Find the Best Bank Reconciliation Software

Best bank reconciliation software is a game-changer for businesses of all sizes. Imagine a world where your bank statements and your company’s records always match up perfectly. No more tedious manual reconciliation, no more headaches trying to track down discrepancies.

It’s a dream come true, and it’s within reach thanks to the amazing technology available today.

Bank reconciliation software automates the process of comparing your bank statements with your internal records, identifying any discrepancies, and helping you resolve them quickly and efficiently. This not only saves you time and money but also helps you maintain accurate financial records, which is essential for making sound business decisions.

Understanding Bank Reconciliation

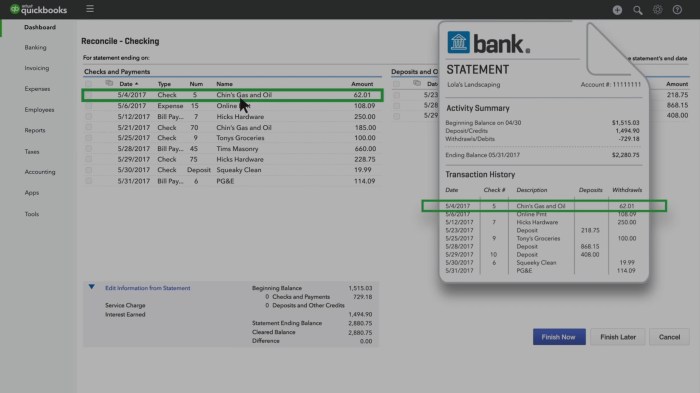

Bank reconciliation is a critical accounting process that ensures the accuracy of a company’s cash balance. It involves comparing the bank statement balance with the company’s cash records and identifying any discrepancies.

Purpose of Bank Reconciliation

The purpose of bank reconciliation is to identify and explain the differences between the bank statement balance and the company’s cash balance. This process helps to:

- Identify errors in recording transactions.

- Detect fraud or unauthorized transactions.

- Ensure the accuracy of the company’s financial statements.

- Provide a clear understanding of the company’s cash position.

Common Discrepancies

Several common discrepancies can arise between bank statements and company records. These discrepancies can be classified as:

- Deposits in Transit:These are deposits made by the company but not yet recorded by the bank. This occurs when a company deposits a check into its bank account after the bank statement cutoff date.

- Outstanding Checks:These are checks issued by the company but not yet cashed by the payee. This happens when the payee delays depositing the check into their account.

- Bank Charges:These are fees charged by the bank for services like monthly maintenance, overdraft protection, or insufficient funds.

- Non-Sufficient Funds (NSF) Checks:These are checks deposited by the company that are returned unpaid due to insufficient funds in the payer’s account.

- Electronic Funds Transfers (EFTs):These are electronic payments or receipts that may not be reflected in the company’s records until later.

- Interest Earned:Interest earned on the company’s bank account may not be reflected in the company’s records.

Importance of Accurate Bank Reconciliation

Accurate bank reconciliation is crucial for financial reporting. It ensures that the company’s cash balance is correctly reported on its financial statements. An accurate reconciliation helps to:

- Prevent errors and omissions:By identifying discrepancies, bank reconciliation helps prevent errors and omissions in the company’s cash records.

- Detect fraud:Discrepancies can be a sign of fraud or unauthorized transactions. Regular reconciliation helps identify these activities.

- Improve internal controls:The process of bank reconciliation strengthens internal controls by providing a check on the accuracy of cash transactions.

- Enhance financial reporting:Accurate reconciliation ensures that the company’s cash balance is correctly reflected in its financial statements, which are used by investors, creditors, and other stakeholders to make informed decisions.

Key Features of Bank Reconciliation Software: Best Bank Reconciliation Software

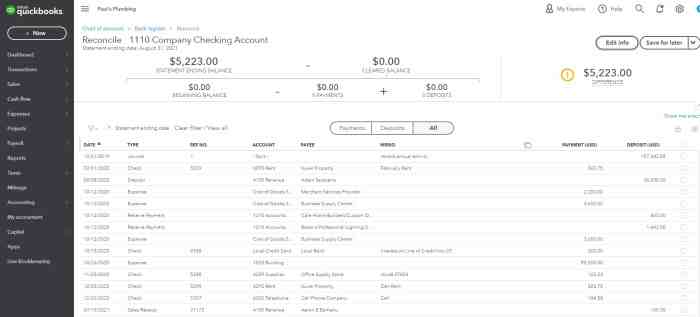

Bank reconciliation software is a powerful tool that can significantly simplify and streamline the reconciliation process. It automates tedious tasks, reduces errors, and provides valuable insights into your financial data.

Essential Features

The key features of a robust bank reconciliation software include:

- Automated Data Import:This feature automatically imports bank statements and transaction data from various sources, eliminating the need for manual data entry. It saves time and reduces the risk of errors.

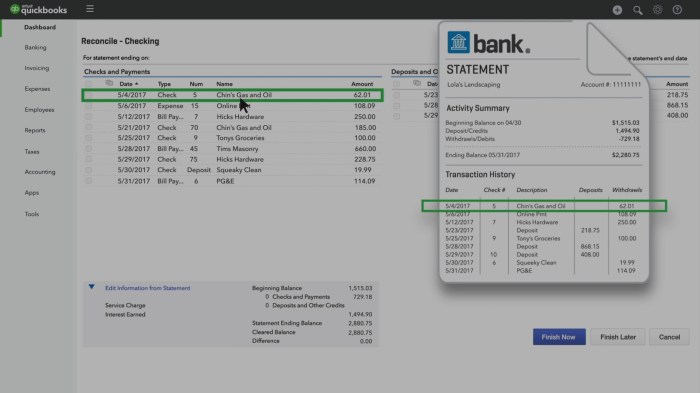

- Matching and Reconciliation:The software uses sophisticated algorithms to match transactions between your bank statements and your internal records. It highlights any discrepancies and provides detailed explanations for easy identification and resolution.

- Exception Handling:This feature allows you to easily manage and track exceptions, such as outstanding checks, deposits in transit, and bank charges. It helps you resolve these discrepancies quickly and efficiently.

- Reporting and Analysis:The software generates comprehensive reports that provide insights into your cash flow, bank balances, and reconciliation process. These reports can help you identify trends, areas for improvement, and potential fraud.

- Security and Compliance:Robust security features are essential to protect your sensitive financial data. The software should comply with industry standards and regulations to ensure the integrity and confidentiality of your information.

Benefits of Automation

Automation plays a crucial role in modern bank reconciliation. It offers numerous benefits, including:

- Increased Accuracy:By eliminating manual data entry and using automated matching algorithms, the software minimizes the risk of human errors. This ensures accurate and reliable reconciliation results.

- Time Savings:Automating the reconciliation process frees up valuable time for your finance team. They can focus on more strategic tasks instead of spending hours on tedious manual reconciliation.

- Improved Efficiency:Automation streamlines the entire process, making it faster and more efficient. This allows you to close your books more quickly and provide timely financial reports.

- Enhanced Visibility:The software provides real-time visibility into your bank reconciliation process, allowing you to track progress, identify issues, and make informed decisions.

Streamlining the Reconciliation Process

Bank reconciliation software streamlines the process in several ways:

- Centralized Platform:The software provides a centralized platform for all your reconciliation activities, eliminating the need for multiple spreadsheets and manual tracking.

- Real-time Updates:The software automatically updates your records with the latest bank statement data, ensuring you always have the most up-to-date information.

- Collaboration and Communication:The software facilitates collaboration and communication among team members involved in the reconciliation process. It provides a platform for sharing information, resolving discrepancies, and ensuring everyone is on the same page.

- Audit Trail:The software maintains a detailed audit trail of all reconciliation activities, making it easy to track changes, identify errors, and comply with regulatory requirements.

Types of Bank Reconciliation Software

Bank reconciliation software comes in various forms, each tailored to specific needs and user preferences. Understanding the different types helps businesses choose the solution that best aligns with their unique requirements.

Cloud-Based and On-Premise Solutions

Cloud-based and on-premise software represent two distinct approaches to bank reconciliation.

Finding the best bank reconciliation software can be a real headache, but it’s crucial for keeping your finances in order. It’s all about streamlining processes and eliminating manual errors, right? Speaking of strategies, Xbox explains its acquisition strategy in a recent article, which highlights the importance of strategic acquisitions for long-term growth.

Similarly, choosing the right bank reconciliation software can be a strategic move for any business looking to optimize its financial operations.

- Cloud-based solutionsare hosted on remote servers, accessible through the internet. They offer flexibility, scalability, and affordability, eliminating the need for on-site infrastructure and software maintenance. Cloud-based solutions are typically subscription-based, with costs varying based on features and user numbers. Examples include Xero, QuickBooks Online, and Zoho Books.

- On-premise solutionsare installed and run on a company’s own servers. They offer greater control over data security and customization, but require significant upfront investment in hardware, software, and maintenance. On-premise solutions are often purchased outright, with ongoing support and maintenance fees.

Examples include Sage Intacct and Microsoft Dynamics 365.

Software Tailored for Specific Industries or Business Sizes

Bank reconciliation software is often tailored to cater to the specific needs of different industries and business sizes.

- Software for specific industries: Some software solutions are designed for particular industries, such as healthcare, retail, or manufacturing. These solutions incorporate industry-specific features and reporting requirements, simplifying bank reconciliation processes. For example, healthcare providers might need software that integrates with electronic health records (EHR) systems to reconcile payments from insurance companies.

- Software for different business sizes: Software solutions are also available for businesses of various sizes. Smaller businesses might prefer simple and affordable solutions, while larger enterprises require more robust features, including advanced reporting, user management, and integration capabilities. For instance, small businesses might use cloud-based solutions like FreshBooks or Xero, while large corporations might opt for enterprise resource planning (ERP) systems like SAP or Oracle.

Types of Bank Reconciliation Software Based on Functionality

Bank reconciliation software can be categorized based on its core functionality.

- Basic bank reconciliation software: These solutions offer essential features, such as importing bank statements, matching transactions, and generating reports. They are suitable for businesses with simple reconciliation needs and limited transaction volume. Examples include Wave Accounting and Zoho Books.

- Advanced bank reconciliation software: These solutions provide more sophisticated features, including automated matching, exception handling, and integration with other accounting systems. They are ideal for businesses with complex reconciliation processes and high transaction volumes. Examples include Xero, QuickBooks Online, and Intuit.

- Specialized bank reconciliation software: These solutions are designed for specific tasks, such as reconciling payments from insurance companies or reconciling transactions from multiple bank accounts. They offer specialized features and reporting capabilities tailored to specific industry needs. Examples include Avalara and Paychex.

Choosing the Right Bank Reconciliation Software

Selecting the best bank reconciliation software for your business is crucial for accurate financial reporting and efficient operations. The right software should streamline your reconciliation process, minimize errors, and provide valuable insights into your cash flow.

Key Factors to Consider

When choosing bank reconciliation software, it’s essential to consider several key factors that align with your specific needs and resources. These factors will guide you towards software that provides optimal functionality and value.

Finding the best bank reconciliation software can be a game-changer for any business, streamlining your finances and ensuring accuracy. However, even with the best tools, you need to be aware of potential security threats, like the recent apple threat notifications mercenary spyware incident.

This highlights the importance of choosing software that prioritizes data security and keeps your financial information safe. Ultimately, the best bank reconciliation software will be one that not only simplifies your processes but also protects your business from vulnerabilities.

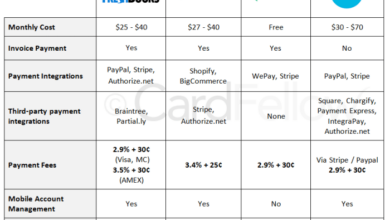

- Budget:Software options range in price, from affordable cloud-based solutions to more expensive enterprise-level packages. Determine your budget and look for software that offers the best value for your investment. For instance, if you’re a small business with limited resources, a cloud-based solution might be a more cost-effective choice.

- Scalability:Choose software that can grow with your business. If your company is expanding, ensure the software can handle increased transaction volumes and data complexity. Consider software with flexible features that can adapt to your changing needs.

- Integration Capabilities:Look for software that integrates seamlessly with your existing accounting software, banking platforms, and other business applications. Seamless integration minimizes manual data entry, reduces errors, and streamlines your workflow.

- User Experience:The software should be user-friendly and intuitive, even for users with limited technical skills. A simple interface and clear navigation will make the reconciliation process faster and less prone to errors. Look for software with features like drag-and-drop functionality, clear reporting options, and helpful tutorials.

Evaluating Software Demos and Trial Periods

Software demos and trial periods provide valuable opportunities to assess the software’s functionality and usability before committing to a purchase. Here are some tips for maximizing these evaluation phases:

- Test Key Features:Focus on testing the features most important to your business, such as automatic matching, error detection, and reporting capabilities. This will give you a realistic sense of how the software will work in your environment.

- Assess User Friendliness:Try navigating the software interface and performing tasks to ensure it’s intuitive and easy to use. Consider the training and support resources available to help you and your team learn the software.

- Evaluate Reporting Options:Explore the software’s reporting capabilities. Can it generate the reports you need, such as bank reconciliation statements, cash flow analyses, and audit trails? This will help you determine if the software can meet your reporting needs.

Security and Compliance Features

Bank reconciliation software handles sensitive financial data, so security and compliance are critical. Look for software that meets industry standards and provides robust security features.

- Data Encryption:Ensure the software encrypts your financial data both in transit and at rest. This protects your data from unauthorized access and cyber threats.

- Two-Factor Authentication:This feature adds an extra layer of security by requiring users to provide two forms of identification, such as a password and a code sent to their phone. This helps prevent unauthorized logins.

- Compliance Certifications:Look for software that meets industry standards like SOC 2 and ISO 27001. These certifications demonstrate that the software meets rigorous security and compliance requirements.

Implementation and Training

Implementing a new bank reconciliation software solution is a significant step that requires careful planning and execution to ensure a smooth transition and maximize the benefits of the new system. Effective user training and support are crucial to ensure adoption and optimize the software’s functionality.

Finding the best bank reconciliation software can feel like a daunting task, but it’s essential for keeping your finances in order. It’s all about finding the right fit for your needs, just like when you’re searching for the perfect home.

And speaking of finding the right fit, I recently stumbled upon a fascinating article about the House Holland looks love trend, which explores how architecture can reflect our personal values. Once you’ve found the right software, you’ll be able to easily reconcile your bank statements, track your expenses, and ultimately gain a clearer picture of your financial health.

Integration with Existing Systems

Integrating the new bank reconciliation software with existing systems is a critical aspect of implementation. This ensures seamless data flow and avoids manual data entry, reducing errors and saving time.Here are some important aspects to consider:

- Data Migration:Carefully plan the transfer of historical bank reconciliation data from existing systems to the new software. This involves data cleansing, validation, and conversion to the new system’s format.

- API Integration:Utilize Application Programming Interfaces (APIs) to connect the new software with your accounting system, banking platforms, and other relevant systems. APIs enable automated data exchange, reducing manual intervention and improving accuracy.

- Third-Party Integrations:Explore the availability of pre-built integrations with popular accounting software, banking platforms, and other relevant third-party applications. This streamlines the integration process and reduces customization requirements.

“A well-planned integration strategy is essential for maximizing the efficiency and accuracy of the new bank reconciliation software.”

Benefits of Bank Reconciliation Software

Bank reconciliation software offers numerous advantages that can significantly streamline your financial processes and enhance your overall financial health. By automating the reconciliation process, these tools free up valuable time for more strategic tasks while improving accuracy and efficiency.

Improved Accuracy and Efficiency, Best bank reconciliation software

Bank reconciliation software automates the tedious and error-prone process of comparing bank statements to internal records, minimizing the risk of human error. It automatically matches transactions, identifies discrepancies, and flags potential issues, ensuring a more accurate and reliable reconciliation. This automation not only saves time but also reduces the likelihood of costly mistakes.

Enhanced Financial Control and Fraud Detection

By providing a clear and comprehensive view of your financial transactions, bank reconciliation software empowers you to identify and address potential discrepancies or irregularities. This enhanced visibility facilitates stronger financial control and allows for the early detection of fraudulent activities.

For example, the software can highlight unusual transactions, duplicate payments, or unauthorized withdrawals, enabling you to investigate and take corrective action promptly.

Impact on Cash Flow Management and Reporting

Accurate and timely bank reconciliation is crucial for effective cash flow management. Bank reconciliation software helps you gain a real-time understanding of your cash position, enabling you to make informed decisions about cash allocation, investment, and debt management. This improved visibility also facilitates the generation of accurate and timely financial reports, which are essential for making strategic business decisions and meeting regulatory requirements.

Future Trends in Bank Reconciliation Software

The bank reconciliation software market is constantly evolving, driven by advancements in technology and changing business needs. Emerging trends are shaping the future of bank reconciliation, leading to more automated, intelligent, and integrated solutions.

Artificial Intelligence and Machine Learning

AI and ML are transforming various industries, and bank reconciliation is no exception. These technologies can automate repetitive tasks, improve accuracy, and provide valuable insights.

- Automated Transaction Matching:AI-powered algorithms can analyze and match transactions from bank statements and accounting systems with high accuracy, reducing manual effort and errors.

- Fraud Detection:ML models can identify unusual transaction patterns and potential fraudulent activities, enhancing financial security.

- Predictive Analytics:AI can analyze historical data to predict future reconciliation needs, optimize resource allocation, and identify potential reconciliation challenges.

Cloud-Based Solutions

Cloud-based bank reconciliation software offers several advantages, including scalability, accessibility, and cost-effectiveness.

- Scalability:Cloud solutions can easily scale to accommodate growing businesses and fluctuating workloads.

- Accessibility:Users can access the software from anywhere with an internet connection, improving collaboration and remote work capabilities.

- Cost-Effectiveness:Cloud solutions eliminate the need for expensive hardware and software licenses, reducing overall costs.

Integration with Other Systems

Modern bank reconciliation software seamlessly integrates with other financial systems, such as accounting software, ERP systems, and payment gateways.

- Real-Time Data Synchronization:Integrated systems ensure real-time data synchronization between bank statements, accounting records, and other relevant data sources.

- Streamlined Workflows:Integration eliminates manual data entry and reduces the risk of errors, streamlining reconciliation processes.

- Enhanced Visibility:Integrated systems provide a comprehensive view of financial transactions, enabling better financial management and decision-making.

Advanced Reporting and Analytics

Bank reconciliation software is increasingly incorporating advanced reporting and analytics capabilities to provide deeper insights into financial data.

- Interactive Dashboards:Visual dashboards offer real-time insights into reconciliation status, key metrics, and potential issues.

- Customizable Reports:Users can generate customized reports based on specific needs and requirements, enabling data-driven decision-making.

- Trend Analysis:Advanced analytics tools can identify trends and patterns in reconciliation data, helping businesses improve their financial processes.