Blockchain, Bitcoin, Crypto Fundamentals: A Deep Dive

Blockchain bitcoin crypto fundamentals – Blockchain, Bitcoin, Crypto Fundamentals: A Deep Dive. These three words, often used interchangeably, represent a revolutionary technological shift that’s changing the world as we know it. From the decentralized nature of blockchain technology to the rise of digital currencies like Bitcoin and the vast array of cryptocurrencies beyond, this area is buzzing with excitement and innovation.

It’s not just about financial speculation; it’s about understanding a new paradigm for value exchange, data security, and even governance.

This exploration delves into the heart of these concepts, breaking down the complex into digestible pieces. We’ll unravel the mysteries of blockchain, explore the history and mechanics of Bitcoin, and discover the vast landscape of cryptocurrencies. Prepare to embark on a journey that will equip you with the knowledge to navigate this exciting new frontier.

Blockchain Fundamentals

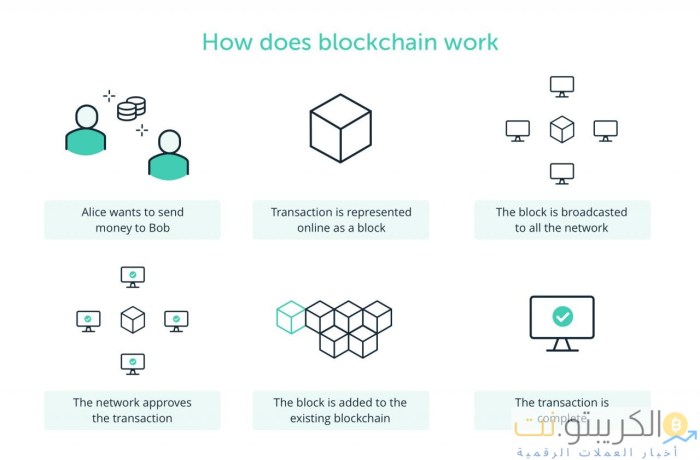

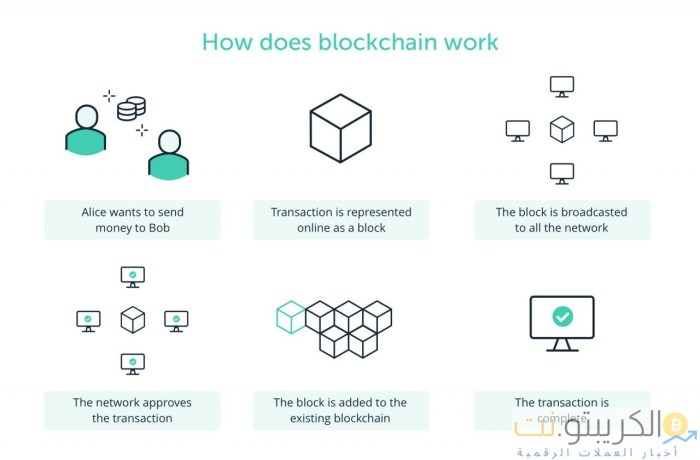

The blockchain is a revolutionary technology that has the potential to transform various industries. It is a distributed, immutable, and transparent ledger that records transactions across a network of computers. This technology has gained immense popularity due to its ability to enhance security, efficiency, and trust in various applications.

Blockchain Architecture

A blockchain is a chain of blocks, each containing a set of transactions. These blocks are linked together cryptographically, forming a secure and tamper-proof record of transactions. Each block contains a timestamp, a hash of the previous block, and a set of transactions.

The hash of a block is a unique identifier that is derived from the contents of the block using a cryptographic function. This hash is also included in the subsequent block, linking the blocks together in a chronological chain.

Key Characteristics of Blockchain

- Decentralization:Blockchain networks are decentralized, meaning there is no single point of control. Transactions are validated and recorded by multiple nodes in the network, ensuring that no single entity has complete control over the data. This decentralized nature makes blockchains resistant to censorship and manipulation.

- Immutability:Once a transaction is recorded on a blockchain, it cannot be altered or deleted. This immutability is achieved through cryptography, where each block is linked to the previous block using a hash function. Any attempt to modify a block would invalidate the hash of the subsequent blocks, making the alteration immediately apparent to all nodes in the network.

Understanding blockchain, Bitcoin, and the broader crypto landscape is crucial for navigating the rapidly evolving financial world. This decentralized technology has the potential to revolutionize industries, and recent appointments like that of Ms. Ludivine Wouters as Non-Executive Director at Euro Manganese, as reported in this article , highlight the growing interest in blockchain’s potential across various sectors.

As we move forward, staying informed about these developments will be key to understanding the future of finance and technology.

- Transparency:All transactions on a blockchain are publicly visible and auditable. This transparency promotes accountability and trust, as anyone can verify the authenticity and integrity of transactions. However, it is important to note that while transactions are public, the identities of the participants may be anonymized using cryptographic techniques.

Types of Blockchains

There are different types of blockchains, each with its own characteristics and applications.

- Public Blockchains:These blockchains are open to anyone and allow anyone to participate in the network. Examples include Bitcoin and Ethereum. Public blockchains are highly secure and transparent, but they may be slower and more expensive than private or consortium blockchains.

- Private Blockchains:These blockchains are controlled by a single organization and only authorized users can participate in the network. Private blockchains offer greater control and privacy but may be less secure and transparent than public blockchains. They are often used for internal business applications.

- Consortium Blockchains:These blockchains are shared by a group of organizations, typically within a specific industry. Consortium blockchains offer a balance between control and transparency, allowing participating organizations to collaborate while maintaining a degree of privacy. They are often used for supply chain management, healthcare, and financial services.

Real-World Applications of Blockchain, Blockchain bitcoin crypto fundamentals

Blockchain technology has numerous real-world applications beyond cryptocurrency.

- Supply Chain Management:Blockchain can track goods and materials throughout the supply chain, providing transparency and traceability. This can help businesses improve efficiency, reduce fraud, and enhance customer trust.

- Healthcare:Blockchain can be used to securely store and share patient medical records, ensuring privacy and data integrity. It can also be used to manage clinical trials and track drug distribution.

- Voting:Blockchain can provide a secure and transparent platform for electronic voting, reducing the risk of fraud and manipulation. This can enhance voter confidence and participation.

- Identity Management:Blockchain can be used to create secure and tamper-proof digital identities, simplifying identity verification and authentication processes. This can improve efficiency and reduce fraud in various applications.

- Digital Asset Management:Blockchain can be used to create and manage digital assets, such as intellectual property, digital art, and gaming items. This can provide secure ownership and facilitate the transfer of digital assets.

Bitcoin Fundamentals

Bitcoin, the world’s first and most popular cryptocurrency, has revolutionized the financial landscape and sparked a global interest in blockchain technology. Its journey began with a mysterious individual known as Satoshi Nakamoto, whose identity remains a mystery. This section delves into the origins of Bitcoin, its core principles, and the factors that influence its value.

Bitcoin’s Genesis

Bitcoin was created in 2008 by Satoshi Nakamoto, an anonymous individual or group of individuals. Nakamoto published a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” outlining the concept of a decentralized digital currency. The paper proposed a novel system for secure and transparent transactions, eliminating the need for intermediaries like banks.

Understanding the fundamentals of blockchain, Bitcoin, and crypto is essential for navigating this rapidly evolving landscape. It’s like learning the rules of a new game before jumping in. One fascinating example of blockchain adoption is captured in the novas adoption story photo book , which documents the real-world impact of this technology on a community.

This project highlights how blockchain can be a powerful tool for change, and it underscores the importance of understanding its potential beyond just the financial aspects.

In 2009, the first Bitcoin block, known as the genesis block, was mined, marking the official launch of Bitcoin.

Understanding the fundamentals of blockchain, Bitcoin, and crypto is essential for navigating this rapidly evolving space. From the decentralized nature of blockchain technology to the intricacies of Bitcoin mining, there’s a lot to unpack. But even amidst the technical complexities, it’s important to remember the human element.

In at home with paula passini , Paula shares her personal insights on the impact of crypto on her life, reminding us that these technologies are ultimately shaping our world in profound ways. This human perspective helps us to see beyond the technical jargon and appreciate the real-world implications of blockchain and crypto.

Bitcoin Mining

Bitcoin mining is the process of validating and adding new transactions to the Bitcoin blockchain. Miners use specialized hardware to solve complex mathematical problems. The first miner to solve the problem receives a reward in the form of newly created Bitcoins.

This process, known as Proof-of-Work (PoW), ensures the security and integrity of the Bitcoin network.

- Block Creation:Miners compete to add new transactions to the blockchain, forming blocks. Each block contains a timestamp, a hash of the previous block, and a list of transactions.

- Hashing:Miners use powerful computers to solve complex mathematical problems, generating a hash that meets specific criteria. The first miner to solve the problem adds the block to the blockchain and receives a reward.

- Block Reward:The reward for mining a block is currently 6.25 Bitcoins, and it halves every four years. This halving mechanism ensures a controlled supply of Bitcoin, preventing inflation.

Factors Influencing Bitcoin’s Price

Bitcoin’s price is highly volatile and influenced by a complex interplay of factors. Understanding these factors can provide insights into the dynamics of the cryptocurrency market.

- Supply and Demand:Like any other asset, Bitcoin’s price is determined by supply and demand. Increased demand from investors and traders drives up the price, while a decrease in demand leads to a decline.

- Market Sentiment:The overall sentiment in the cryptocurrency market plays a significant role in Bitcoin’s price. Positive news and regulatory developments can boost investor confidence, leading to price increases. Conversely, negative news or regulatory uncertainty can trigger price drops.

- Adoption and Use Cases:As more businesses and individuals adopt Bitcoin, its value tends to increase. Growing adoption leads to increased demand and a wider range of use cases.

- Technological Developments:Advancements in blockchain technology, such as the development of new features or scaling solutions, can impact Bitcoin’s price. Positive developments often attract more investors and increase confidence in the long-term viability of the technology.

- Regulatory Landscape:Government regulations and policies can significantly impact Bitcoin’s price. Favorable regulations, such as clear guidelines and recognition of Bitcoin as a legitimate asset class, can boost investor confidence and drive price increases. Conversely, restrictive regulations can create uncertainty and lead to price declines.

Cryptocurrency Fundamentals

Cryptocurrencies have emerged as a revolutionary force in the financial world, offering decentralized and secure alternatives to traditional fiat currencies. This section delves into the core concepts of cryptocurrencies, exploring their unique characteristics, diverse types, and the role of smart contracts in shaping the cryptocurrency ecosystem.

Defining Cryptocurrency and its Differentiation from Fiat Currencies

Cryptocurrencies are digital or virtual currencies that employ cryptography for security and operate independently of central banks or governments. Unlike fiat currencies, which derive their value from government decree, cryptocurrencies rely on decentralized networks and consensus mechanisms for value determination.

- Decentralization:Cryptocurrencies are not controlled by any single entity, eliminating the risk of manipulation or censorship by governments or financial institutions.

- Transparency:All transactions on a cryptocurrency network are recorded on a public ledger, known as a blockchain, ensuring transparency and accountability.

- Security:Cryptography plays a crucial role in securing cryptocurrency transactions, making them resistant to fraud and counterfeiting.

Types of Cryptocurrencies Beyond Bitcoin

While Bitcoin is the most well-known cryptocurrency, the landscape encompasses a wide array of alternatives, each with unique features and applications.

Altcoins

Altcoins, short for “alternative coins,” are cryptocurrencies that emerged after Bitcoin, often seeking to improve upon or address limitations of Bitcoin.

- Ethereum:Known for its smart contract functionality, Ethereum enables the creation and execution of decentralized applications (dApps).

- Litecoin:Designed to offer faster transaction speeds and lower transaction fees compared to Bitcoin.

- Dogecoin:A meme-based cryptocurrency that gained popularity due to its playful nature and strong community support.

Stablecoins

Stablecoins aim to mitigate the volatility inherent in cryptocurrencies by pegging their value to a stable asset, such as the US dollar.

- Tether (USDT):One of the most popular stablecoins, pegged to the US dollar with a 1:1 ratio.

- USD Coin (USDC):Another prominent stablecoin, also pegged to the US dollar.

- Dai (DAI):A decentralized stablecoin that uses algorithms to maintain its value against the US dollar.

The Role of Smart Contracts in the Cryptocurrency Ecosystem

Smart contracts are self-executing contracts stored on a blockchain, automatically enforcing the terms agreed upon by the parties involved. They eliminate the need for intermediaries, reduce transaction costs, and enhance transparency and efficiency.

“Smart contracts are like vending machines. You put in money, you get your snack. No human interaction needed.”

Vitalik Buterin, co-founder of Ethereum

- Decentralized Finance (DeFi):Smart contracts are at the heart of DeFi, enabling the creation of decentralized lending platforms, decentralized exchanges, and other financial services.

- Non-Fungible Tokens (NFTs):Smart contracts are used to create and manage NFTs, unique digital assets that represent ownership of digital or physical items.

- Supply Chain Management:Smart contracts can track the movement of goods and materials in a supply chain, ensuring transparency and accountability.

Cryptocurrency Ecosystem

The cryptocurrency ecosystem is a complex and rapidly evolving network of individuals, businesses, and technologies that interact to facilitate the creation, trading, and use of cryptocurrencies. This ecosystem is constantly evolving, with new players and technologies emerging all the time.

Key Players in the Cryptocurrency Ecosystem

The cryptocurrency ecosystem is comprised of various key players who contribute to its growth and functionality. These players include:

- Exchanges:Exchanges are platforms that allow users to buy, sell, and trade cryptocurrencies. Popular exchanges include Binance, Coinbase, and Kraken. They provide liquidity and facilitate the exchange of cryptocurrencies for fiat currencies and other digital assets.

- Wallets:Wallets are software programs that store and manage cryptocurrency private keys. They allow users to access and control their cryptocurrencies. Wallets can be either hardware or software-based, offering varying levels of security and accessibility. Some popular wallet options include MetaMask, Ledger Nano S, and Trezor.

- Decentralized Finance (DeFi) Platforms:DeFi platforms are built on blockchain technology and aim to provide financial services, such as lending, borrowing, and trading, without relying on traditional intermediaries. These platforms offer various opportunities for users to earn interest on their cryptocurrencies, access loans, and participate in decentralized trading protocols.

Examples include Aave, Compound, and MakerDAO.

- Mining Pools:Mining pools are groups of miners who combine their computing power to increase their chances of successfully validating transactions and earning block rewards. They are crucial for maintaining the security and decentralization of blockchain networks.

- Developers and Builders:Developers and builders are responsible for creating and maintaining the infrastructure and applications that power the cryptocurrency ecosystem. They contribute to the development of new cryptocurrencies, blockchain protocols, and decentralized applications (dApps).

Risks and Opportunities of Investing in Cryptocurrencies

Investing in cryptocurrencies presents both risks and opportunities.

- Volatility:Cryptocurrency prices are highly volatile, experiencing significant fluctuations in value within short periods. This volatility makes it challenging to predict price movements and can lead to substantial losses for investors.

- Security Risks:Cryptocurrencies are susceptible to hacking and theft, as attackers may target wallets, exchanges, and other platforms. Users must take precautions to protect their private keys and funds.

- Regulatory Uncertainty:The regulatory landscape for cryptocurrencies is still evolving, and governments worldwide are working to establish clear regulations. This uncertainty can create challenges for investors and businesses operating in the space.

- Scalability Issues:Some blockchain networks face scalability challenges, which can lead to slow transaction speeds and high fees during periods of high demand. This can hinder the adoption and widespread use of cryptocurrencies.

- Decentralization Challenges:While decentralization is a key feature of cryptocurrencies, it can also create challenges in terms of governance, regulation, and dispute resolution.

Future of Cryptocurrency and Its Impact on the Global Financial System

Cryptocurrency is expected to play a significant role in the future of finance. Its potential impact on the global financial system is far-reaching and could revolutionize how we conduct transactions, manage assets, and access financial services.

- Financial Inclusion:Cryptocurrencies can provide financial services to underserved populations who may lack access to traditional banking systems. By removing intermediaries, cryptocurrencies can facilitate faster and more affordable cross-border payments.

- Transparency and Accountability:Blockchain technology, the underlying foundation of cryptocurrencies, provides a transparent and immutable record of transactions, increasing accountability and reducing fraud.

- New Financial Products and Services:Cryptocurrencies are enabling the development of new financial products and services, such as decentralized lending, borrowing, and insurance, which can offer greater efficiency and accessibility.

- Integration with Traditional Finance:As the cryptocurrency ecosystem matures, there is growing integration with traditional financial institutions, such as banks and investment firms. This integration could lead to increased adoption and mainstream acceptance of cryptocurrencies.

The Relationship Between Blockchain and Cryptocurrency: Blockchain Bitcoin Crypto Fundamentals

Cryptocurrencies are a revolutionary innovation in the financial world, and at the heart of their functionality and security lies blockchain technology. This innovative distributed ledger system provides a secure and transparent framework for recording and verifying transactions, forming the bedrock of the cryptocurrency ecosystem.

The Role of Blockchain in Cryptocurrency Security

Blockchain technology is integral to the security of cryptocurrencies, offering a decentralized and immutable platform for transactions. A distributed ledger, accessible to all participants on the network, records each transaction in a chronological order, forming a chain of blocks.

These blocks are linked together through cryptographic hashing, ensuring the integrity and immutability of the entire chain.

- Decentralization:Blockchain networks operate without a central authority, eliminating the risk of a single point of failure. This decentralized structure makes it highly resistant to censorship and manipulation.

- Transparency:Every transaction on the blockchain is publicly accessible, allowing anyone to view and verify the history of transactions. This transparency enhances trust and accountability within the network.

- Immutability:Once a transaction is recorded on the blockchain, it cannot be altered or deleted. This immutability ensures the integrity and authenticity of the data, making it highly secure and tamper-proof.

- Cryptographic Security:Blockchain networks utilize sophisticated cryptography to secure transactions. Each block is linked to the previous block through a cryptographic hash, ensuring the integrity of the chain. Any attempt to alter a block would result in a change in the hash, making the alteration immediately apparent to all participants on the network.

Consensus Mechanisms

Consensus mechanisms are essential for securing the blockchain network, ensuring that all participants agree on the validity of transactions and the state of the ledger. These mechanisms enable the decentralized network to function harmoniously, maintaining the integrity and security of the blockchain.

- Proof-of-Work (PoW):This consensus mechanism requires miners to solve complex computational puzzles to add new blocks to the blockchain. The first miner to solve the puzzle receives a reward in the form of cryptocurrency, incentivizing them to maintain the network’s security.

- Proof-of-Stake (PoS):In this mechanism, validators are selected to add new blocks to the blockchain based on the amount of cryptocurrency they hold. This system incentivizes validators to act honestly and protect the network, as any malicious actions could result in the loss of their stake.

- Delegated Proof-of-Stake (DPoS):This mechanism combines elements of PoS and traditional voting systems. Users delegate their voting rights to elected representatives who then validate transactions and add new blocks to the blockchain.

Integration of Blockchain and Cryptocurrency into Existing Financial Systems

The integration of blockchain and cryptocurrency into existing financial systems presents both challenges and opportunities. While the technology offers potential for increased efficiency, transparency, and security, there are regulatory and technical hurdles to overcome.

- Regulatory Uncertainty:The lack of clear regulatory frameworks for cryptocurrencies poses a significant challenge to widespread adoption. Governments and financial institutions are still developing regulations to address the unique aspects of blockchain technology and cryptocurrencies.

- Scalability:Existing blockchain networks can face limitations in terms of transaction throughput, particularly during periods of high demand. Scalability solutions are being developed to address this challenge and enable faster and more efficient transaction processing.

- Interoperability:Different blockchain networks often have incompatible protocols, making it difficult to transfer assets between them. Interoperability solutions are being explored to enable seamless communication and asset transfer across various blockchain platforms.

- Security Concerns:While blockchain technology offers robust security features, it is not immune to vulnerabilities. Attacks such as 51% attacks and smart contract vulnerabilities can pose risks to the security of blockchain networks.