What is an Employer of Record: A Guide to Global Hiring

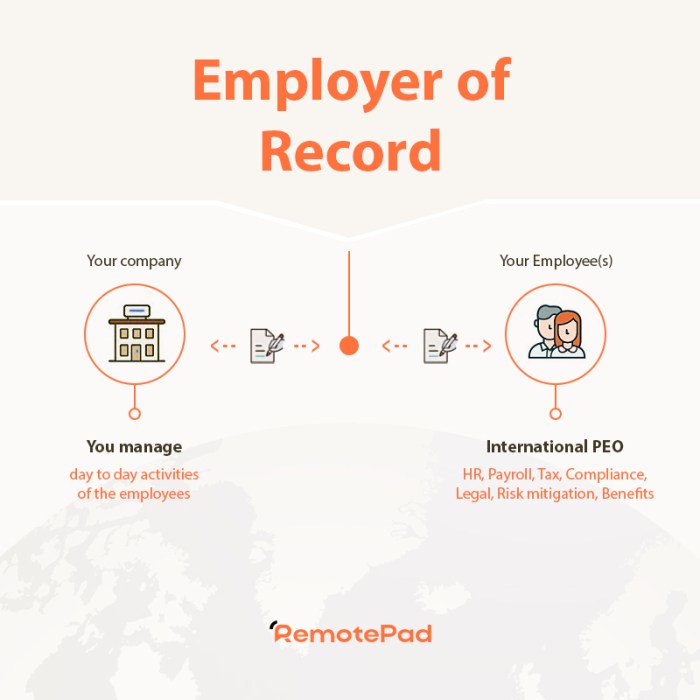

What is an Employer of Record? It’s a question that pops up when you’re expanding your business internationally, looking to hire talent in a new market, or navigating the complexities of remote work. An Employer of Record (EOR) acts as a legal employer for your employees in a different country, taking on the responsibilities of payroll, benefits, and compliance with local labor laws.

Think of it like this: you’re the “boss” who sets the goals and manages the work, but the EOR handles all the HR and legal stuff behind the scenes, ensuring everything runs smoothly according to the regulations of the specific country.

This can be a game-changer for businesses looking to scale globally, tap into a diverse talent pool, and streamline their HR processes.

What is an Employer of Record (EOR)?

In the globalized world of business, companies often need to hire employees in different countries. However, navigating the complexities of labor laws and regulations in each jurisdiction can be a daunting task. This is where an Employer of Record (EOR) comes in.

An EOR acts as a legal employer for your international employees, handling all the administrative and legal obligations associated with their employment.

How an EOR Operates

An EOR operates by becoming the official employer of record for your international employees. This means they handle all the administrative and legal aspects of employment, including:

- Payroll:EORs process payroll, ensuring compliance with local tax laws and regulations. They handle deductions, withholdings, and payments to employees.

- Benefits:EORs can provide a range of benefits to employees, such as health insurance, retirement plans, and paid time off, in accordance with local regulations.

- Compliance:EORs are responsible for ensuring compliance with all applicable labor laws and regulations in the country where the employee is located. This includes laws related to working hours, minimum wage, and employment contracts.

- HR Administration:EORs manage HR tasks such as onboarding, performance reviews, and employee relations.

- Legal Liability:By acting as the employer of record, the EOR assumes legal liability for the employees, shielding your company from potential legal risks.

Common Industries and Situations Where EORs Are Utilized

EORs are utilized in a variety of industries and situations, including:

- Global Expansion:Companies expanding into new markets often use EORs to hire local employees without having to set up a subsidiary or branch office.

- Remote Work:EORs are increasingly popular for companies that employ remote workers in different countries. They provide a streamlined way to manage payroll, benefits, and compliance for these employees.

- Project-Based Work:EORs can be used to hire contractors or temporary workers for specific projects. This allows companies to quickly scale their workforce without the need for permanent employment.

- Talent Acquisition:EORs can help companies access a wider pool of talent by facilitating hiring in countries where they may not have a physical presence.

EOR vs. Traditional Employment: What Is An Employer Of Record

An Employer of Record (EOR) offers a distinct alternative to the traditional employment model. Understanding the differences between these two approaches is crucial for businesses seeking to optimize their workforce management strategies. This comparison will shed light on the responsibilities, legal obligations, and advantages and disadvantages associated with each approach.

An Employer of Record (EOR) is a company that handles all the HR and payroll responsibilities for another company’s employees. It’s a great option for businesses looking to expand globally or manage a remote workforce, but it can be a complex concept.

Think about it like this: sure you could buy some AirPods this Prime Day, but what about these alternatives sure you could buy some airpods this prime day but what about these alternatives ? Just like those alternative headphones, there are plenty of other ways to manage your workforce than traditional employment, and EOR is a great solution for some companies.

Responsibilities

The responsibilities of an EOR and a traditional employer differ significantly. While a traditional employer directly manages all aspects of employee relationships, an EOR acts as a third-party intermediary, assuming the legal and administrative burden of employment.

- Traditional Employer: Handles payroll, benefits, taxes, compliance, and all other employment-related matters directly.

- EOR: Assumes responsibility for payroll processing, benefits administration, tax compliance, and other HR-related functions on behalf of the client company. The client company retains control over the employee’s work and performance.

Employment Contracts and Legal Obligations

The nature of employment contracts and legal obligations varies depending on the employment model.

- Traditional Employer: Enters into a direct employment contract with the employee, outlining terms and conditions of employment. The employer is directly responsible for complying with all applicable labor laws and regulations.

- EOR: Enters into an employment contract with the employee, but the client company retains control over the employee’s work and performance. The EOR is responsible for complying with all applicable labor laws and regulations on behalf of the client company.

Advantages of Using an EOR

- Reduced Administrative Burden: EORs handle the complexities of payroll, benefits, taxes, and compliance, freeing up client companies to focus on their core business operations.

- Global Expansion: EORs provide a streamlined solution for expanding into new markets, enabling businesses to hire and manage employees in different countries without setting up local entities.

- Cost Savings: EORs can help businesses save on costs associated with hiring and managing employees, particularly in terms of payroll processing, benefits administration, and compliance.

- Flexibility: EORs offer flexible employment arrangements, allowing businesses to scale their workforce up or down as needed without the hassle of traditional hiring and termination processes.

Disadvantages of Using an EOR

- Loss of Control: Client companies may have less control over employee management and decision-making processes when using an EOR.

- Potential for Communication Issues: Communication challenges can arise between the client company, EOR, and employees, potentially impacting employee engagement and productivity.

- Cost: While EORs can help reduce administrative costs, they come with their own fees, which can add up, especially for larger organizations.

- Limited Customization: EORs may not be able to offer the same level of customization as traditional employment models, potentially limiting the client company’s ability to tailor benefits and employment arrangements to specific employee needs.

Services Offered by EORs

Employer of Record (EOR) services provide a comprehensive solution for businesses looking to expand their operations globally or hire talent remotely. EORs act as the legal employer of record for your employees, handling all the administrative and legal complexities associated with payroll, benefits, taxes, and compliance.

An Employer of Record (EOR) can be a lifesaver for businesses expanding internationally, handling payroll and compliance in new markets. It’s like having a trusted partner, especially when you’re dealing with complex issues like the recent Europe malware enforcement operation , where navigating legal complexities is crucial.

An EOR can help you stay compliant, ensuring you can focus on your core business without the headache of international employment laws.

EOR Services Overview

EORs offer a wide range of services designed to simplify and streamline the global hiring process. These services can be broadly categorized into the following:

| Service | Description | Benefits | Drawbacks |

|---|---|---|---|

| Payroll & Benefits Administration | EORs handle all aspects of payroll processing, including calculating and paying salaries, withholding taxes, and managing employee benefits. | Reduced administrative burden, compliance with local labor laws, access to competitive benefits packages. | Limited customization of benefits packages, potential for higher costs compared to managing payroll internally. |

| Compliance & Legal Support | EORs ensure compliance with local labor laws, regulations, and tax requirements, including employment contracts, employee handbooks, and termination procedures. | Peace of mind knowing all legal and regulatory requirements are met, minimized risk of legal disputes. | Potential for delays in addressing complex legal issues, dependence on the EOR’s expertise in specific jurisdictions. |

| HR & Onboarding | EORs manage employee onboarding, including background checks, employment contracts, and employee training. | Streamlined onboarding process, improved employee engagement, reduced administrative burden. | Limited control over the onboarding process, potential for communication gaps between the EOR and the client. |

| Global Expansion Support | EORs provide support for expanding into new markets, including setting up local entities, managing payroll, and ensuring compliance. | Simplified global expansion, reduced risk of legal and regulatory issues, access to local market expertise. | Potential for higher costs compared to traditional expansion methods, dependence on the EOR’s expertise in specific markets. |

Benefits of Using an EOR

An Employer of Record (EOR) offers a range of advantages for businesses, particularly those operating in multiple locations or seeking to hire international talent. By outsourcing HR and payroll functions to an EOR, businesses can streamline their operations, reduce administrative burdens, and focus on their core competencies.

Reduced Administrative Burden

EORs handle the complex and time-consuming tasks associated with employing workers, freeing businesses to concentrate on their core operations.

- Payroll Processing:EORs manage payroll calculations, tax withholdings, and timely payments, ensuring compliance with local regulations and reducing the risk of errors.

- HR Administration:From onboarding and employee benefits to performance management and compliance, EORs handle the entire employee lifecycle, relieving businesses of administrative headaches.

- Legal and Regulatory Compliance:EORs are experts in navigating complex labor laws and regulations, ensuring businesses are compliant with local requirements and avoiding potential penalties.

Compliance with Local Labor Laws

Navigating the complexities of labor laws in different countries can be a daunting task for businesses. EORs simplify this process by ensuring compliance with local regulations.

- Employment Contracts:EORs draft compliant employment contracts tailored to specific locations, ensuring legal protection for both the business and employees.

- Labor Standards:EORs adhere to local labor standards, including minimum wage, working hours, and benefits requirements, safeguarding businesses from potential legal issues.

- Tax Compliance:EORs manage payroll taxes and other statutory deductions, ensuring compliance with local tax laws and reducing the risk of penalties.

Access to Global Talent

EORs enable businesses to tap into a wider pool of talent, expanding their reach beyond geographical boundaries.

An Employer of Record (EOR) is a company that acts as the legal employer for your employees, handling payroll, taxes, benefits, and compliance. If you’re looking for a way to manage your workforce without the hassle of setting up a local entity, an EOR can be a great solution.

And while we’re on the topic of work-from-home setups, have you seen the amazing new Samsung’s iMac-like 32-inch smart monitor ? It’s got everything you need for a seamless workflow, and at under $1000, it’s a steal! Back to EORs, remember that choosing the right EOR partner is crucial for your business’s success.

- International Hiring:EORs facilitate hiring in various countries, allowing businesses to access skilled professionals worldwide, regardless of their location.

- Cultural Understanding:EORs have a deep understanding of local cultures and business practices, ensuring seamless integration of international employees into the workforce.

- Global Expansion:EORs support businesses in expanding their operations globally, providing a seamless platform for hiring and managing employees in multiple locations.

Simplified Payroll and Benefits Management

EORs streamline payroll and benefits administration, ensuring accurate and timely payments while providing employees with a comprehensive benefits package.

- Payroll Processing:EORs manage payroll calculations, tax withholdings, and timely payments, ensuring compliance with local regulations and reducing the risk of errors.

- Benefits Administration:EORs offer a range of benefits, including health insurance, retirement plans, and paid time off, simplifying benefits management for businesses.

- Global Benefits:EORs provide access to global benefits packages, ensuring that employees receive appropriate coverage regardless of their location.

Considerations for Choosing an EOR

Choosing the right Employer of Record (EOR) is crucial for businesses looking to expand globally or manage a remote workforce. A well-chosen EOR can streamline your HR processes, ensure compliance with local regulations, and provide valuable support for your employees.

However, selecting the wrong EOR can lead to complications, legal issues, and financial losses. Therefore, careful consideration is essential when making your decision.

Reputation and Experience

A reputable EOR will have a proven track record of success, positive client testimonials, and industry recognition. It’s important to evaluate the EOR’s experience in your target market and industry, ensuring they have a deep understanding of local labor laws and regulations.

Look for EORs that have been in business for a significant period and have a strong reputation for reliability and customer service. You can research an EOR’s reputation by reading online reviews, checking industry publications, and speaking to existing clients.

Service Offerings and Pricing

EORs offer a range of services, including payroll processing, benefits administration, tax compliance, and HR support. It’s important to choose an EOR that provides the services you need at a competitive price. Compare different EORs based on their service offerings, pricing models, and contract terms.

Consider factors such as:

- Payroll processing:Ensure the EOR has robust payroll systems and can handle various payment methods and currencies.

- Benefits administration:Determine if the EOR offers health insurance, retirement plans, and other benefits options that meet your needs.

- Tax compliance:Verify that the EOR has expertise in handling local taxes, including income tax, payroll tax, and VAT.

- HR support:Evaluate the EOR’s HR services, such as employee onboarding, performance management, and employee relations.

- Pricing models:Compare different pricing models, such as fixed fees, per-employee fees, or percentage-based fees.

Compliance Capabilities, What is an employer of record

An EOR’s compliance capabilities are essential for ensuring that your business operates within the legal framework of each country where you employ workers. Look for an EOR that has a deep understanding of local labor laws, including:

- Employment contracts:The EOR should be able to draft compliant employment contracts that adhere to local regulations.

- Payroll taxes:The EOR must be able to accurately calculate and withhold payroll taxes, ensuring compliance with local tax laws.

- Labor regulations:The EOR should be knowledgeable about local labor regulations, such as minimum wage, working hours, and leave policies.

- Data privacy:The EOR must comply with local data privacy laws, such as GDPR in Europe and CCPA in California.

Client Testimonials and Reviews

Client testimonials and reviews provide valuable insights into an EOR’s performance and customer satisfaction. Look for reviews from businesses similar to yours in terms of industry, size, and geographic location. Read reviews from multiple sources, including websites, industry forums, and social media platforms.

Pay attention to both positive and negative reviews, as they can provide a balanced perspective on the EOR’s strengths and weaknesses.

EOR Use Cases

EORs are versatile tools that can be used to solve a variety of business challenges. Their flexibility allows them to be implemented across various industries and scenarios.

Global Expansion

EORs are particularly valuable for companies looking to expand their operations internationally. Setting up a subsidiary in a new country can be a complex and time-consuming process, involving legal and regulatory hurdles. EORs can streamline this process by providing the necessary infrastructure and expertise to manage local employees.

- Reduced Costs and Time:EORs handle payroll, benefits, taxes, and compliance, eliminating the need for companies to establish their own HR infrastructure in new markets. This significantly reduces costs and time to market.

- Access to Talent Pools:EORs provide access to skilled professionals in local markets, enabling companies to tap into a wider talent pool. This is particularly beneficial for industries with specialized skill sets or those facing talent shortages.

- Simplified Compliance:EORs ensure compliance with local labor laws and regulations, minimizing legal risks and penalties. This is crucial for businesses operating in countries with complex employment laws.

Remote Workforce Management

EORs are essential for managing remote workforces, especially for companies with employees in multiple locations. They provide the infrastructure and support needed to effectively manage and pay remote employees.

- Payroll and Benefits Administration:EORs handle payroll processing, benefits administration, and tax compliance for remote employees, regardless of their location. This ensures that employees are paid accurately and on time, and that all legal requirements are met.

- Employee Onboarding and Support:EORs provide onboarding support for remote employees, ensuring a smooth transition into the company. They also offer ongoing support to address any issues or concerns that remote employees may have.

- HR and Compliance:EORs manage HR functions and ensure compliance with labor laws and regulations for remote employees, regardless of their location. This helps to mitigate risks and ensure a consistent employee experience.

Scaling Operations

EORs can be used to scale operations quickly and efficiently, without the need for significant upfront investment in HR infrastructure. This is particularly valuable for startups and businesses experiencing rapid growth.

- Flexible Staffing:EORs allow companies to quickly adjust their workforce size based on changing business needs. This provides flexibility and agility, enabling companies to scale up or down as required.

- Reduced Overhead Costs:EORs eliminate the need for companies to invest in their own HR infrastructure, reducing overhead costs and freeing up resources for other business priorities.

- Improved Efficiency:EORs streamline HR processes, improving efficiency and productivity. This allows companies to focus on core business activities, rather than administrative tasks.