tap into global markets.

Finding the best international merchant account is crucial for businesses that operate across borders. It’s important to consider factors like transaction fees, currency exchange rates, and security features. Don’t forget about financial planning, too – you might want to explore options like cover tax liability life insurance to ensure your business is protected in case of unforeseen circumstances.

A reliable international merchant account can be a key component of a successful global business strategy.

Differences Between Domestic and International Merchant Accounts

Domestic merchant accounts are designed for businesses that primarily operate within their own country. They process transactions in the local currency and adhere to the regulations of the domestic market. In contrast, international merchant accounts cater to businesses that operate globally, allowing them to accept payments in multiple currencies and navigate the complexities of international payment processing.

- Currency Conversion:International merchant accounts handle currency conversions automatically, eliminating the need for businesses to manually exchange currencies. This simplifies the payment process and reduces the risk of currency fluctuations.

- Global Payment Gateways:International merchant accounts integrate with global payment gateways, enabling businesses to accept payments from a wider range of customers using various payment methods, such as credit cards, debit cards, and digital wallets.

- Compliance with International Regulations:International merchant accounts comply with the regulations of multiple countries, ensuring businesses can operate legally and securely in different markets.

Businesses That Benefit from International Merchant Accounts

International merchant accounts are particularly advantageous for businesses that engage in cross-border transactions, including:

- E-commerce Businesses:Online retailers selling products or services globally need international merchant accounts to process payments from customers in different countries.

- Travel and Tourism Companies:Businesses in the travel and tourism industry, such as airlines, hotels, and tour operators, rely on international merchant accounts to accept payments from international travelers.

- Software and Technology Companies:Companies selling software or technology services to clients worldwide require international merchant accounts to process recurring subscriptions and payments.

- Freelancers and Consultants:Freelancers and consultants offering their services globally need international merchant accounts to receive payments from clients in different countries.

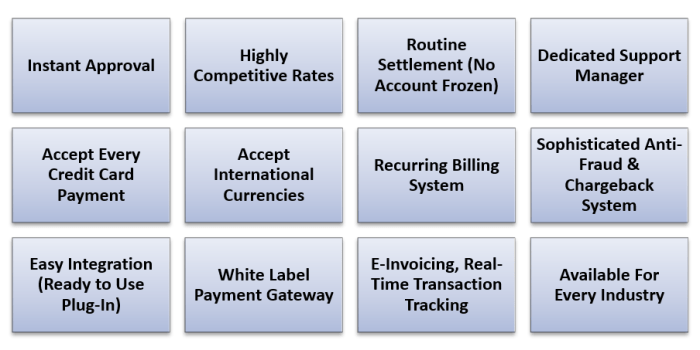

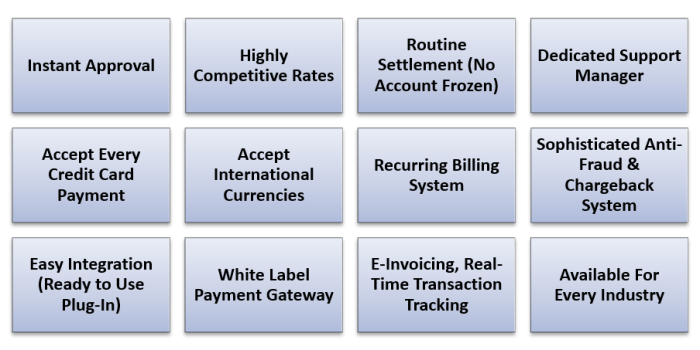

Key Features of a Best International Merchant Account

A well-equipped international merchant account is crucial for businesses that operate across borders. These accounts provide the necessary tools and features to process payments securely and efficiently from customers worldwide.

Payment Processing Methods

International merchant accounts support a wide range of payment processing methods, enabling businesses to cater to diverse customer preferences and needs.

- Credit and Debit Cards:This remains the most common payment method globally, with major card networks like Visa, Mastercard, American Express, and Discover widely accepted. International merchant accounts facilitate seamless processing of these transactions, ensuring fast and secure payments.

- E-Wallets:Popular e-wallets like PayPal, Skrill, and Neteller have gained significant traction, offering a convenient and secure alternative to traditional payment methods. International merchant accounts integrate with these platforms, enabling businesses to accept payments from e-wallet users.

- Alternative Payment Methods:Depending on the region, international merchant accounts may support various alternative payment methods, such as local bank transfers, mobile wallets, and prepaid cards. This flexibility allows businesses to reach a wider customer base, especially in markets where traditional payment methods are less prevalent.

Finding the best international merchant account can be a game of its own, but it doesn’t have to be as intense as the Netflix unveils Squid Game Unleashed games. With the right research and a clear understanding of your business needs, you can find a solution that offers competitive rates, global reach, and reliable customer support.

This will allow you to focus on expanding your business and reaching new customers worldwide.

Security and Fraud Prevention

Security and fraud prevention are paramount for international transactions, as businesses handle sensitive customer data and financial information.

- Data Encryption:Reputable international merchant accounts employ advanced encryption technologies, such as Transport Layer Security (TLS), to protect sensitive data during transmission. This ensures that customer information is secure and cannot be intercepted by unauthorized parties.

- Fraud Detection Systems:These systems use sophisticated algorithms to analyze transaction patterns and identify potential fraudulent activity. By monitoring transactions in real-time, they can flag suspicious activities and prevent unauthorized payments, minimizing financial losses for businesses.

- Chargeback Management:International merchant accounts provide tools to manage chargebacks effectively. This includes access to detailed transaction data, dispute resolution services, and resources to prevent future chargebacks. By understanding and addressing chargeback reasons, businesses can mitigate financial risks and maintain a positive customer experience.

Finding the best international merchant account is crucial for businesses that operate across borders, and it’s essential to consider factors like transaction fees, security, and customer support. While navigating the complexities of international payments, I recently had the opportunity to experience the rejuvenating Dublin mind-body experience , which reminded me of the importance of balance and well-being.

Returning to the world of business, a reliable merchant account ensures smooth transactions, allowing you to focus on what truly matters: growing your global reach.

Choosing the Right International Merchant Account Provider: Best International Merchant Account

Finding the right international merchant account provider is crucial for businesses that operate globally. A well-suited provider can streamline your payment processing, minimize fees, and enhance your customer experience. However, navigating the diverse landscape of providers can be overwhelming.

This section will guide you through the process of selecting the ideal provider for your specific needs.

Comparing International Merchant Account Providers

Evaluating different providers involves comparing their offerings across key aspects. A comprehensive comparison can help you make an informed decision. Here’s a table highlighting some important factors to consider:

| Provider | Fees (Processing, Monthly, Setup) | Features (Payment Gateways, Currency Support, Fraud Prevention) | Customer Support (Availability, Responsiveness, Channels) |

|---|---|---|---|

| Provider A | [Insert specific fee details] | [List key features] | [Describe customer support] |

| Provider B | [Insert specific fee details] | [List key features] | [Describe customer support] |

| Provider C | [Insert specific fee details] | [List key features] | [Describe customer support] |

Evaluating International Merchant Account Providers

A checklist can be helpful for systematically assessing potential providers. Here are some essential criteria to consider:

- Fees:Understand the various fees associated with the account, including processing fees, monthly fees, setup fees, and currency conversion fees. Compare these fees across providers to find the most cost-effective option.

- Features:Evaluate the features offered, such as supported payment gateways, currencies, fraud prevention tools, and reporting capabilities. Choose a provider that aligns with your business requirements.

- Customer Support:Assess the quality and availability of customer support. Look for providers with responsive support teams available through multiple channels, such as phone, email, and live chat.

- Security:Prioritize providers that offer robust security measures, including encryption, fraud detection systems, and compliance with industry standards like PCI DSS.

- Reputation:Research the provider’s reputation by reading reviews and testimonials from existing customers. Look for providers with a strong track record of reliability and customer satisfaction.

- Scalability:Consider your future growth plans. Choose a provider that can accommodate your expanding transaction volume and evolving business needs.

Factors Influencing Provider Selection

The choice of an international merchant account provider should be tailored to your specific business context. Here are some key factors to consider:

- Transaction Volume:Providers may have different pricing structures based on transaction volume. If you anticipate high transaction volumes, you might benefit from a provider with volume-based discounts or tiered pricing.

- Industry Type:Certain providers specialize in specific industries, such as e-commerce, travel, or healthcare. Choosing a provider with expertise in your industry can provide valuable insights and support.

- Geographic Reach:Consider the regions where you operate or plan to expand. Select a provider with a global network that supports your target markets.

Managing and Optimizing International Payments

Managing international payments effectively is crucial for businesses operating in a global marketplace. It involves navigating currency conversions, mitigating risks, and ensuring smooth and cost-effective payment processing. This section delves into best practices for managing international payments and provides insights on optimizing payment processing for efficiency and cost-effectiveness.

Currency Conversion Strategies, Best international merchant account

Currency conversion plays a pivotal role in international payments, as businesses need to convert funds from one currency to another to facilitate transactions. Businesses should consider the following strategies to manage currency conversion effectively:

- Dynamic Currency Conversion (DCC):DCC allows customers to pay in their local currency at the point of sale. While it may seem convenient, DCC rates often carry a higher markup than standard exchange rates. Businesses should be transparent about DCC charges and offer customers the option to pay in the merchant’s currency for potentially better rates.

- Forward Contracts:Forward contracts lock in an exchange rate for a future date, providing certainty and hedging against currency fluctuations. This strategy is beneficial for businesses with predictable international payment flows.

- Currency Hedging:Currency hedging involves using financial instruments like options or futures to mitigate potential losses from currency fluctuations. This strategy is particularly relevant for businesses with large foreign currency exposures.

Risk Mitigation Strategies

International payments are inherently associated with risks, including fraud, chargebacks, and currency fluctuations. Businesses should implement robust risk mitigation strategies to minimize potential losses:

- Fraud Prevention Measures:Implement strong fraud detection systems, including address verification, CVV checks, and real-time monitoring of transaction patterns.

- Chargeback Management:Establish clear chargeback policies, promptly address customer disputes, and maintain accurate records of transactions.

- Insurance Coverage:Consider obtaining insurance coverage for potential losses related to fraud, chargebacks, or currency fluctuations.

Optimizing Payment Processing

Optimizing international payment processing is crucial for efficiency and cost-effectiveness. Businesses should explore the following strategies:

- Automated Payment Processing:Automate payment processing workflows to streamline operations and reduce manual errors.

- Batch Processing:Process payments in batches to reduce transaction fees and improve efficiency.

- Payment Optimization Tools:Utilize payment optimization tools to analyze payment data, identify cost-saving opportunities, and optimize payment processing workflows.

International Payment Processing Flowchart

The following flowchart illustrates the steps involved in processing an international payment:

[Image: Flowchart illustrating the steps involved in processing an international payment]

The flowchart begins with the customer initiating a payment. The payment is then routed through the payment gateway, which processes the transaction and verifies the customer’s details. If the transaction is approved, the payment is then transferred to the merchant’s account.

The payment may involve currency conversion depending on the currencies involved. Once the payment is received, the merchant can then fulfill the order.

International Payment Security and Compliance

In the globalized landscape of e-commerce, safeguarding sensitive financial data and ensuring compliance with international regulations are paramount for businesses accepting payments from customers worldwide. International merchant accounts play a crucial role in helping businesses achieve these goals, offering robust security features and facilitating adherence to essential regulatory frameworks.

Importance of PCI DSS Compliance

The Payment Card Industry Data Security Standard (PCI DSS) is a comprehensive set of security requirements designed to protect cardholder data during payment processing. It is a global standard enforced by major card brands like Visa, Mastercard, American Express, and Discover.

Adhering to PCI DSS is not only essential for maintaining the integrity of financial transactions but also for avoiding hefty fines and potential reputational damage.

- Data Security:PCI DSS mandates stringent security controls for storing, processing, and transmitting cardholder data, including encryption, access control, and vulnerability management. This helps prevent data breaches and protects customer information from unauthorized access.

- Fraud Prevention:By implementing robust security measures, businesses can effectively mitigate the risk of fraudulent transactions. PCI DSS requirements, such as strong password policies and regular security assessments, contribute to a secure payment environment.

- Brand Reputation:Compliance with PCI DSS demonstrates a commitment to data security and fosters trust among customers. It helps businesses maintain a positive brand image and build customer confidence in their payment systems.

International Merchant Accounts and KYC/AML Compliance

Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations are designed to prevent financial crimes such as money laundering and terrorist financing. International merchant account providers assist businesses in complying with these regulations by implementing various measures:

- Customer Due Diligence:International merchant account providers conduct thorough customer due diligence (CDD) processes to verify the identity of their merchants and customers. This includes collecting and verifying essential information such as business registration documents, proof of identity, and source of funds.

- Transaction Monitoring:Reputable providers have sophisticated systems for monitoring transactions and identifying suspicious activities. They use advanced algorithms and real-time data analysis to detect potential money laundering or terrorist financing attempts.

- Reporting Suspicious Activities:International merchant account providers are obligated to report any suspicious activities to the relevant authorities. This proactive approach helps prevent financial crimes and maintain the integrity of the financial system.

Security Measures Implemented by Reputable Providers

Reputable international merchant account providers implement a wide range of security measures to protect sensitive data and ensure secure payment processing. Some common examples include:

- Data Encryption:All data transmitted between the merchant’s website and the payment gateway is encrypted using industry-standard protocols such as TLS/SSL. This ensures that even if data is intercepted, it remains unreadable.

- Tokenization:Sensitive cardholder data is replaced with unique tokens, rendering it unusable for fraudulent purposes. This eliminates the need to store actual card details on the merchant’s servers.

- Two-Factor Authentication:Reputable providers often require two-factor authentication for accessing merchant accounts, adding an extra layer of security. This involves verifying the identity of the user through multiple factors, such as a password and a one-time code sent to their mobile device.

- Regular Security Audits:Reputable providers conduct regular security audits to identify and address vulnerabilities in their systems. These audits ensure that their security measures remain effective and comply with industry best practices.

- Fraud Detection Systems:Advanced fraud detection systems use sophisticated algorithms and machine learning to identify suspicious transactions in real-time. This helps prevent fraudulent activities and protect both merchants and customers.