Gross Profit vs Net Profit: Understanding the Difference

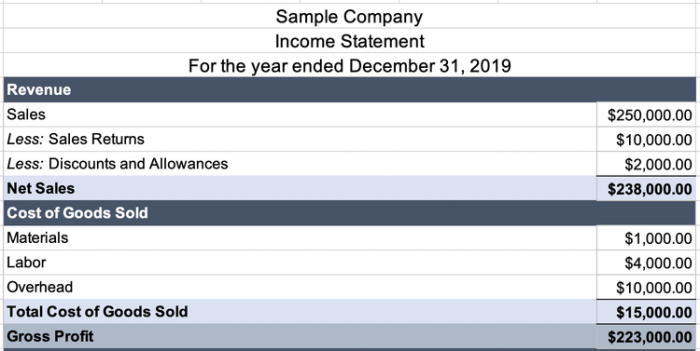

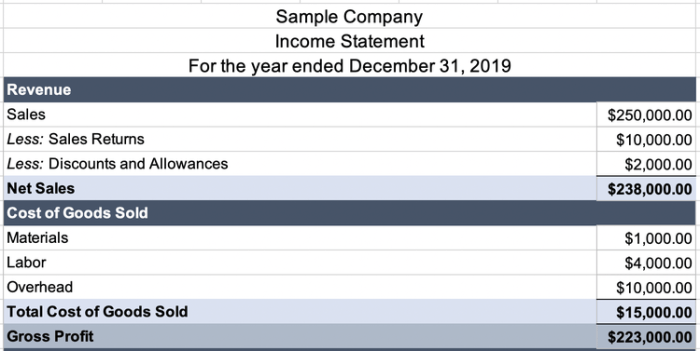

Gross profit vs net profit – these two terms are often thrown around in the business world, but do you truly understand the difference? While both are essential indicators of a company’s financial health, they tell different stories. Gross profit focuses on the core business operations, revealing how much money a company makes after deducting the direct costs of producing its goods or services.

On the other hand, net profit paints a broader picture, taking into account all expenses, including those not directly related to production, to show the company’s true profitability.

This post dives into the intricacies of these two vital financial metrics, exploring their calculation, applications, and limitations. We’ll also analyze their respective margins and examine how they can influence decision-making. By the end, you’ll have a clear understanding of how gross profit and net profit work together to paint a comprehensive picture of a company’s financial performance.

Defining Net Profit: Gross Profit Vs Net Profit

Net profit, also known as net income, is the ultimate measure of a company’s profitability. It represents the amount of money a company has left over after paying all its expenses. This profit is what remains after subtracting all costs, including the cost of goods sold, operating expenses, interest expenses, and taxes, from total revenue.

Calculation of Net Profit

Net profit is calculated by subtracting total expenses from total revenue. The formula is:

Net Profit = Total Revenue

Total Expenses

Total revenue represents the total amount of money a company earns from its operations. Total expenses include all costs incurred by the company to generate revenue.

Examples of Operating Expenses, Interest Expenses, and Taxes

Operating Expenses

Operating expenses are the costs associated with running a business on a day-to-day basis. Examples include:

- Rent

- Salaries

- Utilities

- Marketing and advertising

- Insurance

Interest Expenses

Interest expenses are the costs incurred by a company for borrowing money. These expenses are typically calculated as a percentage of the amount borrowed.

Taxes

Taxes are the payments made by a company to the government based on its profits. These expenses can vary depending on the company’s location and the applicable tax laws.

Assessing a Company’s Overall Profitability, Gross profit vs net profit

Net profit is a crucial indicator of a company’s overall profitability. A higher net profit generally indicates that a company is managing its operations efficiently and generating more revenue than expenses. Investors and lenders often use net profit to assess a company’s financial health and make investment decisions.

Understanding the difference between gross profit and net profit is crucial for any business owner. Gross profit is the revenue minus the cost of goods sold, while net profit considers all expenses, including marketing, salaries, and rent. Think about how password managers built teams to improve security and efficiency – they likely focused on both gross profit (cost of development) and net profit (marketing and sales).

Similarly, businesses need to balance these two figures to ensure sustainable growth and profitability.

Gross profit is what you make after subtracting the cost of goods sold, while net profit takes into account all your expenses. Thinking about these figures might make you wonder if those AirPods on sale for Prime Day are really worth it – maybe you should check out this article on alternative headphones before you decide.

After all, a higher net profit means you have more money to invest back into your business or spend on yourself!

Gross profit is the difference between revenue and the cost of goods sold, while net profit takes into account all expenses, including operating, administrative, and marketing costs. When considering a purchase like the Samsung’s iMac-like 32-inch smart monitor , it’s important to remember that while the cost might be attractive, you should also factor in the potential for increased productivity and efficiency, which can ultimately impact your net profit.