What is Bank Reconciliation: Matching Your Records with the Bank

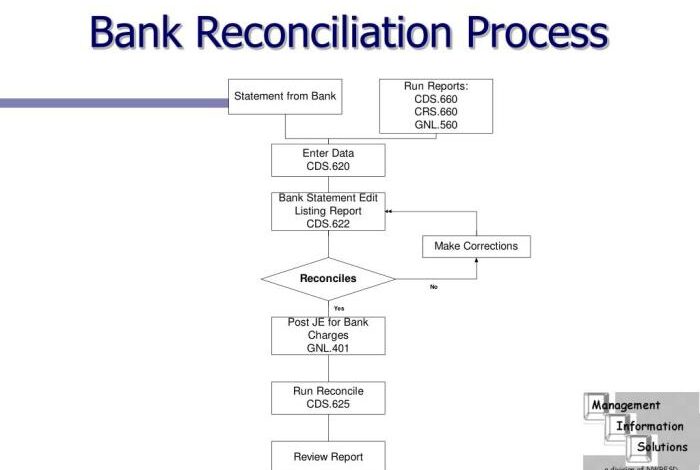

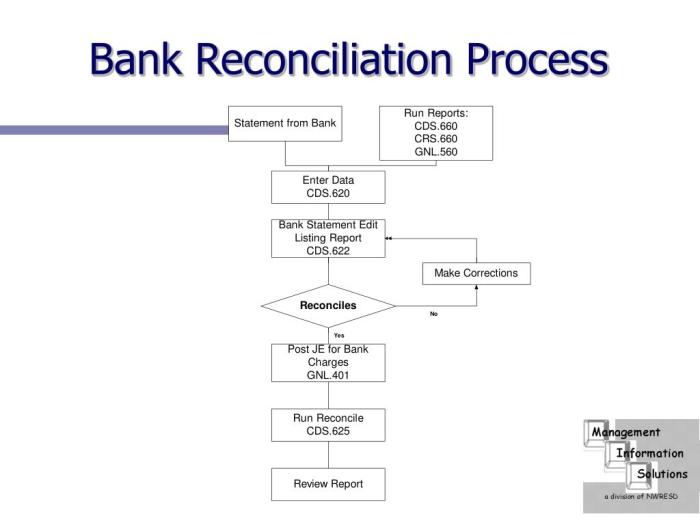

What is bank reconciliation? It’s the process of ensuring your company’s financial records match the bank’s records. Imagine this: you carefully track your expenses and deposits, but when you check your bank statement, the numbers don’t quite align. This is where bank reconciliation comes in, helping you understand the discrepancies and reconcile the differences between your books and the bank’s records.

Bank reconciliation is a crucial part of financial management, ensuring accuracy and preventing potential errors. It’s a detective-like process that helps you uncover hidden transactions, identify errors, and ultimately, maintain a clear picture of your company’s financial health.

Bank Reconciliation Software: What Is Bank Reconciliation

Bank reconciliation software is a valuable tool for businesses of all sizes. It streamlines the process of reconciling bank statements with internal records, reducing the risk of errors and saving time.

Benefits of Bank Reconciliation Software

Bank reconciliation software offers several benefits, including:

- Increased Accuracy:Software automates the reconciliation process, reducing the likelihood of human errors. It also provides built-in checks and balances to ensure accuracy.

- Improved Efficiency:Automation speeds up the reconciliation process, freeing up time for other tasks. Software can handle large volumes of transactions quickly and efficiently.

- Enhanced Visibility:Bank reconciliation software provides real-time insights into cash flow and bank balances. This allows businesses to make informed decisions about cash management.

- Reduced Risk:Software helps identify and prevent fraud by flagging unusual transactions or discrepancies. It also provides a detailed audit trail for compliance purposes.

- Better Collaboration:Some software solutions allow multiple users to access and collaborate on reconciliation tasks. This streamlines communication and ensures everyone is on the same page.

Types of Bank Reconciliation Software, What is bank reconciliation

There are various types of bank reconciliation software available, each with its unique features and benefits. Here are some common categories:

- Standalone Software:This type of software is installed on a local computer and operates independently. It is often more affordable than cloud-based solutions but may require more maintenance.

- Cloud-Based Software:Cloud-based software is accessed through a web browser and stored on a remote server. This offers flexibility and scalability, as users can access the software from anywhere with an internet connection.

- Integrated Software:Some software solutions integrate with other accounting or financial management systems. This eliminates the need to manually input data, streamlining the reconciliation process.

Key Features of Bank Reconciliation Software

Here are some key features to look for in bank reconciliation software:

- Automated Matching:Software should automatically match transactions from bank statements to internal records, reducing manual effort.

- Reconciliation Rules:The ability to define custom reconciliation rules based on specific business requirements.

- Exception Handling:Software should highlight and flag exceptions or discrepancies that require manual review.

- Reporting and Analytics:Robust reporting features to track key performance indicators (KPIs) and identify trends.

- Audit Trail:A detailed audit trail to track changes and ensure compliance with regulatory requirements.

- Security:Robust security measures to protect sensitive financial data.

Comparing Software Options

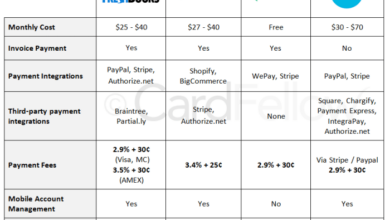

When choosing bank reconciliation software, consider factors such as:

- Cost:Software costs can vary significantly depending on the features and functionality offered.

- Ease of Use:The software should be user-friendly and easy to navigate.

- Integration:Consider whether the software integrates with your existing accounting or financial management systems.

- Customer Support:Choose software with reliable customer support and documentation.

- Scalability:The software should be able to handle your current needs and scale as your business grows.

Bank reconciliation is like a detective story, uncovering the discrepancies between your business records and your bank statement. It’s a process that requires careful attention to detail, much like mastering a new braiding technique. For instance, a twist on the classic three strand braid might involve adding an extra strand or incorporating beads, just as bank reconciliation involves adjusting for outstanding checks, deposits in transit, and bank charges.

By carefully comparing and reconciling these details, you can ensure your financial records are accurate and your business is running smoothly.

Bank reconciliation is a process that helps businesses ensure their bank statements and internal records match. It’s a crucial step in financial accounting, similar to how the Irish Film Institute carefully curates its film archive. You can learn more about the Institute’s efforts here , where they are actively working to preserve and showcase Irish cinematic history.

Just as a bank reconciliation identifies discrepancies, the Institute is dedicated to ensuring the preservation and accessibility of important cultural artifacts.

Bank reconciliation is like that before-and-after picture of a holiday house living room – holiday house living room before after – where you see the difference between what your bank records and your own records show. It’s about matching up the discrepancies and figuring out why your numbers don’t always align, just like how the living room transformation reveals a different space altogether.

So, in essence, bank reconciliation is about making sense of the financial puzzle and achieving a clear picture of your financial health.