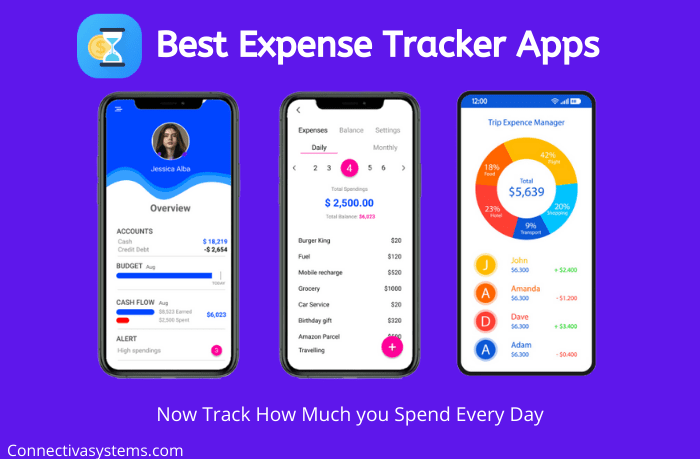

Best Expense Tracker Apps: Take Control of Your Finances

Best expense tracker apps are your secret weapon for conquering financial chaos and achieving your financial goals. Imagine having a clear picture of where your money goes, effortlessly budgeting for your dreams, and making informed decisions about your spending habits.

These apps are more than just tools; they’re your personal finance coaches, guiding you towards financial freedom.

From simple expense logging to sophisticated budgeting and analysis, expense tracker apps offer a range of features to suit every need. Whether you’re a casual spender looking for a basic overview or a meticulous budgeter aiming for financial mastery, there’s an app out there that can empower you to take control of your finances.

Introduction to Expense Tracking Apps: Best Expense Tracker Apps

![]()

In the realm of personal finance, understanding your spending habits is crucial for achieving financial stability and reaching your financial goals. Expense tracking apps have emerged as powerful tools to help individuals gain control over their finances by providing a comprehensive overview of their spending patterns.Expense tracking apps empower you to make informed financial decisions by providing insights into your spending habits.

These apps offer a range of features that go beyond simple expense recording, making them valuable tools for managing your money effectively.

Types of Expense Tracking Apps

Expense tracking apps come in various forms, each catering to specific needs and preferences. Here are some common types:

- Budgeting Apps:These apps help you create and stick to a budget by allowing you to set spending limits for different categories and track your progress towards your financial goals. Popular budgeting apps include Mint, Personal Capital, and YNAB (You Need a Budget).

Keeping track of your spending is essential, and there are so many great expense tracker apps out there to help. While I’m busy managing my finances, I can’t help but be distracted by the latest tech news. I saw an article about all glass imac of the future spotted again as Apple updates its patent ! It’s amazing to think how technology keeps evolving.

But back to those expense tracker apps – I’m sure I can find one that will help me save some money on my next tech purchase!

- Spending Analysis Apps:These apps provide detailed insights into your spending patterns, identifying areas where you might be overspending. They often categorize your expenses, generate charts and graphs, and offer recommendations for saving money. Examples include Expense Tracker by Money Manager and Wally.

Finding the best expense tracker app can be a real game-changer for your financial well-being. But while you’re keeping tabs on your spending, it’s worth noting that even the biggest tech giants aren’t immune to security risks, as evidenced by recent research highlighting misconfiguration issues at Google, Amazon, and Microsoft cloud services.

This just underscores the importance of using secure and reliable tools, like those expense trackers that prioritize data protection, to keep your financial information safe.

- Investment Tracking Apps:These apps allow you to track your investments, including stocks, bonds, and mutual funds. They provide real-time performance data, portfolio diversification analysis, and insights into your investment strategies. Examples include Acorns, Robinhood, and Betterment.

Choosing the Right Expense Tracking App

Navigating the vast landscape of expense tracking apps can feel overwhelming. With so many options available, choosing the right one for your needs is crucial. A well-suited app can empower you to gain control of your finances, track your spending habits, and achieve your financial goals.

Factors to Consider

Selecting the ideal expense tracking app involves evaluating several key factors. These factors directly impact your experience and the app’s effectiveness in helping you manage your money.

Choosing the best expense tracker app can feel overwhelming, with so many options out there. But before you dive into the world of budgeting apps, it’s important to understand the psychology behind how these apps work. After all, they’re essentially using persuasion tactics to encourage you to track your spending.

Think about the techniques used in social engineering attacks, like scarcity, authority, and urgency – 6 persuasion tactics used in social engineering attacks – and you’ll see how they can be subtly applied in the design of expense tracker apps.

So, when choosing your app, be mindful of these tactics and make sure it aligns with your own financial goals and habits.

- Personal Financial Goals:What are you aiming to achieve with expense tracking? Are you trying to save for a specific goal, reduce spending, or simply gain better visibility into your finances? The app you choose should align with your goals.

- Budgeting Needs:Do you require a simple budget tracker or a more advanced system with features like category budgeting, goal setting, and financial reports? The app’s budgeting capabilities should match your needs.

- Device Compatibility:Ensure the app is compatible with your devices (smartphone, tablet, computer). Some apps offer cross-platform compatibility, allowing you to access your data from multiple devices.

- Ease of Use:The app should be intuitive and easy to use. Look for a user-friendly interface with clear navigation and features that are simple to understand and implement.

- Security:Your financial data is sensitive. Choose an app that prioritizes security, using encryption and strong authentication measures to protect your information.

Checklist for Choosing an Expense Tracking App

Before you commit to an expense tracking app, ask yourself these questions to ensure it aligns with your needs and preferences:

- What are my primary financial goals?

- What level of budgeting detail do I require?

- What devices do I use most often?

- How important is a user-friendly interface?

- What security measures are essential for me?

- Do I prefer a free or paid app?

- What features are most important to me?(e.g., bank account syncing, budgeting categories, financial reports, goal setting, debt tracking)

- What is the app’s reputation?(read reviews and check for user ratings)

Recommendations Based on User Needs

The ideal expense tracking app depends on your individual needs and preferences. Here are some recommendations based on common scenarios:

- Simple Budgeting and Tracking:For users seeking a basic app to track spending and create a simple budget, options like Mint, Personal Capital, or PocketGuard can be suitable. These apps often offer free versions with core features.

- Advanced Budgeting and Financial Management:If you require more robust features like detailed budgeting, goal setting, investment tracking, and financial analysis, apps like YNAB (You Need a Budget), EveryDollar, or Personal Capital’s premium version might be more appropriate. These apps typically involve subscription fees.

- Specific Needs:Some apps cater to specific needs, such as debt management (Debt.com), travel expense tracking (Expensify), or business expense tracking (Zoho Expense). Consider these options if you have specialized requirements.

Tips for Effective Expense Tracking

Expense tracking apps can be powerful tools for gaining control of your finances, but their effectiveness depends on how you use them. To maximize the benefits of these apps, it’s essential to implement strategies that go beyond simply logging your transactions.

Here are some practical tips to make your expense tracking journey more successful.

Categorizing Expenses Accurately

Accurate expense categorization is crucial for gaining meaningful insights from your spending data. Without proper categorization, your expense reports will be cluttered and difficult to analyze.

- Start by creating a comprehensive list of expense categories that align with your spending habits. This list should be specific enough to capture the nuances of your spending, but not overly detailed to become cumbersome. For instance, instead of having a single “Food” category, consider separate categories for “Groceries,” “Dining Out,” and “Coffee/Snacks.”

- Use consistent categorization rules to ensure that similar expenses are grouped together. For example, always categorize your “Netflix” subscription under “Entertainment” and your “Spotify” subscription under “Music & Entertainment.”

- Regularly review your expense categories and make adjustments as needed. Your spending habits may evolve over time, requiring updates to your categorization system.

Setting Realistic Budgets

A budget is a roadmap for your finances, guiding your spending and saving decisions. Effective expense tracking apps can help you create and stick to a realistic budget.

- Analyze your past spending patterns to identify areas where you can cut back. Use your expense tracking app to generate reports that show your spending by category and time period. This data can help you understand where your money is going and identify areas where you can make adjustments.

- Set achievable budget goals. Avoid setting unrealistic goals that are likely to lead to frustration and failure. Start with small, manageable changes and gradually increase your savings targets as you become more comfortable.

- Use your expense tracking app to monitor your progress and make necessary adjustments. Regularly review your budget and spending habits to ensure you are on track to achieve your financial goals.

Tracking Spending Trends, Best expense tracker apps

Expense tracking apps can provide valuable insights into your spending patterns, helping you identify areas for improvement.

- Use the app’s reporting features to analyze your spending by category, time period, and other relevant metrics. This data can help you identify recurring spending patterns and potential areas for savings.

- Track your spending over time to identify trends and potential areas for improvement. For example, you might notice that your spending on dining out increases during certain months. This information can help you adjust your budget and make more informed spending decisions.

- Use the app’s alerts and notifications to stay on top of your spending. You can set up alerts for specific categories, spending limits, or when you approach your budget limit.

Identifying Areas for Savings

By analyzing your spending data, you can identify areas where you can cut back and save money.

- Review your spending on subscriptions and memberships. Many people have recurring subscriptions they no longer use or need. Identify and cancel unnecessary subscriptions to free up cash flow.

- Look for opportunities to reduce your utility bills. Make energy-saving changes around your home and compare prices from different utility providers.

- Consider negotiating your monthly expenses, such as cable, internet, and phone bills. Many companies are willing to offer discounts to loyal customers.

Using Expense Tracking Apps for Goal Setting

Expense tracking apps can be valuable tools for achieving financial milestones.

- Set specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. For example, you might set a goal to save $1,000 for a down payment on a car within six months.

- Use the app’s budgeting and savings features to track your progress toward your goals. Set up separate savings accounts or categories for each goal and monitor your progress regularly.

- Adjust your spending habits as needed to stay on track. If you are falling behind on your savings goals, identify areas where you can cut back and reallocate funds.

Expense Tracking App Security and Privacy

Your financial data is incredibly sensitive, and entrusting it to an expense tracking app requires careful consideration of security and privacy practices. Just as you wouldn’t leave your wallet unattended, you need to be mindful of how your financial information is protected within these apps.

Security Measures Implemented by Expense Tracking Apps

Expense tracking apps employ various security measures to protect your financial data. These measures vary depending on the app, but common practices include:

- Encryption:Most reputable expense tracking apps use encryption to safeguard your data during transmission and storage. This means that your financial information is scrambled, making it unreadable to unauthorized individuals. Encryption is like using a secret code to protect your information, ensuring that even if someone intercepts your data, they won’t be able to understand it.

- Two-factor authentication (2FA):This adds an extra layer of security by requiring you to enter a code sent to your phone or email, in addition to your password, when logging in. 2FA acts as a double check, preventing unauthorized access even if someone knows your password.

- Data protection policies:Reputable apps have clear data protection policies outlining how they collect, store, and use your information. These policies should be transparent and readily available for users to review. It’s important to read these policies carefully before using any app to understand how your data is being handled.

Potential Risks and Best Practices for Safeguarding Financial Information

While most expense tracking apps prioritize security, potential risks still exist. It’s crucial to be aware of these risks and take proactive steps to protect your financial information:

- Phishing scams:Be cautious of suspicious emails or messages claiming to be from your expense tracking app, asking for personal information. Never click on links or provide sensitive details through such communications. Phishing scams are designed to trick you into revealing your financial data, so be vigilant and always verify requests through official app channels.

- App permissions:Carefully review the permissions requested by an app before granting access. Some apps might ask for access to your contacts, location, or other sensitive information that isn’t directly related to expense tracking. Only grant permissions that are absolutely necessary for the app’s functionality.

Avoid granting unnecessary permissions, as they could potentially expose your data to vulnerabilities.

- Weak passwords:Using a strong and unique password for your expense tracking app is essential. Avoid using common passwords or phrases that are easily guessed. A strong password should be a combination of uppercase and lowercase letters, numbers, and symbols. You can also consider using a password manager to generate and store strong passwords securely.

A strong password acts as a barrier against unauthorized access, making it harder for hackers to gain access to your account.

- Third-party integrations:Be cautious when connecting your expense tracking app to other services or apps. Carefully review the privacy policies of any third-party services before linking them to your account. Integrating with other services might expose your financial data to third parties, so it’s crucial to choose reputable services with robust security measures.

Always verify the legitimacy of third-party services before linking them to your account, ensuring they are trustworthy and have a strong track record of protecting user data.

- Regular security updates:Ensure your expense tracking app is up-to-date with the latest security patches and updates. These updates often address vulnerabilities that could be exploited by hackers. Regularly updating your app is like installing security patches for your digital wallet, protecting it from known threats and vulnerabilities.