Best Banks for QuickBooks Integration: Streamline Your Finances

Best banks QuickBooks integration is a game-changer for businesses seeking to simplify their financial management. Imagine a world where your bank transactions automatically flow into QuickBooks, eliminating manual data entry and reducing the risk of errors. This seamless integration unlocks a wealth of benefits, from real-time financial insights to streamlined reconciliation processes.

By connecting your bank account to QuickBooks, you gain access to a powerful arsenal of features. Imagine effortlessly downloading bank statements, automatically matching transactions, and effortlessly categorizing expenses. This level of automation not only saves time but also enhances accuracy, ensuring your financial records are always up-to-date and reliable.

Bank Integration for QuickBooks: Streamlining Your Finances

For QuickBooks users, seamless bank integration is more than just a convenience; it’s a game-changer. It transforms the way you manage your finances, saving you time, reducing errors, and providing a clear, real-time picture of your business’s financial health.

Finding the best bank integration for QuickBooks can feel like a never-ending quest. You want seamless syncing, robust features, and a reliable partner. But with all the options out there, it’s easy to get overwhelmed. And just when you think you’ve found the perfect solution, you start wondering, “Is content marketing dead?” is content marketing dead Thankfully, the answer is a resounding no! Content marketing remains a powerful tool for attracting customers and building trust.

So, keep your eyes peeled for the best bank integrations for QuickBooks – they’re out there, waiting to streamline your finances and boost your business!

Imagine a world where your bank transactions automatically flow into QuickBooks, eliminating the need for manual data entry. With this integration, you can say goodbye to tedious reconciliation processes, minimize the risk of human error, and gain instant access to accurate financial insights.

Benefits of Integrating QuickBooks with a Bank

The benefits of connecting your QuickBooks account to your bank are numerous, offering a significant advantage to businesses of all sizes. This integration simplifies accounting tasks, improves financial management, and ultimately empowers you to make better business decisions.

- Automated Transactions:This eliminates the need for manual data entry, saving you time and reducing the risk of errors. Transactions are automatically categorized and reconciled, streamlining your bookkeeping process.

- Real-Time Financial Visibility:Get instant access to your latest bank balances, transaction details, and account activity, providing a clear picture of your financial position.

- Improved Accuracy:By eliminating manual data entry, bank integration minimizes the risk of human errors in recording transactions. This leads to more accurate financial reports and a better understanding of your business’s financial health.

- Enhanced Reconciliation:Automated reconciliation simplifies the process of matching bank statements with QuickBooks transactions, saving you time and effort. This ensures that your records are accurate and up-to-date.

- Streamlined Reporting:With accurate and up-to-date financial data, you can generate more insightful reports and make data-driven decisions. This helps you understand your cash flow, track expenses, and identify areas for improvement.

Examples of Streamlined Accounting Tasks

Bank integration simplifies numerous accounting tasks, offering tangible benefits to your daily operations. Here are some examples of how this integration streamlines your financial management:

- Reconciliation:Instead of manually comparing bank statements with QuickBooks transactions, the system automatically matches them, eliminating the need for tedious manual reconciliation.

- Expense Tracking:Bank integration automatically categorizes your transactions, making it easier to track your expenses and identify areas where you can save money.

- Cash Flow Management:With real-time access to your bank balances and transaction history, you can gain a clear understanding of your cash flow, enabling you to make informed decisions about your business finances.

- Invoice Payment Tracking:The integration allows you to monitor the status of invoice payments, ensuring that you receive payments on time and maintain a healthy cash flow.

Key Features to Consider

Choosing the right bank integration solution for QuickBooks can significantly streamline your financial management. Several features are crucial to maximizing efficiency and accuracy.

Real-Time Bank Feeds

Real-time bank feeds are essential for keeping your QuickBooks data up-to-date. This feature automatically downloads transactions from your bank account into QuickBooks, eliminating the need for manual data entry.

- Eliminates manual data entry errors:Real-time feeds reduce the risk of human error, ensuring accuracy in your financial records.

- Provides a complete financial picture:With real-time updates, you have a clear and accurate view of your cash flow and financial position.

- Improves efficiency:Automatic transaction updates free up your time for more strategic tasks.

Automatic Transaction Matching

This feature automatically matches transactions between your bank account and QuickBooks, reducing the time and effort required for reconciliation.

Finding the best bank for QuickBooks integration can be a real game-changer for your business. Just like putting together a stunning cheese board, the right tools can make all the difference. Speaking of cheese boards, check out this awesome guide on diy a fruit slice cheese board – it’s the perfect complement to your next business meeting! Back to the bank integration, the right partnership will streamline your finances, making everything from bill payments to reconciliation a breeze.

- Saves time and effort:Automatic matching eliminates the need to manually compare transactions, saving valuable time.

- Increases accuracy:The automated process minimizes the risk of human error, ensuring accurate reconciliation.

- Improves financial reporting:Accurate reconciliation leads to more reliable financial statements and reports.

Reconciliation Capabilities

Robust reconciliation capabilities allow you to easily match transactions and identify any discrepancies.

- Simplifies the reconciliation process:Features like transaction filters and sorting options make it easier to identify and resolve discrepancies.

- Provides a clear audit trail:Reconciled transactions are documented, providing a clear audit trail for financial reporting and regulatory compliance.

- Improves financial control:Regular reconciliation helps identify potential errors or fraud, ensuring better financial control.

Bank Statement Downloads

This feature allows you to download bank statements directly into QuickBooks, eliminating the need to manually import them.

- Saves time and effort:Direct downloads eliminate the need to manually enter data from bank statements.

- Ensures accuracy:Automated downloads reduce the risk of data entry errors.

- Simplifies recordkeeping:Bank statements are stored within QuickBooks, simplifying recordkeeping and making it easier to retrieve information.

Transaction Categorization

This feature automatically categorizes transactions, making it easier to track expenses and income.

- Improves financial analysis:Categorized transactions provide valuable insights into spending patterns and revenue streams.

- Facilitates budgeting:By tracking spending by category, you can identify areas for potential savings and make informed budgeting decisions.

- Enhances financial reporting:Categorized transactions improve the accuracy and usefulness of financial reports.

Reporting Functionalities

Robust reporting functionalities allow you to generate insightful reports on your financial performance.

- Provides valuable insights:Reports can highlight trends, identify areas for improvement, and support decision-making.

- Enhances financial visibility:Comprehensive reporting provides a clear picture of your financial health.

- Facilitates compliance:Reporting functionalities can be used to generate reports required for tax filing and regulatory compliance.

Top Banks with QuickBooks Integration

Integrating your bank accounts with QuickBooks can be a game-changer for managing your business finances. It automates tedious tasks, reduces errors, and provides real-time insights into your financial health. Several leading banks offer seamless QuickBooks integration, providing a range of features and benefits for businesses of all sizes.

This article will explore some of the top banks offering QuickBooks integration, highlighting their key features and benefits.

Finding the best banks for QuickBooks integration can be a real headache, especially if you’re trying to manage your finances and streamline your workflow. If you’re looking for some inspiration on how to make your home office work for you, check out at home with mandy pellegrin for some great tips and tricks.

Once you’ve got your workspace sorted, you can focus on finding the right bank integration for your QuickBooks setup and boost your business efficiency.

Top Banks with QuickBooks Integration

Here’s a table comparing some of the leading banks offering QuickBooks integration:

| Bank | QuickBooks Versions Supported | Integration Methods | Key Features |

|---|---|---|---|

| Bank of America | QuickBooks Online, QuickBooks Desktop | API, Direct Connect | Automatic transaction download, reconciliation, reporting, online banking integration, mobile app access. |

| Chase | QuickBooks Online, QuickBooks Desktop | API, Direct Connect | Real-time transaction updates, account aggregation, customizable reports, mobile app access. |

| Wells Fargo | QuickBooks Online, QuickBooks Desktop | API, Direct Connect | Automated transaction download, reconciliation, reporting, online banking integration, mobile app access. |

| Citibank | QuickBooks Online, QuickBooks Desktop | API, Direct Connect | Real-time transaction updates, account aggregation, customizable reports, mobile app access. |

Integration Process and Setup

Integrating your bank account with QuickBooks is a straightforward process that allows you to automate financial data entry and gain valuable insights into your business finances. The integration process typically involves connecting your bank account to QuickBooks Online using a secure connection.

Once connected, your transactions will be automatically imported into QuickBooks, eliminating manual data entry and reducing the risk of errors.

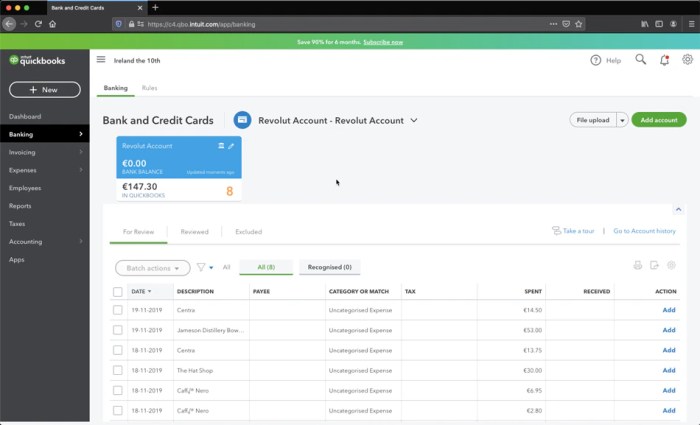

Connecting QuickBooks to a Bank Account, Best banks quickbooks integration

The process of connecting QuickBooks to a bank account involves a series of steps designed to ensure secure data transfer and access.

- Select the “Banking” tab in QuickBooks Online.This will take you to the banking section where you can manage your bank accounts and transactions.

- Click on “Connect a Bank.”This will initiate the bank connection process.

- Search for your bank.Enter your bank’s name in the search bar and select it from the list.

- Log in to your bank account.QuickBooks will redirect you to your bank’s website to securely authenticate your login credentials.

- Authorize QuickBooks to access your account.Review the permissions requested by QuickBooks and grant access to your bank account information.

- Choose the accounts to connect.Select the specific bank accounts you want to integrate with QuickBooks.

- Review and confirm the connection.QuickBooks will display a summary of the connected accounts. Verify the details and confirm the connection.

Challenges and Solutions

While the bank integration process is generally seamless, you might encounter certain challenges during setup.

- Incorrect bank credentials:Double-check your bank login information for accuracy. Ensure you are using the correct username, password, and any security codes or tokens required.

- Bank compatibility issues:Some banks may not offer direct integration with QuickBooks. In such cases, you can use a third-party service like Plaid or Yodlee to facilitate the connection. These services act as intermediaries between your bank and QuickBooks, ensuring secure data transfer.

- Transaction matching issues:QuickBooks may struggle to automatically match transactions with your existing entries. This can occur due to discrepancies in transaction details or insufficient information. To resolve this, manually match transactions or edit transaction details in QuickBooks.

Comparison of Integration Methods: Best Banks Quickbooks Integration

Choosing the right bank integration method for QuickBooks is crucial for seamless financial management. Understanding the pros and cons of each approach helps you select the most suitable option for your specific business needs.

API Integration

API integration is the most advanced and often preferred method for connecting QuickBooks with your bank accounts. It utilizes Application Programming Interfaces (APIs) to enable direct communication between the two systems. This real-time data exchange eliminates manual steps, minimizing errors and enhancing efficiency.

Advantages of API Integration

- Real-Time Data Synchronization:API integration facilitates continuous data flow between your bank and QuickBooks, ensuring your financial records are always up-to-date.

- Automated Transactions:With API integration, transactions are automatically imported into QuickBooks, eliminating the need for manual data entry and reducing the risk of human error.

- Enhanced Security:API integration typically employs secure protocols and encryption to safeguard sensitive financial data during transmission.

- Improved Accuracy:Automated data exchange minimizes the chances of manual input errors, resulting in more accurate financial reports and analysis.

Disadvantages of API Integration

- Technical Complexity:API integration often requires technical expertise for setup and maintenance, potentially involving third-party developers or IT support.

- Limited Bank Support:Not all banks offer API integration, limiting the choice for some businesses.

- Potential for Glitches:While generally reliable, API connections can occasionally experience glitches or disruptions, requiring troubleshooting and resolution.

Direct Connect Integration

Direct Connect integration offers a simplified approach to connecting QuickBooks with your bank accounts. This method leverages a secure connection between the two systems, allowing for direct data exchange without the need for APIs.

Advantages of Direct Connect Integration

- User-Friendly Setup:Direct Connect integration typically involves a straightforward setup process, often guided by intuitive instructions within QuickBooks.

- Wide Bank Compatibility:Direct Connect is supported by a wider range of banks compared to API integration, offering greater flexibility for businesses.

- Reliable Data Transfer:Direct Connect integration provides a secure and reliable channel for data exchange between your bank and QuickBooks.

Disadvantages of Direct Connect Integration

- Less Frequent Updates:Direct Connect typically updates data less frequently than API integration, potentially leading to slight delays in reflecting recent transactions.

- Limited Functionality:Direct Connect integration may not offer the same level of functionality as API integration, such as automatic reconciliation or advanced reporting features.

Manual Import

Manual import is the least automated and often the least efficient method for bank integration with QuickBooks. It involves manually downloading transaction data from your bank’s website and then importing it into QuickBooks.

Advantages of Manual Import

- No Software Dependencies:Manual import does not require any specific software or integrations, making it accessible to businesses with limited technical resources.

- Cost-Effective:Manual import is typically free of charge, eliminating any additional software costs associated with other integration methods.

Disadvantages of Manual Import

- Time-Consuming:Manual import requires significant manual effort, consuming valuable time that could be dedicated to other business tasks.

- Prone to Errors:Manual data entry increases the risk of human error, potentially leading to inaccuracies in your financial records.

- Inefficient Reconciliation:Manual import makes reconciliation more challenging, as it involves manually matching transactions between your bank statements and QuickBooks.

Security and Data Privacy

Integrating your bank accounts with QuickBooks offers significant benefits, but it also raises important security considerations. Protecting your sensitive financial data is paramount, and both banks and QuickBooks providers implement robust measures to ensure data privacy and compliance.

Data Encryption and Secure Communication

Data encryption is a crucial aspect of safeguarding your financial information. Banks and QuickBooks use industry-standard encryption protocols to protect data transmitted between your bank account and QuickBooks. This ensures that your account details, transaction history, and other sensitive information are scrambled and unreadable to unauthorized individuals during transmission.

- Transport Layer Security (TLS): TLS is a widely used encryption protocol that establishes a secure connection between your web browser and the bank’s or QuickBooks’s server, protecting data exchanged during the integration process.

- Secure Sockets Layer (SSL): SSL is another common encryption protocol that provides secure communication between your computer and the bank or QuickBooks server, ensuring that your data is transmitted securely.

Access Control and User Authentication

To prevent unauthorized access to your financial data, both banks and QuickBooks employ robust access control mechanisms. These measures ensure that only authorized individuals can view and manage your financial information.

- Multi-factor Authentication (MFA): MFA adds an extra layer of security by requiring you to provide multiple forms of identification before granting access to your accounts. This could involve entering a password, receiving a one-time code on your mobile device, or using a fingerprint scanner.

- Role-based Access Control (RBAC): RBAC allows administrators to assign different levels of access to users based on their roles within the organization. This ensures that only authorized individuals can access specific data and perform certain actions.

Data Storage and Security

Banks and QuickBooks providers store your financial data in secure data centers with advanced security measures. These measures include:

- Physical Security: Data centers are equipped with physical security measures, such as surveillance cameras, access control systems, and security personnel, to prevent unauthorized access to the facilities.

- Logical Security: Logical security measures, such as firewalls, intrusion detection systems, and regular security audits, are implemented to protect data from unauthorized access and cyberattacks.

Compliance with Industry Standards

Banks and QuickBooks providers adhere to industry-standard regulations and compliance frameworks to protect your financial data.

- Payment Card Industry Data Security Standard (PCI DSS): This standard applies to organizations that process, store, or transmit credit card data. It Artikels security requirements for protecting cardholder data.

- General Data Protection Regulation (GDPR): This regulation applies to organizations that process personal data of individuals within the European Union. It sets stringent requirements for data protection, including consent, transparency, and data subject rights.

Best Practices for Safeguarding Your Data

While banks and QuickBooks providers take comprehensive security measures, it’s crucial to follow best practices to protect your financial information:

- Use Strong Passwords: Choose strong passwords that are difficult to guess and use a unique password for each account.

- Enable Two-Factor Authentication: Whenever possible, enable two-factor authentication for your bank and QuickBooks accounts.

- Be Cautious of Phishing Attempts: Be wary of suspicious emails or links that ask for your financial information. Never provide your login credentials or sensitive information through unverified channels.

- Monitor Your Accounts Regularly: Regularly review your bank and QuickBooks account statements for any suspicious activity.

- Keep Your Software Updated: Ensure that your QuickBooks software and your computer’s operating system are updated with the latest security patches.

Case Studies and Success Stories

Seeing is believing, and the real-world success stories of businesses using QuickBooks bank integration are compelling evidence of its transformative power. These case studies showcase how seamless integration can streamline financial management, boost efficiency, and enhance accuracy, ultimately leading to greater profitability and peace of mind.

Examples of Businesses Successfully Using QuickBooks Bank Integration

The benefits of QuickBooks bank integration extend across diverse industries, empowering businesses of all sizes to manage their finances more effectively. Here are some examples of businesses that have experienced significant improvements:

- Small Retail Store:A small retail store struggling with manual reconciliation and data entry found relief through QuickBooks bank integration. Automatic transaction syncing eliminated tedious manual work, freeing up valuable time for customer service and inventory management. The automated process also reduced errors, ensuring accurate financial records and improved reporting.

- Growing Service-Based Business:A growing service-based business faced challenges with managing multiple bank accounts and reconciling transactions. QuickBooks bank integration simplified account management by consolidating all transactions into one platform. The ability to categorize transactions automatically saved significant time and effort, allowing the business to focus on core operations and growth.

- Large Manufacturing Company:A large manufacturing company with complex financial operations sought a solution to streamline bank reconciliation and improve financial reporting. QuickBooks bank integration provided a centralized platform for managing multiple bank accounts, automating reconciliation, and generating accurate financial reports. This streamlined process improved efficiency and reduced the risk of errors, enabling the company to make informed financial decisions.

Benefits of QuickBooks Bank Integration

Businesses using QuickBooks bank integration have reported a wide range of benefits, including:

- Improved Financial Management:Integration provides a centralized platform for managing all bank accounts, streamlining reconciliation, and generating accurate financial reports. This improved financial management enables businesses to make informed financial decisions, track cash flow, and identify potential financial issues early on.

- Increased Efficiency:Automating transaction syncing and reconciliation eliminates manual data entry, saving valuable time and effort. This freed-up time can be redirected to core business operations, leading to increased productivity and efficiency.

- Enhanced Accuracy:Automation reduces the risk of human error, ensuring accurate financial records and reports. This improved accuracy provides a reliable foundation for decision-making and financial reporting.

Features Contributing to Success

Specific features of QuickBooks bank integration have played a key role in the success of these businesses:

- Automatic Transaction Syncing:This feature eliminates the need for manual data entry, saving time and reducing errors. Transactions are automatically downloaded from bank accounts into QuickBooks, ensuring up-to-date financial records.

- Reconciliation Automation:QuickBooks bank integration automates the reconciliation process, matching transactions between bank statements and QuickBooks records. This significantly reduces the time and effort required for manual reconciliation.

- Categorization and Reporting:The integration allows for automated categorization of transactions, making it easier to track expenses and generate insightful financial reports. This improved reporting provides valuable insights into business performance and financial health.

Future Trends in Bank Integration

The landscape of bank integration with QuickBooks is evolving rapidly, driven by advancements in technology and a growing demand for seamless financial management solutions. Emerging trends are shaping the future of integration, promising enhanced automation, deeper insights, and a more personalized experience for businesses.

Impact of Open Banking and AI

Open banking is revolutionizing the way financial data is shared and utilized. This framework allows third-party applications, like QuickBooks, to access and utilize bank data with user consent. This opens up exciting possibilities for more robust integration, enabling QuickBooks to automatically pull in transactions, categorize them, and reconcile accounts in real-time.

Open banking is poised to transform bank integration by creating a more interconnected financial ecosystem, where data flows freely between banks and accounting software.

Artificial intelligence (AI) is another game-changer. AI algorithms can analyze vast amounts of financial data, identify patterns, and provide predictive insights. AI-powered features within QuickBooks can automate tasks like invoice generation, expense tracking, and fraud detection.

- Predictive Analytics:AI can analyze spending patterns and predict future cash flow needs, helping businesses make informed financial decisions.

- Automated Reconciliation:AI algorithms can automatically match transactions between bank statements and QuickBooks records, reducing manual effort and improving accuracy.

- Personalized Financial Insights:AI can tailor financial reports and dashboards to individual business needs, providing actionable insights that support strategic planning.