What Is Value Added Tax: A Comprehensive Guide

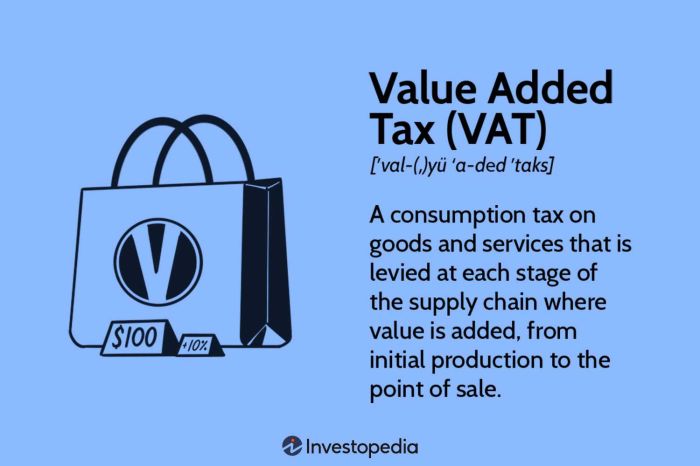

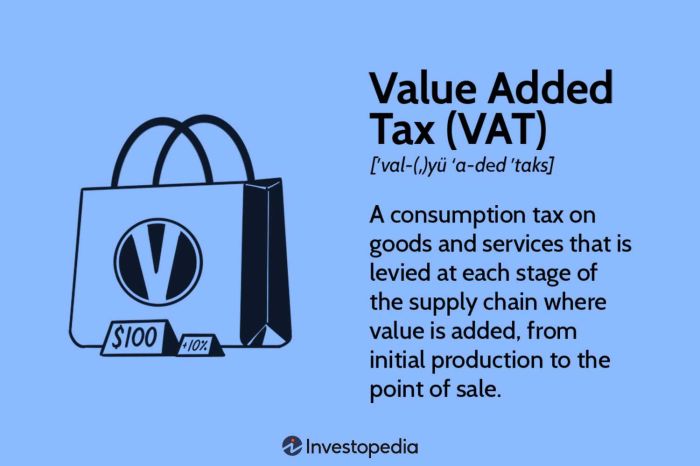

What is value added tax? It’s a common question, and one that deserves a thorough explanation. Value added tax (VAT) is a consumption tax that is levied on the value added to goods and services at each stage of production and distribution.

This means that businesses collect VAT from their customers and then pay it to the government, with the final burden falling on consumers.

From everyday items like groceries and clothing to services like restaurant meals and haircuts, VAT touches almost every aspect of our lives. Understanding how VAT works is essential for both consumers and businesses, as it can significantly impact purchasing decisions, pricing strategies, and overall economic activity.

Definition of Value-Added Tax (VAT)

Value-Added Tax (VAT) is a consumption tax levied on the value added to goods and services at each stage of production and distribution. It is a common form of taxation in many countries, playing a significant role in government revenue generation.

VAT as a Consumption Tax

VAT is considered a consumption tax because it is ultimately borne by the final consumer. The tax is collected at each stage of the production and distribution process, but it is ultimately passed on to the consumer through the price of the goods or services.

Examples of Goods and Services Subject to VAT

A wide range of goods and services are typically subject to VAT. Here are some common examples:

- Food and beverages

- Clothing and footwear

- Electronics and appliances

- Motor vehicles

- Accommodation and travel services

- Financial services

- Telecommunications services

VAT Calculation

VAT is calculated as a percentage of the value added at each stage of the production and distribution process. The value added is the difference between the selling price of a good or service and the cost of the inputs used to produce it.

Value added tax (VAT) is a consumption tax that is added to the price of goods and services. It’s a complex system, but it’s easy to understand when you think about fun projects like making diy mini gradient egg cup planters.

Imagine you’re buying the materials for your planters – each step of the way, from the egg cups to the paint, VAT is likely being added. The final price you pay reflects all those added costs, which ultimately go to the government.

So, the next time you’re making something awesome, remember that VAT is a part of the process!

VAT = (Value Added) x (VAT Rate)

To illustrate the calculation, let’s consider a simple example:A manufacturer produces a product for $100 and sells it to a retailer for $

- The retailer then sells the product to a consumer for $

- Assuming a VAT rate of 10%, the VAT payable at each stage would be:

- Manufacturer:VAT = ($150 – $100) x 10% = $5

- Retailer:VAT = ($200 – $150) x 10% = $5

The final consumer pays the total price of $200, which includes the VAT of $10.

How VAT Works

VAT is a consumption tax that is levied on the value added at each stage of the production and distribution process. This means that the tax is paid by consumers, but it is collected by businesses at each stage of the supply chain.

VAT Registration, What is value added tax

Businesses that exceed a certain turnover threshold are required to register for VAT. The registration process typically involves submitting an application to the relevant tax authority, providing information about the business, and obtaining a VAT registration number. The registration threshold varies from country to country, and it is important for businesses to understand the rules in their jurisdiction.

VAT Rates

VAT rates vary from country to country. Some countries have a single standard rate, while others have multiple rates for different types of goods and services. For example, in the United States, there is no national VAT, but many states have their own sales taxes, which are similar to VAT.

In the European Union, the standard VAT rate is 20%, but member states can apply reduced rates for certain goods and services, such as food, books, and medicines.

VAT Collection and Remittance

When a business sells goods or services, it charges VAT to the customer. The business then remits the VAT collected to the government. The amount of VAT that a business remits is calculated by subtracting the input VAT (the VAT that the business paid on its purchases) from the output VAT (the VAT that the business collected from its sales).

Value-added tax (VAT) is a consumption tax levied on the value added at each stage of production and distribution. It’s a common tax system in many countries, and it can be applied to a wide range of goods and services, including luxury items like those found at the Forzieri Taoist Treasures Taipei showroom.

Understanding VAT is crucial for businesses operating in countries with this tax system, as it affects their pricing and profitability.

VAT Remittance = Output VAT

Input VAT

For example, if a business sells goods for $100 and charges VAT at a rate of 10%, it will collect $10 in VAT from the customer. If the business paid $5 in input VAT on its purchases, it will remit $5 in VAT to the government.

Advantages and Disadvantages of VAT: What Is Value Added Tax

Value-Added Tax (VAT) is a widely used indirect tax system that has both advantages and disadvantages. Understanding these aspects is crucial for evaluating its effectiveness and impact on individuals and businesses.

Economic Benefits of VAT

VAT contributes significantly to a nation’s economy by generating revenue and stimulating consumption.

- Revenue Generation:VAT is a significant source of revenue for governments, providing funding for essential public services like healthcare, education, and infrastructure. Its broad base and efficiency in collection make it a reliable revenue stream. For example, in the European Union, VAT accounts for a substantial portion of government revenue, contributing to public spending on various sectors.

- Consumption Stimulation:By incorporating the tax into the price of goods and services, VAT encourages consumption. This is because consumers are more likely to purchase goods and services when they are already paying a portion of the tax. This effect can be particularly beneficial during economic downturns, where increased consumption can help stimulate growth.

Potential Drawbacks of VAT

While VAT offers economic benefits, it also presents certain drawbacks that can impact consumers and businesses.

- Impact on Consumer Prices:As VAT is embedded in the price of goods and services, it can contribute to inflation. This is because businesses pass on the tax to consumers, leading to higher prices. This impact can be particularly pronounced for essential goods and services, affecting low-income households disproportionately.

- Administrative Burden on Businesses:Implementing and managing VAT systems can be complex and burdensome for businesses. They need to track sales, purchases, and tax rates, which can require additional administrative resources and potentially increase compliance costs. This burden can be particularly challenging for small and medium-sized enterprises (SMEs) with limited resources.

Comparison with Other Tax Systems

VAT is often compared to other tax systems, such as sales tax, to understand its relative advantages and disadvantages.

- Sales Tax:Sales tax is a simpler tax system, typically levied at the point of sale. While it can be easier to administer, it is often considered less efficient than VAT in terms of revenue generation. This is because sales tax is typically levied only on final sales, while VAT is collected at each stage of production and distribution, leading to a broader tax base.

VAT in Different Countries

VAT, being a widely adopted taxation system, is implemented in various countries worldwide. The implementation of VAT, however, varies across different regions and industries, leading to diverse VAT rates, exemptions, and policies.

VAT Rates and Exemptions

VAT rates and exemptions vary considerably across countries. This section explores the specific VAT rates and exemptions in different countries, providing insights into the diverse approaches to VAT implementation.

- European Union:The European Union has a standardized VAT system, with member states setting their own VAT rates within a specified range. The standard VAT rate is generally between 15% and 25%, while reduced rates apply to specific goods and services, such as food, books, and medical supplies.

- United States:The United States does not have a federal-level VAT. Instead, individual states have their own sales taxes, which function similarly to VAT. These sales tax rates vary significantly from state to state, with some states having no sales tax at all.

- Canada:Canada has a national Goods and Services Tax (GST) of 5%. Provinces and territories may also impose their own provincial sales taxes (PST), which are combined with the GST.

- Australia:Australia has a Goods and Services Tax (GST) of 10%. The GST applies to most goods and services, with some exceptions, such as basic food items and medical services.

- Japan:Japan has a consumption tax of 10%. The consumption tax applies to most goods and services, with some exceptions, such as basic food items and medical services.

VAT Policies and Variations

VAT policies can vary significantly across different regions and industries. This section examines the various factors that contribute to these variations, highlighting the complexities of VAT implementation.

- Regional Differences:VAT policies can vary significantly across different regions within a country. For instance, in some countries, certain regions may have lower VAT rates on specific goods or services to promote economic development.

- Industry-Specific Exemptions:Many countries have industry-specific exemptions from VAT. For example, certain sectors, such as healthcare, education, or charities, may be exempt from VAT to encourage their development or to provide essential services at affordable prices.

- Zero-Rating:Some goods and services may be zero-rated for VAT. This means that the VAT rate is 0%, but the goods or services are still subject to the VAT registration and reporting requirements. Zero-rating is often used for exports, to prevent cascading VAT on goods that are exported from a country.

- Reverse Charge Mechanism:The reverse charge mechanism is a special VAT rule that applies to certain transactions. In a reverse charge transaction, the recipient of the goods or services is responsible for paying the VAT instead of the supplier. This mechanism is often used for transactions involving imported goods or services, or for transactions between businesses in different VAT jurisdictions.

Value added tax (VAT) is a consumption tax that’s added to the price of goods and services. It’s a common tax system in many countries, including those where luxury yachting is popular. It’s interesting to see how VAT might be applied to the exciting news that the yacht club de monaco and astir marina vouliagmeni take another step in their collaboration , as this could have implications for the luxury boating market in the Mediterranean.

VAT can be a complex topic, especially when it comes to international transactions, so it’s always good to stay informed about how it might affect the industries we love.

VAT and the Consumer

The Value-Added Tax (VAT) is a consumption tax that is levied on goods and services at each stage of production and distribution. It is ultimately borne by the final consumer, who pays the VAT included in the price of the product or service.

This section will explore how VAT affects consumer prices and purchasing decisions, as well as its potential impact on low-income households.

Impact on Consumer Prices and Purchasing Decisions

VAT is a significant factor in determining the final price of goods and services. When a VAT is imposed, businesses typically pass on the cost to consumers by increasing the price of their products or services. This means that consumers end up paying more for the same goods and services.

The impact of VAT on consumer purchasing decisions can be complex. For essential goods and services, such as food and healthcare, consumers may have limited options to reduce their spending, as these items are necessities. However, for discretionary items, such as entertainment or luxury goods, consumers may be more sensitive to price increases and may choose to reduce their spending or substitute for cheaper alternatives.

For example, a 10% VAT on a $100 item will result in a final price of $110. This may lead some consumers to choose a cheaper alternative or delay their purchase.

Impact on Low-Income Households

VAT can disproportionately impact low-income households. As a regressive tax, VAT tends to take a larger percentage of income from lower-income earners than from higher-income earners. This is because lower-income households typically spend a larger proportion of their income on essential goods and services that are subject to VAT.

For example, a household earning $20,000 per year may spend a significant portion of their income on food, utilities, and transportation, all of which are subject to VAT. A higher-income household earning $100,000 per year may spend a smaller proportion of their income on these items and may be less affected by the VAT.

VAT Rates in Different Countries

The following table Artikels the VAT rates applied to different goods and services in the United Kingdom:| Category| VAT Rate||—|—|| Standard Rate| 20% || Reduced Rate| 5% || Zero Rate| 0% | Standard Rate:Applies to most goods and services, including food, clothing, furniture, and household appliances.

Reduced Rate:Applies to certain goods and services, such as domestic fuel and power, children’s car seats, and energy-saving materials. Zero Rate:Applies to essential goods and services, such as food, children’s clothing, books, and newspapers.

VAT and Businesses

VAT compliance is a crucial aspect of running a business in many countries. Businesses must understand their VAT obligations and ensure they comply with the regulations to avoid penalties.

VAT Compliance Requirements for Businesses

VAT compliance requirements vary depending on the country and the type of business. However, some common requirements include:

- Registering for VAT: Businesses must register for VAT if their turnover exceeds a certain threshold. This threshold varies by country.

- Keeping accurate records: Businesses must keep detailed records of all VAT-related transactions, including sales, purchases, and expenses.

- Filing VAT returns: Businesses must file VAT returns periodically, typically monthly or quarterly, depending on the country.

- Paying VAT liabilities: Businesses must pay any VAT due to the tax authorities on time.

Businesses must comply with all applicable VAT regulations to avoid penalties. These penalties can range from fines to imprisonment, depending on the severity of the offense.

Accounting Procedures Involved in VAT Reporting

VAT reporting involves recording and tracking all VAT-related transactions. This process ensures accurate calculation and reporting of VAT liabilities. Here’s a breakdown of the accounting procedures involved:

- Input VAT:This is the VAT paid on purchases by businesses. Businesses can claim input VAT as a deduction from their output VAT liability.

- Output VAT:This is the VAT charged on sales by businesses. Businesses are required to collect output VAT from their customers and remit it to the tax authorities.

- VAT Return:Businesses must file VAT returns periodically, typically monthly or quarterly, depending on the country. These returns summarize the business’s input VAT and output VAT for the reporting period.

- VAT Liability:This is the difference between output VAT and input VAT. Businesses must pay any VAT liability to the tax authorities.

Accurate accounting procedures are crucial for VAT compliance. Businesses must ensure they have a robust system for recording and tracking VAT-related transactions. This system should be able to generate accurate reports for VAT returns and provide a clear picture of the business’s VAT liability.

Minimizing VAT Liability

Businesses can take several steps to minimize their VAT liability. Some common strategies include:

- Claiming input VAT:Businesses can claim input VAT on all eligible purchases, reducing their output VAT liability.

- Negotiating with suppliers:Businesses can negotiate with suppliers to reduce the VAT charged on purchases.

- Using VAT-exempt supplies:Businesses can use VAT-exempt supplies, such as those related to education or healthcare, to reduce their output VAT liability.

- Optimizing business processes:Businesses can optimize their business processes to reduce VAT-related costs. This may involve streamlining supply chains, reducing waste, and improving inventory management.

Businesses should consult with a qualified accountant or tax advisor to explore the best strategies for minimizing their VAT liability.