Find the Best Business Budgeting Software

Finding the best business budgeting software is crucial for any entrepreneur or business owner looking to take control of their finances. Budgeting software empowers you to track expenses, forecast income, analyze financial performance, and make informed decisions that drive growth.

From simple expense tracking to sophisticated financial modeling, the right software can streamline your operations and help you achieve your financial goals.

The market offers a wide array of budgeting software options, each catering to specific needs and business sizes. Whether you’re a solopreneur or a large corporation, there’s a solution out there to simplify your budgeting process and empower you to make data-driven decisions.

Business Budgeting: Why It Matters and How Software Can Help

Business budgeting is the process of creating a detailed plan for how you will spend your money over a specific period. It involves forecasting your income and expenses, setting financial goals, and allocating resources accordingly. Effective budgeting is crucial for any business, regardless of size or industry.

It helps you stay on track financially, make informed decisions, and achieve your long-term objectives.

While creating a budget manually is possible, using budgeting software offers numerous advantages that can streamline the process and enhance its effectiveness. Here are some key benefits:

Benefits of Using Budgeting Software

Budgeting software provides a comprehensive suite of tools and features designed to simplify and automate the budgeting process. This translates into several benefits for businesses:

- Improved Accuracy and Efficiency:Budgeting software automates calculations and data entry, reducing the risk of human error and saving time. It can also integrate with other business systems, such as accounting software, for seamless data transfer and greater accuracy.

- Real-time Monitoring and Analysis:Budgeting software offers real-time insights into your financial performance. You can track your actual expenses against your budget, identify deviations, and take corrective measures promptly. This proactive approach helps prevent financial surprises and ensures you stay on track.

- Enhanced Collaboration and Communication:Budgeting software enables seamless collaboration among team members. You can share budgets, track progress, and communicate updates efficiently, fostering a shared understanding of financial goals and strategies.

- Scenario Planning and Forecasting:Many budgeting software solutions offer scenario planning tools that allow you to explore different financial scenarios and their potential impact on your business. This can help you make informed decisions based on data-driven insights.

- Improved Decision-Making:By providing a clear picture of your financial position, budgeting software empowers you to make informed decisions about resource allocation, investments, and operational efficiency. You can prioritize projects, optimize spending, and make strategic choices based on sound financial data.

Key Features of Business Budgeting Software

Business budgeting software is a powerful tool for managing your company’s finances. It provides a range of features designed to simplify budgeting, improve financial control, and enhance decision-making.

Finding the right business budgeting software can be a game-changer, helping you stay on top of expenses and maximize profits. And while you’re mastering your finances, don’t forget to personalize your tech experience by learning how to create a new access point name on your Android device.

This simple tweak can add a touch of individuality to your digital world, just like a well-organized budget can bring clarity and control to your business.

Expense Tracking

Expense tracking is the foundation of any effective budget. This feature allows you to categorize and monitor every dollar spent by your business.

- Automated Data Entry:Many software solutions integrate with bank accounts and credit cards, automatically importing transactions to eliminate manual data entry.

- Categorization and Tagging:Categorizing expenses helps you understand where your money is going. Tagging allows for even more granular tracking, such as associating specific expenses with projects or departments.

- Real-time Visibility:Real-time expense tracking provides an up-to-the-minute view of your spending, enabling you to identify potential overspending and make adjustments as needed.

Income Forecasting

Income forecasting is the process of predicting future revenue based on historical data, market trends, and other relevant factors.

Finding the best business budgeting software can be a real game-changer, helping you stay on top of your finances and make informed decisions. Speaking of staying on top of things, it seems like Netflix is also doing some spring cleaning, ditching support for these older Apple TV streaming boxes , so you might want to upgrade before your next binge-worthy show premieres.

Just like a good budget app, a reliable streaming device keeps your entertainment running smoothly!

- Sales History Analysis:Software analyzes past sales patterns to project future income based on seasonal trends, product performance, and customer behavior.

- Scenario Planning:This allows you to explore different income scenarios, such as the impact of price changes or marketing campaigns. For example, you can model the potential impact of a new product launch or a change in marketing strategy.

- Data Visualization:Income forecasting tools often present data in easy-to-understand charts and graphs, making it easier to identify trends and make informed decisions.

Reporting

Detailed and customizable reports are essential for analyzing your financial performance and making informed decisions.

- Budget vs. Actual:Compare your planned budget with actual spending to identify variances and understand areas where you’re over or under budget.

- Profit and Loss Statements:Track your revenue, expenses, and profitability over time. This provides valuable insights into the health of your business.

- Cash Flow Statements:Monitor your cash inflows and outflows to ensure you have enough cash on hand to meet your financial obligations.

Financial Analysis

Financial analysis tools provide insights into your company’s financial health and help you make better decisions.

Finding the best business budgeting software can feel like a quest, but with the right tools, you can gain control of your finances. Just like the new Intel Lunar Lake NPU intel lunar lake npu promises to revolutionize AI processing, a solid budgeting platform can transform your business operations.

With automated tracking, real-time insights, and seamless collaboration features, the right software can free you from spreadsheets and empower you to make data-driven decisions.

- Trend Analysis:Identify patterns in your financial data to predict future performance and make proactive adjustments.

- Key Performance Indicators (KPIs):Track important financial metrics, such as return on investment (ROI) and profit margin, to measure your business’s success.

- Comparative Analysis:Compare your financial performance to industry benchmarks or previous periods to assess your strengths and weaknesses.

Budgeting Methods

Business budgeting software often supports various budgeting methods to suit different needs and preferences.

- Zero-Based Budgeting:This method starts with a clean slate, requiring you to justify every expense from scratch. It can help identify unnecessary spending and improve resource allocation.

- Cash Flow Budgeting:This method focuses on managing cash flow by tracking all cash inflows and outflows. It’s particularly useful for businesses with seasonal fluctuations in revenue or expenses.

Types of Business Budgeting Software

The best business budgeting software for you depends on the size of your company, your budget, and your specific needs. There are many different types of software available, each with its own set of features and benefits.

Categorization of Business Budgeting Software

Different software categories are tailored to different business needs and resources.

Cloud-Based Software

Cloud-based software is hosted on a remote server and accessed through a web browser. This means that you can access your data from anywhere with an internet connection. Cloud-based software is often more affordable than on-premise software, and it can be easier to set up and use.

- Advantages:

- Accessibility from any location with an internet connection.

- Lower upfront costs compared to on-premise software.

- Automatic updates and maintenance by the software provider.

- Scalability to accommodate business growth.

- Disadvantages:

- Dependence on a stable internet connection.

- Potential security concerns if the provider’s systems are compromised.

- Limited customization options compared to on-premise software.

Examples of Cloud-Based Budgeting Software

- Zoho Analytics:A comprehensive business intelligence platform offering budgeting and forecasting tools, ideal for small and medium businesses.

- Xero:Popular accounting software with budgeting features, suitable for small businesses and startups.

- NetSuite:Comprehensive ERP software with robust budgeting capabilities, suitable for medium and large enterprises.

On-Premise Software

On-premise software is installed and run on your own servers. This gives you more control over your data and security, but it can also be more expensive to set up and maintain.

- Advantages:

- High level of security and control over data.

- Customization options to tailor the software to specific business needs.

- No dependence on an internet connection for access.

- Disadvantages:

- Higher upfront costs for software purchase and server infrastructure.

- Responsibility for software updates and maintenance.

- Limited accessibility compared to cloud-based software.

Examples of On-Premise Budgeting Software

- Microsoft Dynamics 365 Finance:A comprehensive ERP software with advanced budgeting and forecasting capabilities, suitable for large enterprises.

- SAP Business Planning and Consolidation:A robust solution for large enterprises, offering sophisticated budgeting, planning, and forecasting tools.

- Oracle Hyperion Planning:A powerful budgeting and planning solution for large enterprises, known for its scalability and advanced analytics.

Open-Source Software

Open-source software is free to use and modify. This means that you can customize the software to meet your specific needs, and you can also contribute to its development. Open-source software is often less feature-rich than commercial software, but it can be a good option for businesses with limited budgets.

- Advantages:

- Free to use and modify.

- Flexibility and customization options.

- Active community support for troubleshooting and development.

- Disadvantages:

- Limited features compared to commercial software.

- May require technical expertise to install and maintain.

- Lack of dedicated support from a software provider.

Examples of Open-Source Budgeting Software

- Odoo:An open-source ERP software with budgeting features, suitable for small and medium businesses.

- Apache OFBiz:A comprehensive open-source enterprise software suite with budgeting capabilities, suitable for larger businesses.

- Dolibarr ERP CRM:A free and open-source ERP and CRM system with budgeting and financial management tools.

Factors to Consider When Choosing Budgeting Software

Choosing the right business budgeting software is crucial for financial planning and control. The decision requires careful consideration of several factors that align with your specific needs and goals.

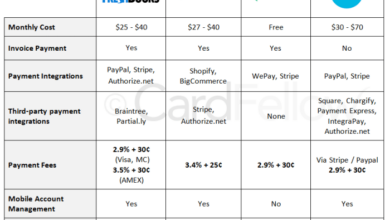

Pricing

The cost of budgeting software varies significantly, ranging from free options to expensive enterprise-level solutions. It’s important to consider your budget constraints and the value you expect from the software.

- Free Options:Free software may offer basic budgeting features, suitable for small businesses or individuals with simple needs. However, they often lack advanced features and customization options.

- Subscription-Based:Subscription models offer a monthly or annual fee, providing access to a range of features and support. These plans can be more cost-effective for businesses with evolving needs.

- One-Time Purchase:Some software is available for a one-time purchase, offering ownership of the software. This option can be more cost-effective in the long run, but may require additional costs for updates and support.

Features

The features of budgeting software directly impact its functionality and usefulness. Consider the specific features you need for your business, such as:

- Budgeting and Forecasting:Features that allow you to create and manage budgets, track expenses, and forecast future financial performance.

- Reporting and Analytics:Capabilities to generate reports, analyze financial data, and gain insights into your business performance.

- Collaboration and Communication:Features that enable team members to collaborate on budgets, share data, and communicate effectively.

- Integration:The ability to integrate with other business applications, such as accounting software, CRM systems, and payment gateways.

Ease of Use

The user interface and experience are critical for the adoption and success of budgeting software. Choose software that is intuitive and easy to learn, even for users with limited technical expertise. Consider factors like:

- Intuitive Interface:A user-friendly interface with clear navigation and intuitive features.

- Customization:The ability to customize reports, dashboards, and other elements to meet your specific needs.

- Mobile Access:Availability of mobile apps for on-the-go access and management.

Integration Capabilities

The ability to integrate with other business applications is crucial for seamless data flow and improved efficiency. Consider the integration capabilities of the software, such as:

- Accounting Software:Integration with accounting software for automatic data transfer and reconciliation.

- CRM Systems:Integration with CRM systems to track customer interactions and revenue.

- Payment Gateways:Integration with payment gateways for online transactions and financial reporting.

Customer Support

Reliable customer support is essential for resolving issues, getting assistance with the software, and ensuring a smooth user experience. Consider the following aspects:

- Availability:Availability of support through various channels, such as phone, email, and live chat.

- Responsiveness:Quick response times and effective resolution of issues.

- Knowledge Base:Access to comprehensive documentation, tutorials, and FAQs.

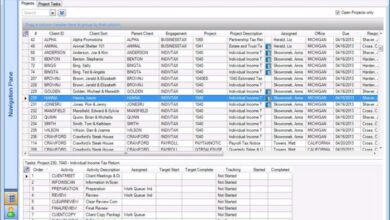

Popular Business Budgeting Software Options

Choosing the right budgeting software can be overwhelming, given the plethora of options available. This section will delve into some of the most popular and well-regarded business budgeting software options, providing insights into their features, pricing, pros, and cons. This will help you make an informed decision based on your specific business needs and preferences.

Popular Software Options and Comparisons

To understand the different software options available, here’s a comparison of some popular business budgeting software, focusing on their key features, pricing, advantages, and drawbacks:

| Software | Key Features | Pricing | Pros | Cons |

|---|---|---|---|---|

| Xero |

|

Starts at $35 per month |

|

|

| QuickBooks Online |

|

Starts at $25 per month |

|

|

| Zoho Books |

|

Starts at $19 per month |

|

|

| FreshBooks |

|

Starts at $15 per month |

|

|

User Reviews and Testimonials

Real-world experiences are crucial in making informed decisions. Here are some user reviews and testimonials from various online platforms that provide insights into the strengths and weaknesses of these software options:

“Xero’s budgeting tools are a game-changer for my business. They’ve helped me stay on track with my financial goals and make better decisions.”

John Smith, Owner of [Company Name]

“QuickBooks Online is a great tool for small businesses, but I find it lacks some customization options for more complex financial scenarios.”

Jane Doe, Owner of [Company Name]

“Zoho Books offers a good balance of features and affordability. It’s a great option for growing businesses.”

Peter Jones, Owner of [Company Name]

“FreshBooks is simple and easy to use, perfect for freelancers and small teams. However, it’s not ideal for businesses with complex budgeting needs.”

Mary Brown, Owner of [Company Name]

Implementing Budgeting Software

You’ve chosen the perfect budgeting software for your business, but now comes the crucial step: implementation. A smooth and successful implementation ensures you reap the full benefits of your new software.

Data Migration

The initial step involves migrating your existing financial data into the new software. This process requires careful planning and execution.

- Identify Data Sources:Determine all sources of financial data, such as spreadsheets, accounting software, and bank statements.

- Clean and Validate Data:Ensure data accuracy by cleaning and validating it before migration. This involves identifying and correcting errors, inconsistencies, and duplicates.

- Choose Migration Method:Select a suitable migration method based on the software’s capabilities and the volume of data. Options include manual input, file imports, or API integrations.

- Test and Verify:Thoroughly test the migrated data after the process to ensure its accuracy and completeness.

User Training

Training is vital for users to understand the software’s functionalities and utilize it effectively.

- Develop Training Materials:Create comprehensive training materials, including user manuals, online tutorials, and interactive guides, tailored to different user roles and skill levels.

- Conduct Training Sessions:Organize interactive training sessions, workshops, or webinars to provide hands-on experience and answer user questions.

- Provide Ongoing Support:Offer ongoing support through FAQs, online forums, email, or dedicated support teams to address user queries and troubleshoot issues.

Ongoing Maintenance

Regular maintenance is crucial for optimizing software performance and ensuring data integrity.

- Regular Updates:Install software updates regularly to benefit from new features, security patches, and bug fixes.

- Data Backups:Implement a robust backup strategy to protect against data loss due to hardware failures, software errors, or cyberattacks.

- Security Measures:Ensure data security by implementing strong passwords, two-factor authentication, and regular security audits.

Tips for Maximizing Benefits

To maximize the benefits of your budgeting software, consider these tips:

- Set Clear Goals:Define specific goals for using the software, such as improving budget accuracy, reducing financial risks, or enhancing financial reporting.

- Involve Key Stakeholders:Engage key stakeholders, including finance teams, department heads, and management, in the implementation process to ensure buy-in and active participation.

- Regularly Review and Adjust:Continuously review and adjust budgeting processes based on insights gained from the software and evolving business needs.

- Integrate with Other Systems:Integrate the budgeting software with other business systems, such as accounting software, CRM, and ERP, to streamline data flow and improve efficiency.

Best Practices for Business Budgeting: Best Business Budgeting Software

A well-structured budget is a cornerstone of financial stability and growth for any business. It provides a clear roadmap for resource allocation, expenditure control, and ultimately, achieving business objectives. Effective budgeting requires a blend of best practices, strategic thinking, and a willingness to adapt to changing circumstances.

Creating Accurate and Effective Budgets

Creating accurate and effective budgets involves a systematic approach that ensures all relevant factors are considered.

- Start with a Realistic Forecast:Begin by projecting your income and expenses based on historical data, market trends, and anticipated changes. This involves analyzing past performance, conducting market research, and identifying potential growth opportunities or challenges.

- Categorize Expenses:Divide your expenses into meaningful categories, such as operational costs, marketing, salaries, and rent. This granular approach provides insights into where your money is going and allows for more effective cost management.

- Use the Zero-Based Budgeting Method:This method requires you to justify every expense item, starting from a zero baseline. This forces you to prioritize spending and eliminate unnecessary expenditures, promoting efficiency.

- Incorporate Contingency Funds:Unexpected events can disrupt even the most well-planned budgets. Allocate a percentage of your budget for unforeseen expenses, such as equipment repairs, legal fees, or economic downturns.

- Regularly Review and Adjust:A budget is not a static document. Regularly review your budget, at least quarterly, to ensure it aligns with your current financial performance and business goals. Adjust as needed to reflect changing market conditions, new opportunities, or unexpected expenses.

Forecasting Income

Accurate income forecasting is crucial for developing a realistic budget.

- Analyze Historical Sales Data:Review past sales figures to identify trends, seasonality, and growth patterns. This data can help you predict future income with greater accuracy.

- Conduct Market Research:Stay informed about industry trends, competitor activity, and potential changes in consumer demand. This helps you adjust your forecasts based on external factors.

- Consider New Products or Services:If you plan to launch new offerings, factor in their potential impact on your income. Research their market potential, pricing strategies, and anticipated sales volume.

- Use Forecasting Tools:Software applications designed for financial forecasting can analyze historical data, identify trends, and generate more accurate predictions.

Managing Expenses, Best business budgeting software

Managing expenses effectively is critical for maximizing profitability and ensuring financial stability.

- Identify Cost-Saving Opportunities:Conduct a thorough analysis of your expenses to identify areas where you can reduce costs without compromising quality or service. This might involve negotiating better rates with suppliers, streamlining processes, or finding alternative solutions.

- Implement Expense Tracking Systems:Use budgeting software or other expense tracking tools to monitor spending in real-time. This allows you to identify spending patterns, detect anomalies, and take corrective action promptly.

- Negotiate Supplier Contracts:Regularly review and negotiate your supplier contracts to ensure you are getting the best possible rates and terms. This can significantly reduce your overall expenses.

- Embrace Automation:Automate repetitive tasks, such as invoice processing or payroll, to improve efficiency and reduce administrative costs.

Analyzing Financial Performance

Regularly analyzing your financial performance is essential for identifying areas for improvement and making informed decisions.

- Track Key Performance Indicators (KPIs):Monitor metrics such as profit margins, cash flow, and return on investment (ROI) to gauge your financial health and identify areas requiring attention.

- Compare Actual Performance to Budget:Regularly compare your actual expenses and income to your budgeted figures. This allows you to identify variances, understand the reasons behind them, and make necessary adjustments.

- Use Financial Reporting Tools:Budgeting software often includes reporting features that provide insightful dashboards and reports, helping you visualize your financial performance and make data-driven decisions.