QuickBooks Payroll vs SurePayroll: Which is Right for You?

QuickBooks Payroll vs SurePayroll: Choosing the right payroll solution for your business can be a daunting task, especially with so many options available. Both QuickBooks Payroll and SurePayroll are popular choices, but they cater to different needs and offer unique features.

This comparison dives deep into the strengths and weaknesses of each platform, helping you make an informed decision that aligns with your business goals.

Whether you’re a small startup or a growing enterprise, navigating the complexities of payroll processing, tax compliance, and employee management can be a headache. This is where dedicated payroll solutions like QuickBooks Payroll and SurePayroll come in. They streamline these processes, offering a range of features designed to simplify payroll administration and ensure accuracy.

Overview

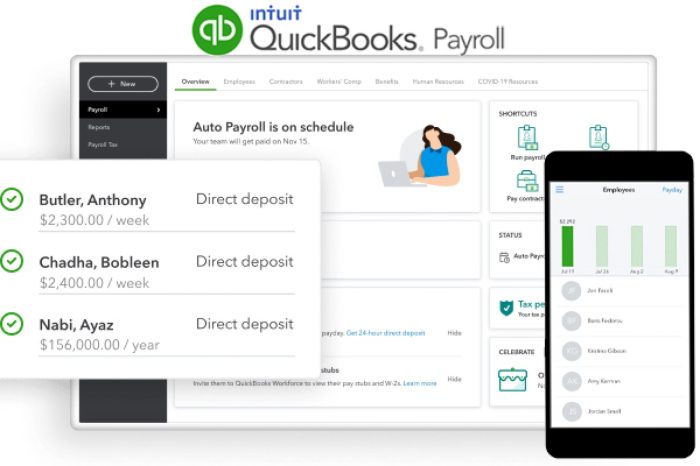

QuickBooks Payroll and SurePayroll are popular payroll solutions designed to streamline the payroll process for businesses of all sizes. QuickBooks Payroll, a product of Intuit, is a comprehensive solution integrated with QuickBooks accounting software, offering features such as payroll processing, tax filing, direct deposit, and employee benefits administration.

SurePayroll, a product of Paychex, is a cloud-based payroll solution known for its user-friendly interface and affordable pricing, targeting small businesses and freelancers.Comparing QuickBooks Payroll and SurePayroll helps businesses make informed decisions based on their specific needs, budget, and desired level of integration with other business systems.

Key Features and Target Audience

QuickBooks Payroll and SurePayroll cater to different business needs and offer unique features.

- QuickBooks Payroll: Primarily targets businesses already using QuickBooks accounting software, providing seamless integration with their financial records. It offers a wide range of features, including:

- Payroll processing for hourly, salaried, and contract employees

- Tax filing and compliance with federal, state, and local regulations

- Direct deposit and paper check options for employee payments

- Employee benefits administration, including health insurance and retirement plans

- Time tracking and expense management tools

- Integration with other QuickBooks products, such as QuickBooks Online and QuickBooks Self-Employed

- SurePayroll: Primarily targets small businesses and freelancers, offering a user-friendly interface and flexible pricing plans. Key features include:

- Payroll processing for hourly, salaried, and contract employees

- Tax filing and compliance with federal, state, and local regulations

- Direct deposit and paper check options for employee payments

- Employee benefits administration, including health insurance and retirement plans

- Mobile app for managing payroll on the go

- Integration with other business software, such as accounting and HR platforms

Features and Functionality

Both QuickBooks Payroll and SurePayroll offer a comprehensive suite of features designed to simplify payroll processing and management. However, their strengths and weaknesses lie in different areas, making one platform potentially more suitable for certain businesses than the other.

Payroll Processing

Payroll processing is the core functionality of both platforms. Both QuickBooks Payroll and SurePayroll automate the calculation of employee wages, deductions, and taxes, ensuring accurate and timely payments.

Choosing between QuickBooks Payroll and SurePayroll can be a tough decision for small business owners. Both offer features like direct deposit and tax filing, but their strengths lie in different areas. It’s fascinating to see how these companies are leveraging Google generative AI chatbots to analyze customer data and improve their services.

Ultimately, the best payroll solution depends on your specific needs and budget, so research both options carefully before making a decision.

- QuickBooks Payroll integrates seamlessly with QuickBooks accounting software, simplifying data entry and providing a unified view of financial records.

- SurePayroll offers a user-friendly interface, making it easy to navigate and manage payroll tasks.

Tax Filing

Both platforms handle federal, state, and local tax filings, ensuring compliance with all applicable regulations.

- QuickBooks Payroll offers a comprehensive suite of tax forms and filing options, catering to a wide range of businesses.

- SurePayroll streamlines the tax filing process, offering automated calculations and e-filing capabilities.

Direct Deposit, Quickbooks payroll vs surepayroll

Both platforms support direct deposit, enabling businesses to deposit employee paychecks directly into their bank accounts.

- QuickBooks Payroll offers flexible direct deposit options, allowing businesses to customize payment schedules and amounts.

- SurePayroll provides secure and reliable direct deposit services, ensuring timely and accurate payments.

Employee Onboarding

Both platforms offer tools to facilitate employee onboarding, helping businesses streamline the hiring process and onboard new employees efficiently.

- QuickBooks Payroll provides features like electronic I-9 forms and employee handbooks to simplify the onboarding process.

- SurePayroll offers customizable onboarding checklists and communication tools to keep new employees informed and engaged.

Time Tracking

Both platforms offer time tracking capabilities, allowing businesses to track employee hours worked and ensure accurate payroll calculations.

- QuickBooks Payroll integrates with time tracking software like TSheets, providing a comprehensive solution for time and attendance management.

- SurePayroll offers a built-in time tracking feature, allowing employees to clock in and out directly from the platform.

Reporting

Both platforms provide detailed reporting capabilities, allowing businesses to analyze payroll data and make informed decisions.

- QuickBooks Payroll offers a wide range of customizable reports, providing insights into payroll expenses, tax liabilities, and employee performance.

- SurePayroll offers user-friendly reports that provide key payroll metrics and insights, helping businesses track payroll trends and make data-driven decisions.

Feature Comparison Table

| Feature | QuickBooks Payroll | SurePayroll |

|---|---|---|

| Payroll Processing | Seamless integration with QuickBooks accounting software | User-friendly interface for easy navigation |

| Tax Filing | Comprehensive suite of tax forms and filing options | Streamlined tax filing process with automated calculations and e-filing |

| Direct Deposit | Flexible direct deposit options with customizable payment schedules | Secure and reliable direct deposit services for timely payments |

| Employee Onboarding | Electronic I-9 forms and employee handbooks for efficient onboarding | Customizable onboarding checklists and communication tools |

| Time Tracking | Integration with time tracking software like TSheets | Built-in time tracking feature for employee clock-in and clock-out |

| Reporting | Wide range of customizable reports for detailed payroll analysis | User-friendly reports for tracking payroll trends and making data-driven decisions |

Pricing and Plans

Choosing the right payroll software for your business depends on various factors, including the size of your workforce, budget, and specific payroll needs. QuickBooks Payroll and SurePayroll are popular options with different pricing structures and features. This section compares their pricing plans to help you make an informed decision.

Choosing between QuickBooks Payroll and SurePayroll can be a tough decision, especially when considering factors like pricing, features, and ease of use. But the recent news that Apple could face a class action lawsuit over iCloud’s 5GB free plan and limitations on third-party backup alternatives makes me wonder if we’ll see more scrutiny on how companies manage data storage and access.

Back to QuickBooks Payroll and SurePayroll, I’d say the best option for you depends on your specific business needs and budget.

Pricing Plans and Features

Both QuickBooks Payroll and SurePayroll offer various pricing plans to cater to different business needs. Here’s a breakdown of their plans and key features:

| Feature | QuickBooks Payroll | SurePayroll |

|---|---|---|

| Plans | Self-Employed, Simple Start, Essentials, Premium, Elite | Basic, Plus, Premium |

| Pricing | Starts at $45 per month for Self-Employed; $55 per month for Simple Start; $85 per month for Essentials; $115 per month for Premium; $145 per month for Elite | Starts at $39 per month for Basic; $59 per month for Plus; $79 per month for Premium |

| Payroll Features |

|

|

| Additional Features |

|

|

| Value Proposition | QuickBooks Payroll offers a comprehensive payroll solution with strong integration with QuickBooks Online, making it a good choice for businesses that already use QuickBooks. Its premium plans include robust HR features. | SurePayroll provides a more affordable option, particularly for small businesses. Its Plus and Premium plans offer competitive features, including time tracking and HR support. |

Ease of Use and User Experience

When choosing a payroll software, ease of use and user experience are crucial factors. Both QuickBooks Payroll and SurePayroll aim to provide user-friendly platforms, but their approaches differ.

Interface Design and Navigation

Both platforms offer intuitive interfaces, but QuickBooks Payroll has a more polished and modern design, while SurePayroll’s interface might feel slightly outdated.

- QuickBooks Payroll:The interface is visually appealing and organized, with clear menus and icons. Navigation is straightforward, and users can easily find the features they need.

- SurePayroll:The interface is functional but may not be as visually appealing as QuickBooks Payroll. Navigation is generally intuitive, but some users might find it slightly less streamlined.

Onboarding Process

The onboarding process is the initial setup and configuration of the payroll software.

- QuickBooks Payroll:QuickBooks Payroll provides a guided onboarding process with helpful tutorials and resources. The process is relatively straightforward, especially for users familiar with QuickBooks products.

- SurePayroll:SurePayroll’s onboarding process is generally straightforward, but it might require more manual input compared to QuickBooks Payroll. The process is less guided, and users might need to refer to the help center more frequently.

User Feedback

User feedback on both platforms is generally positive, with many users appreciating the ease of use and helpful support resources.

- QuickBooks Payroll:Users praise the intuitive interface, robust features, and helpful customer support. Some users find the pricing to be a concern, especially for small businesses.

- SurePayroll:Users appreciate the simplicity and affordability of the platform. However, some users might find the interface less modern and the customer support less responsive compared to QuickBooks Payroll.

Customer Support and Resources

Getting reliable and timely support is crucial when using payroll software, as any errors or delays can have serious consequences. QuickBooks Payroll and SurePayroll both offer a range of customer support options, but they differ in their availability and quality.

Customer Support Channels

The availability of various customer support channels provides users with flexibility in choosing the most convenient method to reach out for assistance.

- Phone Support: Both QuickBooks Payroll and SurePayroll offer phone support as a primary option. QuickBooks Payroll provides 24/7 phone support, while SurePayroll’s phone support hours are limited to weekdays.

- Email Support: Both platforms also offer email support, allowing users to submit inquiries and receive responses within a reasonable timeframe. However, email support is typically slower than phone support.

- Live Chat: QuickBooks Payroll offers live chat support, providing users with immediate assistance during business hours. SurePayroll does not currently offer live chat support.

- Online Resources: Both platforms have comprehensive online resources, including FAQs, help articles, and video tutorials. These resources can help users find answers to common questions and resolve issues independently.

Quality and Responsiveness of Customer Support

The quality and responsiveness of customer support are essential factors in determining the overall user experience.

- QuickBooks Payroll: QuickBooks Payroll is generally known for its responsive and knowledgeable customer support. Users often report positive experiences with phone support, with agents able to resolve issues efficiently. The online resources are also comprehensive and easy to navigate. However, some users have reported longer wait times for phone support during peak hours.

Choosing the right payroll software can feel like wading through a sea of options, just like trying to pick the perfect VR headset. While QuickBooks Payroll and SurePayroll both offer solid features, I found that ive tested more than 15 vr headsets but theres only one id recommend buying this prime day for my needs.

Ultimately, the best choice for you will depend on your business size, budget, and specific payroll requirements.

- SurePayroll: SurePayroll’s customer support has received mixed reviews. While some users have praised the helpfulness and responsiveness of support agents, others have reported difficulties reaching support or receiving satisfactory solutions. The online resources are adequate but may not be as comprehensive as those offered by QuickBooks Payroll.

Integrations and Compatibility

Both QuickBooks Payroll and SurePayroll offer integration capabilities with other business software and applications. These integrations can streamline your workflow, automate tasks, and improve data accuracy. This section will delve into the specific integrations offered by each platform and their compatibility with various operating systems and devices.

Integrations with Other Software

The ability to integrate with other business software is crucial for seamless operations and data flow. Here’s a comparison of the integration capabilities of QuickBooks Payroll and SurePayroll:

- QuickBooks Payroll:QuickBooks Payroll seamlessly integrates with other Intuit products, such as QuickBooks Online and QuickBooks Self-Employed. It also integrates with popular third-party applications, including:

- Accounting Software:Xero, Zoho Books, FreshBooks

- CRM Software:Salesforce, HubSpot

- E-commerce Platforms:Shopify, BigCommerce

- Time Tracking Software:Toggl Track, Timely

- Project Management Software:Asana, Trello

- SurePayroll:SurePayroll offers a more limited range of integrations compared to QuickBooks Payroll. It integrates with popular accounting software like Xero and QuickBooks Online. However, its integration capabilities with other types of software are more limited.

Compatibility with Operating Systems and Devices

Both QuickBooks Payroll and SurePayroll are accessible from various operating systems and devices. This allows for flexibility and convenience in managing payroll tasks.

- QuickBooks Payroll:QuickBooks Payroll is compatible with Windows, macOS, iOS, and Android. This means you can access and manage payroll functions from your desktop computer, laptop, tablet, or smartphone.

- Desktop:Windows, macOS

- Mobile:iOS, Android

- SurePayroll:SurePayroll is also compatible with various operating systems and devices, including:

- Desktop:Windows, macOS

- Mobile:iOS, Android

Security and Compliance

Safeguarding your sensitive financial data and ensuring compliance with regulations are crucial considerations when choosing payroll software. Both QuickBooks Payroll and SurePayroll implement robust security measures and strive to comply with relevant industry standards.

Security Measures

Both QuickBooks Payroll and SurePayroll prioritize data security with comprehensive measures to protect your sensitive information.

- Data Encryption:Both platforms encrypt data both in transit and at rest using industry-standard encryption protocols, such as TLS/SSL and AES-256, to protect sensitive information from unauthorized access.

- Two-Factor Authentication (2FA):Both QuickBooks Payroll and SurePayroll offer two-factor authentication as an additional layer of security, requiring users to enter a code sent to their mobile device in addition to their password for login.

- Access Control and Permissions:Both platforms allow administrators to set granular access controls and permissions for different users, limiting access to sensitive information based on roles and responsibilities.

- Regular Security Audits:Both QuickBooks Payroll and SurePayroll undergo regular security audits by independent third-party organizations to assess and validate their security controls and practices.

- Security Monitoring and Incident Response:Both platforms have dedicated security teams that monitor their systems for potential threats and vulnerabilities and have established incident response plans to address security incidents promptly.

Compliance with Industry Standards and Regulations

Both QuickBooks Payroll and SurePayroll demonstrate their commitment to compliance with relevant industry standards and regulations.

- SOC 2 Compliance:Both platforms have achieved SOC 2 Type II compliance, demonstrating their adherence to rigorous security, availability, processing integrity, confidentiality, and privacy controls.

- PCI DSS Compliance:Both platforms comply with the Payment Card Industry Data Security Standard (PCI DSS) for handling sensitive payment card information securely.

- HIPAA Compliance:QuickBooks Payroll offers HIPAA-compliant features for businesses in the healthcare industry, enabling them to securely manage employee health information.

- GDPR Compliance:Both QuickBooks Payroll and SurePayroll have implemented measures to comply with the General Data Protection Regulation (GDPR), ensuring the protection of personal data of individuals in the European Union.

Target Audience and Use Cases

Both QuickBooks Payroll and SurePayroll are popular payroll solutions, but they cater to different types of businesses. Understanding their target audiences and ideal use cases can help you determine which platform is best suited for your specific needs.To effectively choose between QuickBooks Payroll and SurePayroll, it’s crucial to consider the unique characteristics of your business, including size, industry, and payroll requirements.

QuickBooks Payroll: Target Audience and Use Cases

QuickBooks Payroll is a comprehensive payroll solution that’s well-suited for a wide range of businesses. It’s particularly advantageous for businesses that already use QuickBooks for accounting and financial management.

- Small to Medium-Sized Businesses (SMBs):QuickBooks Payroll is a popular choice for businesses with up to 100 employees, providing a balance of features and affordability.

- Businesses Using QuickBooks for Accounting:Integrating seamlessly with QuickBooks, QuickBooks Payroll streamlines payroll processing and financial reporting, eliminating the need for manual data entry.

- Businesses in Various Industries:QuickBooks Payroll supports a wide range of industries, offering customizable features to meet specific needs.

- Businesses with Complex Payroll Needs:QuickBooks Payroll offers advanced features like multi-state payroll, employee benefits administration, and direct deposit, catering to businesses with intricate payroll requirements.

SurePayroll: Target Audience and Use Cases

SurePayroll specializes in providing easy-to-use payroll solutions for small businesses. Its intuitive interface and affordable pricing make it an attractive option for startups and entrepreneurs.

- Small Businesses and Startups:SurePayroll is designed for businesses with limited payroll experience, offering a simplified approach to payroll management.

- Businesses with Simple Payroll Needs:SurePayroll is ideal for businesses with basic payroll requirements, such as paying hourly wages and withholding taxes.

- Businesses with Limited Budget:SurePayroll offers competitive pricing plans, making it a cost-effective option for small businesses with tight budgets.

- Businesses Seeking Online Convenience:SurePayroll is entirely cloud-based, allowing you to manage payroll from any device with an internet connection.

Conclusion: Quickbooks Payroll Vs Surepayroll

Choosing the right payroll software can significantly impact your business’s efficiency and compliance. Both QuickBooks Payroll and SurePayroll offer robust features, but their strengths lie in different areas.

Key Findings and Recommendations

- QuickBooks Payrollexcels for businesses that already use QuickBooks Online for accounting and need a seamless integration. Its comprehensive features, including payroll, benefits administration, and time tracking, make it a powerful all-in-one solution. However, its pricing can be higher compared to SurePayroll, particularly for larger businesses.

- SurePayrollshines for small businesses and startups seeking a user-friendly and affordable payroll solution. Its simple interface and straightforward pricing make it easy to manage payroll without extensive accounting expertise. However, its features are less comprehensive compared to QuickBooks Payroll, and it lacks the same level of integration with other business applications.