Trump Tariffs US Taxes Imports

Trump tariffs: US taxes imports from Canada, Mexico and China ignited a global trade war, impacting economies and international relations. This in-depth exploration delves into the historical context, Trump’s policies, economic repercussions, and the complex effects on trade relationships, social and political implications, and the current status. From the initial motivations to the ongoing consequences, this analysis unravels the multifaceted story of these tariffs.

The tariffs imposed by the Trump administration targeted various goods, from steel and aluminum to agricultural products. This had significant consequences for businesses, consumers, and the overall economic landscape. The article examines the different sectors most affected, and the subsequent responses from other countries. Understanding the complexities of this trade war requires a comprehensive analysis of the historical, economic, and political dimensions.

Historical Context of Tariffs

Tariffs, taxes on imported goods, have been a recurring feature of international trade throughout history. Understanding the historical context of tariffs, particularly between the US and its key trading partners like Canada, Mexico, and China, is crucial for analyzing the current trade landscape and potential impacts of policies like the Trump tariffs. This exploration delves into past trade agreements, disputes, and previous tariff actions by the US government to provide a clearer picture of the long-term patterns.The history of trade relations between the US and these nations has been marked by periods of cooperation and conflict, often revolving around the application and modification of tariffs.

The ebb and flow of these policies has been influenced by economic conditions, political considerations, and evolving global trade dynamics.

Major Trade Agreements and Disputes

Numerous trade agreements have shaped the relationship between the US and its trading partners. These agreements have established rules and frameworks for trade, but also fostered disputes when those rules were challenged or perceived as unfair. Examples include the North American Free Trade Agreement (NAFTA), which aimed to reduce tariffs and increase trade among the US, Canada, and Mexico, but faced criticism and renegotiation.

Similarly, the ongoing trade disputes between the US and China over intellectual property, trade imbalances, and other concerns have highlighted the complexities and sensitivities surrounding international trade.

Examples of Previous US Tariff Actions

The US government has a long history of imposing tariffs on imported goods. These actions have been motivated by a variety of factors, including protecting domestic industries, addressing perceived trade imbalances, and responding to national security concerns. Previous actions offer valuable insights into the potential consequences and unintended effects of tariff policies. For instance, tariffs on steel and aluminum imports, implemented in 2018, sparked significant international backlash and led to retaliatory measures from other countries.

Timeline of Key Tariff Events

| Year | Event | Country Impacted | Description |

|---|---|---|---|

| 1930 | Smoot-Hawley Tariff Act | Various | Imposed significant tariffs on imported goods, contributing to the Great Depression. |

| 1948 | General Agreement on Tariffs and Trade (GATT) | Various | Established a framework for reducing trade barriers globally. |

| 1994 | North American Free Trade Agreement (NAFTA) | US, Canada, Mexico | Reduced tariffs and increased trade among the three countries. |

| 2002 | Tariffs on Steel Imports | Various | Imposed tariffs on steel imports, leading to retaliatory measures from other countries. |

| 2018 | Tariffs on Steel and Aluminum Imports | Canada, Mexico, China | Imposed tariffs on steel and aluminum imports, sparking significant international disputes. |

Trump’s Tariff Policies

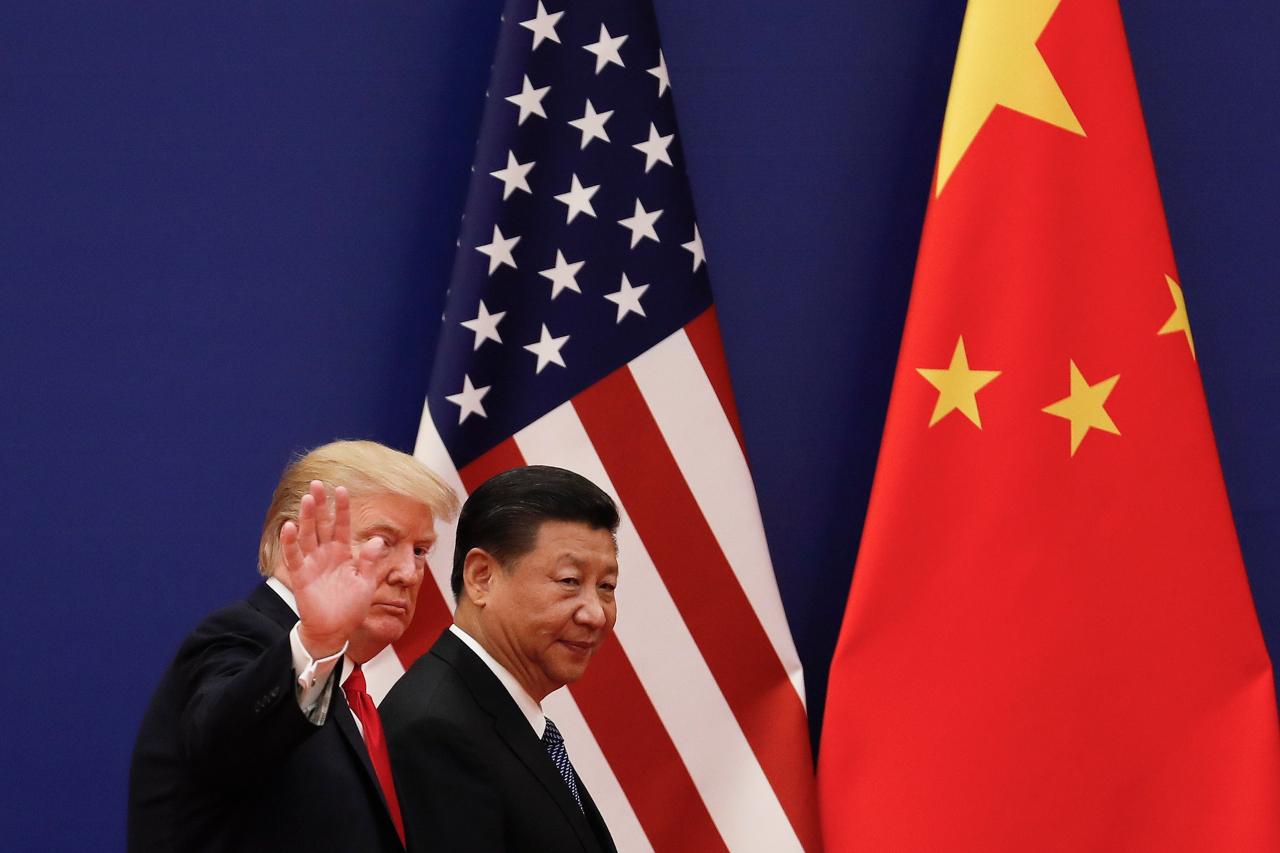

Donald Trump’s approach to trade tariffs was a defining characteristic of his presidency, significantly altering the global trade landscape. His policies, often controversial, aimed to protect American industries and jobs, and were frequently met with retaliatory measures from other nations. Understanding his rationale and the consequences of these policies is crucial to evaluating their impact.Trump’s tariff policies were rooted in a belief that unfair trade practices by other countries were harming American businesses and workers.

He argued that tariffs would level the playing field, forcing foreign competitors to reduce their prices and improve their labor practices. This philosophy was central to his “America First” agenda, prioritizing domestic interests above international cooperation.

Types of Tariffs Imposed

Trump’s administration imposed various types of tariffs, primarily targeting imported goods from China, Mexico, and Canada. These included tariffs on steel, aluminum, solar panels, washing machines, and a wide range of manufactured goods. The tariffs were implemented through different mechanisms, such as Section 301 tariffs, which were used to target countries deemed to be engaging in unfair trade practices.

Comparison with Previous Administrations

Previous US administrations had engaged in trade disputes and tariffs, but Trump’s approach differed significantly in its scale and scope. Previous administrations generally used tariffs more selectively, often as a response to specific trade violations, whereas Trump’s approach was more aggressive and widespread. The use of tariffs as a tool for broader economic negotiation was unprecedented in its intensity during his term.

Comparison Table of Tariffs

| President | Country | Tariff Rate | Reason |

|---|---|---|---|

| Trump | China | Various, ranging from 10% to 25% | Allegations of intellectual property theft, unfair trade practices, and forced technology transfer. |

| Trump | Mexico | 25% on steel, 10% on aluminum | National security concerns regarding steel and aluminum imports. |

| Trump | Canada | 25% on steel, 10% on aluminum | National security concerns regarding steel and aluminum imports. |

| Obama | China | Various, mostly on specific products | Addressing trade imbalances and intellectual property concerns. |

| Obama | Mexico | Limited tariffs on specific products | Addressing trade imbalances and specific import issues. |

Economic Impacts of Tariffs

The imposition of tariffs, particularly those levied by the United States on imports from Canada, Mexico, and China, has significant ripple effects across the global economy. These measures, intended to protect domestic industries and influence trade practices, inevitably affect businesses, consumers, and international relations. Understanding these consequences is crucial to assessing the overall impact of such policies.

US Economic Impacts

The US, as a major player in global trade, experienced a complex mix of impacts from its tariff policies. Tariffs, by increasing the cost of imported goods, can boost domestic production in certain sectors. However, this often comes at the cost of higher consumer prices and potential disruptions to supply chains. For example, industries reliant on imported components or raw materials faced higher production costs, which could have led to reduced competitiveness in the global market.

Consumer Price Impacts

Tariffs directly affect consumer prices by increasing the cost of imported goods. These price increases are often passed on to consumers, potentially leading to inflation and reducing purchasing power. The availability of certain goods may also be affected, with consumers potentially facing limited choices or higher prices for substitute products. For instance, the tariffs on steel and aluminum led to increased prices for automobiles and other products that used these materials.

Impacts on US Industries

The impact of tariffs varies across different industries. Some sectors, particularly those heavily reliant on imported inputs, experienced significant challenges. Others, such as those producing competing goods domestically, might have seen a temporary boost in demand.

| Industry | Effect on US Businesses | Effect on Consumers | Effect on Foreign Markets |

|---|---|---|---|

| Automotive | Increased production costs due to tariffs on steel and aluminum imports. | Higher prices for cars and car parts. | Reduced demand for US-made cars in affected countries. |

| Electronics | Higher prices for imported components. | Higher prices for electronic devices. | Reduced demand for US-made electronics in countries with tariffs on their products. |

| Agriculture | Reduced exports to countries imposing tariffs. | Potentially higher prices for agricultural products. | Reduced imports of US agricultural products to countries imposing tariffs. |

Impacts on Foreign Markets

Tariffs imposed by the US can have a significant impact on foreign markets. These measures can disrupt trade relationships and lead to retaliatory actions by other countries. China, for example, responded to US tariffs with tariffs on US goods, creating a trade war that affected global supply chains and trade patterns. The effects on other countries, such as Canada and Mexico, varied based on their reliance on US markets and their own responses to the tariffs.

Effects on Trade Relationships

Trump’s tariffs significantly strained trade relationships with key US partners. The imposition of tariffs, often in response to perceived unfair trade practices, sparked retaliatory measures and led to uncertainty in global markets. The subsequent ripple effects on supply chains and international cooperation were profound.

Impact on Trade Relationships with key partners

The tariffs, while intended to protect American industries and jobs, had a complex and often negative impact on trade relationships. The US, traditionally a proponent of free trade, saw its reputation tarnished as it became associated with protectionist policies. This erosion of trust had repercussions for future negotiations and agreements. The retaliatory tariffs from other nations further complicated the situation, resulting in trade wars that disrupted global supply chains and impacted businesses worldwide.

Responses and Countermeasures by Other Countries

Other countries responded to Trump’s tariffs with a variety of countermeasures. These ranged from imposing tariffs on US goods to filing lawsuits against the US policies at international organizations. Many countries, including Canada, Mexico, and China, initiated their own tariffs on US products to offset the economic damage.

Impact on Political Relations

The imposition of tariffs had a demonstrably negative impact on political relations. Trade disputes became focal points of diplomatic tensions, and trust between the US and its trading partners eroded. The acrimonious nature of the trade disputes hampered efforts to address other global challenges cooperatively. The actions taken by the US created a climate of distrust, affecting broader international cooperation.

Summary of Reactions to Trump’s Tariffs

| Country | Response | Specific Actions | Impact on Relations |

|---|---|---|---|

| Canada | Imposed tariffs on US goods, initiated legal challenges | Tariffs on US steel and aluminum, challenged tariffs in WTO | Strained, but not completely broken, bilateral relations. Canada and US remained critical trading partners. |

| Mexico | Imposed tariffs on US goods, initiated legal challenges | Tariffs on US agricultural products, challenged tariffs in WTO | Strained bilateral relations, particularly regarding agricultural exports. Trade volumes reduced. |

| China | Imposed tariffs on US goods, initiated retaliatory measures | Tariffs on US soybeans, technology products, initiated trade negotiations | Deeply strained relations, resulting in a trade war that had lasting impacts on global trade. Trade volumes reduced. |

| European Union | Imposed tariffs on US goods, initiated legal challenges | Tariffs on US steel and aluminum, challenged tariffs in WTO | Strained relations, but the EU remained a significant trading partner with the US. |

Social and Political Implications: Trump Tariffs: US Taxes Imports From Canada, Mexico And China

Trump’s tariffs sparked a complex web of social and political repercussions, extending far beyond the economic realm. The policies ignited passionate debates, fractured political alliances, and significantly impacted public perception of trade and international relations. These implications are crucial to understanding the full impact of the tariff actions.The tariffs deeply affected various segments of the US population, from consumers to businesses, and ultimately influenced voting patterns and political discourse.

This section will explore these social and political ramifications in detail.

Impact on Public Opinion

Public opinion regarding Trump’s tariffs was deeply divided. Those who supported the tariffs often cited national security concerns, the need to protect American jobs, and the desire to pressure foreign nations to adopt more favorable trade practices. Conversely, opponents highlighted the negative economic consequences for consumers, businesses, and the overall economy, as well as the damage to international relations.

Political Discourse and Polarization

The tariff policies significantly polarized the political landscape. The debate surrounding tariffs became a central theme in political campaigns, further intensifying existing divisions and contributing to a climate of mistrust and skepticism. The rhetoric surrounding the tariffs became highly charged, often characterized by accusations of unfair trade practices and nationalistic appeals.

Arguments for and Against Tariffs, Trump tariffs: US taxes imports from Canada, Mexico and China

Arguments for the tariffs often revolved around the idea of protecting American industries and jobs from foreign competition. Supporters claimed that tariffs would level the playing field, reduce trade deficits, and strengthen American manufacturing. On the other hand, opponents emphasized the negative effects on consumers, businesses, and the overall economy, including increased prices and reduced consumer choice.

Public Opinion in the US Regarding Trump’s Tariffs

| Group | Opinion | Justification |

|---|---|---|

| Labor Unions | Mixed | While some saw tariffs as protecting jobs, others worried about the potential negative economic consequences for their members. |

| Farmers | Negative | Tariffs led to decreased exports and retaliatory tariffs from other countries, harming agricultural exports. |

| Manufacturers | Mixed | Some manufacturers benefited from protectionist policies, while others faced challenges due to higher input costs. |

| Consumers | Negative | Higher import costs translated into higher prices for goods and services, impacting consumer spending power. |

| Businesses | Negative | Increased costs, supply chain disruptions, and uncertainty impacted businesses across various sectors. |

| Republicans | Generally Positive | Many aligned with the administration’s protectionist stance. |

| Democrats | Generally Negative | Most opposed the tariffs, citing economic and international relations concerns. |

The table above represents a simplified overview of the complex public opinions surrounding Trump’s tariffs. Individual opinions within each group varied significantly.

Current Status and Future Outlook

Source: abcnews.com

The Trump-era tariffs on imports from Canada, Mexico, and China remain a significant factor in the global trade landscape. While the initial impact is largely documented, the ongoing effects and potential future ramifications are still unfolding. The status of these tariffs, coupled with evolving geopolitical dynamics, significantly influences the path of international trade relations.The current status of the tariffs is complex and multifaceted.

While some tariffs have been removed or reduced, others persist, creating uncertainty for businesses and consumers. The ongoing impact includes lingering supply chain disruptions, adjustments in manufacturing locations, and shifts in global trade flows. The implications for prices, consumer choice, and overall economic growth are still being assessed.

Current Status of Tariffs

The tariffs imposed during the Trump administration on goods from Canada, Mexico, and China are currently in various stages of implementation and effect. Some have been eliminated, while others remain in place. The enforcement and collection of these tariffs continue to affect businesses and trade relationships. Monitoring their impact on specific industries and the wider economy remains a significant task.

Trump’s tariffs on imports from Canada, Mexico, and China have definitely had an impact, but did you know that the American kestrel falcon, a fascinating bird of prey, is uniquely special to Ohio? Nature: American kestrel falcons are special to Ohio These tariffs, while complex, highlight the interconnectedness of global trade and the need to consider the environmental impact, too.

So, next time you hear about those trade disputes, remember the unique birds right here in the US.

Ongoing Disputes and Negotiations

Several disputes and ongoing negotiations related to these tariffs are still active. Discussions about the specific terms and conditions of trade agreements, including renegotiations or replacements, are occurring between countries. The aim is to reach mutually beneficial agreements to resolve trade imbalances and ensure fair and transparent trade practices.

Possible Future Scenarios for Trade Relations

The future of trade relations between the US and its trading partners is uncertain. Several factors, including the ongoing political climate, global economic conditions, and the evolution of trade agreements, will shape the direction of these relations. The US and its trading partners may seek alternative strategies for resolving trade disputes or explore new trade agreements.

Potential for Further Tariff Actions

The possibility of future tariff actions cannot be ruled out. Future policies may depend on economic conditions, geopolitical developments, and the objectives of the governing bodies. The current political landscape and the potential for future trade negotiations make this scenario an area of active concern. Examples from past administrations provide insight into potential actions but should be analyzed in the context of the specific time and circumstances.

Current Status of Trade Agreements

| Agreement | Status | Current Tariffs | Potential Future Action |

|---|---|---|---|

| USMCA (United States-Mexico-Canada Agreement) | In effect | Varying, some eliminated | Possible renegotiation or amendments depending on future trade policy |

| China-US Trade Deal (Phase One) | In effect | Varying, some remain | Possible further negotiations or adjustments depending on the progress of economic developments and political considerations |

| WTO (World Trade Organization) agreements | In effect | Varying, tariffs may impact the effectiveness of WTO rules | Potential for further disputes and adjustments as global trade patterns evolve |

Illustrative Examples of Tariffs

Trump’s trade policies, particularly his imposition of tariffs, significantly impacted global trade dynamics. Understanding the specific tariffs levied and the reasoning behind them provides crucial insight into the motivations and effects of these policies. This section details specific instances of tariffs imposed on imports from Canada, Mexico, and China, illustrating the scope and nature of these trade restrictions.

Specific Tariffs on Steel and Aluminum

One of the most prominent examples of Trump’s tariffs involved steel and aluminum imports. The administration argued these tariffs were necessary to protect American industries and jobs. The tariffs targeted imports from Canada, Mexico, and China. The rationale was to reduce trade imbalances and encourage domestic production.

- Canada: Tariffs were applied to steel and aluminum imports from Canada. The specific tariff rates varied based on the type of product and import method. These tariffs were a source of significant tension and prompted retaliatory measures from Canada.

- Mexico: Mexico also faced tariffs on steel and aluminum imports, with similar tariff rates and justifications as those imposed on Canada. These actions also spurred retaliatory measures from Mexico.

- China: China was also targeted with tariffs on steel and aluminum imports. The rationale behind these tariffs, similar to those on Canada and Mexico, focused on trade imbalance reduction and domestic job creation.

Tariffs on Various Chinese Goods

Beyond steel and aluminum, Trump’s administration imposed tariffs on a wide range of Chinese goods. These tariffs were largely motivated by concerns over intellectual property theft and unfair trade practices.

Trump’s tariffs on imports from Canada, Mexico, and China are definitely a hot topic right now. While everyone’s glued to the latest college basketball scores, live results: Kansas-Baylor, UNC vs , it’s worth remembering how these trade policies impact everyday things. The ripple effect of tariffs on imported goods continues to be felt across the economy, and it’s something that’s likely to remain a factor in future trade negotiations.

| Product | Country | Tariff Rate | Reason |

|---|---|---|---|

| Washing Machines | China | 25% | Alleged unfair trade practices and dumping. |

| Solar Panels | China | 25-30% | Alleged unfair trade practices and dumping. |

| Certain Electronics | China | 10-25% | Alleged unfair trade practices and intellectual property theft. |

| Agricultural Products | China | 5-25% | Trade imbalance concerns. |

The table above represents a snapshot of these tariffs. It’s important to note that the list of affected goods was extensive and varied. The tariff rates also varied depending on the specific product and circumstances.

Case Studies of Industries Impacted

Source: cbsnewsstatic.com

Trump’s tariffs, particularly those targeting steel, aluminum, and various Chinese goods, had a significant ripple effect across numerous sectors. These policies, intended to protect domestic industries, instead created complex and often unpredictable consequences for businesses, consumers, and international trade relations. Understanding the specific impacts on different industries is crucial for evaluating the overall effectiveness and unintended repercussions of the tariff policies.The tariffs’ impact extended beyond the directly targeted industries, as supply chains interconnected and adjustments cascaded throughout the economy.

The resulting disruptions in production, increased costs, and shifts in consumer behavior were not always easily predicted or contained. This section will delve into specific case studies of affected industries, illustrating the multifaceted consequences of the tariffs.

Automotive Industry

The automotive industry, a significant part of the US economy, was profoundly affected by the tariffs on steel and aluminum. These metals are essential components in vehicle manufacturing. Tariffs led to increased costs for automakers, impacting their profitability and ability to compete. The tariffs also affected the supply chains of automotive manufacturers, as parts suppliers faced increased costs and potential disruptions in their own production processes.

The ripple effect was felt further down the supply chain, as parts manufacturers faced increased input costs and had to adjust their pricing strategies. This led to price increases for consumers and a potential decrease in demand for vehicles.

Trump’s tariffs on imports from Canada, Mexico, and China are definitely a hot topic right now. It’s interesting to see how these trade policies ripple through the economy, and how they might impact things like the cost of goods. Speaking of ripple effects, a recent game between the Warriors and Drew saw a setback led by Jersey Shore grad McCracken, a Jersey Shore grad McCracken leads Warriors in setback against Drew , which could be a small reflection of the bigger picture, when considering how international trade and domestic sports can both be affected by economic shifts.

Ultimately, these tariffs continue to shape global trade relationships.

Construction Industry

The construction industry relies heavily on steel and aluminum for various building materials. Tariffs imposed on these materials directly impacted the cost of construction projects. Contractors faced higher prices for raw materials, potentially leading to project delays or cost overruns. This directly affected the profitability of construction companies and could have discouraged investment in new projects. Moreover, the tariffs could have affected the availability of certain materials, creating further challenges for the construction industry.

Machinery Industry

The machinery industry, which often uses steel and aluminum in its products, was similarly impacted by the tariffs. Increased costs for raw materials were passed on to consumers, making machinery more expensive. This could have reduced demand and potentially affected the profitability of machinery manufacturers. The tariffs also affected the supply chains of machinery manufacturers, impacting their ability to procure materials and maintain efficient production processes.

For example, a manufacturer of heavy construction equipment might experience significant increases in the cost of steel, impacting their pricing strategy and the competitiveness of their products in the market.

Table: Case Studies of Industries Impacted

| Industry | Impact on Production | Impact on Supply Chain | Overall Effect |

|---|---|---|---|

| Automotive | Increased production costs, potentially impacting profitability | Disruptions in the supply of parts and components | Higher vehicle prices, potentially reduced demand |

| Construction | Increased costs for raw materials, potential delays and cost overruns | Reduced availability of certain materials | Higher construction costs, potentially impacting investment in new projects |

| Machinery | Higher prices for machinery, potentially reducing demand | Disruptions in the supply of raw materials and components | Reduced competitiveness in the global market, potential impact on profitability |

Closing Summary

In conclusion, Trump’s tariffs on imports from Canada, Mexico, and China proved to be a significant event with far-reaching implications. The policies significantly impacted trade relationships, domestic industries, and global markets. While the specifics of the tariffs and their impacts may vary depending on the sector and country, the overarching theme was one of global economic uncertainty and the challenges of navigating complex trade relations.

The legacy of these tariffs continues to shape the current landscape of international trade, prompting ongoing debate and discussions about the best approaches to global economic cooperation.

Essential FAQs

What were the main reasons behind Trump’s tariff policies?

Trump’s policies were driven by a combination of concerns about trade imbalances, national security, and job creation. He argued that these tariffs would protect American industries and workers, while opponents contended that they would harm consumers and disrupt global supply chains.

How did other countries respond to Trump’s tariffs?

Various countries retaliated with tariffs on American goods, leading to a trade war with significant economic consequences for all parties involved. This resulted in disputes, negotiations, and a shift in international trade dynamics.

What is the current status of these tariffs?

Many of the tariffs imposed during the Trump administration have either been removed, adjusted, or remain in place, depending on ongoing trade negotiations and agreements.

What are the long-term effects of these tariffs?

The long-term effects are still unfolding, and there is no consensus on their definitive impact. However, they have significantly altered trade patterns, creating uncertainties for businesses and consumers in various sectors.