Best Accounting Software for Consultants: Streamline Your Finances

Best accounting software for consultants is crucial for navigating the unique financial landscape of this profession. Whether you’re a solo freelancer or head a large consulting firm, efficient accounting is essential for managing time, expenses, and projects effectively. Choosing the right software can significantly simplify your financial operations, freeing up time for what matters most: providing exceptional consulting services.

The ideal accounting software for consultants should offer features tailored to their specific needs, including robust time tracking, expense management, invoicing, and project management capabilities. It should also seamlessly integrate with other business tools to streamline workflows and enhance productivity.

Understanding Consultant Needs

Consultants, as independent professionals, have unique accounting needs that differ from traditional businesses. They often work on multiple projects simultaneously, requiring meticulous tracking of time, expenses, and project profitability. This is where specialized accounting software designed for consultants comes into play, offering features that streamline their financial management.

Accounting Software Features Ideal for Consultants

Specialized accounting software for consultants is designed to address their unique needs, providing a comprehensive suite of features that simplify their financial management.

- Time Tracking:Consultants need to accurately track their time spent on projects to ensure accurate billing and profitability analysis. Software with integrated time tracking features allows consultants to record time spent on specific projects, tasks, or clients, often with the ability to generate detailed reports.

This helps ensure they are compensated fairly for their services.

- Expense Tracking:Consultants often incur expenses related to their work, including travel, supplies, and client entertainment. Software with expense tracking capabilities allows consultants to categorize and track these expenses, often with the ability to generate reports for tax purposes. This helps consultants stay organized and ensure they are maximizing tax deductions.

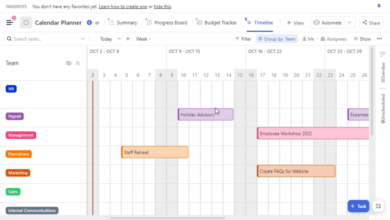

- Project Management:Consultants often work on multiple projects concurrently. Software with project management features allows consultants to manage project budgets, track progress, and monitor profitability. This helps consultants stay organized and ensure they are delivering projects on time and within budget.

- Invoicing and Billing:Consultants need to generate professional invoices for their clients. Software with invoicing features allows consultants to create customized invoices, track payments, and manage outstanding balances. This helps consultants streamline their billing process and ensure they are getting paid on time.

- Reporting and Analytics:Consultants need to track their financial performance to make informed business decisions. Software with reporting and analytics features allows consultants to generate financial reports, track key performance indicators (KPIs), and identify areas for improvement. This helps consultants gain valuable insights into their business and make data-driven decisions.

Challenges Consultants Face with Traditional Accounting Software

Traditional accounting software, designed for businesses with more complex operations, may not be the best fit for consultants. They often lack the specialized features that consultants need, leading to several challenges.

- Lack of Time Tracking:Many traditional accounting software packages do not offer dedicated time tracking features. This forces consultants to manually track their time, which can be time-consuming and prone to errors.

- Limited Expense Tracking:Traditional accounting software may have basic expense tracking features, but they often lack the ability to categorize and track expenses in a way that is useful for consultants. This can make it difficult for consultants to track their expenses and maximize tax deductions.

- Lack of Project Management Features:Traditional accounting software often lacks the project management features that consultants need to manage multiple projects simultaneously. This can make it difficult for consultants to stay organized and track the profitability of their projects.

- Complex Interface:Traditional accounting software can be complex and difficult to use, especially for consultants who are not accounting professionals. This can lead to frustration and wasted time.

Top Accounting Software Features for Consultants

Choosing the right accounting software can be a game-changer for consultants. It streamlines financial management, boosts productivity, and helps you focus on what matters most – your clients.

To make an informed decision, it’s crucial to understand the essential features that cater to the unique needs of consultants.

Finding the best accounting software for consultants can be a real head-scratcher, especially when you’re trying to balance your books with a busy schedule. Speaking of balancing, I was super bummed about the lackluster Prime Day AirTag deals this year, but thankfully, there are some great Tile alternatives out there! If you’re looking for a reliable way to track your belongings, check out this article: prime day airtag deals a letdown here are 3 tile alternatives id recommend.

Anyway, back to accounting software, the key is to find a solution that’s both user-friendly and powerful enough to handle your unique needs.

Features for Consultants

The best accounting software for consultants goes beyond basic bookkeeping. It offers a suite of features designed to manage projects, track time, handle expenses, and generate insightful reports.

| Feature | Xero | QuickBooks Online | FreshBooks | Zoho Books |

|---|---|---|---|---|

| Time Tracking | Yes, includes project-based time tracking, billing, and reporting. | Yes, includes project-based time tracking, billing, and reporting. | Yes, includes project-based time tracking, billing, and reporting. | Yes, includes project-based time tracking, billing, and reporting. |

| Expense Management | Yes, allows tracking and categorizing expenses, generating expense reports. | Yes, allows tracking and categorizing expenses, generating expense reports. | Yes, allows tracking and categorizing expenses, generating expense reports. | Yes, allows tracking and categorizing expenses, generating expense reports. |

| Invoicing | Yes, allows creating and sending invoices, managing payments. | Yes, allows creating and sending invoices, managing payments. | Yes, allows creating and sending invoices, managing payments. | Yes, allows creating and sending invoices, managing payments. |

| Project Management | Limited project management features, but integrates with third-party tools. | Limited project management features, but integrates with third-party tools. | Offers basic project management features, but integrates with third-party tools. | Includes comprehensive project management features. |

| Reporting | Provides customizable reports for analyzing profitability, performance, and client data. | Provides customizable reports for analyzing profitability, performance, and client data. | Provides customizable reports for analyzing profitability, performance, and client data. | Provides customizable reports for analyzing profitability, performance, and client data. |

| Integrations | Integrates with various business tools like CRM, payment gateways, and project management software. | Integrates with various business tools like CRM, payment gateways, and project management software. | Integrates with various business tools like CRM, payment gateways, and project management software. | Integrates with various business tools like CRM, payment gateways, and project management software. |

Software Options for Different Consultant Types: Best Accounting Software For Consultants

Choosing the right accounting software is crucial for consultants of all sizes, as it directly impacts their financial management, efficiency, and overall success. Different types of consultants have varying needs and requirements, making it essential to select a solution that aligns with their specific business model and goals.

Software Solutions for Freelancers

Freelancers often require software that is easy to use, affordable, and can handle basic accounting tasks. These solutions should be mobile-friendly, allowing freelancers to manage their finances on the go. Here are some software options specifically designed for freelancers:

- FreshBooks:This popular cloud-based accounting software is designed for small businesses and freelancers. It offers features like invoicing, expense tracking, time tracking, and reporting. FreshBooks integrates with various popular apps, making it easy to manage finances from one platform.

- Xero:While Xero is a more comprehensive accounting solution, it also offers a streamlined experience for freelancers. It provides invoicing, expense tracking, bank reconciliation, and reporting features. Xero’s user-friendly interface and mobile app make it suitable for freelancers who need to manage their finances on the go.

- Wave Accounting:This free accounting software is an excellent option for freelancers who are just starting out. It offers basic accounting features like invoicing, expense tracking, and bank reconciliation. Wave Accounting also offers paid plans with additional features for those who need them.

These software solutions can help freelancers automate their accounting tasks, improve their invoicing process, track their expenses, and gain valuable insights into their financial performance.

Finding the right accounting software for consultants can be a game-changer. It’s not just about tracking invoices and expenses, but also managing client relationships and ensuring compliance. As you navigate these complexities, it’s important to keep an eye on the broader trends in identity management, like those outlined in the recent Okta customer identity trends report.

Understanding how identity is evolving can help you choose software that not only meets your current needs, but also adapts to future security and privacy challenges.

Software Solutions for Small Consulting Firms

Small consulting firms require accounting software that can handle more complex tasks than freelancers, including managing multiple projects, tracking client payments, and generating detailed financial reports. Here are some accounting software options suitable for small consulting firms:

- Zoho Books:This cloud-based accounting software offers comprehensive features for small businesses, including invoicing, expense tracking, project management, and reporting. Zoho Books’ user-friendly interface and mobile app make it a suitable option for small consulting firms.

- QuickBooks Online:QuickBooks Online is a popular accounting software solution for small businesses, offering a wide range of features, including invoicing, expense tracking, bank reconciliation, and reporting. QuickBooks Online’s integration with other business apps makes it a versatile solution for small consulting firms.

- Xero:Xero’s comprehensive features make it a suitable option for small consulting firms. It offers invoicing, expense tracking, bank reconciliation, project management, and reporting capabilities. Xero’s user-friendly interface and mobile app make it easy for small consulting firms to manage their finances on the go.

These software solutions can help small consulting firms streamline their operations, manage their finances effectively, and gain valuable insights into their business performance.

Software Solutions for Large Consulting Agencies

Large consulting agencies require robust accounting software that can handle a high volume of transactions, manage multiple projects, track client payments, and generate detailed financial reports. These solutions should also integrate with other business applications to optimize their operations.Here are some accounting software options suitable for large consulting agencies:

- NetSuite:This cloud-based enterprise resource planning (ERP) software offers a comprehensive suite of accounting features, including invoicing, expense tracking, bank reconciliation, project management, and reporting. NetSuite’s integration with other business applications makes it a powerful solution for large consulting agencies.

Finding the right accounting software for consultants can be a real game-changer. You need something that’s flexible enough to handle your unique billing needs and can easily integrate with other tools you use. While I’m on the topic of things that are game-changers, did you hear that Apple’s iPhone 16 could finally get the capacitive buttons that the iPhone 15 missed out on, with a supplier now lined up?

Read more about it here. Anyway, back to accounting software – I’m currently testing out a few different options and I’ll be sharing my findings soon. Stay tuned!

- Sage Intacct:Sage Intacct is a cloud-based accounting software designed for mid-market and enterprise businesses. It offers a wide range of features, including invoicing, expense tracking, bank reconciliation, project management, and reporting. Sage Intacct’s robust functionality and scalability make it suitable for large consulting agencies.

- Microsoft Dynamics 365 Business Central:This cloud-based ERP software offers a comprehensive suite of accounting features, including invoicing, expense tracking, bank reconciliation, project management, and reporting. Microsoft Dynamics 365 Business Central’s integration with other Microsoft products makes it a powerful solution for large consulting agencies.

These software solutions can help large consulting agencies manage their complex operations, track their finances effectively, and gain valuable insights into their business performance.

Key Considerations When Choosing Accounting Software

Choosing the right accounting software is crucial for consultants, as it can streamline financial management, improve efficiency, and ultimately contribute to business success. A thoughtful selection process is essential to ensure the software aligns with your specific needs and requirements.

Cost

The cost of accounting software is a significant factor to consider, as it can vary widely depending on the features, pricing plans, and number of users.

- Subscription fees:Most accounting software providers offer subscription-based pricing models, where you pay a monthly or annual fee for access to the software. These fees can vary depending on the plan you choose and the features included.

- Pricing plans:Software providers often offer different pricing plans to cater to the needs of various businesses. Basic plans may offer essential features at a lower cost, while more advanced plans may include additional features at a higher price.

- Hidden costs:Be aware of potential hidden costs, such as fees for additional users, integrations, or support services. It’s essential to carefully review the terms and conditions of the software provider to understand all associated costs.

Ease of Use

Consultants often have diverse technical backgrounds, so choosing software that is easy to learn and use is critical.

- User interface:The user interface (UI) should be intuitive and user-friendly, with clear navigation and easily accessible features.

- Learning curve:Consider the time it takes to learn and master the software. Software with a gentle learning curve is ideal for consultants who may not have extensive accounting experience.

- Overall user experience:The overall user experience should be positive, with minimal technical glitches and a smooth workflow.

Mobile Accessibility

In today’s mobile-first world, consultants need the ability to access and manage their accounts from anywhere, anytime.

- Mobile apps:Look for accounting software with dedicated mobile apps that provide access to essential features, such as viewing invoices, tracking expenses, and managing clients.

- Responsive design:Ensure the software has a responsive design that adapts seamlessly to different screen sizes, allowing for a consistent experience across devices.

Security

Protecting sensitive financial data is paramount for consultants.

- Data encryption:The software should use robust encryption methods to protect data in transit and at rest.

- User permissions:Implement granular user permissions to control access to specific data and features, ensuring only authorized individuals can access sensitive information.

- Data backup options:Regular data backups are essential to safeguard against data loss. Look for software that offers automatic backups or allows you to create manual backups.

Customer Support

Reliable customer support is essential for consultants who may encounter technical issues or need assistance with the software.

- Technical support:The software provider should offer readily available technical support via phone, email, or chat.

- Documentation:Comprehensive documentation, including user guides, tutorials, and FAQs, can help consultants troubleshoot issues and learn how to use the software effectively.

- Community forums:Access to online community forums or knowledge bases can provide a platform for consultants to connect with other users, share best practices, and seek assistance from peers.

Tips for Optimizing Accounting Software for Consultants

Choosing the right accounting software is just the first step. To truly maximize its benefits, you need to optimize it for your specific needs as a consultant. This involves going beyond the basics and implementing strategies that streamline your workflow, improve billing accuracy, and enhance financial insights.

Setting Up Accurate Client and Project Records

Accurate client and project records are the foundation of efficient accounting for consultants. They allow you to track time, expenses, and revenue associated with each project, ensuring accurate billing and insightful financial reporting.

- Create Detailed Client Profiles:Include contact information, project details, payment terms, and any relevant notes. This helps you stay organized and avoid confusion when working on multiple projects.

- Use Project Codes:Assign unique project codes to each client project. This makes it easy to categorize transactions, track project profitability, and generate reports based on specific projects.

- Maintain a Consistent Data Entry Process:Establish a clear process for entering client and project information. This ensures consistency and minimizes errors.

Utilizing Time Tracking Features

Accurate time tracking is crucial for consultants, as it directly impacts billing accuracy and profitability. Leveraging the time tracking features of your accounting software can significantly simplify this process.

- Choose a Time Tracking Method:Your software may offer various options, such as manual entry, timer-based tracking, or integration with project management tools. Select the method that best suits your workflow.

- Track Time Regularly:Develop a habit of tracking your time in real-time. This helps you avoid forgetting tasks and ensures accurate billing. You can set reminders or use timers to maintain consistency.

- Use Time Tracking for Project Management:Time tracking can also be valuable for project management. It allows you to identify bottlenecks, monitor progress, and allocate resources effectively.

Automating Invoice Generation and Payment Reminders

Automating invoice generation and payment reminders can save you time and ensure timely payments. Most accounting software offers these features, enabling you to streamline your billing process.

- Set Up Invoice Templates:Create professional invoice templates with your logo, contact information, and payment terms. This saves time and ensures consistency across invoices.

- Automate Invoice Sending:Configure your software to send invoices automatically upon completion of a project or at pre-determined intervals.

- Implement Payment Reminders:Set up automated reminders to be sent to clients if payments are overdue. This helps maintain cash flow and minimizes late payments.

Creating Customized Reports for Financial Analysis, Best accounting software for consultants

Accounting software provides powerful reporting capabilities that can help you gain valuable insights into your business finances. By creating customized reports, you can track key metrics, identify trends, and make informed decisions.

- Track Revenue and Expenses:Generate reports to monitor your revenue and expenses over time. This helps you identify areas for improvement and ensure profitability.

- Analyze Project Performance:Create reports that analyze the profitability of individual projects. This allows you to identify successful projects and areas where you may need to adjust your pricing or processes.

- Monitor Cash Flow:Generate reports that track your cash flow, highlighting potential cash flow shortages or surpluses. This helps you plan for future expenses and investments.

Implementing Best Practices for Data Security and Backup

Protecting your financial data is crucial. Implement best practices for data security and backup to minimize the risk of data loss or breaches.

- Use Strong Passwords:Create strong passwords for your accounting software and any related accounts. Avoid using easily guessed passwords and consider using a password manager to securely store your credentials.

- Enable Two-Factor Authentication:This adds an extra layer of security by requiring a code from your phone or email in addition to your password. Most accounting software providers offer this feature.

- Regularly Backup Your Data:Implement a regular data backup schedule. This ensures you have a copy of your financial records in case of hardware failure or data corruption. Consider using cloud-based backup solutions for added security and convenience.