Accounting Software for Multiple Businesses: A Streamlined Solution

Accounting software multiple businesses – Accounting software for multiple businesses is a game-changer for companies with various locations or departments. Imagine juggling spreadsheets, reconciling transactions across different sites, and trying to maintain financial clarity – it’s a logistical nightmare! But with the right accounting software, you can centralize operations, streamline processes, and gain real-time insights into your financial health across all business units.

Imagine a world where invoices are automatically generated, expenses are tracked effortlessly, payroll is processed with ease, and reports are readily available, all from a single, unified platform. This is the power of accounting software designed for multiple businesses. It’s not just about managing finances; it’s about empowering you to make informed decisions, optimize resources, and drive growth.

The Need for Accounting Software in Multiple Businesses

Managing finances across multiple locations or departments within a business can be a complex and time-consuming task. Without dedicated accounting software, businesses may face significant challenges in tracking financial data, ensuring accuracy, and maintaining compliance.

Centralized Accounting System Benefits

Implementing a centralized accounting system offers numerous advantages for multi-location businesses. A unified system provides a single source of truth for financial information, streamlining operations and improving financial visibility across all business units. This allows for better decision-making based on real-time insights and facilitates a more efficient allocation of resources.

Simplifying Tasks with Accounting Software

Accounting software simplifies various tasks, including:

- Invoicing:Streamlines the invoicing process by automating invoice creation, tracking payments, and managing customer accounts. This reduces errors and improves efficiency in managing accounts receivable.

- Expense Tracking:Simplifies expense tracking by allowing users to categorize expenses, generate reports, and analyze spending patterns. This helps businesses identify areas for cost optimization and improve financial control.

- Payroll:Automates payroll processing, ensuring accurate and timely payment to employees. This reduces manual errors and streamlines the payroll process, saving time and resources.

- Reporting:Provides comprehensive financial reports that offer insights into business performance, profitability, and cash flow. These reports help businesses make informed decisions and monitor financial health across different locations.

Key Features of Accounting Software for Multiple Businesses

Managing multiple businesses can be complex, and having the right accounting software is crucial for streamlining operations and maintaining financial clarity. Accounting software designed for multi-business entities offers a range of features that cater to their unique needs, simplifying financial management and enhancing operational efficiency.

Multi-Currency Support

Multi-currency support is essential for businesses operating in multiple countries or dealing with international transactions. Accounting software with multi-currency capabilities allows you to:

- Track and manage transactions in different currencies.

- Convert currencies at real-time exchange rates.

- Generate financial reports in multiple currencies.

This feature ensures accurate financial reporting and simplifies the process of reconciling transactions across different currencies.

Managing multiple businesses can be a real headache, especially when it comes to keeping track of finances. A good accounting software can be a lifesaver, but sometimes you might need to make changes to your app setup. If you’re looking to remove an app from your Google Play Store account, be sure to check out this helpful article on google play store app deletion.

Once you’ve streamlined your app management, you can focus on finding the right accounting software to manage your diverse business needs.

Consolidated Reporting

Consolidated reporting is a critical feature for multi-business entities, allowing them to:

- Aggregate financial data from multiple businesses into a single report.

- Gain a comprehensive view of the overall financial performance of the group.

- Make informed decisions based on consolidated financial information.

Consolidated reporting helps businesses track profitability, identify trends, and allocate resources effectively across their various entities.

User Role Management

User role management is essential for controlling access to sensitive financial data and ensuring data security. Accounting software with robust user role management features enables businesses to:

- Assign different levels of access to users based on their roles and responsibilities.

- Control which users can view, edit, or delete financial data.

- Audit user activity and track changes made to financial records.

This feature helps maintain data integrity, prevent unauthorized access, and comply with regulatory requirements.

Inventory Management

For businesses with multiple locations, inventory management is a critical aspect of operations. Accounting software with robust inventory management features helps businesses:

- Track inventory levels across all locations in real-time.

- Manage stock replenishment and order fulfillment efficiently.

- Minimize stockouts and overstocking, reducing costs and improving customer satisfaction.

Integrated inventory management systems provide visibility into stock levels, allowing businesses to optimize inventory levels and streamline supply chain operations.

Finding the right accounting software for multiple businesses can be a real headache. You need something that can handle everything from basic bookkeeping to complex financial reporting. And just like I’ve tested more than 15 VR headsets, but there’s only one I’d recommend buying this Prime Day , the right software can make all the difference.

With the right tools, you can streamline your finances, save time, and make better decisions for your businesses.

Purchase Order Tracking

Purchase order tracking is crucial for businesses that make frequent purchases from multiple suppliers. Accounting software with purchase order tracking features helps businesses:

- Create and manage purchase orders electronically.

- Track the status of orders from placement to delivery.

- Generate reports on purchase order activity and vendor performance.

This feature helps businesses manage supplier relationships effectively, streamline procurement processes, and improve cost control.

Budgeting Tools

Budgeting tools are essential for multi-business entities to plan and track financial performance. Accounting software with integrated budgeting features allows businesses to:

- Create and manage budgets for each business unit.

- Track actual expenses against budgeted amounts.

- Generate variance reports to identify areas of overspending or underspending.

Budgeting tools provide businesses with valuable insights into financial performance, enabling them to make informed decisions and allocate resources effectively.

Managing multiple businesses can be a real headache, especially when it comes to accounting. Keeping track of invoices, expenses, and inventory across different entities is a daunting task. But there’s a silver lining! New Excel features like working text lists, as detailed in this article , can make your life much easier.

By streamlining your data entry and organization, you can free up more time to focus on growing your businesses.

Integration with Other Business Applications

Integrated accounting software solutions connect seamlessly with other business applications, such as CRM, e-commerce, and payroll systems. This integration streamlines business processes, eliminates data duplication, and improves efficiency. For example:

- Integration with a CRM system allows businesses to track customer interactions and sales opportunities.

- Integration with an e-commerce platform automates order processing and inventory management.

- Integration with a payroll system simplifies employee compensation and tax reporting.

By integrating with other business applications, accounting software becomes a central hub for managing all aspects of a multi-business entity’s operations.

Choosing the Right Accounting Software for Multiple Businesses: Accounting Software Multiple Businesses

Selecting the ideal accounting software for multiple businesses is a crucial step toward streamlining operations and enhancing financial visibility. It’s not just about finding a tool that handles basic bookkeeping; it’s about finding a solution that seamlessly integrates with your diverse business needs and fosters efficient management across the board.

Factors to Consider When Choosing Accounting Software

When selecting accounting software for multiple businesses, it’s essential to consider various factors that influence its suitability and effectiveness. These factors help you narrow down your choices and ensure the software aligns with your specific requirements.

- Business Size:The size of your businesses will dictate the complexity of your accounting needs. Smaller businesses may find simpler software solutions sufficient, while larger enterprises might require more robust features.

- Industry:Different industries have unique accounting requirements. For example, a retail business will have different needs compared to a manufacturing company.

- Budget:Accounting software comes with varying pricing models, ranging from free options to subscription-based plans. Your budget will influence the features and capabilities you can access.

- Specific Requirements:Consider your specific accounting needs, such as inventory management, payroll processing, or invoicing. Ensure the software provides the necessary functionalities.

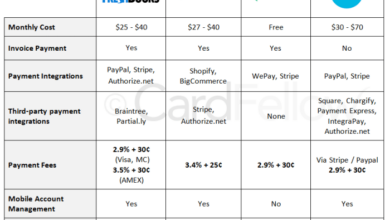

Comparing Accounting Software Options

Once you’ve identified your key requirements, it’s time to compare different accounting software options. This comparison should focus on features, pricing models, and user interface to determine the best fit for your multi-business environment.

- Features:Compare the features offered by each software, including accounting basics, reporting capabilities, bank reconciliation, inventory management, payroll processing, and integrations with other business tools.

- Pricing Models:Explore different pricing models, such as fixed monthly fees, tiered pricing based on features, or pay-as-you-go options. Consider the long-term cost implications of each model.

- User Interface:Assess the user interface’s ease of navigation and intuitiveness. A user-friendly interface simplifies data entry, reporting, and overall software usage.

Popular Accounting Software Solutions for Multiple Businesses

Here’s a table comparing popular accounting software solutions for multiple businesses, highlighting their key features, pricing, and suitability for multi-business environments:

| Software | Key Features | Pricing | Multi-Business Suitability |

|---|---|---|---|

| Xero | Cloud-based accounting, invoicing, bank reconciliation, inventory management, payroll, reporting | Starts at $35/month | Excellent, offers multi-company management |

| QuickBooks Online | Cloud-based accounting, invoicing, bank reconciliation, inventory management, payroll, reporting | Starts at $25/month | Good, provides multi-company features |

| Zoho Books | Cloud-based accounting, invoicing, bank reconciliation, inventory management, payroll, reporting | Starts at $19/month | Good, offers multi-company management |

| FreshBooks | Cloud-based accounting, invoicing, expense tracking, time tracking, reporting | Starts at $15/month | Limited multi-company capabilities, better suited for smaller businesses |

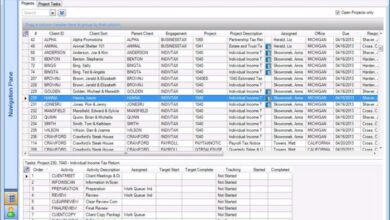

Implementing and Integrating Accounting Software

Successfully implementing and integrating accounting software across multiple businesses is crucial for streamlined operations, improved financial visibility, and enhanced decision-making. This process requires a well-defined plan that addresses data migration, user training, and system configuration.

Data Migration

Migrating data from existing systems to the new accounting software is a critical step. It ensures a smooth transition and accurate financial reporting.

- Identify and Prioritize Data:Determine the essential data that needs to be migrated, including customer information, invoices, expenses, and financial statements. Prioritize data based on its importance and frequency of use.

- Data Cleaning and Validation:Before migration, ensure data accuracy and consistency. Clean up any duplicate entries, errors, or inconsistencies. This step ensures data integrity in the new system.

- Choose Migration Method:Select the appropriate data migration method, such as manual entry, data import, or using a third-party migration tool. The chosen method should align with the software’s capabilities and the volume of data.

- Testing and Verification:After migration, thoroughly test the data in the new system to confirm its accuracy and completeness. Compare the data with the source system to identify any discrepancies.

User Training

Providing comprehensive user training is essential to ensure the effective use of the accounting software.

- Develop a Training Plan:Create a structured training plan that covers all aspects of the software, including core functionalities, common tasks, and troubleshooting tips.

- Tailor Training to User Roles:Design training modules specific to the roles and responsibilities of different users, ensuring they receive relevant information.

- Hands-on Practice:Include practical exercises and simulations to allow users to apply their knowledge and gain confidence in using the software.

- Ongoing Support:Offer ongoing support through user manuals, FAQs, online resources, and dedicated help desks to address user queries and provide assistance.

System Configuration

Configuring the accounting software to meet the specific needs of each business is essential for efficient operations.

- Chart of Accounts:Establish a standardized chart of accounts across all businesses, ensuring consistent financial reporting and analysis.

- Security and Access Control:Implement robust security measures to protect sensitive financial data. Assign appropriate access levels to different users, limiting their access to specific information.

- Workflow Automation:Automate repetitive tasks like invoice processing, expense tracking, and payroll, reducing manual effort and improving efficiency.

- Reporting and Analytics:Configure the software to generate customized reports and dashboards that provide valuable insights into financial performance and operational efficiency.

Integrating Accounting Software, Accounting software multiple businesses

Integrating accounting software with other business applications, such as CRM, inventory management, and e-commerce platforms, streamlines data flow and reduces manual effort.

- Identify Integration Needs:Determine which business applications require integration with the accounting software. This includes analyzing data flow between systems and identifying potential areas for automation.

- Choose Integration Method:Select the appropriate integration method, such as API connections, data synchronization tools, or middleware solutions. The chosen method should align with the capabilities of both systems.

- Test and Monitor Integration:After integration, thoroughly test the data flow between systems to ensure accuracy and consistency. Monitor the integration process to identify any issues and ensure smooth data exchange.

Cloud-Based Accounting Software

Cloud-based accounting software offers several benefits for multi-location businesses, including accessibility, scalability, and data security.

- Accessibility:Users can access the software from any device with an internet connection, enabling remote access and collaboration.

- Scalability:Cloud-based software can easily adapt to changing business needs, allowing businesses to scale their operations without significant IT infrastructure investments.

- Data Security:Cloud providers invest heavily in data security measures, ensuring the protection of sensitive financial information through encryption, access controls, and regular backups.

Optimizing Accounting Software for Multiple Businesses

Investing in accounting software is just the first step. To truly reap its benefits, you need to optimize it for your multiple businesses. This involves leveraging its powerful features, automating tasks, and ensuring seamless integration across your business operations. By following best practices and maximizing the software’s potential, you can gain deeper insights into your financial performance, streamline operations, and make informed decisions.

Leveraging Reporting Capabilities

Accounting software provides a wealth of data that can be used to gain valuable insights into your businesses’ financial performance. You can generate reports on various aspects such as profitability, cash flow, inventory, and customer activity. These reports can help you identify trends, pinpoint areas for improvement, and make data-driven decisions.

- Utilize customizable reports:Most accounting software allows you to customize reports to meet your specific needs. For instance, you can create reports that show profitability by business unit, customer, or product line. This allows you to drill down into specific areas and gain deeper insights.

- Set up alerts and notifications:Configure the software to send alerts when key metrics reach specific thresholds. This can help you stay on top of potential problems and take proactive measures to address them.

- Compare performance across businesses:Utilize the reporting capabilities to compare the financial performance of different businesses. This allows you to identify best practices, benchmark performance, and implement strategies for improvement across the board.

Automating Tasks

Accounting software can significantly reduce manual effort by automating repetitive tasks. This frees up your time and resources to focus on strategic initiatives.

- Automate invoice generation and sending:Set up automated invoice generation and sending for recurring transactions. This eliminates the need for manual data entry and ensures timely payment collection.

- Schedule recurring payments:Automate payments for recurring expenses like rent, utilities, and subscriptions. This reduces the risk of missed payments and ensures that your financial obligations are met on time.

- Reconcile bank transactions:Leverage automated bank reconciliation features to streamline the reconciliation process. This saves time and reduces the risk of errors.

Customizing Workflows

Tailoring the software to your specific business processes can enhance efficiency and accuracy.

- Define custom workflows:Set up workflows that align with your specific business processes. This ensures that tasks are completed in a consistent and efficient manner across all businesses.

- Create custom fields:Add custom fields to track information that is relevant to your specific industry or business needs. This allows you to gather and analyze data that is specific to your operations.

- Integrate with other applications:Connect your accounting software with other business applications such as CRM, inventory management, and payroll. This allows you to automate data exchange and streamline your operations.

Maintaining Accurate Financial Records

Accurate financial records are crucial for making informed decisions and ensuring the financial health of your businesses.

- Establish clear data entry procedures:Develop and implement clear data entry procedures for all users. This ensures consistency and accuracy in data recording.

- Regularly review and reconcile records:Conduct regular reviews and reconciliations to identify and correct any errors. This helps to maintain the integrity of your financial data.

- Implement strong internal controls:Establish strong internal controls to prevent fraud and ensure the accuracy of financial information. This includes segregation of duties, authorization procedures, and regular audits.

Ensuring Data Integrity

Protecting the integrity of your financial data is paramount.

- Regularly back up your data:Implement a robust data backup strategy to protect against data loss due to hardware failure, natural disasters, or cyberattacks.

- Use strong passwords and access controls:Limit access to sensitive financial data to authorized personnel. Implement strong passwords and multi-factor authentication to enhance security.

- Stay updated with security patches:Regularly update your accounting software and operating system to protect against vulnerabilities and security threats.

Ongoing Training and Support

Continuous training and support are essential to ensure that users are fully equipped to utilize the accounting software effectively.

- Provide regular training sessions:Offer regular training sessions to familiarize users with new features and updates. This ensures that they are comfortable using the software and maximizing its capabilities.

- Offer ongoing support:Provide ongoing support to users through phone, email, or chat. This allows them to resolve issues promptly and get the help they need to perform their tasks effectively.

- Encourage user feedback:Regularly solicit user feedback to identify areas for improvement and enhance the user experience. This helps to ensure that the software is meeting the needs of your users.