Best Online Bookkeeping Services: Streamline Your Finances

Best online bookkeeping services are changing the way businesses manage their finances. Gone are the days of stacks of paper receipts and endless spreadsheets. Today, you can access powerful tools that automate tasks, improve accuracy, and provide valuable insights into your financial health, all from the comfort of your computer or mobile device.

These services cater to a wide range of businesses, from solopreneurs to large enterprises. Whether you’re a seasoned entrepreneur or just starting out, online bookkeeping offers a solution to simplify your accounting processes and give you more time to focus on what matters most: growing your business.

Introduction to Online Bookkeeping Services

Online bookkeeping services have revolutionized the way businesses manage their finances, offering a convenient and efficient alternative to traditional bookkeeping methods. These services provide a platform for businesses to track their income and expenses, manage invoices, reconcile bank statements, and generate financial reports, all from the comfort of their computers or mobile devices.Online bookkeeping services offer a multitude of benefits for businesses of all sizes, from solo entrepreneurs to large corporations.

Finding the best online bookkeeping service can be a game-changer for small businesses, freeing up time and energy for what truly matters – like creating art, just like the amazing Andy Warhol drawings featured in this recent Artnet article.

Whether you’re a seasoned artist or just starting out, having a solid bookkeeping system in place is crucial for success. It allows you to focus on your creative passion while knowing your finances are in order.

These benefits include:

Benefits of Online Bookkeeping Services, Best online bookkeeping services

- Increased Efficiency and Productivity:Online bookkeeping services automate many tedious tasks, such as data entry and reconciliation, freeing up business owners and employees to focus on other important aspects of their operations.

- Improved Accuracy and Reliability:Automated systems reduce the risk of human error, ensuring that financial records are accurate and reliable. This is particularly important for tax purposes and financial reporting.

- Real-Time Access to Financial Data:Online bookkeeping services provide real-time access to financial data, allowing business owners to monitor their financial performance and make informed decisions.

- Reduced Costs:Online bookkeeping services can be significantly more cost-effective than hiring a full-time bookkeeper, especially for small businesses.

- Enhanced Security:Online bookkeeping services often employ robust security measures to protect sensitive financial data from unauthorized access.

- Scalability:Online bookkeeping services can easily scale with the growth of a business, accommodating increasing volumes of financial data and transactions.

Types of Online Bookkeeping Services

Online bookkeeping services come in various forms, catering to different needs and budgets. Here are some common types:

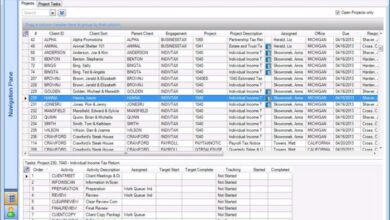

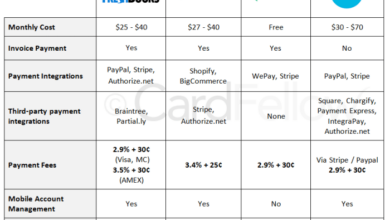

- Cloud-Based Accounting Software:These platforms offer a comprehensive suite of bookkeeping tools, including invoicing, expense tracking, bank reconciliation, and financial reporting. Examples include Xero, QuickBooks Online, and FreshBooks.

- Virtual Bookkeeping Services:These services employ experienced bookkeepers who work remotely to manage a business’s financial records. They typically use cloud-based accounting software to streamline their processes.

- Hybrid Services:Some online bookkeeping services offer a combination of software and virtual bookkeeping support, providing businesses with the best of both worlds.

Integration with Other Business Tools: Best Online Bookkeeping Services

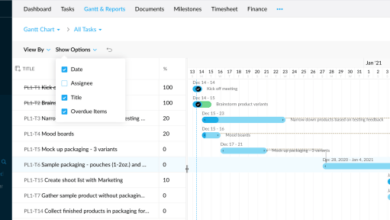

Online bookkeeping services are designed to work seamlessly with other essential business tools, streamlining workflows and enhancing data accuracy. This integration eliminates manual data entry, reduces errors, and provides a comprehensive view of your business operations.

Integration with Accounting Software

Integrating online bookkeeping services with accounting software allows for real-time data synchronization. This eliminates the need to manually transfer data between systems, ensuring consistency and reducing the risk of errors.

- Data Synchronization:Transactions recorded in the bookkeeping service are automatically updated in the accounting software, eliminating manual data entry and ensuring consistency.

- Automated Reporting:Integrated systems generate comprehensive financial reports, providing insights into your business’s financial performance.

- Improved Accuracy:Automated data transfer minimizes the risk of human error, ensuring accurate financial records.

Integration with CRM Systems

Integrating online bookkeeping services with CRM systems provides a holistic view of customer interactions and financial transactions. This allows businesses to analyze customer spending patterns, track revenue generated from specific customers, and improve customer relationship management.

- Customer Segmentation:Analyze customer spending patterns and segment customers based on their financial activity, enabling targeted marketing and sales efforts.

- Revenue Tracking:Track revenue generated from individual customers, providing insights into customer lifetime value and identifying high-value clients.

- Enhanced Customer Service:Access customer financial data within the CRM system, enabling customer service representatives to provide more informed and personalized support.

Integration with Payment Gateways

Integrating online bookkeeping services with payment gateways automates the reconciliation of transactions and provides real-time insights into cash flow. This eliminates manual data entry, reduces reconciliation errors, and improves financial visibility.

- Automated Reconciliation:Transactions processed through the payment gateway are automatically reconciled with the bookkeeping service, eliminating manual data entry and minimizing errors.

- Real-Time Cash Flow Monitoring:Track incoming and outgoing payments in real-time, providing a clear picture of your business’s cash flow position.

- Improved Financial Reporting:Access detailed reports on payment transactions, including payment volume, average transaction size, and payment trends.

Impact of Integrations on Efficiency and Data Flow

Integrating online bookkeeping services with other business tools significantly improves efficiency and data flow, resulting in:

- Reduced Manual Data Entry:Automated data transfer eliminates the need for manual data entry, saving time and reducing errors.

- Improved Data Accuracy:Real-time data synchronization ensures consistency across all systems, minimizing errors and improving data reliability.

- Enhanced Financial Visibility:Access comprehensive financial reports and insights into cash flow, enabling better financial decision-making.

- Streamlined Workflows:Integrated systems streamline business processes, reducing administrative overhead and freeing up time for strategic tasks.

The Future of Online Bookkeeping

Online bookkeeping is rapidly evolving, driven by advancements in technology and the changing needs of businesses. The future of this field promises a seamless, automated, and intelligent approach to managing financial records.

Automation and Artificial Intelligence in Bookkeeping

Automation and artificial intelligence (AI) are transforming the way businesses manage their finances. These technologies are automating repetitive tasks, reducing errors, and freeing up bookkeepers to focus on higher-level tasks.

- Automated Data Entry:AI-powered tools can automatically extract data from invoices, receipts, and bank statements, eliminating the need for manual data entry. This significantly reduces the risk of human error and saves time for bookkeepers.

- AI-Driven Insights:AI algorithms can analyze financial data to identify trends, patterns, and anomalies, providing valuable insights that can help businesses make informed decisions. This allows bookkeepers to proactively identify potential issues and optimize financial performance.

- Real-Time Reporting:Automation enables real-time financial reporting, providing businesses with up-to-the-minute insights into their financial health. This empowers businesses to make faster and more informed decisions based on current data.

The Role of Online Bookkeeping Services

Online bookkeeping services are poised to play an increasingly vital role in the business landscape. As businesses become more reliant on technology, the demand for efficient and reliable bookkeeping solutions will continue to grow.

- Accessibility and Scalability:Online bookkeeping services offer businesses of all sizes access to professional bookkeeping solutions without the need for in-house staff. This is particularly beneficial for small businesses and startups that may not have the resources to hire a full-time bookkeeper.

- Integration with Other Business Tools:Online bookkeeping services are increasingly integrating with other business tools, such as CRM systems, e-commerce platforms, and project management software. This seamless integration streamlines workflows and provides a comprehensive view of business operations.

- Data Security and Compliance:Online bookkeeping services are committed to providing secure and compliant data storage and management solutions. This ensures that businesses’ financial data is protected and meets regulatory requirements.

Finding the best online bookkeeping service can be a game-changer for small businesses, allowing you to focus on your passion while keeping your finances in order. Just like a well-organized accounting system, a carefully crafted feather blocked dress DIY project requires meticulous attention to detail and a clear vision.

Similarly, the right bookkeeping service can help you track your income and expenses, ensuring your business thrives and avoids any financial pitfalls.

Finding the best online bookkeeping service can feel like a game of chance sometimes. You’re trying to balance features, cost, and ease of use, and sometimes you hit a wall of friction that makes you want to throw in the towel.

Just like friction hurts especially in gaming , a clunky bookkeeping platform can really derail your workflow. That’s why choosing the right service is so crucial – it can make all the difference between a smooth, efficient experience and a frustrating one.