Online Payment Methods for Small Business: A Guide to Growth

Online payment methods for small business are no longer a luxury, but a necessity in today’s digital landscape. With the rise of e-commerce and the increasing demand for convenient payment options, small businesses need to adapt and embrace these modern solutions.

This guide will explore the various online payment methods available, helping you choose the best fit for your business and enhance your customer experience.

From traditional credit card processing to mobile payment solutions like Apple Pay and Google Pay, there’s a wide array of options to consider. Each method comes with its own set of advantages and disadvantages, and understanding these nuances is crucial for making informed decisions.

We’ll also delve into the importance of security, integration, and the evolving trends in online payments, ensuring your business is equipped to thrive in the digital age.

The Rise of Online Payments for Small Businesses

In today’s digital age, small businesses are increasingly embracing online payment methods to streamline their operations and reach a wider customer base. The convenience and accessibility of online payments have revolutionized the way businesses conduct transactions, making it easier for both buyers and sellers to complete purchases seamlessly.

Growth of Online Payments in the Small Business Sector

The adoption of online payment solutions by small businesses is rapidly accelerating, driven by factors such as the increasing popularity of e-commerce and the growing preference for digital transactions among consumers.

- A 2022 study by Statista revealed that the global online payment market size was valued at $6.68 trillion in 2022 and is projected to reach $15.5 trillion by 2030, reflecting the significant growth potential of this sector.

- According to a survey by PayPal, 88% of small businesses in the United States accept online payments, highlighting the widespread adoption of these solutions within the small business community.

Benefits of Online Payments for Small Businesses

The adoption of online payment methods offers a multitude of benefits for small businesses, enhancing their efficiency, security, and customer satisfaction.

- Increased Convenience:Online payments simplify the transaction process, allowing customers to make purchases from anywhere, anytime, without the need for physical cash or checks. This convenience can lead to increased sales and customer loyalty.

- Enhanced Security:Online payment gateways utilize advanced encryption technologies to protect sensitive customer data, reducing the risk of fraud and unauthorized access. This security assurance fosters trust and confidence among customers.

- Improved Efficiency:Online payments automate the payment process, eliminating the need for manual processing and reconciliation. This automation streamlines operations, saves time, and reduces errors.

- Expanded Reach:Online payment methods enable businesses to reach a wider customer base, including those who prefer to shop online or who are located geographically distant. This expanded reach can significantly boost sales and revenue.

- Reduced Costs:Online payments often involve lower transaction fees compared to traditional payment methods, reducing the overall cost of accepting payments. This cost-effectiveness can improve the profitability of small businesses.

Benefits of Online Payments for Customers

Online payment methods also offer significant benefits for customers, making it easier and more convenient to make purchases.

- Convenience:Customers can make purchases from their computers, smartphones, or tablets, without having to visit a physical store or carry cash. This convenience is particularly appealing to busy consumers who value their time.

- Security:Online payment gateways employ advanced security measures to protect customer data, ensuring safe and secure transactions. This security assurance provides peace of mind and encourages customers to make purchases with confidence.

- Multiple Payment Options:Online payment systems typically offer a variety of payment options, including credit cards, debit cards, digital wallets, and bank transfers. This flexibility allows customers to choose the most convenient payment method for them.

- Trackable Transactions:Online payments provide customers with clear transaction records and receipts, making it easier to track their purchases and manage their finances.

Types of Online Payment Methods

Offering diverse online payment options is crucial for small businesses to cater to various customer preferences and increase their reach. This allows customers to choose the method most convenient for them, enhancing the overall shopping experience and encouraging repeat purchases.

Popular Online Payment Methods

Here is a comprehensive list of popular online payment methods that small businesses can leverage to streamline their transactions:

| Method | Description | Pros | Cons |

|---|---|---|---|

| Credit/Debit Cards | The most common and widely accepted form of online payment, enabling customers to pay directly from their bank accounts. |

|

|

| Digital Wallets | Digital wallets, such as PayPal, Apple Pay, and Google Pay, store payment information securely and allow for quick and easy online purchases. |

|

|

| Direct Bank Transfers | Direct bank transfers allow customers to make payments directly from their bank accounts to the merchant’s account. |

|

|

| Buy Now, Pay Later (BNPL) | BNPL services like Afterpay, Klarna, and Affirm offer customers the option to split their purchases into installments, with interest-free or low-interest options. |

|

|

| Cryptocurrency | Cryptocurrency payments, such as Bitcoin and Ethereum, offer a decentralized and secure alternative to traditional payment methods. |

|

|

Choosing the Right Payment Method

Choosing the right online payment method is crucial for any small business, as it directly impacts customer satisfaction, transaction security, and overall financial efficiency. This decision requires careful consideration of various factors, ensuring a seamless and secure payment experience for both the business and its customers.

Factors to Consider

When selecting an online payment method, small businesses should consider several key factors that directly influence their operational efficiency and customer experience.

- Transaction Fees:Payment processors typically charge fees for each transaction, which can vary based on the method used, transaction volume, and other factors. Businesses should carefully evaluate these fees to minimize costs and maximize profit margins.

- Security and Fraud Protection:Ensuring secure payment processing is paramount to protect both the business and its customers from fraud. Businesses should choose payment methods with robust security features, such as encryption, tokenization, and fraud detection systems.

- Ease of Use for Customers:A simple and user-friendly payment experience is essential for customer satisfaction. Businesses should select methods that are familiar and convenient for their target audience, minimizing friction in the checkout process.

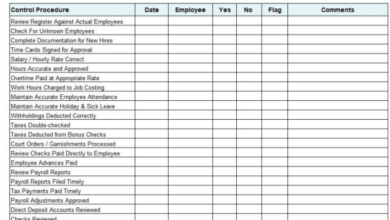

- Integration with Existing Systems:Seamless integration with existing business systems, such as accounting software and inventory management tools, is crucial for efficient operations. Businesses should select payment methods that offer smooth integration to avoid manual data entry and potential errors.

- Customer Support:Reliable customer support is essential for resolving payment issues and ensuring a positive customer experience. Businesses should choose payment providers with responsive and helpful customer support channels.

Decision-Making Process

A structured decision-making process can help small businesses effectively choose the right online payment method. Here’s a flowchart to guide the selection process:  The flowchart Artikels the key steps involved in selecting an online payment method. Businesses should carefully evaluate each factor and choose the method that best aligns with their specific needs and objectives.

The flowchart Artikels the key steps involved in selecting an online payment method. Businesses should carefully evaluate each factor and choose the method that best aligns with their specific needs and objectives.

Target Audience, Business Size, and Industry

The choice of online payment method should also consider the target audience, business size, and industry.

- Target Audience:Businesses should consider the demographics and preferences of their target audience. For example, a business targeting younger customers might consider offering mobile payment options like Apple Pay or Google Pay, while a business catering to an older demographic might prioritize traditional credit card payments.

- Business Size:The size of the business influences the volume of transactions and the complexity of payment processing. Small businesses might opt for simple and cost-effective payment solutions, while larger businesses might require more advanced features and integrations.

- Industry:Different industries have specific payment requirements. For example, online retailers might need payment gateways that support recurring billing, while healthcare providers might need solutions that comply with HIPAA regulations.

Security and Fraud Prevention

In the realm of online payments, security is paramount. Small businesses need to implement robust measures to protect their customers’ sensitive financial data and maintain trust in their brand.

Best Practices for Protecting Sensitive Customer Data

Safeguarding customer data is essential for preventing fraud and maintaining customer confidence. Here are some crucial best practices:

- Use Secure Sockets Layer (SSL) Certificates:SSL certificates encrypt data transmitted between a website and a customer’s browser, making it unreadable to unauthorized individuals. Look for the padlock icon in the browser address bar and ensure the website address starts with “https”.

- Regularly Update Software:Keeping software, including operating systems, web browsers, and payment gateways, up to date patches security vulnerabilities that hackers could exploit.

- Implement Strong Passwords:Encourage customers to use strong passwords, including a combination of uppercase and lowercase letters, numbers, and symbols. Password managers can help users create and store secure passwords.

- Data Encryption:Encrypt customer data at rest and in transit using industry-standard encryption algorithms like AES-256. This prevents unauthorized access even if data is stolen.

- Tokenization:Instead of storing sensitive card data, use tokenization. This replaces actual card numbers with unique tokens, making it much harder for fraudsters to steal and use card information.

- Regular Security Audits:Conduct regular security audits to identify vulnerabilities and implement necessary security controls. This helps to proactively prevent breaches.

Common Online Payment Fraud Risks and Strategies for Prevention

Fraudsters are constantly evolving their tactics. Small businesses must be aware of common fraud risks and implement strategies to prevent them.

- Chargebacks:Customers may dispute charges, claiming they did not authorize the transaction. To mitigate this risk, businesses should obtain clear authorization from customers, provide detailed order confirmations, and implement robust fraud detection systems.

- Phishing Attacks:Fraudsters may send emails or text messages that appear to be from legitimate businesses, attempting to trick customers into revealing their payment information. Businesses should educate customers about phishing attacks and never ask for sensitive information via email or text.

- Skimming:This involves installing devices on point-of-sale (POS) terminals to steal card data. Businesses should use secure POS terminals and regularly check for signs of tampering.

- Identity Theft:Fraudsters may use stolen identities to make unauthorized purchases. Businesses should verify customer identities using multiple data points, such as address verification, and implement fraud detection tools.

Integration and Setup

Integrating online payment methods into your small business website or platform is a crucial step towards streamlining your operations and providing a seamless customer experience. This process involves connecting your website to a payment gateway, allowing you to securely accept payments from your customers.

Setting up a payment gateway involves several steps, each with its own unique considerations. Let’s delve into the details of this process and explore the key factors to ensure a smooth and secure integration.

Choosing a Payment Gateway

The first step is to select a payment gateway that best suits your business needs. There are numerous options available, each with its own set of features, fees, and compatibility.

- Consider factors such as transaction fees, supported payment methods, security features, and integration capabilities.Some popular options include Stripe, PayPal, Square, and Authorize.Net.

- Research and compare different payment gatewaysto determine the best fit for your specific requirements.

Setting Up Your Payment Gateway, Online payment methods for small business

Once you have chosen a payment gateway, you will need to create an account and configure it according to your business needs. This typically involves providing information about your business, including your bank account details and merchant ID.

Setting up online payment methods for your small business is a crucial step in expanding your reach. It allows customers to purchase your goods or services with ease, regardless of their location. Think of it like a nesting simple song lyrics painting – each element, from the online store to the payment gateway, contributes to a harmonious whole.

A smooth online payment experience can encourage repeat business and build customer loyalty.

- Create an account with your chosen payment gateway, following their specific registration process.

- Provide your business information, including legal name, address, contact details, and tax identification number.

- Link your bank accountto receive payment settlements.

- Configure payment settings, such as currency, supported payment methods, and transaction limits.

- Set up security features, including fraud prevention measures and customer authentication options.

Integrating Your Payment Gateway with Your Website

After configuring your payment gateway, you will need to integrate it with your website or platform. This involves installing the necessary code and setting up the payment processing flow.

- Follow the payment gateway’s integration guide, which typically includes detailed instructions and code snippets.

- Use their provided API or pluginsto connect your website to the payment gateway.

- Test the integration thoroughlyto ensure that all payment functions are working correctly.

Testing and Ensuring Functionality

Testing is a crucial step in the integration process. It helps to ensure that the payment gateway is correctly integrated and that all payment functions are working as expected.

Setting up online payment methods is a must for any small business today, allowing you to reach a wider audience and streamline transactions. Of course, sometimes you need a little retail therapy to motivate you! If you’re looking for a splurge, check out the Harvey Nichols best shoes and boots for some serious style inspiration.

Once you’re back in business mode, remember that secure and convenient payment options are crucial for building trust and encouraging repeat customers.

- Conduct test transactionsusing various payment methods to verify the entire payment flow, from checkout to payment confirmation.

- Check for any errors or inconsistenciesand resolve them promptly.

- Monitor your payment gateway’s dashboardto track transaction history and identify any potential issues.

Customer Experience

In today’s digital landscape, customer experience is paramount for any business, and small businesses are no exception. Online payment methods play a crucial role in shaping a positive customer experience by offering convenience, security, and a seamless checkout process.

Convenience and Security

Providing a variety of convenient and secure payment options is essential for attracting and retaining customers. Customers want to be able to pay for goods and services in a way that is convenient for them, whether it’s using a credit card, debit card, digital wallet, or a mobile payment app.

By offering a wide range of payment methods, businesses can cater to a broader customer base and make the purchasing process as smooth as possible.

Optimizing the Checkout Process

A smooth checkout process is key to a positive customer experience. Here are some tips for optimizing your online checkout:

- Keep it simple:The checkout process should be straightforward and easy to navigate. Avoid unnecessary steps or confusing forms. Use clear and concise language, and ensure the checkout page is visually appealing and easy to read.

- Offer multiple payment options:As mentioned previously, providing a variety of payment options caters to different customer preferences and makes the checkout process more convenient. This can include credit cards, debit cards, digital wallets like PayPal and Apple Pay, and mobile payment apps like Google Pay and Samsung Pay.

Online payment methods are a must-have for any small business, especially those operating in the food industry. Just imagine trying to run a bakery like Back in the Day Bakery without accepting credit cards or mobile payments! It would be a logistical nightmare, and you’d likely lose out on a lot of potential customers.

Fortunately, there are tons of affordable and user-friendly options available, making it easier than ever for small businesses to accept payments online and in-person.

- Provide clear and concise information:Ensure that customers have access to all the information they need during the checkout process, including shipping costs, estimated delivery times, and return policies. This transparency builds trust and reduces the likelihood of abandoned carts.

- Offer guest checkout:Many customers are hesitant to create an account just to make a purchase. Offering a guest checkout option allows customers to make a purchase without having to create an account, which can increase conversion rates.

- Enable mobile optimization:With the rise of mobile commerce, it’s essential to ensure that your checkout process is optimized for mobile devices. The checkout page should be responsive and easy to use on any screen size. Mobile optimization is critical to ensure a smooth and seamless checkout experience for customers who are browsing and purchasing on their smartphones or tablets.

Mobile Payments

Mobile payments are rapidly becoming the preferred way for consumers to make purchases, and small businesses are increasingly embracing this trend. The convenience, speed, and security of mobile payment solutions are attracting both businesses and customers, making them an essential part of the modern retail landscape.

Mobile Payment Solutions

Mobile payment solutions offer a variety of features and benefits, making them attractive to both businesses and customers. Here are some of the most popular mobile payment solutions:

- Apple Pay: Apple Pay allows users to make payments with their iPhone, Apple Watch, or iPad. It uses Near Field Communication (NFC) technology to securely transmit payment information to a point-of-sale (POS) terminal. Apple Pay supports various credit and debit cards, as well as loyalty programs and gift cards.

It offers features like contactless payments, transaction history, and fraud protection.

- Google Pay: Google Pay is a similar service to Apple Pay, allowing users to make payments with their Android devices. It also uses NFC technology and supports various credit and debit cards, as well as loyalty programs and gift cards. Google Pay offers features like contactless payments, transaction history, and fraud protection.

- Samsung Pay: Samsung Pay is another mobile payment solution that works with Samsung devices. It uses NFC technology and supports a wider range of credit and debit cards compared to Apple Pay and Google Pay. It also offers features like Magnetic Secure Transmission (MST) technology, which allows users to make payments with older POS terminals that don’t have NFC capabilities.

Samsung Pay also offers contactless payments, transaction history, and fraud protection.

- Venmo: Venmo is a peer-to-peer (P2P) payment app that allows users to send and receive money from friends and family. Venmo also allows businesses to accept payments from customers, making it a popular choice for small businesses that operate in a social or online environment.

Venmo offers features like contactless payments, transaction history, and social sharing of payments.

Benefits of Mobile Payments

Adopting mobile payment options offers several benefits for small businesses:

- Increased Convenience: Mobile payments offer a quick and easy way for customers to make purchases, reducing checkout lines and wait times. This convenience can lead to increased customer satisfaction and loyalty.

- Enhanced Security: Mobile payment solutions often use advanced security features, such as tokenization and encryption, to protect sensitive payment information. This can reduce the risk of fraud and data breaches.

- Reduced Costs: Mobile payment solutions can help businesses reduce the costs associated with traditional payment methods, such as credit card processing fees. Some mobile payment solutions offer lower transaction fees than traditional credit card processors.

- Improved Customer Experience: Mobile payments can enhance the customer experience by offering a seamless and convenient way to make purchases. Customers can easily track their spending and manage their accounts through their mobile devices.

- Increased Sales: The convenience and speed of mobile payments can encourage customers to make impulse purchases. They can also lead to increased sales by attracting new customers who prefer mobile payment options.

Challenges of Mobile Payments

While mobile payments offer numerous benefits, there are also some challenges that small businesses need to consider:

- Adoption Rates: Not all customers use mobile payment solutions, and adoption rates can vary depending on the region and demographic. This means that businesses may still need to offer traditional payment methods to cater to all customers.

- Security Concerns: While mobile payment solutions offer enhanced security features, there are still concerns about data breaches and fraud. Businesses need to ensure that they implement robust security measures to protect their customers’ information.

- Integration Costs: Integrating mobile payment solutions into existing POS systems can be expensive, especially for small businesses with limited resources.

- Technical Support: Businesses need to provide adequate technical support to customers who may have difficulties using mobile payment solutions. This can require additional training and resources.

Cost Considerations: Online Payment Methods For Small Business

When choosing an online payment method, it’s crucial to carefully consider the costs involved. While convenience and security are paramount, understanding the financial implications is essential for making informed decisions that benefit your business.

Transaction Fees

Transaction fees are a significant cost factor in online payments. These fees are typically charged as a percentage of the transaction amount plus a fixed fee. Understanding the breakdown of these fees is crucial.

- Percentage Fee:This is a percentage of the transaction amount charged by the payment processor. Rates vary depending on the processor and the type of payment method. For example, credit card transactions generally have higher percentage fees than debit card transactions.

- Fixed Fee:This is a flat fee charged per transaction, regardless of the amount. This fee can range from a few cents to a few dollars, depending on the processor.

- Other Fees:Some processors may charge additional fees, such as monthly fees, statement fees, or chargeback fees. It’s important to be aware of all fees associated with a payment processor before signing up.

Setup Fees

Some payment processors charge setup fees when you first sign up for their services. These fees can vary depending on the processor and the features you choose.

- Initial Setup Fee:This is a one-time fee charged to set up your account and integrate the payment gateway with your website or point-of-sale system.

- Recurring Monthly Fees:Some processors charge a monthly fee for access to their services, even if you don’t process any transactions. These fees can range from a few dollars to a few hundred dollars per month, depending on the features and services included.

Other Expenses

Besides transaction and setup fees, other expenses can impact your overall payment processing costs.

- Hardware Costs:If you’re using a physical point-of-sale system, you’ll need to purchase hardware such as a card reader or a terminal. The cost of this equipment can vary depending on the type and features of the hardware.

- Software Costs:Some payment processors offer software that can help you manage your payments and track your transactions. These software solutions can come with monthly or annual subscription fees.

- Customer Support Costs:If you need assistance with setting up your payment gateway or troubleshooting any issues, you may incur customer support costs. Some processors offer free customer support, while others charge for premium support services.

Cost-Effectiveness

It’s important to consider the overall cost-effectiveness of different payment options. While some payment methods may have lower transaction fees, they may have higher setup fees or other hidden costs.

Consider the volume of transactions you expect to process, the average transaction amount, and the features you need when evaluating the cost-effectiveness of different payment options.

Future Trends

The world of online payments is constantly evolving, driven by technological advancements and changing consumer preferences. Small businesses need to stay informed about these trends to adapt their payment strategies and remain competitive. This section will explore emerging trends in online payment methods for small businesses, highlighting the potential impact of innovative technologies and outlining the future of payment processing.

Blockchain and Cryptocurrency

Blockchain technology, the underlying framework for cryptocurrencies like Bitcoin, is poised to revolutionize online payments. Blockchain offers several advantages for small businesses:* Enhanced Security:Blockchain’s decentralized nature makes it highly resistant to fraud and hacking, providing a secure platform for transactions.

Reduced Transaction Fees

Blockchain transactions typically have lower fees compared to traditional payment gateways, saving businesses money.

Faster Processing Times

Blockchain transactions are processed much faster than traditional methods, allowing for quicker settlements and improved cash flow.

- Cryptocurrency Adoption:As cryptocurrency adoption grows, businesses will increasingly accept cryptocurrencies as payment. This opens up new customer segments and provides a competitive advantage. For example, businesses catering to tech-savvy or environmentally conscious consumers may find cryptocurrency payments appealing.

- Stablecoins:Stablecoins, cryptocurrencies pegged to traditional currencies like the US dollar, offer greater price stability than volatile cryptocurrencies. This makes them a more attractive option for businesses and consumers who want to avoid the risks associated with cryptocurrency price fluctuations.

The Rise of Embedded Finance

Embedded finance refers to the integration of financial services into non-financial platforms. This means that businesses can offer financial products and services, such as payments, lending, and insurance, directly within their existing platforms.

- Convenience for Customers:Customers can access financial services without leaving the platform they’re already using, simplifying the payment process and improving the overall customer experience.

- Increased Revenue Opportunities:Businesses can generate additional revenue by offering financial services to their customers. For example, an e-commerce platform could offer a buy now, pay later (BNPL) option to increase sales.

The Future of Payment Processing

The future of payment processing will be characterized by seamless, personalized, and secure experiences. Emerging trends include:* Artificial Intelligence (AI):AI will play a crucial role in fraud detection, risk management, and personalized payment experiences. AI-powered systems can analyze vast amounts of data to identify fraudulent transactions and provide tailored payment options to customers.

Biometric Authentication

Biometric authentication methods, such as fingerprint scanning and facial recognition, are becoming increasingly popular for secure online payments. These methods offer a more convenient and secure alternative to traditional passwords.

Voice Commerce

Voice assistants are becoming commonplace, and voice commerce is expected to grow significantly. Businesses will need to adapt their payment systems to accept voice commands and ensure a smooth payment experience for voice-enabled transactions.