Capital One Forrester Study: Self-Service Data Strategies

Capital one forrester study self service data strategies – Capital One Forrester Study: Self-Service Data Strategies delves into how a financial giant like Capital One leverages data to drive customer experience and business success. This study highlights the power of self-service data strategies, empowering business users with access to valuable insights and fostering a data-driven culture.

The study reveals Capital One’s approach to data governance, security, and visualization, showcasing how they empower employees to make data-informed decisions.

The study’s findings provide a blueprint for organizations looking to adopt similar strategies, offering valuable insights into the challenges and opportunities associated with empowering business users with data. It’s a must-read for anyone interested in the future of data-driven decision-making.

Forrester Study Findings

The Forrester study, “Capital One’s Self-Service Data Strategies: Empowering Business Users with Data Access and Insights,” provides a comprehensive analysis of Capital One’s approach to self-service data. The study highlights the company’s commitment to democratizing data access and empowering business users to leverage data for informed decision-making.

Capital One’s Success in Empowering Business Users

The study recognizes Capital One’s significant progress in enabling business users to access and utilize data effectively. The company’s self-service data strategies have resulted in several key achievements:

- Increased Data Literacy:Capital One has invested in training programs and resources to enhance data literacy among its business users, enabling them to understand and interpret data effectively.

- Enhanced Data Access:The company has implemented a robust data governance framework and self-service data platforms that provide business users with easy access to relevant data sources.

- Improved Data-Driven Decision-Making:By empowering business users with data insights, Capital One has seen a notable improvement in data-driven decision-making across various departments.

Recommendations for Future Data Strategy Development, Capital one forrester study self service data strategies

The study offers several recommendations for Capital One to further enhance its self-service data strategies:

- Expand Data Democratization:Capital One should continue to expand data access and empower a wider range of business users, including those in non-technical roles, with data-driven insights.

- Promote Data Collaboration:Fostering a collaborative data culture can encourage knowledge sharing and innovation, leading to more effective data utilization across the organization.

- Invest in Data Science and Analytics:Continued investment in data science and analytics capabilities will enable Capital One to unlock deeper insights from its data and drive more impactful business outcomes.

Self-Service Data Strategies

Self-service data strategies empower business users to access and analyze data independently, without relying heavily on IT or data science teams. This approach fosters data-driven decision-making, accelerates insights, and enhances agility within organizations.

Capital One’s Implementation of Self-Service Data Initiatives

Capital One has been a pioneer in promoting self-service data initiatives, recognizing the potential of democratizing data access to drive business outcomes. The company has implemented a comprehensive approach, leveraging various tools and technologies to empower its employees.

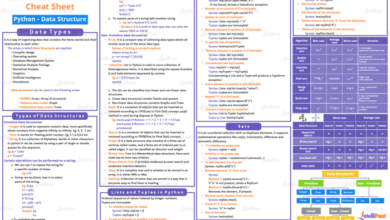

Key Tools and Technologies

- Data Catalogs:Capital One utilizes data catalogs to provide a centralized repository of data assets, making it easy for users to discover, understand, and access relevant data. These catalogs often include metadata, data lineage, and quality information, enabling users to make informed decisions about data usage.

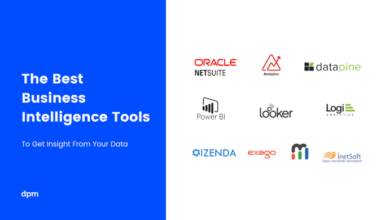

- Data Visualization Tools:The company has invested in user-friendly data visualization tools, such as Tableau and Power BI, to enable users to create interactive dashboards and reports, facilitating data exploration and communication of insights.

- Self-Service Analytics Platforms:Capital One has adopted self-service analytics platforms like Alteryx and SAS Visual Analytics, providing users with a range of analytical capabilities, including data preparation, transformation, and modeling, without requiring extensive coding skills.

Challenges and Opportunities of Empowering Business Users

Empowering business users with data access presents both challenges and opportunities. It is crucial to strike a balance between providing access and ensuring data security and governance.

The Capital One Forrester study on self-service data strategies highlights the importance of empowering users with access to data. This can be especially helpful for scheduling and planning, which is why I was excited to learn about the new Google Calendar features, like the ability to create custom reminders and schedule recurring events.

These new features could really enhance data-driven decision-making in a way that aligns with the study’s findings.

Challenges

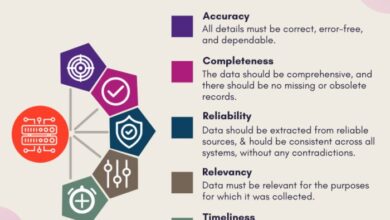

- Data Quality and Integrity:Ensuring the accuracy, consistency, and reliability of data is paramount. Organizations need to implement robust data quality management practices to prevent the spread of inaccurate or misleading information.

- Data Security and Privacy:Protecting sensitive data is crucial. Organizations must implement appropriate access controls, data masking, and encryption techniques to safeguard data privacy and comply with relevant regulations.

- Data Literacy and Training:Business users need to be equipped with the necessary data literacy skills to effectively leverage self-service data tools. Organizations should invest in training programs to enhance user understanding of data concepts, analysis techniques, and data visualization best practices.

Opportunities

- Faster Insights and Decision-Making:Self-service data strategies enable users to access and analyze data quickly, leading to faster insights and more agile decision-making. This agility is crucial in today’s dynamic business environment.

- Increased Data-Driven Culture:Empowering business users with data access fosters a data-driven culture, encouraging data-informed decision-making across all levels of the organization. This shift can lead to improved operational efficiency and strategic planning.

- Enhanced Collaboration and Innovation:Self-service data strategies can break down silos between business users and data professionals, fostering collaboration and innovation. This collaborative approach can lead to the discovery of new insights and the development of innovative solutions.

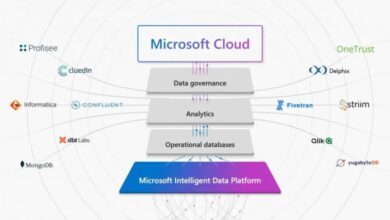

Data Governance and Security: Capital One Forrester Study Self Service Data Strategies

Capital One’s self-service data strategy is underpinned by a robust data governance and security framework that ensures data integrity, confidentiality, and compliance. This framework is essential for maintaining trust in the data, protecting sensitive information, and mitigating potential risks associated with self-service data access.

The Capital One Forrester study highlighted the importance of self-service data strategies for organizations, empowering users to access and analyze data directly. One powerful technique for data analysis is applying COUNTIF logic, which can be effectively implemented in Power BI.

Learn more about applying COUNTIF logic in Power BI to gain insights from your data and drive informed decision-making, as emphasized by the Capital One Forrester study.

Data Governance Framework

Capital One has established a comprehensive data governance framework that encompasses data quality, data ownership, data access control, and data lineage. This framework ensures that data is accurate, consistent, and reliable, and that users have appropriate access to the data they need.

- Data Quality:Capital One employs data quality checks and validation processes to ensure that data is accurate, complete, and consistent. This includes data cleansing, data profiling, and data validation techniques.

- Data Ownership:Clear data ownership is established for each data asset, assigning responsibility for data accuracy, quality, and usage. This helps to ensure accountability and consistency in data management.

- Data Access Control:Access to data is restricted based on user roles and permissions, ensuring that only authorized individuals can access sensitive information. This is achieved through role-based access control (RBAC) mechanisms.

- Data Lineage:Tracking the origin and movement of data helps to understand data dependencies and ensure data integrity. Capital One utilizes data lineage tools to trace data from its source to its destination.

Data Security Measures

Capital One employs a multi-layered security approach to protect data from unauthorized access, use, disclosure, disruption, modification, or destruction. These measures include:

- Data Encryption:Sensitive data is encrypted both at rest and in transit, ensuring that even if unauthorized access occurs, the data remains protected.

- Access Control:Access to data is strictly controlled through authentication and authorization mechanisms. Multi-factor authentication and role-based access control are implemented to enhance security.

- Network Security:Firewalls, intrusion detection systems (IDS), and intrusion prevention systems (IPS) are used to protect the network from unauthorized access and malicious attacks.

- Data Loss Prevention (DLP):DLP tools are used to monitor and prevent sensitive data from leaving the organization’s network without authorization.

- Regular Security Audits:Regular security audits are conducted to identify and address vulnerabilities in the data security infrastructure.

Risk Mitigation Strategies

While self-service data strategies offer significant benefits, they also introduce potential risks that need to be mitigated. Capital One addresses these risks through:

- Data Masking:Sensitive data is masked or anonymized when it is accessed by users who do not require access to the raw data. This helps to protect sensitive information without compromising data usability.

- Data Usage Monitoring:Data usage patterns are monitored to detect any suspicious activity or potential misuse of data. This helps to identify and address security threats proactively.

- Security Awareness Training:Users are provided with security awareness training to educate them on data security best practices and potential threats. This helps to reduce the risk of human error and data breaches.

- Incident Response Plan:A comprehensive incident response plan is in place to handle any data security incidents effectively and efficiently. This plan includes steps for identifying, containing, and recovering from security breaches.

Data Visualization and Reporting

Capital One’s approach to data visualization and reporting prioritizes accessibility and insights for business users. The company leverages a variety of tools and techniques to ensure data is presented in a clear, concise, and actionable manner.

Data Visualization Tools and Techniques

Capital One utilizes a range of data visualization tools and techniques to effectively communicate data insights. These tools include dashboards, charts, and other visual representations, designed to cater to different levels of data literacy and business needs.

- Interactive Dashboards:Capital One employs interactive dashboards that provide a consolidated view of key performance indicators (KPIs) and trends across various business areas. These dashboards allow users to drill down into specific data points and explore different dimensions of the data, facilitating informed decision-making.

For example, a marketing dashboard might display key metrics like customer acquisition cost, conversion rates, and campaign performance, enabling marketers to track campaign effectiveness and identify areas for improvement.

- Visualizations for Different Data Types:Capital One utilizes a diverse set of visualizations, including bar charts, line graphs, scatter plots, and heatmaps, to represent different data types effectively. For instance, bar charts can illustrate customer segmentation by demographics, while line graphs can depict revenue trends over time.

- Data Storytelling:Capital One recognizes the importance of data storytelling in conveying insights effectively. The company uses data visualization to create narratives that engage audiences and highlight key findings. For example, a visualization might illustrate the impact of a new product launch on customer satisfaction and revenue growth, providing a compelling story that supports strategic decisions.

Impact of Data Visualization on Decision-Making

Data visualization plays a crucial role in enhancing decision-making at Capital One. By presenting complex data in a readily understandable format, it empowers business users to:

- Identify Trends and Patterns:Visualizations help users quickly identify trends and patterns in data that might be difficult to discern from raw data alone. This enables proactive decision-making based on emerging trends and insights.

- Make Data-Driven Decisions:Data visualization facilitates data-driven decision-making by providing clear and concise evidence to support business strategies. By presenting data in a compelling and easily digestible format, it helps users make informed decisions based on objective data rather than gut feelings.

- Improve Communication and Collaboration:Data visualization serves as a common language for communication and collaboration across different departments and levels of the organization. By sharing data insights through visualizations, teams can effectively communicate their findings and collaborate on strategic initiatives.

Data Analytics and Machine Learning

Capital One’s self-service data strategy heavily relies on data analytics and machine learning to extract valuable insights from its vast data repositories. This enables the company to make data-driven decisions, improve customer experiences, and gain a competitive edge in the financial services industry.

Predictive Modeling

Capital One employs a wide range of predictive modeling techniques to forecast future trends and behaviors. For instance, they use models to predict customer churn, credit risk, and fraud detection. These models help the company proactively address potential issues and optimize its operations.

Predictive modeling is a statistical technique that uses historical data to predict future outcomes.

Capital One’s Forrester study on self-service data strategies is fascinating, highlighting the power of empowering users to access and analyze data. It’s a reminder that data insights are crucial across industries, from financial services to fashion. Speaking of fashion, be sure to check out this insightful interview with InStyle EIC Sally Holmes and designer Aurora James catch up with instyle eic sally holmes plus talk with designer aurora james – it’s a great example of how data-driven insights can inform creative decisions.

Back to the Capital One study, the findings emphasize the importance of user-friendly interfaces and robust data governance for successful self-service data initiatives.

Customer Segmentation

Capital One utilizes customer segmentation to group customers based on shared characteristics and behaviors. This allows the company to tailor its marketing campaigns and product offerings to specific customer segments, leading to improved customer engagement and satisfaction.

Customer segmentation is the process of dividing a customer base into groups with similar characteristics.

Advanced Analytics Techniques

Capital One leverages advanced analytics techniques such as machine learning algorithms, natural language processing, and deep learning to uncover complex patterns and insights from its data. These techniques enable the company to automate tasks, improve decision-making, and develop innovative products and services.

Advanced analytics techniques are sophisticated methods that use data mining, statistical modeling, and machine learning to extract insights from data.

Data Science and AI

Data science and artificial intelligence play a pivotal role in Capital One’s self-service data strategy. The company has invested heavily in building a data science team and developing AI-powered solutions. These efforts have enabled Capital One to automate data analysis tasks, improve model accuracy, and gain a deeper understanding of its customers.

Data science is an interdisciplinary field that uses scientific methods, processes, algorithms, and systems to extract knowledge and insights from structured and unstructured data.

Artificial intelligence (AI) is the simulation of human intelligence processes by computer systems.

Data Culture and Training

Capital One’s commitment to data-driven decision-making extends beyond its advanced technology and infrastructure. The company recognizes that a successful data strategy requires a robust data culture, where employees at all levels embrace data as a valuable resource and leverage it to drive business outcomes.

This section will explore Capital One’s efforts to foster this data-driven culture, highlighting the importance of data literacy and training programs for business users, and identifying key strategies for promoting data awareness and encouraging data-informed decision-making.

Data Literacy and Training Programs

Capital One understands that data literacy is fundamental to a data-driven culture. To empower employees to effectively utilize data, the company has implemented comprehensive training programs across various levels of the organization. These programs cater to diverse needs, from introductory data literacy workshops for new hires to advanced analytics courses for data scientists.

The importance of data literacy training for business users cannot be overstated. Business users who possess a strong understanding of data can:

- Identify relevant data sources: By understanding the different data sources available, business users can select the most appropriate data for their specific needs.

- Interpret data effectively: Data literacy enables users to understand the meaning of data and draw meaningful insights from it.

- Communicate data insights clearly: Business users can effectively communicate data-driven insights to colleagues and stakeholders, influencing decision-making.

- Ask informed questions: Equipped with data literacy, business users can ask more relevant and insightful questions, leading to more effective data analysis.

Capital One’s training programs are designed to equip employees with the necessary skills to navigate the data landscape effectively. These programs cover a wide range of topics, including:

- Data visualization: Understanding how to effectively present data through charts, graphs, and dashboards.

- Statistical analysis: Learning basic statistical concepts and techniques to analyze data.

- Data storytelling: Developing the ability to communicate data insights in a compelling and engaging way.

- Data ethics: Understanding the ethical considerations surrounding data usage and privacy.

Promoting Data Awareness and Data-Informed Decision-Making

Beyond training, Capital One actively promotes data awareness and encourages data-informed decision-making through various initiatives.

Data-Driven Culture Initiatives

Capital One fosters a data-driven culture through:

- Data-centric leadership: Leaders at all levels champion data-driven decision-making and encourage the use of data to inform strategic choices.

- Data-driven performance metrics: Implementing data-driven performance metrics to track progress and identify areas for improvement.

- Data-focused communication: Encouraging data-driven communication within the organization, where data insights are shared and discussed regularly.

- Data-driven innovation: Fostering a culture of experimentation and innovation where data is leveraged to develop new products and services.

Encouraging Data-Informed Decision-Making

Capital One encourages data-informed decision-making by:

- Data accessibility: Making data readily available to employees through self-service tools and dashboards.

- Data governance: Establishing clear data governance policies to ensure data quality, consistency, and security.

- Data visualization tools: Providing employees with user-friendly data visualization tools to help them understand and communicate data insights.

- Data analytics platforms: Offering access to advanced data analytics platforms to enable more sophisticated analysis and modeling.

Case Studies and Best Practices

Capital One’s journey to empower business users with data has been marked by several successful self-service data initiatives. These initiatives have not only enabled business users to gain insights from data but also helped the company to make better decisions and achieve better business outcomes.

This section delves into specific case studies and best practices that have guided Capital One’s success in this domain.

Capital One’s Self-Service Data Initiatives

Capital One has successfully implemented several self-service data initiatives, each focusing on a specific business need.

- Marketing Analytics Dashboard:This initiative empowered marketing teams to analyze campaign performance and customer behavior in real-time. The dashboard provided interactive visualizations and reports, enabling marketers to identify trends, optimize campaigns, and personalize customer experiences.

- Fraud Detection Platform:This platform provided analysts with self-service tools to analyze transaction data, identify suspicious patterns, and develop predictive models to prevent fraudulent activities. The platform’s user-friendly interface and automated workflows enabled analysts to quickly identify and address potential fraud threats.

- Customer Experience Analytics:This initiative provided customer service representatives with access to real-time customer data, enabling them to understand customer needs and preferences. This facilitated personalized service interactions, improved customer satisfaction, and reduced resolution times.

Key Best Practices for Designing and Implementing Self-Service Data Strategies

Designing and implementing effective self-service data strategies requires a comprehensive approach that considers various aspects of data management, security, and user experience.

- Start Small and Scale Gradually:Begin with a pilot project focused on a specific business need, then gradually expand the scope as users become comfortable and the infrastructure matures.

- Prioritize User Experience:Ensure the tools and interfaces are user-friendly and intuitive, providing easy access to relevant data and analysis capabilities.

- Foster a Data-Driven Culture:Encourage data literacy and data-driven decision-making throughout the organization, providing training and support to users at all levels.

- Ensure Data Quality and Governance:Implement robust data quality and governance procedures to maintain data accuracy, consistency, and security.

- Provide Ongoing Support and Training:Offer ongoing support and training to users to ensure they can effectively leverage self-service data tools and maximize their benefits.

Lessons Learned from Capital One’s Experience

Capital One’s journey in empowering business users with data has yielded valuable lessons that can guide other organizations embarking on similar initiatives.

- Data Literacy is Crucial:Empowering business users with data requires a strong emphasis on data literacy, ensuring users understand data concepts, analytical techniques, and best practices for data interpretation.

- Data Governance is Essential:Robust data governance procedures are crucial for maintaining data quality, security, and compliance.

- Collaboration is Key:Effective self-service data initiatives require collaboration between IT, data science, and business teams.

- Continuous Improvement is Necessary:Regularly assess and refine self-service data initiatives to ensure they meet evolving business needs and user expectations.